Stockwatch: is this a genuine turning point for Ocado?

Long labelled a ‘jam tomorrow’ story, the FTSE 250 retail technology firm just bounced off historic lows. Analyst Edmond Jackson discusses whether risk really has tilted to the upside.

25th July 2025 11:04

by Edmond Jackson from interactive investor

Shares in grocery technology and logistics provider Ocado Group (LSE:OCDO) jumped 12% to 311p last Friday in response to results for the half-year to 1 June, gaining further traction this week to around 340p.

It marks a breakout of sorts after both sides of the group were shown growing, and management expressed confidence about positive cash flow in the next financial year. But how reliable is this?

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

Since Ocado listed in 2010, market sentiment has often been a tussle between traders who saw it as an overhyped logistics firm and, more recently, those visualising an emerging technology licenser that enables global retail partners to enhance their operations.

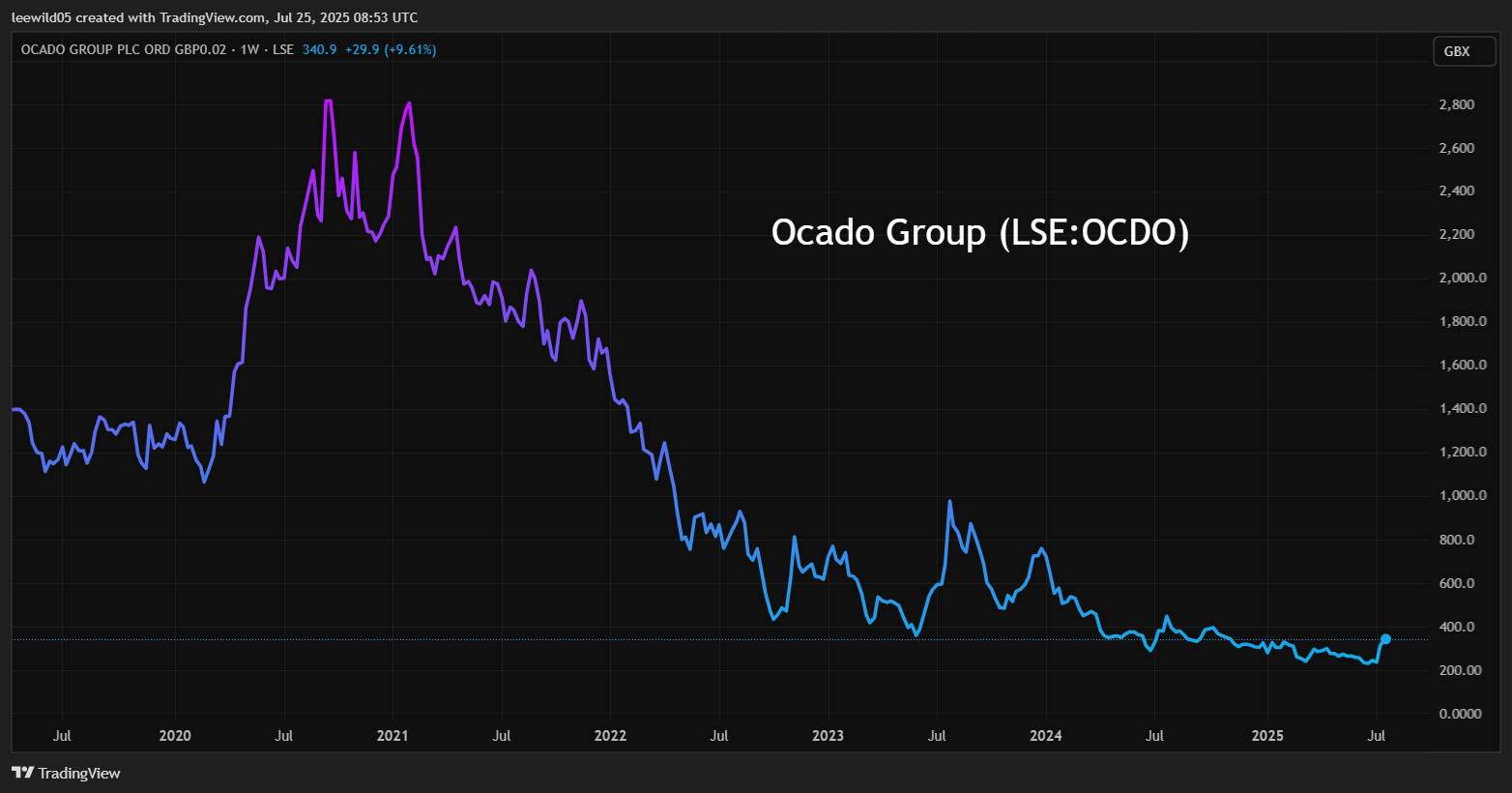

From 2017 to 2019, there was a major rally from 250p to over 1,300p, then Covid’s impact on supermarkets also provided a boost to share speculation, which saw Ocado shares up to 2,800p in 2020 and similarly in 2021. This bull trade then unwound down to 450p in October 2022 and continued to derate despite failed rallies. The March low of 222p and trading close to that as recently as 30 June, is as cheap as the shares have been since summer 2016.

Source: TradingView. Past performance is not a guide to future performance.

But with adjusted profit emerging on the technology side after years of losses, and this gaining revenue momentum, I can see why this interim report has been received well and three disclosed short sellers trimmed their positions straight after the results.

The business split has shifted since 2023, when retail constituted 90% of group revenue versus technology. This has reduced to 59% with these results, also 21% of adjusted EBITDA (earnings before interest, tax, depreciation and amortisation).

- ii view: Ocado still optimistic about core tech solutions unit

- Where to invest in Q3 2025? Four experts have their say

I originally drew attention to Ocado as a “buy” at 525p in January 2018, reiterating the sentiment that May at 800p following major French and Canadian technology/warehousing deals. I adjusted to “hold” from mid-2019 at 1,150p and with hindsight should have paid more attention to the bear trend, but the future is what counts now.

A relatively strong first half to 1 June 2025

Within continuing operations, group revenue up 13% to £674 million included an increase of 15% at technology solutions to £277 million and 12% at logistics to £397 million. In terms of adjusted EBITDA, technology jumped 109% to £73 million and logistics by 10% to £19 million. But hefty ongoing depreciation/amortisation charges (albeit 6% lower) at £174 million – and £44 million net interest charges - mean an overall pre-tax loss of £138 million, albeit improved from £153 million in 2024.

Net profits were boosted to £612 million, however, by a £778 million non-cash gain from the deconsolidation of its Ocado Retail joint venture, which was reclassified as an associate. I doubt this is behind a near 13% rise since the results, more likely it is overall improvement within the results and statement.

A market capitalisation near £2.9 billion compares with recent consensus for uplift from £1.2 billion revenue in 2024 to near £3 billion in the current financial year to 1 December and £3.3 billion in 2026 – hence broadly in line with sales, despite profitability depending on your perspective.

Ocado Group - financial summary

year ended 1 Dec

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 949 | 1,108 | 1,271 | 1,455 | 1,599 | 1,757 | 2,332 | 2,498 | 2,514 | 1,110 | 1,215 |

| Operating margin (%) | 1.7 | 1.9 | 1.7 | 0.4 | -2.0 | -10.6 | 0.0 | -5.4 | -18.0 | -19.5 | -23.2 |

| Operating profit (£m) | 16.3 | 21.4 | 21.6 | 5.4 | -31.9 | -187 | 0.5 | -135 | -453 | -216 | -282 |

| Net profit (£m) | 7.3 | 11.8 | 12.0 | -8.3 | -44.9 | -212 | -134 | -223 | -455 | -314 | -336 |

| Reported EPS (p) | 1.2 | 1.9 | 2.0 | -1.4 | -6.9 | -29.4 | -18.7 | -30.2 | -58.9 | -23.2 | -36.8 |

| Normalised EPS (p) | 1.5 | 2.2 | 2.5 | -1.2 | -6.7 | -20.9 | -27.0 | -33.1 | -60.3 | -35.2 | -37.2 |

| Operating cashflow/share (p) | 12.1 | 13.4 | 15.8 | 19.7 | 19.6 | 7.1 | 31.4 | -2.2 | 1.0 | 10.1 | 32.8 |

| Capex/share (p) | 12.8 | 16.0 | 20.2 | 30.2 | 26.0 | 35.8 | 62.9 | 93.4 | 102 | 65.7 | 48.7 |

| Free cashflow/share (p) | -0.7 | -2.6 | -4.4 | -10.4 | -6.4 | -28.6 | -31.5 | -95.6 | -101 | -55.6 | -15.9 |

| Net debt (£m) | 99.4 | 132 | 165 | 231 | -47.7 | -146 | -704 | 359 | 576 | 1,031 | 953 |

| Net assets per share (p) | 37.2 | 41.0 | 41.7 | 41.4 | 80.4 | 150 | 239 | 214 | 225 | 182 | 144 |

Source: historic company REFS & published accounts.

Management reiterates its focus on turning cash flow positive in the next financial year to 1 December 2026, and its presentation on the company’s website says the retail side is now self-funding. As yet, the cash flow statement is net-negative: outflows of £108 million albeit improved from £201 million due to higher revenues, lower capital expenditure and cost controls, hence supporting next year’s target if the trend broadly continues.

Consensus forecasts to date still anticipate net losses - £224 million this financial year, easing to £200 million in 2026.

Ocado thus remains a “jam tomorrow story” and some shareholders have raised eyebrows after the CEO said: “don’t obsess over short-term profitability” in a post-results interview, having received a £54 million bonus in 2020 as part of an £88 million scheme for Ocado bosses back then.

Yet if one is over-cynical, it is possible to miss a turning point. Technology capacity has been added in Australia, Spain and South Korea, and the CEO cites “ramping up commercial conversations across global regions...many of these markets have developed substantially in recent years and the online channel is fully established as the major growth driver in grocery globally”.

So, you have a major market low, the key technology side looking as if it is finally gaining momentum, and what seems to be a balance of short sellers appearing to sense it is time to start cashing in their downward bets. Risk may now have tilted to the upside rather than downside.

Interesting technical position in the short book

In terms of disclosed short positions over 0.5% of issued share capital, it has varied from 0.5% in April 2022 to a peak of 8.3% in May 2024, as hedge funds sought to exploit the downwards chart. Currently 5.4%, it still implies £154 million staked on a downside scenario, yet it’s what you can expect to see after a major downtrend. Only a minority of hedge funds are ahead of the game, most are trend followers.

If a share is even only possibly at an inflection point upwards, short-closing can help make it so.

In July, five of the disclosed short sellers trimmed their positions, within which three did so as disclosed on 18 July, perhaps helping the price jump on the 17 July interim results day. The last time a disclosed short was raised was 17 April and by 0.01% to 0.50% (this position currently is sustained).

While it is early to assume anything about the trend here, it is a relevant change to note when judging supply and demand for shares.

Mid-year balance sheet shows 28% improvement in net assets

The rise to £1,750 million, or 209p per share was helped by a 14% rise in non-current assets to £3,381 million, although current assets fell 23% to £1,014 million.

Both non-current and current liabilities saw moderate reductions despite total borrowings barely changed at £1,485 million (£300 million of which has been refinanced). Lower lease liabilities and trade payables helped.

Goodwill and intangible assets account for £671 million, or 38% of the net total, which strikes me as fair enough for an increasingly tech-driven group.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Trading Strategies: FTSE 100 high-flyer backed to keep outperforming

Period-end cash rose 11% to £746 million, or 89p per share, in context of the cash flow statement showing £176 million investment in tangible/intangible assets. The cash position also helps resolve debt as it matures: £600 million convertible bonds this December, £500 million senior notes in October 2026 and £350 million convertible bonds in January 2027. In its results presentation, management expresses confidence of meeting such needs.

Broad if early stage credentials as a speculative ‘buy’

A lack of established profits record and impossibility to define intrinsic value, rule out Ocado as an investment. But these elements I identify - of a major chart low, improving narrative and financials, short sellers starting to look edgy, and a bounce on these results – imply the prospect at least of a support level forming, possibly a medium-term bull trend if improvements continue.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.