Stockwatch: risk, profit, bank results and PepsiCo

PepsiCo just beat earnings forecasts, but our companies analyst worries about politics and the economy.

14th July 2020 11:43

by Edmond Jackson from interactive investor

PepsiCo just beat earnings forecasts, but our companies analyst worries about politics and the economy.

Overall, I think this current quarter of US results is quite redundant for global sentiment towards stocks. Everyone knows big holes will appear in second-quarter numbers, and the crux will come this autumn when we find out whether third-quarter results affirm or deny the much-vaunted V-shape recovery. But the numbers and outlook statements – if management care to give them at all – are relevant to how businesses are coping.

California reverting to closures of public spaces yesterday, in response to Covid-19 seemingly out of control, is more relevant to the global rally that has followed US stocks higher.

The S&P 500 index had enjoyed a 1.6% rally yesterday – powered as ever by big tech stocks – until the news triggered a reversal to see the index 0.9% close easier. The tech-rich Nasdaq index had been up 1.9%, yet closed down 2.1%. That’s quite ironic given its story has been tech resilient and prospering during the pandemic. More likely, I suggest, is euphoria being vulnerable to the slightest mood shift.

Prospect of US tax rises become relevant

Currently, in opinion polls, Joe Biden enjoys 308 US electoral college votes versus 132 for Donald Trump, in a race for an estimated threshold 270 votes to clinch the Presidency this November. So, if public health chaos becomes more widespread, triggering further shutdowns, this will clobber hopes for a V-shaped recovery and undermine Trump further.

The relevant point for equities in a Biden victory (or simply anticipation thereof) is net present values hit by the Democrats’ proposal to hike corporation tax from 21% to 28%, to raise an estimated $1.3 trillion. Doubling various foreign income taxes would also bring in $309 billion. Of itself, the taxation rise would only go half way to restoring 35% tax before the Trump administration slashed it in 2017, but equities have likely advanced materially with the help of this. So, although Biden’s policy is not radical socialism, there is a cost to be borne.

Similarly, the Democrats’ proposals for personal taxation will only affect the very wealthy, and then by a modest scratch. Independent estimates put the top 1% of society seeing their net income 7.8% lower, the next 5% on 1.1% lower and all others 0.6% lower. This seems an intelligent election strategy aimed to avoid alienating the middle class, and hard for the wealthiest to argue it would be a damaging tax on enterprise. Even Elon Musk, capitalism’s top pin-up boy, has said there’s “no need” for multiple homes.

- Most-popular US stocks: backing the tech rally

- Chart of the week: the future for Tesla shares

- How UK investors can reduce risk and improve the odds of success

I would expect this to resonate with a majority of Americans, after the Trump years have exacerbated inequalities. The Democrats’ plan is to raise tax revenue by $3.8 trillion over the next decade, although it is hard to estimate the upshot for GDP besides social “levelling up”. Some analysts reckon on a 1-1.5% hit, but I see this as impossible to gauge unless you know how effective will be new government spending plans. Quite like the Brexit debate on trade, forecasts can reflect economists’ political sympathies.

But there is no doubting the negative impact to US corporate earnings. Goldman Sachs estimates a 12% hit to its 2021 estimates for S&P 500 earnings.

Risk of factors conflating for an inflection point

The chief risk I see for global equities is US earnings releases being jeopardised, the economy disrupted once again and a Biden victory looking increasingly likely. This current earnings season can’t help us divine that too well, but it should at least inform on how different companies are coping.

Consensus is for second-quarter S&P 500 earnings to plunge nearly 44% on revenue some 12% down. However, there’s wide dispersion: due to lower oil prices the energy sector is expected to take a 152% earnings hit, followed by consumer discretionary down 114%. Then cyclically exposed sectors such as industrials, down 87%, financials 52% and materials 39%. Healthcare, consumer staples and IT are much less affected, albeit still down 18% to 9%. Only utilities are expected to escape the second-quarter carnage, up 2%.

Goldman Sachs is more negative than consensus, targeting a 60% plunge among S&P 500 firms, relative to a 65% like-for-like plunge in the fourth quarter of 2009 after the financial crisis. The Russell 2000 index of smaller companies fares much worse however, down 120%. On this basis it remains possible for second-quarter US earnings to disappoint.

Consensus looks for a 24% earnings decline in 2020, then a 30% rebound (helped by the arithmetic low) in 2021 and 15% in 2022. But frankly this is plucking numbers out of the air while the unpredictable pandemic and US politics lurk.

Banks are the chief focus of interest this week

Banks are always a general litmus test of an economy, reflecting demand for credit. Critics of excess monetary stimulus argue that their vital contribution is being undermined by ultra-low interest rate policies trashing their business models. So, their results will be interesting in terms of the US economy and effects of Fed policy.

My recollection, however, is that individual bank performances often diverges radically, also between retail/commercial and investment banking activities. Furthermore, the latter may see reduced merger and acquisitions deals to earn fees from, yet their trading desks benefit from QE.

- US earnings season: what US company results for Q2 2020 might look like?

- The Ian Cowie portfolio: a contrarian approach to the quest for yield

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

After a shock in April, it is now expected that banks are setting aside billions of dollars of extra provisions, as a buffer against rising bankruptcies and non-performing loans. While earnings releases may separate this out as exceptional, mind that even adjusted earnings per share will no longer enjoy support from buybacks, given they are suspended in a bid to preserve capital.

Retail/commercial bank results are also likely to feel the effect of allowing customers to skip payments rather than accelerate defaults, albeit possibly postponing the inevitable if the pandemic drags on.

The second-quarter hit could be especially hard on margins after the Federal Reserve’s end-March interest rate cuts, plus US bank deposits soaring to over $2 trillion this year (multiples of previous records for a six monthly increase) and slower loan growth. Yet, only Wells Fargo (NYSE:WFC) is expected to post a loss, while JPMorgan Chase (JPM) and Citigroup (NYSE:C) are expected to see profit falls over 60%. Bank stocks have lagged the market rally since end-March, the sector down around 35% for 2020 versus 1% for the S&P 500 index.

My take-away point is that if banks broadly disappoint this week, then mind the risk to markets alongside Covid-19’s resurgence. They’re a first key hurdle.

Snacks, not drinks, have rescued PepsiCo as a defensive stock

Soft drinks manufacturers tend to be seen as relatively defensive, enjoying price/earnings (PE) multiples of 15x or better, just witness mid cap Britvic (LSE:BVIC) at the lower end of the range here, while PepsiCo (NASDAQ:PEP) enjoys 26x, a true growth stock rating despite a capitalisation 72x greater than Britvic. Such a contrast epitomises the dilemma, from a UK perspective, of engaging current US valuations.

Yesterday, PepsiCo reported second-quarter revenue down 3.1% to $15.95 billion, albeit ahead of $15.37 billion consensus. The overall number masks weakness in beverage – down 7% to $4.97 billion – versus potato chips and other snacks up 7% to $4.27 billion.

This follows directly from effects of the pandemic: closure of venues to eat out, and of corner shops, food & drink outlets at petrol stations to buy soft drinks, and from vending machines at offices, which all hit sales. But then people sat at home have indulged snacks, while healthily option Quaker Oats has enjoyed a 23% revenue jump to $664 million as reduced commuting has encouraged more genuine breakfasting.

Management says beverage sales are now reviving along with people’s mobility, while Oats’ remarkable growth has eased but home snacking continues apace. They reckon more eating at home is a permanent shift, also e-commerce sales which doubled during the quarter. In May, the company launched two new websites, snacks.com and PantryShop.com. Investment continues apace to capture people trying online groceries a first time.

| PepsiCo, Inc. - performance by products and regions | |||||

|---|---|---|---|---|---|

| $ million | |||||

| 12 weeks ended | 24 weeks ended | ||||

| 13/06/2020 | 15/06/2019 | 13/06/2020 | 15/06/2020 | ||

| Net Revenue | |||||

| Frito-Lay North America | 4,273 | 4,010 | 8,347 | 7,825 | |

| Quaker Foods North America | 664 | 540 | 1,298 | 1,134 | |

| Pepsico Beverages N/America | 4,970 | 5,322 | 9,808 | 9,832 | |

| Latin America | 1,567 | 1,886 | 2,877 | 3,127 | |

| Europe | 2,725 | 3,000 | 4,564 | 4,620 | |

| Africa, Middle East & S/Asia | 983 | 997 | 1,614 | 1,576 | |

| Asia Pacific | 763 | 694 | 1,318 | 1,219 | |

| Total | 15,945 | 16,449 | 29,826 | 29,333 | |

| Operating Profit | |||||

| Frito-Lay North America | 1,278 | 1,249 | 2,480 | 2,408 | |

| Quaker Foods North America | 196 | 127 | 346 | 265 | |

| Pepsico Beverages N/America | 397 | 690 | 694 | 1,079 | |

| Latin America | 219 | 278 | 450 | 508 | |

| Europe | 351 | 339 | 497 | 454 | |

| Africa, Middle East & S/Asia | 59 | 236 | 193 | 341 | |

| Asia Pacific | 189 | 116 | 331 | 222 | |

| Unallocated expenses | -370 | -306 | -748 | -540 | |

| Total | 2,319 | 2,729 | 4,243 | 4,737 | |

| Source: https://investors.pepsico.com | |||||

A slight beat versus earnings expectations

Net income is 19% lower at $1.65 billion, or $1.18 a share, however the adjusted earnings per share (EPS) figure in focus was $1.32 versus $1.25 consensus, hence the stock rising nearly 2% at one stage yesterday to over $137. That it closed up only 0.3% at $134.9, after the news from California, shows how “macro,” and specifically Covid-19, are dictating US market values. In this situation, management avoids any future guidance.

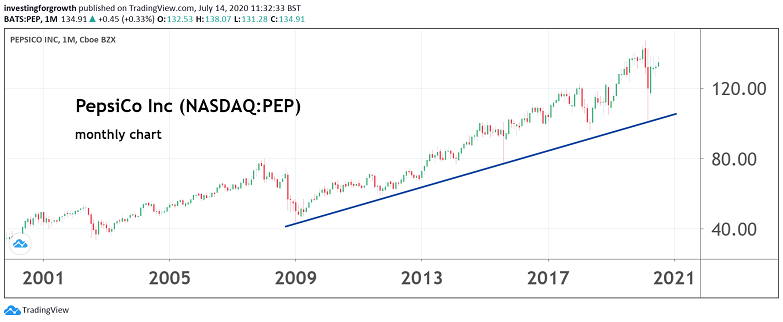

Source: TradingView. Past performance is not a guide to future performance.

It is a fairly neutral upshot for the story of non-alcoholic drinks representing defensive growth, although PepsiCo as a brand still tends to be linked with the kind of drinks we should cut back on, despite often using sugar substitutes. More positively, its juice business is booming, yet remains modest in a group context.

And it is tricky to compare with Britvic’s performance, given its last update was interim results to 14 April: revenue was 1.4% better, after-tax profit rose 11.5%, and adjusted EPS was up 2.7%.

My extract from the results also shows mixed performance globally: falling organic sales in Europe, Africa, the Middle East and Asia; flat in Latin America, while Asia Pacific has enjoyed 15% growth. To an extent, this reflects the different stages and degrees that various parts of the world are dealing with Covid-19.

PepsiCo, therefore, shows an overall respectable performance and prospects, just nothing special. Its stock is effectively a proxy for the US market - inherently overvalued if much less so in wider domestic context. On the basis that monetary policy remains supportive of equities, I rate the shares: Hold.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.