Stockwatch: time to buy UK housebuilders?

Risk/reward is more attractive now as the government and central bank water down sector cyclicality.

15th May 2020 09:46

by Edmond Jackson from interactive investor

Risk/reward is more attractive now as the government and central bank water down sector cyclicality.

Announcements by housebuilders this week – towards a phased resumption of construction activity and home viewings – underline the medium-term investment appeal of their shares. So long as a second wave of Covid-19 doesn’t rise up, they look better-placed than many businesses to contain financial damage, re-build cash flows and resume (currently suspended) dividends.

Fundamental attractions: top-down and bottom-up

Construction and home ownership are enduring priorities for a Conservative Party that subsidises home ownership and the builders who donate to it. Despite risks from unemployment, demand looks supported by low mortgage rates and the Tories extending Help to Buy from 2021 to 2023.

Remember how nearly three years ago, Morgan Stanley’s detailed study of Help to Buy concluded its chief beneficiary was housebuilder profits.

Secondly, financial profiles for industry leaders - see the tables for Barratt Developments (LSE:BDEV) and Taylor Wimpey (LSE:TW.) - show high operating margins at least in the high teen percentages, very strong free cash flow, and cash reserves outweighing debt.

Admittedly, that reflects boom years, and dividends are now being axed, but their essential fundamentals are still good, so long as the house-building cycle is in their favour. It would appear that government is rigging the housing market like central banks do financial markets.

Doubtless other industries will revive from lows, and there will be special situations, but at this stage it seems worth underlining such key criteria – the caveat being, to beware the impact costs of lockdown materialising.

There’s just been a nasty such shocker by way of interim results from Countryside Properties (LSE:CSP), while others have mainly made reassuring words in updates.

| Taylor Wimpey - financial summary | ||||||

|---|---|---|---|---|---|---|

| year end 31 Dec | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

| Turnover (£ million) | 2,686 | 3,140 | 3,676 | 3,965 | 4,082 | 4,341 |

| Operating margin (%) | 18.5 | 20.1 | 20.7 | 17.7 | 20.3 | 19.7 |

| Operating profit (£m) | 497 | 632 | 762 | 704 | 829 | 857 |

| Net profit (£m) | 374 | 490 | 589 | 555 | 657 | 674 |

| IFRS3 earnings/share (p) | 11.5 | 14.9 | 17.9 | 16.9 | 20.0 | 20.6 |

| Normalised earnings/share (p) | 10.9 | 15.2 | 18.0 | 21.7 | 21.7 | 20.1 |

| Operating cashflow/share (p) | 5.9 | 12.4 | 16.4 | 18.4 | 19.6 | 15.6 |

| Capex/share (p) | 0.3 | 0.2 | 0.2 | 0.2 | 0.1 | 0.4 |

| Free cashflow/share (p) | 5.6 | 12.2 | 16.2 | 18.2 | 19.5 | 15.2 |

| Dividend/share (p) | 1.6 | 1.7 | 2.8 | 4.7 | 6.2 | 7.6 |

| Covered by earnings (x) | 7.4 | 9.0 | 6.4 | 3.6 | 3.2 | 2.7 |

| Cash (£m) | 213 | 323 | 450 | 601 | 734 | 630 |

| Net Debt (£m) | -113 | -223 | -365 | -512 | -617 | -518 |

| Net assets per share (p) | 77.9 | 83.6 | 88.7 | 95.8 | 98.4 | 101 |

| Source: historic Company REFS and company accounts |

Contrasts in bigger versus small-scale builder disciplines

Hiking around locally I’ve been horrified how smaller residential improvement projects have resumed, with no real regard for social distancing measures.

Also, a sub-contractor replacing gas mains with at least four men in close proximity. Maybe it matters less outdoors, like tree surgeon duos have operated together in recent weeks, moreover the age profiles are lower than people most at risk.

Be first to watch our interviews with fund manager like Nick Train and Keith Ashworth-Lord, plus leading City analysts and our own experts.

Just click here now.

By contrast, a 1 May update from Barratt cited

“a detailed set of working practices…a nominated social distancing marshal will be present on all sites…training and support for our employees and sub-contractors”.

The hope has to be that another lockdown isn’t brought about by a more lax approach elsewhere, and people generally circulating more.

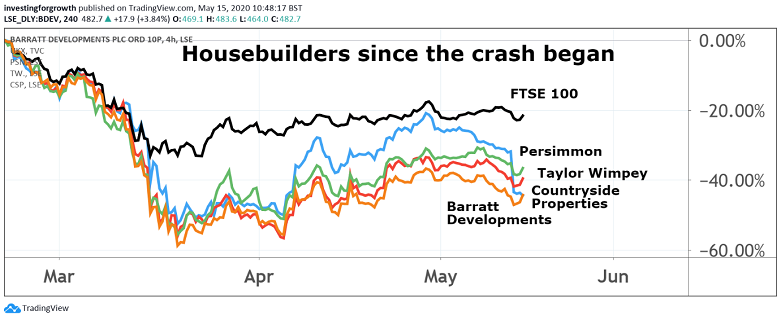

Meanwhile, and looking at daily charts, house-building stocks are typically moving in unison like so much nowadays, with overall volatility led by Wall Street. If you agree with my central top-down/bottom-up rationale, there’s a case also for diversifying across leaders like Persimmon (LSE:PSN).

Persimmon has clarified £610 million of cash as of 20 March, versus £195 million land commitments in due course, backed also by a £300 million credit facility. Yesterday, its stock weakened with the market however, despite another positive update, reflecting the herd mentality for safety in highly uncertain times.

Countryside incurs a £29 million interim profit hit

The chart for mid-cap Countryside Properties (LSE:CSP) is so far the exception. Its shares were initially down 20% yesterday after interim results quantified the cost of lost completions/land sales in March. It meant a £29 million hit to profit and also increased net debt by £83 million.

The stock recovered slightly mid-afternoon to close down 17% at 305p, which capitalises Countryside at £1.7 billion versus Barratt at around £1.9 billion with its stock at 465p and Taylor Wimpey around £4.7 billion at 137p – both are in the FTSE 100 index.

Source: TradingView. Past performance is not a guide to future performance.

So, Countryside isn’t some exposed small-cap, and we can anticipate near-term damage coming even the big boys’ way – hence my flagging this, if chiefly why my broad stance on the sector is ‘hold’. Bad news on hopefully transitory costs is conceivably a buying opportunity, assuming no reversion to lockdowns.

More positively, Countryside says its forward order book (as of end-March) is up 45% to over £1.5 billion – quite a staggering advance, as if affirming underlying demand for homes generally, although there is caution about “significantly reduced build rates as we adjust to new ways of working”.

That appears quite a contrast with Barratt’s rather breezy optimism, although Barratt did make clear a phased return to work with around 50% of sites in phase one. Barratt had also cautioned about a low level of reservations, albeit in a 1 May update since when the government has eased viewing restrictions.

Countryside’s adjusted operating margin has halved to 11% contributing to interim earnings per share (EPS) down from 12.9p to 8.1p, in context of 37.7p for the year to September 2019 and a strong second-half bias. Potentially, that means the worst impact of the crisis was taken during a weaker period anyway; and Countryside’s extent of order book can mitigate the effect on EPS for the full year to 30 September.

Pencilling in a mid to high 20p of earning derives a price/earnings (PE) multiple around 11x, which is very modest for a stock where short-term earnings are impacted but the company’s order book suggests can firmly recover in the medium-term.

Countryside has resumed activity on 80% of sites. Much still obviously depends how sustainable and progressive the lockdown easing proves.

PE’s are low for a market recovery; but hoping for low NAV’s is futile

Outside the house-building sector such a “recovery PE” could be nearer 30x in more normal circumstances – which admittedly these aren’t. Buyers still got the upper hand from 290p upwards yesterday, but the crux remains whether the UK can avoid a second viral wave compromising activity again.

Mind also, 305p currently is an 88% premium to Countryside’s end-March net tangible assets per share of 161p.

That’s high in a long-term cyclical context; house-building stocks have historically reverted to discounts during economic recession, but free market economics haven’t applied for a while.

Ultra-low mortgage rates and Help to Buy, persist, hence so do asset premiums. Barratt, for example, at 466p, is currently trading around its last published net asset value, although Taylor Wimpy at 138p trades at a circa 37% premium to 101p.

- Could Nick Train’s ‘burst of hedonism’ boost top stocks?

- 10 Tiny Titans: cheap small-caps with a record of strong momentum

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

How things have changed – largely as a result of macro policy propping up housing – since I drew attention to Barratt as a ‘buy’ at 92p in November 2011, chiefly along a rationale its stock traded under 0.5 times net asset value (NAV) compared with the house-building sector on 0.8x NAV.

It would appear fruitless waiting for such valuations to re-appear, if we are currently in a Covid-19 related down-cycle, given the Bank of England and Tory government has progressively juiced the housing market since the 2008 crisis.

| Barratt Developments - financial summary | ||||||

|---|---|---|---|---|---|---|

| year end 30 Jun | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

| Turnover (£ million) | 3,157 | 3,760 | 4,235 | 4,650 | 4,875 | 4,763 |

| Operating margin (%) | 13.0 | 15.3 | 15.8 | 17.2 | 17.7 | 18.9 |

| Operating profit (£m) | 410 | 577 | 668 | 799 | 863 | 899 |

| Net profit (£m) | 305 | 449 | 550 | 616 | 672 | 740 |

| IFRS3 earnings/share (p) | 30.4 | 44.6 | 54.3 | 60.7 | 65.9 | 72.3 |

| Normalised earnings/share (p) | 30.4 | 44.6 | 54.3 | 61.4 | 66.4 | 72.6 |

| Operating cashflow/share (p) | 24.1 | 18.2 | 64.5 | 38.3 | 50.4 | 35.3 |

| Capex/share (p) | 0.5 | 0.5 | 0.6 | 0.4 | 0.7 | 0.7 |

| Free cashflow/share (p) | 23.6 | 17.7 | 63.8 | 37.9 | 49.7 | 34.6 |

| Dividend/share (p) | 10.3 | 15.1 | 18.3 | 24.4 | 26.5 | 29.1 |

| Covered by earnings (x) | 3.0 | 3.0 | 3.0 | 2.5 | 2.5 | 2.5 |

| Cash (£m) | 275 | 360 | 758 | 784 | 982 | 658 |

| Net Debt (£m) | -75 | -184 | -581 | -711 | -791 | -758 |

| Net assets per share (p) | 340 | 372 | 399 | 428 | 453 | 478 |

| Source: historic Company REFS and company accounts |

Unemployment as a potential rogue factor

There’s a somewhat “conditional” theme to housebuilders’ updates, where I would add we have yet to see the true effects of unemployment on confidence to enter into home purchase agreements.

In a positive sense, some couples/families may be quids-in currently, if two people are furloughed on 80% pay and with diminished outgoings, but the chancellor has indicated companies must start contributing financially this summer, which could trigger lay-offs presently deferred while government picks up the wage bill.

Overall, however, I expect a manifestly “One Nation” Tory prime minister, also with Trump-like tendencies on the spending/debt front, and a central bank that has stayed in the global race with peers, for stimulus measures, to keep housing supported.

Broadly, I therefore rate the sector a ‘hold’ within which – and especially if you lack exposure – future updates like Countryside’s, quantifying the recent financial impact, lend scope to ‘buy’. As ever in these circumstances, consider averaging-in to manage risk.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.