Shares for the future: this one’s still a ‘screaming buy’

Analyst Richard Beddard wonders whether he was mad to rate this stock so highly, or everybody else is. But after fresh analysis, the business still gets a top three score.

23rd May 2025 15:00

by Richard Beddard from interactive investor

When I scored Churchill China (LSE:CHH) last year it got 10 out of 10, which is extremely rare. The score implied the business was excellent and the share price was very low in comparison to normalised profit.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

My enthusiasm encouraged me to follow up three previous trades by adding more shares to the Share Sleuth portfolio:

Source: ShareScope.

Since then, the share price has almost halved.

Today, I’m wondering whether I was mad, or everybody else is. If Churchill was a screaming buy then, other things being equal, I will not be able to find words to describe it now.

What’s the problem with Churchill China?

To get a feel for where Churchill may be going, we need to know where it has come from.

Source: Churchill China.

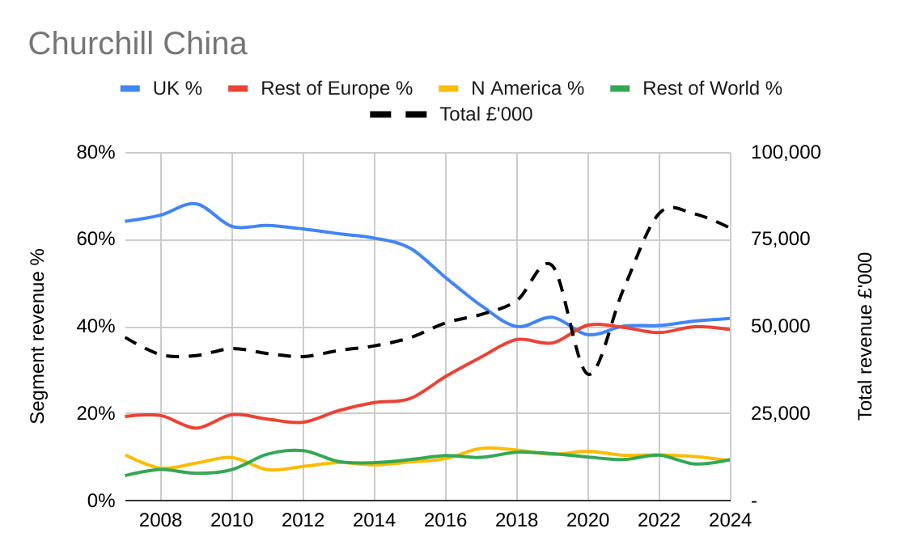

The dashed line tells part of the story. It is Churchill’s total revenue since 2007, which has grown by 87%.

That might sound low for such a long period but during the early, no-growth years, Churchill was exiting much of its retail business, which outsourced production, to focus on tableware for the hospitality sector made in its own factory.

Retail brought in nearly 40% of revenue in 2007 but today it is no longer separately reported. Contraction in one part of the business was obscuring growth in the other.

The accelerating period of revenue growth ended in a spike in 2019 due in part to the acquisition of Furlong Mills, which supplies clay, glaze and colour to Churchill and other potters.

Many factors drove growth in the last decade. Eating out was increasingly popular, and eateries preferred pricier coloured and textured tableware over traditional plain white designs.

Churchill is adept at mass producing patterned plates due to the particular qualities of British clays, know-how developed over centuries, and proprietary developments in the production process that allow it to place the pattern beneath the glaze in a simple and highly automated process.

- Stockwatch: is this FTSE 100 share now a contrarian buy?

- This is why investors blow up – even when knowing the future

This process makes the plates attractive, relatively cheap to manufacture and durable, a quality required by commercial kitchens, where tableware receives knocks and goes through multiple dishwasher cycles each day.

Churchill found success in Europe (red line in the chart above), which increased its contribution to the company’s sales from 20% to 40%. In 2024, European sales were 274% higher than they were in 2007.

While UK revenue fell from more than 60% to 40% over the same period, it still grew modestly in absolute terms despite Churchill’s much larger share of the UK market.

During the second half of the 2010’s, greater volumes going through its factory in Stoke-on-Trent meant that it was operating more efficiently. The company was not only growing revenue, it was getting better at it, and profit grew faster.

Since 2020, revenue has been much more volatile and Churchill has experienced two years of contraction, a 5% revenue decline in the year to December 2024 and a 46% decline in 2020.

Churchill receives repeat business due to breakages and as customers expand, but the pandemic shut hotels, restaurants and canteens. Customers were not breaking plates and they were not opening new restaurants.

When the pandemic abated, demand for tableware surged back. Then the cost-of-living crisis dampened our appetites. Now hotels and restaurants are counting their pennies again due to increases in the national living wage and national insurance costs in the UK.

Churchill believes people still want to eat out, but the compression of profitability at eateries means its customers are reluctant to invest in tableware.

Despite the declines of 2020 and 2024, Churchill’s revenue has grown modestly by 15% over the five-year period. The disappointing thing for me is that the European growth engine may be sputtering.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Lloyds among bank shares tipped following sector upgrade

Every year since 2020, Europe has performed marginally less well than the UK despite its earlier outperformance, Churchill’s much lower market share there, and the company’s expectation that it will be the primary source of growth.

Brexit may explain why, although Churchill tells me that except for prospective customers worrying about slow delivery, it hasn’t been an issue. In fact, the company has a distribution hub in Rotterdam and supplies most European orders in 24 hours.

Other factors may be significant, like the reinstatement of 19% VAT on hospitality in Germany last year (it is reverting to 7% again this year) and falling whiteware sales in southern Europe. Since white tableware is less differentiated, Churchill’s whiteware is less competitive than its patterned tableware in what is a more price-sensitive geography.

2024: a bad year for a good company

Volatile demand, as well as higher energy and labour costs, mean Churchill’s factory is operating less efficiently, and profitability has yet to recover to pre-pandemic levels. A 5% decline in revenue translated to a 21% decline in adjusted profit.

Churchill is responding to these challenges by cutting costs and investing in process improvement, including electrification to reduce energy costs and emissions.

Cash conversion of 19% in 2024 was poor, due to an increase in working capital. This, the company says, was mainly because of the timing of the year-end date, which gave it less time to shift stock and collect payment.

The company may also have held more stock in anticipation of a second-half recovery which did not materialise. This is forgivable. Churchill’s strategy requires it to hold stock to meet deliveries on time.

Cash flow should improve in 2025 and Churchill remains in a very strong financial position. It had no debt at the year end and cash handily exceeded modest lease obligations.

- Sector Screener: expect further capital gains from this pair

- Fund managers’ favourite UK smaller companies

Happily, another factor will improve cash flow henceforward. Churchill’s pension is in surplus and it no longer needs to make deficit payments. These cost it £1.2 million in 2024, and more in previous years.

Churchill has a great product and usually delivers it quickly. I always check the tableware when we eat out, and it is often Churchill, especially in the UK. I drink coffee from a Churchill cup every day, and it looks as good as it did when it was given to me at the company’s AGM sometime in the 2010s. There is none of the staining that I see in the cheap mug Howdens gave me at one of their AGMs (Howdens doesn’t make cups, so this is no stain on the fitted kitchen supplier!)

Management deserves credit for the company’s success. Chief executive David O’Connor was appointed in 2014 and joined the business 32 years ago. Sales director since 2015, James Roper, joined in 2001.

He is one of several members of the Roper family on the list of major shareholders. The family took control in 1922, and it seems likely their ownership has been a stabilising factor. Staff are highly trained and “given the space to make decisions without fear of failure”. The average term of service is nearly 12 years.

2024 was a bad year, but Churchill’s after-tax return on capital of 11% does not make it look like a bad business. I think its enduring qualities will see it through this period of turbulent profitably. It should emerge stronger.

Scoring Churchill China: more circumspection

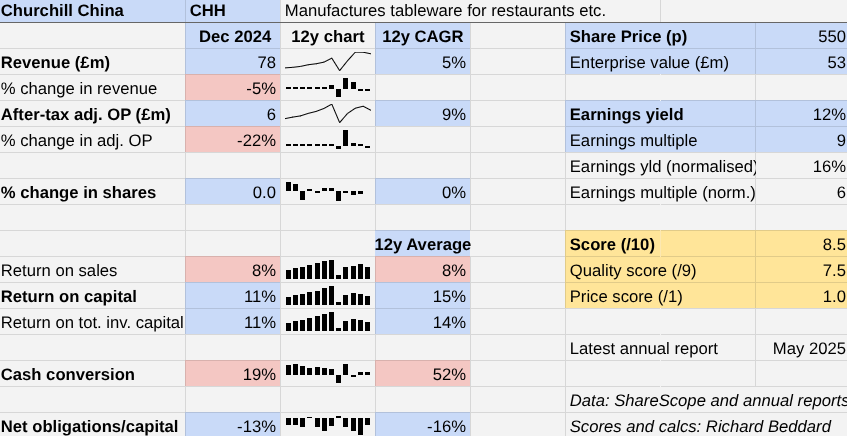

Churchill China | CHH | Manufactures tableware for restaurants etc. | 21/05/2025 | 8.5/10 |

How successfully has Churchill China made money? | 2.0 | |||

A proprietary manufacturing process enables Churchill to make durable attractive tableware cheaply, resulting in profitable long-term growth. Since 2020, the hospitality market has been disrupted. Revenue has been volatile and profitability sub-par. | ||||

How big are the risks? | 2.5 | |||

Churchill operates less efficiently when volumes are low but it has remained comfortably profitable through thick and thin (except in 2020 when it broke even). The company has no debt, experienced management and a local vertically integrated supply chain. The big opportunity is Europe, but sales growth has lagged the UK since 2020. | ||||

How fair and coherent is its strategy? | 3.0 | |||

The company focuses on long-term growth drivers: customer service, empowering employees, investing to reduce costs and emissions and increase productivity and product quality. | ||||

How low (high) is the share price compared to normalised profit? | 1.0 | |||

Low. A share price of 550p values the enterprise at £53 million, about 6 times normalised profit. | ||||

A score of 8.5/10 indicates Churchill China is a good long-term investment. | ||||

NB: Bold text indicates factors that reduce the score. Bold and italicised text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explainedhere) | ||||

My score is more circumspect than my previous one, when I gave Churchill a score of 9 and the share price was already low enough to boost the total score to 10 out of 10.

I naively assumed that Churchill would bounce back more convincingly, but the world has changed, recovery is protracted, and growth rates may be lower in the future than the past.

That said, in my opinion Churchill’s score is still high enough to earn the “screaming buy” epithet!

19 Shares for the future

Here is the ranked list of Decision Engine shares that score more than 7 out of 10. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score more than 7 out of 10 to be good value.

0 | company | description | score |

1 | James Latham | Imports and distributes timber and timber products | |

2 | FW Thorpe | Makes light fittings for commercial and public buildings, roads, and tunnels | |

3 | Churchill China | Manufactures tableware for restaurants etc. | 8.5 |

4 | Dewhurst | Manufactures pushbuttons and other components for lifts and ATMs | |

5 | Howden Joinery | Supplies kitchens to small builders | |

6 | Oxford Instruments | Manufacturer of scientific equipment for industry and academia | |

7 | Renishaw | Whiz bang manufacturer of automated machine tools and robots | |

8 | Solid State | Assembles electronic systems (e.g. computers and radios) and distributes components | |

9 | Focusrite | Designs recording equipment, loudspeakers, and instruments for musicians | |

10 | Macfarlane | Distributes and manufactures protective packaging | |

11 | Bunzl | Distributes essential everyday items consumed by organisations | |

12 | Renew | Repair and maintenance of rail, road, water, nuclear infrastructure | |

13 | Advanced Medical Solutions | Manufactures surgical adhesives, sutures, fixation devices and dressings | |

14 | YouGov | Surveys and distributes public opinion online | |

15 | Porvair | Manufactures filters and laboratory equipment | |

16 | James Halstead | Manufactures vinyl flooring for commercial and public spaces | |

17 | Games Workshop | Manufactures/retails Warhammer models, licences stories/characters | |

18 | Hollywood Bowl | Operates tenpin bowling and indoor crazy golf centres | |

19 | Jet2 | Flies holidaymakers to Europe, sells package holidays |

Scores and stats: Richard Beddard. Data: ShareScope and annual reports

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

21 more speculative shares

Shares that score 7 or less out of 10 are more speculative, either because their share prices are high in relation to normalised profit or because I am less confident in the businesses than I should be (or both!).

4imprint Group (LSE:FOUR), Anpario (LSE:ANP), and Keystone Law Group Ordinary Shares (LSE:KEYS) have published annual reports and are due to be re-scored.

0 | company | description | score |

20 | *Victrex* | Manufactures PEEK, a tough, light and easy to manipulate polymer | |

21 | *Treatt* | Sources, processes and develops flavours esp. for soft drinks | |

22 | *Tracsis* | Supplies software and services to the transport industry | |

23 | Softcat | Sells hardware and software to businesses and the public sector | |

24 | 4Imprint | Customises and distributes promotional goods | |

25 | Celebrus | Makes marketing and fraud prevention software, sells it as a service | |

26 | *Marks Electrical* | Online retailer of domestic appliances and TVs | |

27 | Volution | Manufacturer of ventilation products | |

28 | *Anpario* | Manufactures natural animal feed additives | |

29 | Auto Trader | Online marketplace for motor vehicles | |

30 | Dunelm | Retailer of furniture and homewares | |

31 | *RWS* | Translates documents and localises software and content for businesses | |

32 | Bloomsbury Publishing | Publishes books, and digital collections for academics and professionals | |

33 | Quartix | Supplies vehicle tracking systems to small fleets and insurers | |

34 | Goodwin | Casts and machines steel. Processes minerals for casting jewellery, tyres | |

35 | Judges Scientific | Manufactures scientific instruments | |

36 | DotDigital | Provides automated marketing software as a service | |

37 | Garmin | Manufactures sports watches and instrumentation | |

38 | Tristel | Manufactures disinfectants for simple medical instruments and surfaces | |

39 | Cohort | Manufactures military technology, does research and consultancy | |

40 | Keystone Law | Runs a network of self-employed lawyers |

Scores and stats: Richard Beddard. Data: ShareScope and annual reports

Click on a share's score to see a breakdown (scores may have changed due to movements in share price)

Shares in *italics* score less than 6/9 for business quality and may be removed

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Churchill China and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.