Stockwatch: three shares trading at big discounts

As investors pore over results from sector constituents, analyst Edmond Jackson reveals which of these shares he’d buy and why.

3rd October 2025 12:21

by Edmond Jackson from interactive investor

Earlier this year we saw how discounts extended to over 20%, even 30%, among real estate investment trusts (REITS) after retail-exposed portfolios were shunned as more shopping gets done online. This led to a spate of takeovers at useful premiums, and it could be said in hindsight that buying a selection of those at the steepest discount paid off.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Is there a parallel currently in pub shares? Another way you may hear this feature is, for example, Fuller Smith & Turner Class A (LSE:FSTA) trading at around 0.8x tangible book value on a 3.7% expected yield with the share price at 588p, and AIM-listed Young & Co's Brewery Class A (LSE:YNGA) at 0.7x tangible book on a 3.1% expected yield at near 800p. I include yield especially because price/earnings (PE) ratios tend to vary, and while assets are ultimately worth what they can earn, the market price may settle at a meaningful yield for holding risks.

Ironically, and despite its boss forever complaining, VAT disparity with supermarkets is killing the pubs’ trade. At around 640p, Wetherspoon (J D) (LSE:JDW) trades at 1.8x net tangible assets on a 1.8% yield. Its chart is broadly similar to other pub shares, struggling post-Covid as food, drink, energy and employment costs have risen:

Source: TradingView. Past performance is not a guide to future performance.

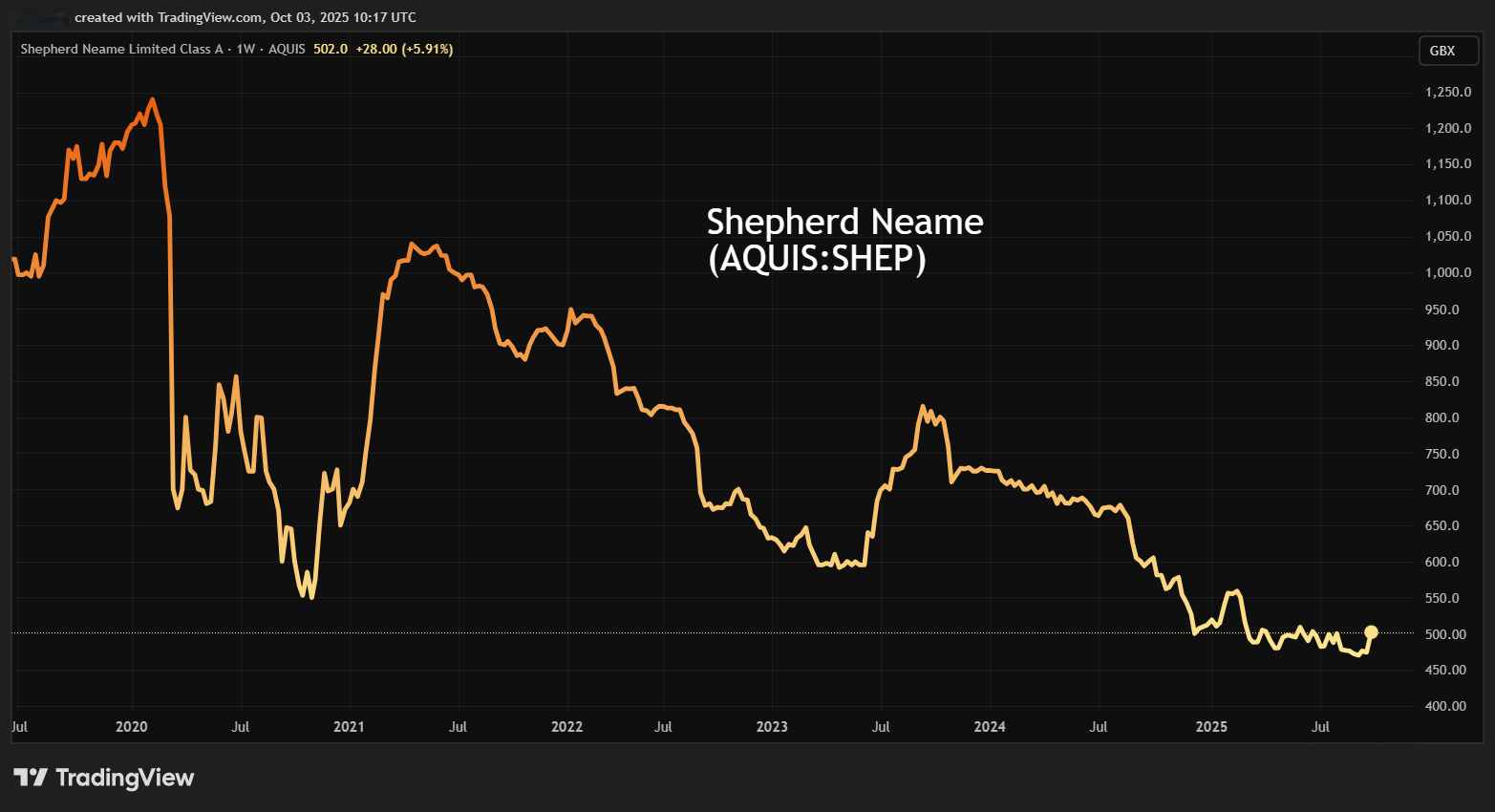

A 60% discount to net tangible assets for Shepherd Neame and Marston’s

These two shares are relative outliers and the stark comparison with Wetherspoon makes me consider if they are due long-term mean-reversion upwards, similarly as Wetherspoon’s premium to asset value has moderated.

Unlike the REITs, takeovers are yet to manifest in this sector, probably because Marston’s (LSE:MARS)’s carries a lot of debt, and Shepherd Neame Ltd (AQUIS:SHEP) is a small £74 million business listed on the Aquis Stock Exchange where there is scant trading. But if this has contributed to loss of interest while pubs have faced rising costs, liquidity does not look a problem for private investors. Free float of shares (that can be publicly traded) is estimated at 51% versus 49% for Fuller’s capitalised at £319 million.

- Equity boom delivers shock result in September

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Trades in recent days have been struck up to £35,000 worth and within a 3% spread. On 1 April, the Shepherd Neame chair bought £24,200 worth at 484p versus a current price of 498p, which is up over 6% since last Wednesday’s annual results.

The figures show market price at around 0.4x net tangible assets on a 4.3% yield based on the 21.4p dividend in respect of this latest financial year to 28 June. Possibly the price rise is tacit evidence that a near 41% discount to 1,220p net tangible assets is excessive and can mean-revert.

Source: TradingView. Past performance is not a guide to future performance.

This is an operator of pubs and hotels in Kent and the South East, with a small beer brewing side. Adjusting for a slight change to its financial year-end, underlying pre-tax profit came little changed at £7.6 million on revenue down 3% to £164 million, with underlying basic earnings per share down 3% to 36.5p versus 30.0p reported. Ample cover for the dividend meant a 4% increase to 21.5p, hence a 4.3% yield.

It is respectable if unexciting progress where higher costs have forced UK pub closures at a rate of six per week in 2024 and possibly as much as eight as higher employment costs took effect from last April.

But after pubs probably over-expanded in the UK, maybe this contraction is serving useful purpose of cutting the national estate to those genuinely needed? In which case performance of those better-managed boozers could improve and the time to buy shares is well before the evidence. A big discount to assets could be seen as an aspect of “margin of safety”.

Shepherd Neame - financial summary

Year-end 28 Jun

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

| Turnover (£ million) | 146 | 118 | 86.9 | 152 | 166 | 172 | 164 |

| Operating margin (%) | 10.3 | -13.7 | -12.4 | 6.9 | 4.6 | 6.8 | 7.4 |

| Operating profit (£m) | 15.1 | -16.2 | -10.7 | 10.4 | 7.6 | 11.7 | 12.1 |

| Net profit (£m) | 2.6 | -19.4 | -17.8 | 6.3 | 3.5 | 4.9 | 4.4 |

| EPS - reported (p) | 17.5 | -132 | -121 | 42.3 | 23.3 | 33.0 | 29.9 |

| EPS - normalised (p) | 14.1 | -2.6 | -109 | 50.4 | 45.5 | 44.2 | 43.1 |

| Operating cashflow/share (p) | 152 | 129 | 12.4 | 142 | 139 | 163 | 148 |

| Capital expenditure/share (p) | 92.4 | 82.2 | 26.3 | 36.6 | 70.4 | 99.0 | 101 |

| Free cashflow/share (p) | 59.2 | 46.7 | -13.9 | 106 | 68.3 | 64.5 | 47.0 |

| Dividends per share (p) | 30.1 | 0.0 | 15.0 | 0.0 | 20.0 | 20.7 | 21.5 |

| Covered by earnings (x) | 0.6 | 0.0 | -8.0 | 0.0 | 1.2 | 1.6 | 1.4 |

| Return on total capital (%) | 4.8 | -6.4 | -3.2 | 3.2 | 2.3 | 3.5 | 1.7 |

| Cash (£m) | 0.1 | 9.8 | 5.6 | 5.6 | 1.4 | 4.5 | 0.3 |

| Net debt (£m) | 82.0 | 140 | 149 | 131 | 136 | 135 | 135 |

| Net assets (£m) | 208 | 185 | 169 | 177 | 179 | 181 | 182 |

| Net assets per share (p) | 1,401 | 1,247 | 1,140 | 1,194 | 1,205 | 12,017 | 12,213 |

Source: company accounts.

Shepherd Neame’s retail pubs and hotels have managed an 11% rise in operating profit to £10.0 million, while tenanted pubs were near flat at £12.6 million. The brewing side saw operating profit fall from £1.5 million to £1.0 million on revenue down 13% with beer volume down 92%. A new packaging tax is blamed for passing on costs to consumers, although I notice that beer prices seem to have risen 50% or more over five years – coinciding with younger people drinking less alcohol.

Capital expenditure – including one pub acquisition – was maintained at around £15 million, which presumably helped net asset value rise very slightly to 1,229p per share. However, refurbishment, for example, is essential simply to maintain pubs and hotels in satisfactory condition, and is not necessarily going to boost returns.

Since pub groups are likely to struggle to show meaningful organic growth in the medium term, I speculate that Shepherd Neame could end up being acquired, hence I tilt to a “buy” stance.

Marston’s asset discount is significantly justified by debt

At 39.5p, a capitalisation of £251 million compares with £650 million net tangible assets on the last 29 March balance sheet.

After a roller coaster from 2012-22, the chart has appeared to show quite a “bowl” formation in the past three years, if not dissimilar to Wetherspoon, as if operating costs are the key factor affecting perception:

Source: TradingView. Past performance is not a guide to future performance.

Marston’s last results showed like-for-like revenue up 3% over the 31 weeks to 3 May albeit proclaimed a 10.5% rise in the following five weeks. Underlying pub operating profit rose 20% to £63.3 million and a slight pre-tax loss in 2024 became a £19.0 million profit.

While this helped the shares test 45p by July, confidence cracked again with a drop to 36p by September – despite an update re-affirming 2.9% growth in like-for-like sales over 41 weeks and “margin expansion initiatives continue to deliver strong results, building on progress in the first half year”.

- Stockwatch: scope for this small cap’s share price to treble?

- Why these three sectors stand out from the crowd

Being rolled out was a “labour scheduling tool...to ensure the right team is in place at the right time – driving productivity, improving the guest experience and supporting operational flexibility”.

“Further food and drink simplification” hardly sounds appealing but is among further initiatives – also smart metering – enabling the group tofully offset the financial impact of recent increases to National Insurance and the National Minimum Wage.

Marston’s and Shepherd Neame appear similarly to imply higher costs can be managed through, but you wonder how much food and drink prices can realistically be raised.

Marston’s still had confidence in full-year profit expectations to 30 September where the last consensus was for £51.5 million net profit and a near doubling in normalised earnings per share (EPS) to 7.8p. This rises to 8.8p for September 2026, hence a 12-months’ forward PE of possibly just 4.5x.

Marston’s - financial summary

Year-end 29 Sep

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 992 | 1,140 | 784 | 516 | 402 | 800 | 872 | 899 |

| Operating margin (%) | 17.0 | 11.7 | 10.3 | -55.7 | -26.6 | 18.2 | 10.3 | 16.9 |

| Operating profit (£m) | 168 | 133 | 80.3 | -287 | -107 | 146 | 90.2 | 152 |

| Net profit (£m) | 84.7 | 45.0 | -17.7 | -360 | 163 | 137 | -9.3 | -18.5 |

| EPS - reported (p) | 14.1 | 7.0 | -5.9 | -55.1 | -20.3 | 21.4 | -3.0 | 2.8 |

| EPS - normalised (p) | 16.7 | 15.3 | 6.0 | 3.3 | -0.4 | 13.1 | 4.8 | 4.0 |

| Operating cashflow/share (p) | 35.5 | 28.5 | 30.9 | 24.7 | 5.5 | 20.9 | 22.3 | 32.7 |

| Capital expenditure/share (p) | 32.6 | 25.4 | 21.2 | 10.1 | 7.4 | 10.9 | 10.3 | 7.3 |

| Free cashflow/share (p) | 2.9 | 3.1 | 9.8 | 14.7 | -1.9 | 10.0 | 12.0 | 25.4 |

| Dividends per share (p) | 7.5 | 7.5 | 7.5 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Covered by earnings (x) | 1.9 | 0.9 | -0.8 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Return on total capital (%) | 6.6 | 5.2 | 3.3 | -13.0 | -4.9 | 6.5 | 4.1 | 7.7 |

| Cash (£m) | 175 | 161 | 39.6 | 36.6 | 29.8 | 25.1 | 24.0 | 40.0 |

| Net debt (£m) | 1,329 | 1,386 | 1,399 | 1,639 | 1,610 | 1,600 | 1,574 | 1,266 |

| Net assets (£m) | 931 | 919 | 774 | 249 | 406 | 648 | 640 | 655 |

| Net assets per share (p) | 147 | 145 | 122 | 39.3 | 64.1 | 102 | 101 | 103 |

Source: company accounts.

Yet there have been no dividends since 2019, chiefly due to £1,254 million net debt accumulated in expansionary years. In the last interim results, a net £44.3 million went on interest payments, swiping 68% off operating profit. At least the cash flow statement showed another £21.5 million repayment of securitised debt as in the first half of 2024. But net cash from operations showed a 10.5% decline to £81.4 million, while investment rose from £10.3 million to £27.8 million.

It therefore looks a long haul for Marston’s to gnaw down its debt, where an equity raise at a big discount to assets would be unacceptably dilutive. For this reason, I’m sceptical that it can become a takeover target.

Mind you, Wetherspoon is trading down 5% at 634p this morning despite annual results to 27 July showing operating profit up 5% on like-for-like sales up similarly, with pre-tax profit up 10%. Initial response notes net debt up from £660 million to £723 million amid investment and buying out rented pubs, hence net finance costs taking 44% of operating profit.

I suspect pub shares are liable to remain in see-saw mode until effects of the 26 November Budget are seen on business and consumers, hence I would shy off “buy” stances for the likes of Marston’s and Wetherspoon – given their debt.

Marston’s is in the frame, however, with a year-end trading update due on Wednesday 8 October. Re-assurance could help the shares as they did with Shepherd Neame, which has risen from a steep discount to assets.

Its directors have bought shares materially all the way down from over 100p in late 2017: the CEO lastly spending £66,500 last December at 44.9p, and the chief financial officer (departed a week ago at the financial year-end) £50,300 worth at the same price.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.