Stockwatch: poised to rally or classic value trap?

Trading near post-Covid lows, these shares have piqued the interest of analyst Edmond Jackson. Here, he reveals whether he’d buy them now.

28th October 2025 11:20

by Edmond Jackson from interactive investor

Mid-cap shares in specialist media group Future (LSE:FUTR) have risen to 647p from an all-time low of 612p on 20 October. The business derives revenue from advertising, e-commerce affiliate sales, plus some 200 higher-profile consumer magazines.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

Its acquisitive history is shown by a balance sheet with 138% net assets that constitute goodwill or intangibles and, although a strongly cash-generative profile has helped pay down net debt to around £240 million, net interest costs took 18% of operating profit in the first half to 31 March.

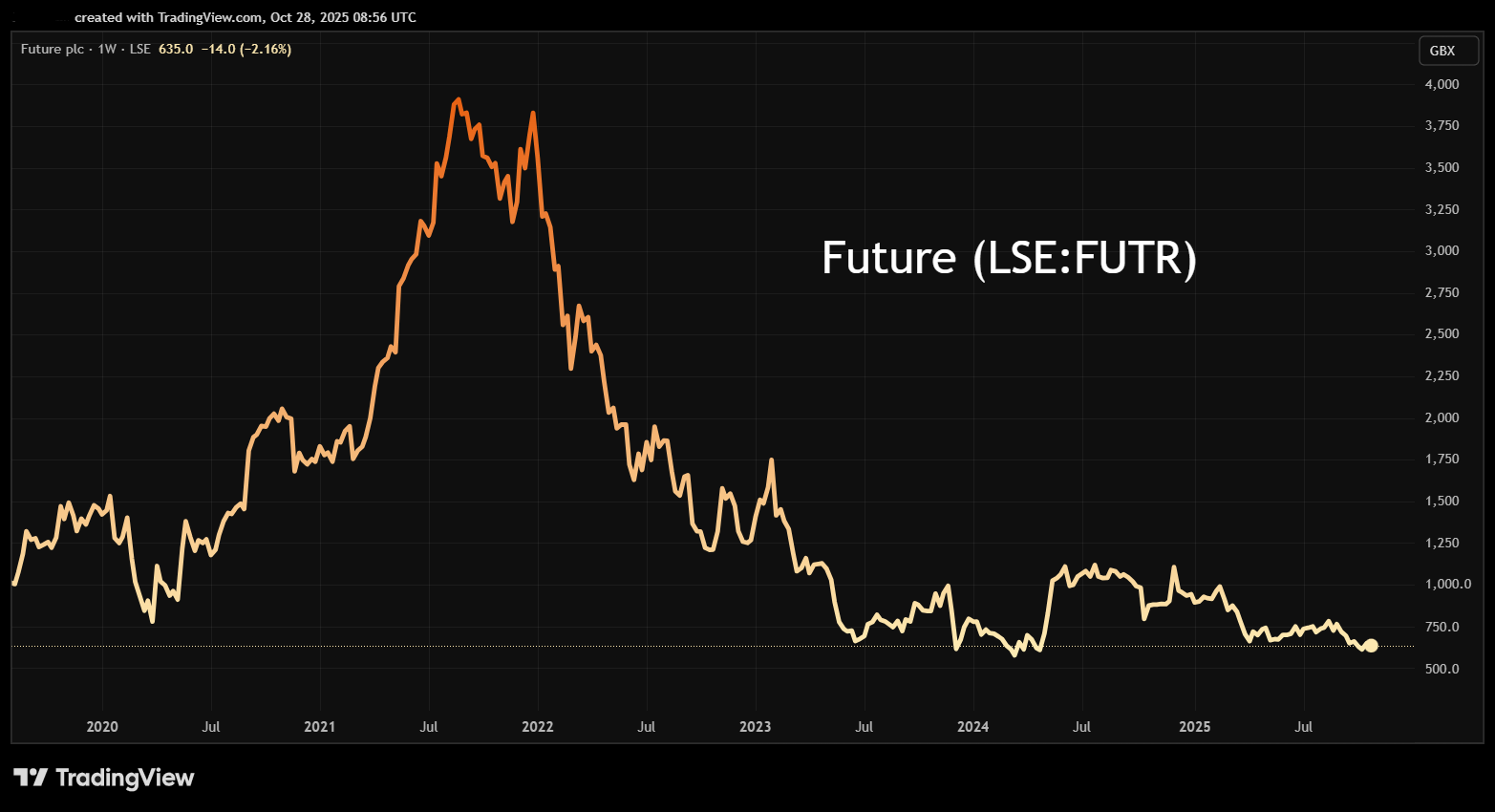

Future shares were a trailblazer from around 150p in 2017 to over 1,400p just before Covid. They soared to near 4,000p in mid-2021, then the momentum bubble burst (as it did with plenty of other shares) and Future was hit by a post-pandemic advertising slump – shares had fallen to 616p by early 2024 and have been volatile moving sideways ever since.

Source: TradingView. Past performance is not a guide to future performance.

Double-digit margins boost cash generation

The 10-year table shows operating margin rising, particularly in the March 2020 year, although in terms of radical change it was early 2021 when Future bought the listed price comparison website group GoCompare.

The idea was to combine Future’s audience insights and content creation, with GoCo’s price comparison technology, generating a stronger e-commerce and financial services offering for consumers, plus an enhanced platform for advertisers. At this point, Future shares were around 1,800p.

Future - financial summary

Year end 30 Sep

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 59.8 | 59.0 | 84.4 | 130 | 222 | 340 | 607 | 825 | 789 | 788 |

| Operating margin (%) | -2.8 | -24.1 | 0.9 | 4.1 | 6.8 | 14.9 | 19.0 | 22.8 | 22.1 | 17.0 |

| Operating profit (£m) | -1.7 | -14.2 | 0.8 | 5.3 | 26.7 | 50.7 | 115 | 189 | 175 | 134 |

| Net profit (£m) | 1.6 | 2.9 | 8.1 | 44.3 | 66.1 | 122 | 113 | 76.8 | ||

| EPS - reported (p) | -7.7 | -50.7 | 3.3 | 4.7 | 9.3 | 45.4 | 58.1 | 101 | 94.1 | 66.8 |

| EPS - normalised (p) | 3.8 | 8.1 | 13.3 | 13.5 | 31.9 | 71.9 | 79.2 | 113 | 111 | 71.8 |

| Operating cashflow/share (p) | -33.0 | 7.0 | 20.8 | 16.0 | 56.6 | 83.4 | 146 | 167 | 152 | 148 |

| Capital expenditure/share (p) | 7.7 | 8.8 | 5.4 | 3.9 | 6.5 | 6.5 | 9.8 | 9.6 | 9.4 | 12.1 |

| Free cashflow/share (p) | -40.6 | -1.8 | 15.4 | 12.1 | 50.2 | 76.9 | 136 | 158 | 142 | 136 |

| Dividends per share (p) | 0.5 | 1.0 | 1.6 | 2.8 | 3.4 | 3.4 | 3.4 | |||

| Covered by earnings (x) | 9.5 | 9.3 | 28.4 | 20.8 | 29.7 | 27.7 | 19.6 | |||

| Cash (£m) | 2.5 | 2.9 | 10.1 | 6.4 | 6.6 | 19.3 | 324 | 29.2 | 60.3 | 39.7 |

| Net debt (£m) | 1.8 | -0.5 | 10.0 | 17.8 | 40.3 | 86.8 | 225 | 492 | 372 | 295 |

| Net assets (£m) | 31.4 | 21.2 | 61.3 | 173 | 213 | 381 | 862 | 1,061 | 1,115 | 1,062 |

| Net assets per share (p) | 120 | 73.4 | 115 | 212 | 255 | 389 | 715 | 878 | 936 | 947 |

Source: historic company REFS and company accounts.

One way of looking at the de-rating is to consider if £594 million paid for GoCo was reasonably fair. If it was, then a current market value of £638 million with the shares at 647p implies the media side is worth only £46 million, or 0.1x the sales they achieved in the financial year to 30 September 2020. The price/earnings (PE) ratio would be just over 1x. Or did Future overpay for GoCo which substantially justifies a de-rating?

Yet that could be true, and the media operations have weak near-term prospects, but down at this price the shares might still offer value. Much work has been undertaken to upgrade and refocus Future from traditional print to a digital media platform, and the CEO since 31 March was the chief technology officer who became responsible for the business-to-consumer brands.

However, price comparison websites have attracted competition, and the old Moneysupermarket.com – now Mony Group (LSE:MONY) – is an ex-growth share trading sideways on a forward PE of 10.5x and a yield approaching 7%.

- Stock market bull run – a third year of stellar annual returns?

- Sector Screener: rate cuts to aid two cheap housebuilders

That Future generated £156 million free cash flow in its March 2024 year and is currently amid a £55 million buyback programme, suggests to me the kind of business liable to get on the private equity evaluation radar. While it currently wouldn’t be wise to gear up the company further, its business is able to support debt.

On 22 May, the CEO bought £100,000 worth of shares and the finance director close to £50,000, both at just over 647p. As for institutional holders, on 1 October, Fidelity appeared to more than double its stake to 10%, otherwise there are no significant changes this year.

As we have seen at B&M European Value Retail SA (LSE:BME), there can be clauses in employment contracts requiring bosses to buy shares, so their buying may not be a guide to the current state of the business, although Future’s CFO took office 13 months ago.

The buying came after the 16 May half-year results included how, due to ongoing macro uncertainty, a more cautious view was being taken of the second-half year, anticipating a low single-digit decline in organic revenue for the full financial year.

Curiosities with consensus forecasts

One published consensus forecast for this latest financial year anticipates a 6% decline in revenue to £740 million, with barely much improvement to September 2027. Yet net profit is targeted to rise from £76.8 million in 2024 to £135 million, providing a 72% advance in normalised earnings per share (EPS) to 123p. Even if growth moderates to 8% in 2026, the circa 12-month forward PE would barely be 5x and the PE-to-growth (PEG) ratio highly attractive at 0.6.

This I find hard to square with the first-half numbers, even though operating expenses as a percentage of revenue eased from 83.7% to 81.7%, helping operating profit rise 8.5% to £69.1 million. A 27% reduction in the net interest charge also helped interim net profit advance 25% to £42.0 million. But I don’t get the £135 million annual consensus, and much could hinge on business/consumer confidence in the wake of November’s Budget, given a 31 March year-end.

Yet a 25 September pre-close update affirmed adjusted operating profit expectations – cited as a range of £197-208 million – with organic revenue performance broadly as expected. Advertising performance is mixed, although magazine revenues are resilient and robust.

- Shares for the future: an attractive contrarian stock

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

After a standout 2024 year for GoCo, its performance has moderated, with a slowdown both in car and home insurance. Future said: “Alongside good strategic progress, the group continues to maintain its strong financial characteristics of attractive profit margin and good cash generation.”

Mind you, this is adjusted operating profit, and the 10-year table has shown a considerable gap between reported and normalised EPS, although that significantly relates to goodwill amortisation.

Future still qualifies potentially as a classic value investment: shares in a business with strong market positions and fundamentals, but out of favour amid essentially near-term issues. The key question appears to be around how difficult the UK economy – 64% of first-half revenue, the rest US – could get.

Notable share selling lately is a concern

The last Holding in Company announcement on 3 October involved GoCo founder Sir Peter Wood having sold down from 3.7% to 2.9%, hence now below the disclose threshold. On 24 September, he had owned 4.8%, so he appears to have rather lost confidence lately, although such a “tap” of shares could have helped explain the fall to 612p.

Of more concern, I find, is a hike in short positions by three traders since July above the disclosure threshold of 0.5% of issued share capital: GLG Partners is short of 0.83%, Marble Bar Asset Management 1.62% and Walleye Capital 0.63%. Moreover, all three have slightly raised these short trades in the last week or so, as if a flavour of conviction.

Several caveats I would make include how short sellers can have a very near-term view. Sometimes hedge funds get sold a particular bearish view by one broker, and short sellers are not immune from bad timing, from which long-only investors can benefit with courage to buy.

But it is a real concern given that one needs firm good reasons to counter this negativity, just when we are on tenterhooks as to how the Budget will affect UK business and consumers.

By way of comparison, S4 Capital (LSE:SFOR), a £157 million digital advertiser and marketing services group, has likewise seen its shares slump over the last few years:

Source: TradingView. Past performance is not a guide to future performance.

This business has barely much earnings record. However, there are projections to deliver net profit of over £30 million this year and next, implying a forward PE of 4.5 versus 4.8, if you believe those for Future. There is only one disclosed short seller and [they have] been slightly trimming the position.

Is Future a classic ‘value trap’?

This is the dilemma where logic suggests waiting for better insight on trading, but by that time the shares might be higher, even simply if the news doesn’t prove as bad as feared.

No further updates are due until annual results on 4 December, but UK macro events might be of greater influence than the numbers.

Yet the company is £38 million through its £55 million buyback programme, hence an aspect of market support remains.

So, it depends on your risk appetite and macro view. One investment adage says that one of the riskiest shares is a cyclical looking cheap ahead of a downturn. Against this, it’s possible that UK-oriented shares stage a relief rally after the Budget, whatever is announced.

I therefore apply a “buy” stance in the belief that, while it’s unclear whether this is the bottom, it is the right call on a two-year view.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.