Stockwatch: is this the next cheap share to be taken over?

This previously very profitable tip has fallen out of favour, but the share price has steadied, and the latest update was positive. Analyst Edmond Jackson reassesses this AIM company.

27th May 2025 10:19

by Edmond Jackson from interactive investor

After noting the takeover of pawnbroker H&T Group (LSE:HAT) at a huge premium, it is interesting to compare and contrast another smaller AIM-listed company on a modest rating. Insolvency services group Begbies Traynor Group (LSE:BEG) has, moreover, also released a positive trading update, so (somewhat perversely) it’ll be interesting to see what that might imply for the UK economy.

- Learn with ii: ISA Allowance | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Similarly to H&T before an offer, Begbies, at 100p a share currently, trades on a 12-months forward price/earnings (PE) multiple of around 9x and is priced for a 4.4% prospective yield. Its narrative has generally been good over the years, but frustratingly its shares have quite often trended at odds with its financial performance.

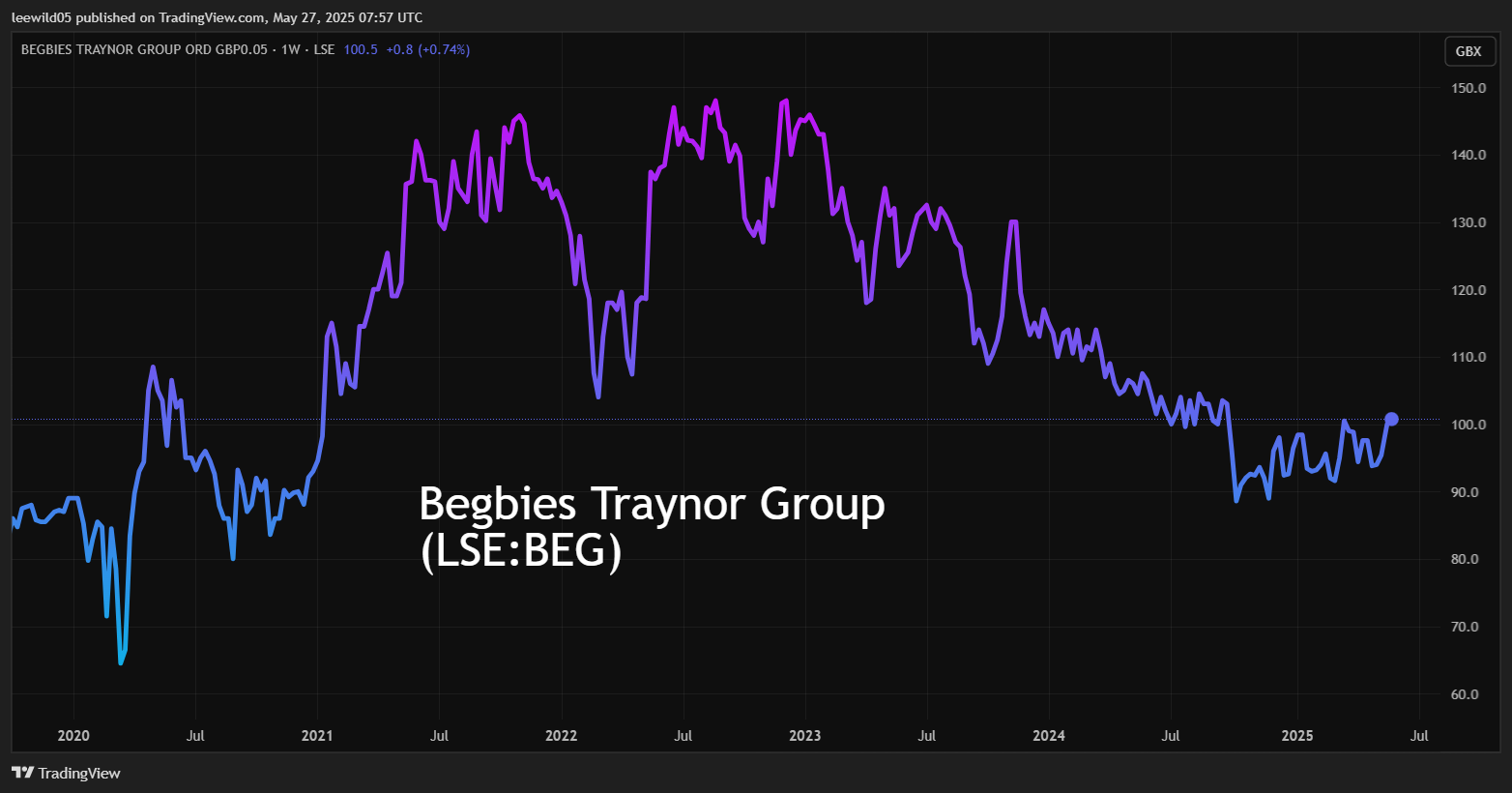

For example, see the five-year chart below trending lower for the past couple of years despite normalised earnings per share (EPS) having risen from around 3p to 5p and to over 10p if consensus to 30 April is correct.

Source: TradingView. Past performance is not a guide to future performance.

Quite like H&T’s erratic share performance, what’s the point of holding them as a hedge against an economic downturn if they do not perform when conditions are tough?

Essential parallels between these two groups

Similarly, as H&T is the UK’s largest pawnbroker, Begbies is the largest insolvency specialist.

A gripe tends to be that there’s a big difference between reported and normalised EPS – this is the case for both companies but is greater for Begbies – as a result of acquisitions generating exceptional costs and amortisation of intangibles via the income statement. While the latter can be excused as an accounting matter, advisory and integration/restructuring costs are borne by shareholders.

- Shares for the future: this one’s still a ‘screaming buy’

- Insider: sizeable director purchases at two FTSE 250 companies

Strategically, both have tried to balance activities to mitigate earnings volatility. Begbies has diversified into property services and advisory, which have actually held up well despite the UK’s challenges. H&T is in jewellery retail, which you might think trends counter to pawnbroking given discretionary spending is often crimped in a slowdown. But it makes operational sense to dovetail with pawnbroking should customers wish or need to sell; and in harder times jewellery buyers may opt for second-hand.

But is a takeover likely to materialise for Begbies?

If it does, then I would bet on a private equity-funded management buyout as more likely than a third party. FirstCash Holdings Inc (NASDAQ:FCFS) identified H&T as a key means to its UK/European expansion, hence strategic benefits motivating that takeover.

Begbies has spent over 20 years as a listed company after its founding in 1989. Its best rating was achieved early on, in the run-up to the 2008 crisis, although probably involved excess speculation and risk engagement back then. After collapsing to 20p, the shares only steadily recovered to over 100p pre-Covid, re-gaining 200p in the lockdowns period but which similarly reflected risk appetite for small-caps.

More recently there was a derating to 88p by last October, which hardly squares with Begbies’ financial track record and might have made management think whether it could be time to move on from a fickle AIM listing.

Begbies Traynor Group - financial summary

year ended 30 Apr

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 45.4 | 50.1 | 49.7 | 52.4 | 60.1 | 70.5 | 83.8 | 110 | 122 | 137.0 |

| Operating margin (%) | 0.7 | 3.7 | 2.9 | 5.3 | 7.3 | 5.5 | 3.3 | 4.4 | 5.9 | 6.5 |

| Operating profit (£m) | 0.3 | 1.9 | 1.4 | 2.8 | 4.4 | 3.9 | 2.8 | 4.9 | 7.2 | 7.7 |

| Net profit (£m) | -1.6 | 0.5 | -0.3 | 1.4 | 2.3 | 0.9 | 0.2 | -0.5 | 2.9 | 1.5 |

| EPS - reported (p) | -0.6 | 0.4 | 0.2 | 1.3 | 1.9 | 0.7 | 0.1 | -0.3 | 1.8 | 0.9 |

| EPS - normalised (p) | 1.4 | 0.9 | 1.3 | 2.0 | 2.9 | 2.4 | 3.5 | 3.1 | 4.3 | 5.1 |

| Return on equity (%) | -1.0 | 0.7 | 0.4 | 2.5 | 3.9 | 1.5 | 0.2 | -0.6 | 3.5 | 1.8 |

| Operating cashflow/share (p) | 3.9 | 6.2 | 5.2 | 6.6 | 4.9 | 1.3 | 9.5 | 6.4 | 3.9 | 5.6 |

| Capital expenditure/share (p) | 1.3 | 0.5 | 0.3 | 0.4 | 0.9 | 0.6 | 0.9 | 0.7 | 0.6 | 0.9 |

| Free cashflow/share (p) | 2.6 | 5.8 | 4.9 | 6.2 | 4.0 | 0.7 | 8.6 | 5.7 | 3.3 | 4.7 |

| Dividends per share (p) | 2.2 | 2.2 | 2.2 | 2.4 | 2.6 | 2.8 | 3.0 | 3.5 | 3.8 | 4.0 |

| Covered by earnings (x) | -0.3 | 0.2 | 0.1 | 0.5 | 0.7 | 0.3 | 0.04 | -0.1 | 0.5 | 0.2 |

| Cash (£m) | 9.2 | 7.6 | 6.7 | 3.5 | 4.0 | 7.3 | 8.0 | 9.7 | 8.0 | 5.6 |

| Net debt (£m) | 12.8 | 10.4 | 10.3 | 15.7 | 14.6 | 11.1 | 5.8 | 1.7 | 5.2 | 13.1 |

| Net assets (£m) | 61.0 | 60.2 | 58.1 | 56.2 | 58.1 | 65.6 | 86.3 | 84.5 | 84.3 | 78.4 |

| Net assets per share (p) | 55.7 | 54.3 | 54.4 | 51.1 | 50.8 | 51.3 | 57.2 | 55.1 | 54.6 | 49.3 |

Source: historic company REFS and company accounts.

This latest update in respect of the April 2025 year cites 10% organic revenue growth, or 12% at the reported level to £153 million, with adjusted pre-tax profit up 7% to £23.5 million. At first sight that implies some loss of margin where 5.6% was achieved at the group operating level in the April 2024 year.

Yet “business recovery and advisory” saw 11% organic revenue growth, with margins said to be “consistent” in the second half, the interim accounts having shown a 16.5% normalised operating margin at the group level and 7.6% reported. An increased fee pipeline on appointed cases is said to support ongoing revenue growth in this April 2026 year, which is reassuring if tricky to quantify.

Property advisory and transaction services have seen 2025-year revenue grow 15%, or 7% organically - the interim accounts represent around 30% of group revenue and at lower margin than the business advisory/insolvency side (explaining the apparent margin slip at group level).

- Trading Strategies: why stock market gains could be ahead

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

The dilemma for growth-oriented investors is the financial summary table showing returns on equity only as high as 3%. While the dividend has been uncovered by earnings, free cash flow (what really counts) has been consistently ahead of payouts. As yet, consensus only expects around 3% growth in metrics for the April 2026 year, which would be flat after inflation.

On the other hand, it is at times like this – the business apparently lacking growth appeal – when offers tend to be made, on the grounds that the listing costs no longer make sense. Shareholders feel any useful premium is welcome so they can invest elsewhere.

Supportive macro context for Begbies’ main business

Whether it remains public or goes private, there should be growth opportunities for “business recovery” services, with property auctions and advice part of this.

The EY Item Club of forecasters predicts the UK economy is set to slow sharply for the next two years as global trade conflicts dampen consumer spending and business investment. An Ipsos poll tracking net economic optimism in Britain since 1978, has found three-quarters of Britons expect the economy to get worse over the next year, just 7% reckon it will improve, and 13% think it will stay the same.

Obviously, sentiment can be fickle, and the UK economy did grow marginally better than expected from last January to March compared with 2024, even if gross domestic product rose only 0.7% against a 0.6% forecast. But it was no recession, and was, in fact, higher growth than other G7 countries during that period as the threat of US tariffs began to disrupt commerce.

It's unclear whether that is as good as it gets this year as some extent of US tariffs weigh and UK consumers react to higher bills and taxes from April.

- Stockwatch: is this FTSE 100 share now a contrarian buy?

- How DB to DC pension shift is impacting workers’ retirements

The Bank of England has, however, cut interest rates in respect of economic headwinds – despite these including inflation – which may mitigate stress on indebted firms.

Begbies’ last “red flag alert” report indicated a 13% rise in businesses in “critical” financial distress during the first quarter of 2025, versus a 3% decline in the last quarter of 2024. Bars and restaurants, travel and tourism, showed the greatest increase as you might expect where discretionary spending is involved.

A ‘conundrum’ remains for these shares

I last wrote on Begbies in January 2024, describing them as a “conundrum”, albeit retaining a “buy” stance at 112p having initiated “buy” at 87p in December 2020, moderated to “hold” at 140p in May 2021 then resumed “buy” at 137p that October.

I was significantly influenced by the red flag alert reports and a modest rating around 10x forward earnings. In hindsight, these red flag reports do consistently flag “distressed” sectors and perhaps a 10x PE is justified considering H&T’s long-term return on equity has been up to four times Begbies.

I still cannot help think Begbies is a sound business where management might choose to go private – seeing more costs than benefits in maintaining a listing. While net debt rose to £13 million a year ago, the latest update cites a net cash position.

No directors have seen fit to buy shares lately, however. Instead, last October, a non-executive director and his wife sold £126.6K worth of shares at an average price of 92.4p (but there might have been a specific reason to do so, we don’t know).

At 100p, I retain a “buy” stance, but somewhat speculatively.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.