Sprue Aegis: Do this and they'll be 'dirt cheap'

22nd June 2018 15:50

by Richard Beddard from interactive investor

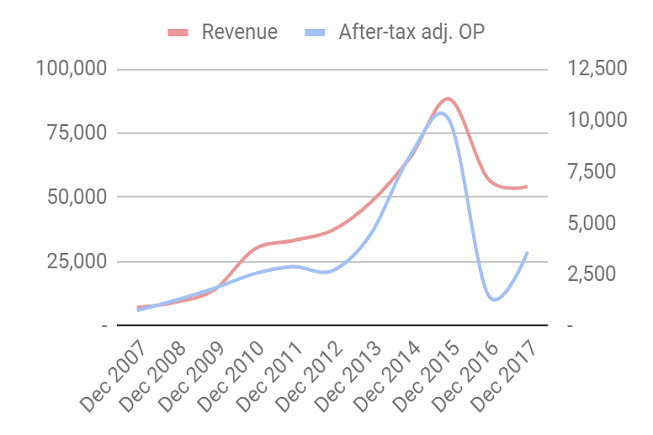

When it floated on AIM in 2014, Sprue Aegis was a youthful company with more than a decade of profitable growth behind it and a leading position in the UK retail market for smoke alarms and carbon monoxide detectors.

A focus on design had earned it dozens of patents protecting products that required little or no maintenance, were simple to install, and effective at sounding the alarm. A distribution agreement with a giant American supplier had opened the door to new customers in Europe, and it seemed Sprue would blossom into a European or perhaps global leader.

Living dangerously

Events could hardly have turned out differently. Over the last three years, the company has been hit by crisis after crisis. A massive surge in demand in 2015 due to legislation mandating smoke alarms in French homes was followed by a the strongest of backwashes. Once the French had alarmed their houses, Sprue's distributor had too much stock and little need for more alarms. Revenue and profit collapsed.

Source: interactive investor Past performance is not a guide to future performance

In the same year, a battery fault required Sprue to prepare to replace hundreds of thousands of alarms at an estimated cost of nearly £6 million, a calamity that delayed the certification of products in Germany, another country with new legislation.

Then, in March 2017 BRK, Sprue's supplier, served notice on the distribution agreement governing the companies' relationship, leaving Sprue scrambling to find and equip contract manufacturers to replace most of its products: BRK products distributed by Sprue, and Sprue products manufactured by a BRK subsidiary.

Alleging breaches of the agreement, BRK took legal action against Sprue, and although the two companies settled amicably, that amicability cost Sprue £3.8 million.

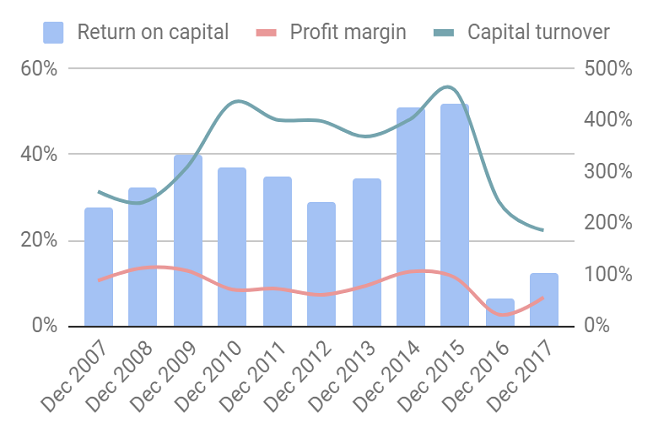

With management's attention on finding and equipping new contract manufacturers, one in Poland for Sprue-branded products, and one in China to replace BRK branded products, profitability slumped:

Source: interactive investor Past performance is not a guide to future performance

And just in case you think the slight upturn in my charts in 2017 represents a final turning point, it doesn't. In a faint echo of the destocking in France, Sprue's experiencing destocking in Germany and expects to make a loss in the half-year about to end, and revenue to be lower in the year to December 2018.

Despite its promise, Sprue's recent history shows the company has been anything but stable and growing. The question is, is Sprue out of the fire?

Drawing a line under the past, embracing the future

The company believes a clean break with BRK draws a line. By shifting production to contract manufacturers, one in Poland and one in China, it has reduced the number of products it makes by half and redesigned them so they can be manufactured more efficiently. Tooling the factories has been costly, but Sprue believes profit margins will improve and fewer products means it will have less cash tied up in stock.

Perhaps Spru's supplier troubles are over, but I'm not sure. It is still heavily dependent on its main suppliers. It is also dependent on distributors in Europe, where it earned 40% of revenue in 2017. Distributors own the customer relationship, and they cause Sprue pain too, because it supports them through wild downswings in demand by not demanding payment too quickly. Though Sprue has recovered some of the debt now, cash flow was reduce by £1.7 million at the year end while it waited for a distributor to pay invoices already over six months old.

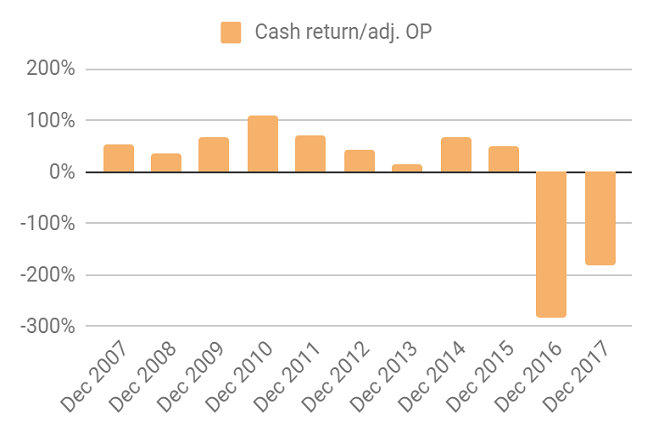

On average over the last eleven years just 23% of the adjusted profit figure has been earned in cash. When Sprue was growing rapidly it had to buy more stock, which dampened cash flow and as it contracted, it relaxed payment, which also dampened cashflow.

Source: interactive investor Past performance is not a guide to future performance

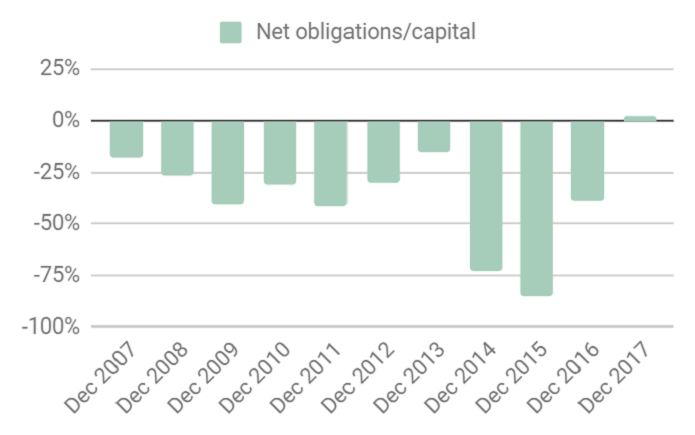

Warranty costs, provisioned in 2015 and treated as exceptional for the purpose of calculating profit, are still using up cash and so is investment in new technology, particularly connected alarms that talk to each other and can be monitored on a smartphone. For the first time I can remember, Sprue borrowed during 2017, and at the year end its once handsome net cash position had evaporated:

Source: interactive investor Past performance is not a guide to future performance

Sprue says the German market is moving swiftly to embrace connected products but it is uncertain enough about adoption rates that it has switched to an accounting convention allowing it to recognise less of the cost relating to investment in connected products in its income statement until sales take off.

Since the cash flow account records the cost in full immediately, this may increase the discrepancy between cash flow and accounting profit further. So will the cash cost of the settlement with BRK in 2018.

While Sprue sites cash flow and working capital as ‘key performance indicators’, Its annual report doesn’t disclose the levels it deems acceptable, which slightly unnerves me.

The promise of the connected home has drawn in new entrants: big tech companies like Google's Nest. Sprue's products work with Samsung's SmartThings platform, but Samsung is currently promoting another smoke detector made by ADT on its websites.

Frankly, I have no idea who will be the winners if our homes become connected, but I fear incumbent providers of stand-alone alarms are at risk.

As usual, I've scored Sprue under five criteria. The maximum score is two per criterion, giving a total out of 10:

Profitable: Does the company make good money without borrowing excessively?

Score: 0

Arguably it has in 2017, a 12% return on capital isn't bad. But Sprue only earned a 6% return on capital in 2016, and 2018 may be difficult too. Cash conversion is very poor, which makes me wonder whether high profits in the past truly reflect Sprue's profitability.

Adaptable: How will it make more money?

Score: 1

Sprue was founded twenty years ago and developed a highly profitable business and market leading products. It could innovate again, but the prospect of connected homes has attracted new, and innovative competitors and in Europe, Sprue will be competing against its former partner, BRK, now too.

Resilient: What could go wrong?

Score: 1

Plenty. Sprue remains heavily reliant on inconsistent demand from legislation, two suppliers, a small number of distributors, and for the first time I can remember, external finance.

Equitable: Will we all benefit?

Score: 1

Sprue says it is building a "high performance team culture" to "surprise and excite" customers, but it doesn’t elaborate much. The executive chairman and chief product officer are founders, and own nearly 15% of the shares, which gives them an incentive to be shareholder friendly.

Reasonably priced: Is the share price modest?

Score: 2

The shares cost about 10 times adjusted profit in 2017. If I could be more certain about Sprue's accounting and prospects they'd be dirt cheap.

I'm not at all certain. Profitability should rebound as management focus turns from firefighting back to designing better smoke alarms but I'm put off by unpredictable revenues driven by legislation and the potential for new entrants to upend the home safety market.

A total score of 5/10 is not sufficient to recommend Sprue. That doesn't mean it won't do well. I just can't find enough good reasons to believe it will.

Last week, I threatened to drop Sprue from my Decision Engine (a souped up watchlist). Actually, I'm going to follow the company for another year because it is so unlike most of the other suppliers of physical products I follow.

Companies like Victrex, Dewhurst, Thorpe (F W), Tristel and XP Power Ltd seek to retain and extend their control of manufacturing and distribution.

There's an argument that Sprue's way is better, that designers are best at designing, manufacturers are best at manufacturing and distributors are best at selling.

Experience, though, tells me you can have both control and efficiency.

Here are Richard's most recent articles:

- 16 conviction shares to consider

- Walker Greenbank: Cheap but fearful

- Hollywood Bowl close to joining exclusive club

- Anpario: Gearing up for growth

- Are Next shares a buy for the long term?

- 16 shares for the future

- Is Portmeirion in the 'buy' zone?

- XP Power shares: They're electrifying!

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.