Shares for the future: a sea of blue at this AIM company

A tough period has been followed by consolidation then recovery to a multi-year high, and analyst Richard Beddard has stopped penalising this financially strong business.

6th June 2025 15:00

by Richard Beddard from interactive investor

My spreadsheets highlight financial ratios in pink if they are at a level that might concern us. Last year and the year before many of Anpario (LSE:ANP)’s numbers were blushing. This year they are resplendent in blue.

- Invest with ii: Open an ISA | ISA Investment Ideas | ISA Offers & Cashback

Bad year, bad year, good year...

Anpario makes natural animal feed additives. They improve animal health, enabling them to grow faster and bigger, helping farms to be more productive.

Farming is a capricious business, susceptible to animal diseases such as bird flu. Cyclical variations in feed costs and farmgate prices mean farm profitability fluctuates, sometimes dramatically.

Anpario’s additives use natural high-quality ingredients. The company deliberately positions itself in this portion of the market because the products are differentiated by the novelty of their formulations. This earns it good profit margins.

But there is a trade-off. Farmers often choose cheaper, less-effective additives or forego them altogether when times are tough. Volatile demand means Anpario’s revenue is unpredictable.

To control quality and maximise efficiency, Anpario centralises manufacturing in Worksop, Nottinghamshire. This is another trade-off. The high fixed costs of manufacturing mean changes in revenue are magnified in profit.

- Rolls-Royce, IAG, Glencore among FTSE 100 big winners in May

- Stockwatch: a small-cap share with robust prospects

Anpario’s profitability is also susceptible to changes in raw material costs and tariffs. Tariffs depress farm profitability and disrupt markets by encouraging producers to dump additives on relatively low-tariff markets.

Over the last three years all these factors have been at play, which is why Anpario’s results have been alternately pink, as profitability has suffered, and blue, as it has bounced back.

In the year to December 2023, Anpario’s revenue fell 6% and adjusted profit fell 20%. The company’s 10-year compound annual growth rate (CAGR) in revenue was 2% and profit had grown at 1% CAGR. These were the pink numbers.

Return on capital was a sub-par but still respectable 13%.

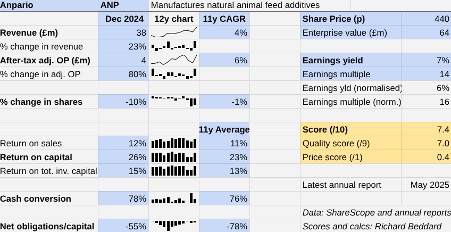

In 2024, Anpario’s revenue grew 23% and adjusted profit grew 80%. It has grown revenue at 4% CAGR and profit at 6% CAGR over the last 11 years. Return on capital was 3% higher than the average at 26%.

Cash conversion was healthy, and typical for Anpario at 76%. Every year I can remember it has had more cash than financial obligations at the year end.

Next year the company’s results will be buoyed by the first full-year contribution of Bio-Vet, acquired in September 2024, and Anpario has had a positive start to 2025.

Sharp declines in revenue and sharper declines in profit are not unprecedented, though, so it would be foolhardy to judge Anpario by a single year’s results.

If we judge Anpario by the averages, it is a profitable business that has not grown very fast.

Good business

The market is often challenging, but I think Anpario is a good business.

I visited the company’s headquarters near Worksop almost a decade ago. Anpario was orderly and industrious. There were packages racked, labelled and bound for exotic destinations. The entrance to the warehouse was a door at the back of the office and management were on first name terms with employees.

Chief executive Richard Edwards assembled Anpario in a series of acquisitions between 2006 and 2012. He oversaw their integration and the development of the Anpario brand.

Since then, Anpario has opened direct sales offices in major meat farming areas such as Brazil, China and the US. Today, direct sales contribute as much to revenue as distributors, and it is not dependent on any single region.

Almost a fifth of Anpario’s staff have been there for more than a decade and 8% have been employed for over 15 years. These experienced staff, Anpario says, bring on the next generation. Finance director Marc Wilson must have been one of them. He joined the business in 2010 when he was still in his 20s and was promoted to the board in 2021.

- Can Mag 7 tech rally continue after best month in two years?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

This year, Anpario made a £1.2 million provision for bonus payments, much more than usual. Although the size of the provision, which reduced after tax profit by about 20%, might raise an eyebrow, the spoils have been widely spread.

The three executives’ share of the pool is 42%, leaving 58% for employees. “Just about everyone got a bonus,” Richard Edwards tells me. The only ones not to were sales people incentivised by personal targets they did not reach.

Diversifying

Anpario’s biggest brand is Orego-Stim (37% of sales). It is made from oregano oil, which has antibiotic and antiparasitic properties.

The company also makes acidifiers, which make animal gut chemistry more hostile to pathogens, and toxin-binders, which absorb toxins produced by mould and fungi in animal feed and render them indigestible.

Bio-Vet brings it another category of products: probiotics.

Anpario is a middle-ranking business in these markets, along with 50 or so other companies with annual revenues between £10 million and £100 million. Above them are sometimes massive agribusinesses that have acquired niche additive producers. Below them are small family owned businesses such as Bio-Vet. They are often focused on one or two products.

Anpario can grow in two ways. The first is by improving recipes and reformulating them for new species, partnering with universities and farmers to demonstrate they work, and “selling the science” to distributors and farmers.

It can also acquire other niche additive manufacturers and put their products through its distribution network.

A principal objective of both strategies is to diversify, because many of the challenges Anpario faces, principally disease and farm profitability, are localised geographically and by species.

The acquisition of Bio-Vet in September furthers diversification because Bio-Vet makes probiotics, which Anpario does not, and primarily sells them to dairy and other ruminant farmers, hitherto a relatively small market. BioVet takes the ruminant contribution to revenue from 7% to about 23%, but poultry remains Anpario’s biggest market.

Anpario now has an opportunity to develop feed protocols and products that combine the benefits of phytogenics like Orego-Stim and probiotics. Phytogenics are derived from plants and control bad microbes in the gut. Probiotics encourage good microbes. They work well together because phytogenics clear the way for probiotics to do their work.

In Bio-Vet, Anpario appears to have picked up a complementary business at a price that has barely dented the company’s strong finances.

Even though acquisitions have always been part of Anpario’s strategy, Bio-Vet is its first significant acquisition since 2012. This is not for the want of trying. Richard Edwards tells me that founders often consider selling, but want time to get their business humming along strongly enough to achieve a full price.

Often this never happens. Anpario made its first approach to Bio-Vet in 2017, but it was only after the founder died that it sealed the deal. This year, Edwards says tariffs and economic uncertainty have added to the reasons owners do not want to sell.

- Insider: boss buys shares so cheap it’s a joke

- 10 hottest ISA shares, funds and trusts: week ended 30 May 2025

Meanwhile, the company continues “turning over many stones”, also cosying up to larger listed agribusinesses that are divesting under pressure from shareholders.

Patience is good, much money is wasted at other firms on expensive and ill-fitting acquisitions, but I think we must assume organic growth will remain important.

Growing organically means continuing to slug it out in the wonderfully complex but somewhat baffling animal feed additive arena, worth $33 billion (£24.4 billion) according to an estimate from 2018. Anpario’s subset of the market, phytogenics, acidifiers, and toxin-binders, was worth nearly $6 billion then, and the company believes it has a roughly 2% share.

Even within the smaller phytogenic subsector in which Orego-Stim sits, there are many competing products. While Anpario has the leading oregano-based product, farmers can buy additives made from turmeric, rosemary and yucca, for example.

In acidifiers, Anpario competes with its own suppliers, like BASF, who sell bulk liquid organic acids. Anpario places the acid in a carrier matrix so it can be ingested and kill pathogens in the gut. The bulk product is sprayed on animals.

The wider market includes prebiotics, enzymes, vitamins, minerals, antibiotics, which are widely banned but still used because they are cheap, and phosphates.

Selling the science, I think, is also dogged, patient work.

Scoring Anpario

In the past, I have penalised Anpario’s score because meat farming stokes climate change, principally through the production of methane. I have decided that is wrong. Healthier animals produce less methane, global meat consumption is growing slowly, and while that is the case I am in favour of products that reduce the impact.

Anpario | ANP | Manufactures natural animal feed additives | 30/05/2025 | 7.4/10 |

How successfully has Anpario made money? | 2.0 | |||

Anpario is a highly profitable business formed in a series of acquisitions that ended in 2012. Since then it has refined feed additive formulations, opened sales offices in the major meat producing regions and developed online sales. This has brought it modest growth in revenue and profitover the long-term | ||||

How big are the risks? | 2.0 | |||

Farming is capricious, although Anpario is diversifying to reduce risk. There are cheap and sometimes nasty substitutes for Anpario's natural high quality additives. Fixed costs weigh on profit when revenue falls but are mitigated by a decent base level of profitability and a strong balance sheet. | ||||

How fair and coherent is its strategy? | 3.0 | |||

Natural additives make animals healthier, farms more productive, and replace antibiotic growth promoters and chemical nasties. Anpario is employee friendly. Its strategy is to sell the science and occasionally acquire like-businesses when the price is right. | ||||

How low (high) is the share price compared to normalised profit? | 0.4 | |||

Low. A share price of 440p values the enterprise at £64 million, about 16 times normalised profit. | ||||

A score of 7.4/10 indicates Anpario is a good long-term investment. | ||||

NB: Bold text indicates factors that reduce the score. Bold and italicised text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explained here) | ||||

My respect for Anpario is tempered, though, by its capricious and competitive markets, and the two-steps forward one step-back pattern of growth.

No Shares for the future!

Richard is away this week. This article was filed last Friday. You can see last week’s Shares for the future here.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Anpario and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.