The specialist fund that is outpacing rivals

This fund halved in value this time last year, but since November has been in fine form, says Saltydog.

22nd March 2021 14:36

by Douglas Chadwick from ii contributor

This fund halved in value this time last year, but since November has been in fine form, writes Saltydog Investor.

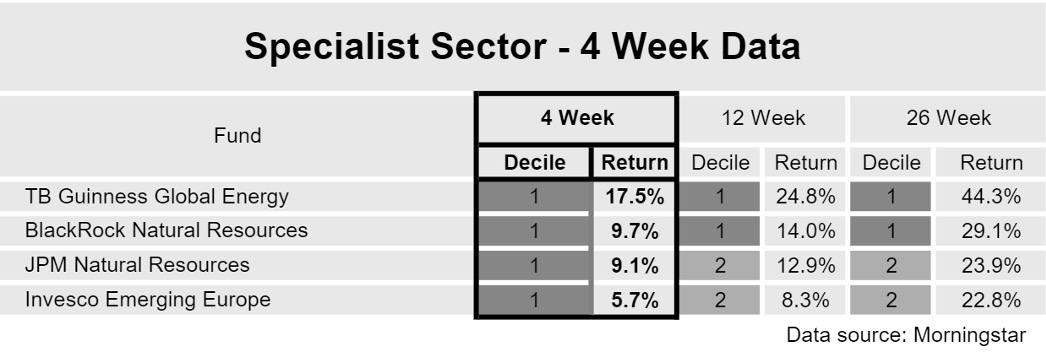

In last week’s analysis, where one of the things we do is rank funds based on their performance over the previous four weeks, the TB Guinness Global Energy fund came out on top.

Most sectors have had a difficult month and when we looked last week nearly all of them were showing four-week losses. The worst, China/Greater China, was down 13.3% and then it was Technology and Telecommunications, down 6.7%.

In recent weeks, the UK sectors have bucked this trend and the UK Equity Income, UK All Companies and the UK Smaller Companies sectors have been in form. The best-performing fund from these three sectors was the Aviva Investors UK Listed Equity High Alpha fund, which was showing a four-week return of 12.6%.

- How Saltydog invests: a guide to its momentum approach

- Best and worst fund sectors a year on from the Covid-19 sell-off

- Cutting back on some old fund favourites

We do not calculate a sector average for the ‘Specialist’ sector. This sector contains funds that do not naturally fit into any of the other sectors, and they can invest in all sorts of different assets. This means that the performance of the funds within the sector is not highly correlated.

From time to time, the leading fund (or funds) in this sector beat all the others in our analysis and that has been the case recently with the TB Guinness Global Energy fund. As at Friday 12 March, it was showing a four-week return of 17.5%.

Note: four-week data to 12 March.

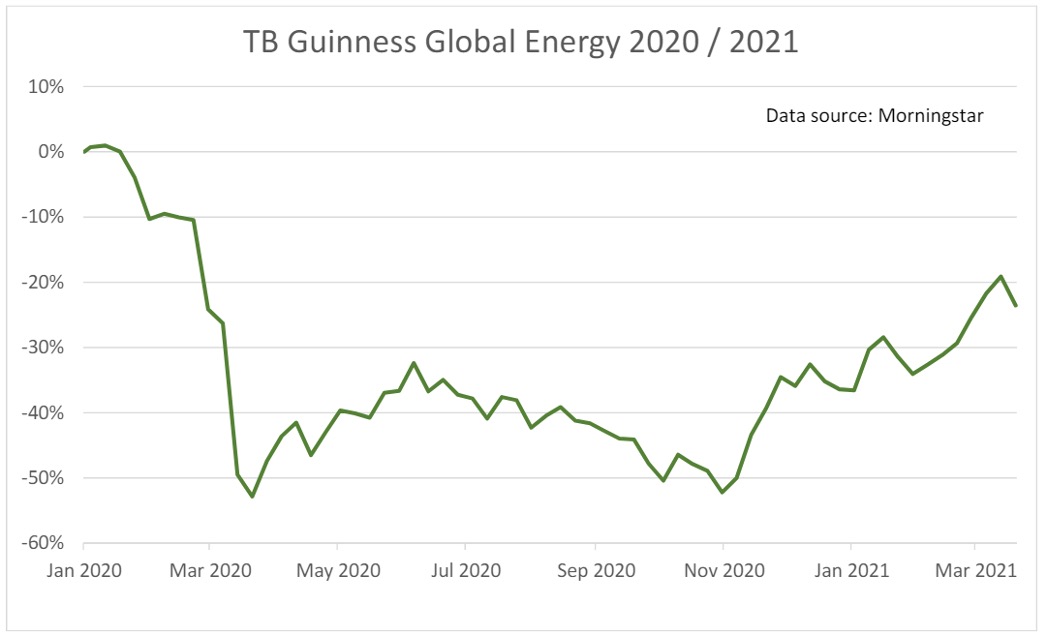

Although last week it fell by almost 5.5%, its performance since last November still looks impressive.

The TB Guinness Global Energy fund (formerly the Artemis Global Energy fund) was launched in April 2011. Its investment policy is to invest in the shares of companies engaged in the oil and gas sector, energy, generation and transmission. However, the fund may also invest in companies seeking to develop and exploit new energy technologies, and companies that service the energy sector.

Its largest holdings are usually in the massive multinational companies such as Exxon Mobil (NYSE:XOM), BP (LSE:BP.), Chevron (NYSE:CVX), Royal Dutch Shell (LSE:RDSB) and Total (NYSE:TOT)

These companies had a particularly difficult 2020. The global lockdown drastically reduced the demand for energy, and this had a direct impact on the bottom-line of these businesses. This downturn was reflected in the price of the TB Guinness Global Energy fund, which had halved in value by this time last year.

It then started to recover but fell back again as the second wave of the Covid-19 pandemic forced countries around the world back into lockdown.

It was not until the beginning of November that it really got going again. Several vaccines had been produced and were doing well in clinical trials. Roll-out was planned for December and that is what happened, at least in the UK. Investors could finally look beyond the pandemic to a time when businesses were back up and running and people were starting to move more freely.

We picked up this trend in December, which is when our more adventurous demonstration portfolio, the ‘Ocean Liner’, first invested in this fund. We added to our holding a couple of weeks ago.

As well as providing information on funds, we also track the performance of investment trusts and exchange-traded funds (ETFs).

In recent weeks, we have also noticed the ETFs tracking world energy, gasoline, gas and oil exploration/production, petroleum, crude oil and heating oil, generating some of the best returns.

Stock markets tend to be forward-looking with prices reflecting what investors think the world might be like in one or two years’ time. Current trends would suggest much higher levels of industrial activity than we are seeing at the moment – I hope that is the case.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.