Sipps: an essential guide to taking control of your investments for retirement

Sipps are well-suited to people who want to take charge of their pension savings, and offer plenty of fl…

15th July 2020 10:33

by Ceri Jones from interactive investor

Sipps are well-suited to people who want to take charge of their pension savings, and offer plenty of flexibility.

A self-invested personal pension, or Sipp, lets you take control of your pension pot and investments with a flexibility that is particularly useful when it comes to drawing your pension.

As with other approved pension schemes, if you’re under 75 and resident in the UK for tax purposes, you automatically receive basic-rate tax relief from the government on your contributions.

- Invest with ii: What is a SIPP? | Is a SIPP right for me? | SIPP Tax Relief Explained

If you pay higher-rate tax (40%) or additional-rate tax (45%) you can claim the additional sums back from the taxman in your annual tax self-assessment. You can only contribute and receive tax relief on as much income as you earn, but children and other non-taxpayers may contribute up to £3,600 every tax year.

- What does coronavirus mean for your retirement plans?

- Withdrawing income from a Sipp in a bear market: dos and don'ts

Once it’s in a Sipp wrapper, your savings will grow free from UK income and capital gains tax. Most Sipps offer a wide range of investments, including funds, shares, investment trusts and exchange traded funds (ETFs), which you can buy and sell whenever you like. Platforms such as Hargreaves Lansdown, AJ Bell Youinvest, and interactive investor offer a wide range of funds across various sectors, geographies and investment styles. These platforms are normally ‘execution only’, meaning you take no advice from the firm, so their charges are low.

Some Sipps, commonly known as full Sipps, also allow you to borrow up to 50% of the value of your fund and invest in commercial property. This can be useful for entrepreneurs keen to buy their business premises, but full Sipps have the highest charges and in some cases high minimum contributions, so are only suitable for larger pension funds. They are offered by firms such as Rowanmoor, Hornbuckle, James Hay, Curtis Banks (Suffolk Life) and Dentons Pensions.

Sipps are also offered by insurance companies such as Royal London and Prudential, and these often allow investment in commercial property; but they are limited in terms of their other investment offerings, and some insist that you put some of your pension fund into the insurer’s own funds or portfolios.

Portfolio planning

Each Sipp holder will need to choose investments that suit their individual requirements, and so it will help if you have some financial know-how and the time to monitor your portfolio’s performance.

For example, if you are relatively young with a long career still ahead of you, you may be comfortable with a high-risk portfolio, but if you are approaching retirement you might choose a more conservative portfolio to avoid the risk of losing money at a time in your life when it would be difficult to make it back up.

“It will be important to take on sufficient risk to grow your pension, but thinking about how long until you’ll need to access the money will dictate quite how adventurous you can be,” explains Nathan Long, senior analyst at Hargreaves Lansdown. “A heavy exposure to global stock markets would be sensible for those under 50, with perhaps a small exposure of 10-20% in total return funds to help lessen the pension’s fluctuations while adding some additional diversification.

“Someone in their 50s looking to consolidate their pension needs to be far more aware of when and how they may need to access their pension. Those planning to work until their 70s would have a completely different mix from someone targeting early retirement with an annuity at 55. Assuming the plan would be to access (the fund) around state pension age, there is still plenty of time to grow your pension and so a healthy exposure to global stock markets is important, making sure it’s well-diversified and not too reliant on a single country’s stock market.”

- My search for a truly ethical fund for my pension and Isa

- Ask Money: could you enlighten me on the lifetime allowance?

Long suggests that adding exposure to total return funds and strategic fixed income funds from age 50 through to accessing the pension is important. “If you’re planning to use income drawdown for retirement, you probably want to have around 60% invested in the stock market at the point of needing to draw your income,” he adds.

Of course, the value of your Sipp can fall, as many investors discovered when Covid-19 caused havoc in late March, and it can be hard to make up losses. To demonstrate, if your portfolio loses 30%, and subsequently regains 30%, that does not take it back to square one but to 91% of the original value.

If you’re not sure you are able to make decisions around monitoring and managing the portfolio, you may want to seek independent advice, or use the Sipp providers’ own ready-made portfolios based on risk profiles or themes. If you’re keen on socially responsible investment, for example, interactive investor categorises the ethical universe into three styles: Avoid, Consider and Embrace.

Property investment potentially offers higher yields than the dividends available from funds and equities, and the prospect of a capital gain that (because it is in a Sipp) will be exempt from capital gains tax. However, there may be additional costs involved, such as management and maintenance fees, and switching Sipp providers will be difficult as this means a change of ownership. If a property purchase falls through, the lost sunk costs may well also be higher than for transactions outside a Sipp.

Suggested portfolio 1: active growth for 50-somethings

| Investment | Portfolio weighting (%) |

|---|---|

| Liontrust Special Situations | 10 |

| Castlefield CFP SDL UK Buffettology | 10 |

| Scottish Mortgage | 15 |

| Fidelity Global Dividend | 10 |

| Fundsmith Equity | 15 |

| F&C Investment Trust | 10 |

| JPMorgan Emerging Markets | 10 |

| Jupiter Strategic Bond | 10 |

| Capital Gearing | 5 |

| Standard Life Private Equity | 5 |

| Total | 100 |

Notes: Supplied by interactive investor

Suggested portfolio 2: income in retirement

| Investment | Portfolio weighting (%) |

|---|---|

| City of London | 10 |

| Man GLG UK Income Professional | 10 |

| Fidelity Global Dividend | 15 |

| Bankers | 10 |

| Artemis Global Income | 15 |

| Murray International | 10 |

| Utilico Emerging Markets | 10 |

| Jupiter Strategic Bond | 10 |

| Standard Life Private Equity | 5 |

| BMO Commercial Property | 5 |

| Total/weighted average | 100 |

Notes: Supplied by interactive investor

How much to save?

As a rule of thumb, if you can afford to, you should save an annual percentage of your salary equal to at least half your age when you start saving. So if you start saving when you’re 36, you should consider putting at least 18% of your salary in your pension each year until you retire, maintaining this percentage as your age and (hopefully) earnings increase. This should provide income of around two thirds of your pre-retirement income, often called ‘replacement income’, which should enable you to afford a comparable lifestyle in retirement to the one you had in work, based on the assumption that life in retirement is typically cheaper, and many of life’s big purchases and raising a family will already have been paid for.

There is an annual limit for contributions of £40,000. However, if your ‘adjusted income’, which is your total income (not just earnings) plus the pension contributions your employer pays in for you, is over £240,000, your annual allowance will be progressively reduced, falling to £4,000 if your income is £312,000 or more. Furthermore, if you’ve flexibly accessed a pension, in most cases you can only contribute up to £4,000 each year (this does not apply to final salary pensions).

If you haven’t used your full allowance from previous years, you might be able to carry it forward and use it in the current tax year. Many investors also overlook the ability to pay into a Sipp until age 75, whereby even if you are not working you can avail yourself of the £3,600 annual contribution allowed for non-taxpayers.

The lifetime allowance (LA) limits the total value of all your tax-advantaged pension savings. It currently stands at £1,073,100 and is set to rise each year in line with inflation. Your pensions are measured against this allowance from a pension whenever you take money from your pension, and again when you turn 75.

You can apply to HMRC to protect your LA at the higher levels allowed before the government took an axe to it in 2015. There are two types of protection still open: individual protection 2016 and fixed protection 2016. Individual protection 2016 protects your LA at the lower of the value of your pension savings at 5 April 2016, or £1.25 million, and you can apply if your pension was worth more than £1 million at 5 April 2016. With this type of protection you can continue to pay into your pension.

Fixed protection fixes your LA at £1.25 million but you or your employer must not have added to your pension savings since 5 April 2016, and you cannot continue to pay into it except in very limited circumstances. Investors with fixed protection in place need to be particularly careful that they are not auto-enrolled by an employer, which is mandated every three years. HMRC will issue you with a number and certificate for the protection, which you should pass on to your Sipp provider.

Taking benefits

Benefits can be taken from a Sipp when you reach age 55 (57 from 2028), even if you have not yet given up work. This flexibility can be harnessed if you wish to retire gradually, perhaps going part-time or becoming self-employed, supplementing your earned income with pension.

You can usually take up to 25% tax-free, with the remainder taxed as income. People typically take a regular income, but you can take ad hoc payments instead. You simply tell the provider what income you’d like to take, and for every benefit payment they issue a payslip with tax deducted. Sometimes the Sipp provider will deduct too much tax, as it typically treats your first withdrawal (which could be a lump sum or even the whole pension) as the first of regular monthly payments to be paid over the rest of the tax year, which can take you into a higher tax bracket. Usually, the Sipp provider will sort this out over the following months but occasionally you may have to reclaim the overpaid tax back from HMRC.

You can use some or all of your Sipp proceeds to buy an annuity, which provides a guaranteed regular income. This may become more appealing as you get older and can obtain better rates (because by then you will have a reduced life expectancy, and are more likely to have an illness). Certainly, by your 80s you may no longer want the hassle of monitoring your investments.

Pros and cons

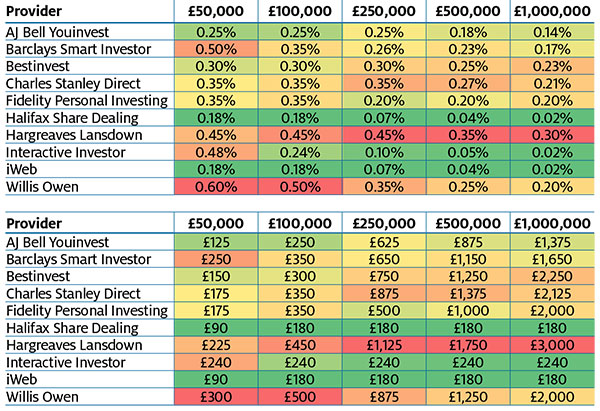

Sipp charging structures are complex: the annual administration fee will be either a flat fee or a percentage of your investments on a sliding scale, reducing as your fund gets larger, and there can be a range of fees for holding different types of investment.

There will also be dealing charges for buying and selling shares, and some Sipps have an initial set-up fee. The best way to compare charges is to predict your fund size, whether the holdings will be shares or unit trusts, and the number of trades you are likely to make in a year, and compare your resulting Sipp’s profile with the tables below.

You also have to be careful with full Sipps as HMRC has been clamping down on permittable investments. For instance, residential property held in a Sipp will incur tax penalties, although there are exemptions for mixed-use premises such as a shop with a flat above. These problems often arise inadvertently several years after setting up a Sipp, when the investor is focused on maximising value from the property, for example by the conversion of an empty unit into a residential letting.

Sipps can be particularly useful in pulling together all your bits and pieces of pension savings from over the years. Putting them in one place makes for economies in charging structures and greater visibility over overall investment performance, while the Sipp structure offers more attractive investment opportunities than legacy pensions.

Many investors have set up Sipps to take transfers from final salary occupational pension schemes. This allows people greater control over their pension pot, with the facility to take out more in some years and less in other years as particular needs arise. Moving to a Sipp can also help with IHT planning, particularly if you have an impaired life expectancy. While a final salary pension would die with you (although there would be dependents’ pensions), a Sipp fund can be left to dependents tax-free if you die before age 75.

Sipp costs compared for a range of pension pot sizes

Please click here to see a larger version of this table

Source: the Lang Cat, as at May 2020.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.