The tax-free pension cash conundrum: how to draw and use it wisely

Craig Rickman answers some of the key questions you may have when drawing a tax-free lump sum from your pension.

9th November 2023 09:36

by Craig Rickman from interactive investor

Few financial decisions are more important than how you choose to draw from your pension pot. This money needs to support you for the duration of your retirement, and perhaps a loved one’s, too.

Not only must you navigate the delicate terrain that is guaranteed versus flexible income, but also select the best way to draw lump sums.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

The good news is that, in most cases, you can take 25% without paying a penny to the taxman - called a pension commencement lump sum (PCLS) - once you hit age 55 (rising to 57 in 2028).

As the remaining 75% is taxable, this seems a no-brainer. But there’s more to consider. “When should I draw it out?” and “Should I take the lot in one go or phase withdrawals over time?” are two important questions to ask.

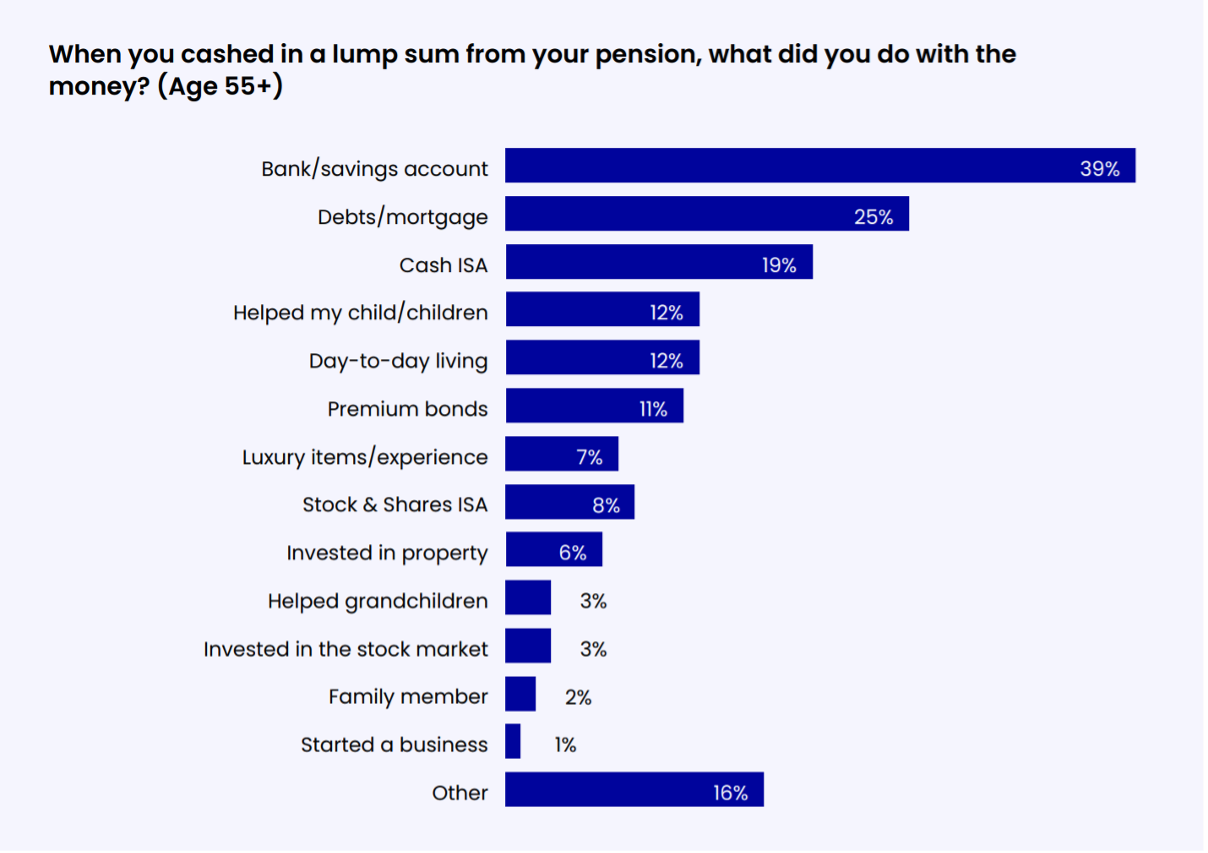

A further consideration is what to do with the money once you’ve drawn it. interactive investor’s Great British Retirement Survey found that four in 10 (39%) stick it in their bank and savings account, even though alternative options might be more suitable and tax efficient.

Like any big financial decision, achieving the right outcome takes some careful planning. So, what do you need to think about?

How much tax-free cash can I take?

The maximum is 25% of your total pension funds, capped at £268,275, which is 25% of the lifetime allowance. This allowance has now been lifted, meaning there’s no limit of what your pension can be worth without facing a hefty tax charge, but the maximum tax-free cash limit remains. However, you may be able to take more if you registered for one of the various lifetime allowance protections.

If you have a defined benefit (DB) scheme, the rules around tax-free cash can be a bit more complicated. Check with your scheme to find out where you stand.

What are my options for taking tax-free withdrawals?

Well, there are a few options available to you. The first is to take your 25% tax-free cash in one hit. With the remainder you can either buy an annuity or keep the money in a self-invested personal pension (SIPP) and draw income or further lump sums either now or in the future. These will be taxed at your marginal rate at the time of withdrawal.

- DIY Investor Diary: why this is the only fund in my SIPP

- Pension funding post-retirement: when can it make sense?

Alternatively, you could draw your tax-free cash in instalments, using what’s called an uncrystallised funds pension lump sum (UFPLS). To unpack this ambiguous piece of pension jargon, 25% of your withdrawal is tax free, while the remainder is taxable. For instance, you’re a basic-rate taxpayer and encash £10,000 from your SIPP under UFPLS: £2,500 (25%) is not taxed while £7,500 (75%) is taxed at 20% (£1,500) - an equivalent tax rate of 15%.

Finally, you can take a smaller portion of tax-free cash. Let’s say you have a £500,000 pension pot that you are yet to touch and need £20,000 for a new kitchen, but you do not require any income. In this scenario, you could move £80,000 of your pot into drawdown, taking £20,000 of this as tax-free cash. The £60,000 could be left in your SIPP, while you can make further decisions with the remaining £420,000 untouched pension when you need to.

As drawing cash from your pension can get quite complicated, it might be worth seeking professional advice.

How do people use their pension lump sums?

interactive investor’s Great British Retirement Survey of 8,000 respondents uncovered what people typically do with the lump sums they encash from their pensions.

There are a couple of things that stick out. The first is that cash savings, either bank accounts, individual savings accounts (ISA) or Premium Bonds, are the preferred destination - significantly more popular than investing in the stock market. As everyone’s financial situation is unique, it’s hard to pass comment on whether each individual has done the right thing. But given the stock market has historically outpaced cash over the long term, the heavy lean towards savings accounts does raise some questions.

- Seven pension tips I learned as a financial adviser

- Autumn Statement 2023 preview: what might Jeremy Hunt have in store?

The second concern is that interest earned on bank savings is taxable, so HMRC could grab a slice if what you receive exceeds the annual tax-free savings allowance of £1,000. If you pay 40% tax your allowance drops to £500, while if you're in the 45% tax bracket, all your savings are taxable.

What should I do with a lump sum once I’ve taken it?

Once you’ve taken cash out of your pension, the next step is to decide what to do with it. Here you will need to get your priorities in order, but what should these be? Here’s a checklist to give you some steer.

1) Buy things you need and clear debt

First, if you have any outstanding borrowings such as a mortgage, loans, or credit cards, paying them off should be your first port of call. Entering retirement straddled with debt can be a problem, both financially and emotionally.

Second, if there’s anything you desperately need to buy, such as a new car, now might be a good time.

2) Top up your cash holdings

History tells us that when investing for the long term, cash tends to underperform other asset classes, such as shares and property.

But equally, the security and certainty offered by cash is a key component of a balanced and diversified portfolio, so making sure you allocate enough is important.

If you’ve opted to keep your money invested during retirement and make flexible withdrawals from your SIPP, a cash buffer of two to three years spend can be sensible. This will avoid selling shares should markets perform poorly, which can thwart how quickly your pot grows once stocks rebound.

You can either hold this buffer in your SIPP, or in accessible savings, such as a Cash ISA.

3) Invest for either growth or income

It’s easy to draw your tax-free cash and leave it in a bank or savings account, but unless you have an immediate need for the money this can do your financial future more harm than good - especially if the interest rate you receive lags inflation.

It’s therefore worth considering how to put the money to better use. You might want to supplement your pension income or seek to grow your wealth. If your investment time frame is five years or more, a Stocks and Shares ISA, which protects any gains or income from HMRC, can be a sensible option.

A further option is to pay some of your lump sum back into your pension, but pension recycling rules might restrict you here. They’re also quite complicated, so it’s worth taking professional advice to make sure you’re doing the right thing.

4) Luxury items and gifts to loved ones

If you’re already wealthy enough to not need the money, either now or in the future, then luxury spend or gifting to younger generations will not only bring pleasure but can also reduce any IHT problem you may have.

- Five ways to take control of inheritance tax

- Give away your wealth to save mega tax bill: your guide to gifting rules for IHT

When gifting from capital, you must survive seven years before the money moves outside your estate, so the sooner you do it the better. However, you can give away £3,000 a year free from IHT - and can claw forward last year’s allowance if unused – meaning a couple could gift £12,000 today without any IHT implications.

What else should I consider?

Watch out for the money purchase annual allowance (MPAA)

The MPAA shrinks the maximum amount you can pay into a pension every year from £60,000 to £10,000, which can pose a problem if you plan to continue to make pension payments after taking a lump sum.

If you take out tax-free cash and don’t make flexible withdrawals, or use the remaining pot to buy an annuity, then the MPAA isn’t triggered. However, using UFPLS will trigger the MPAA. So if you make pension withdrawals while you’re still working and plan to continue beefing up your pension savings, choose with care.

Understand the impact on IHT

Unless you have plans for your tax-free cash, and have an IHT problem, it’s usually best to leave the money in your pension. That’s because pensions are usually considered outside your estate and so whoever inherits the pot when you die won’t pay IHT. However, if you die after age 75, any withdrawals are subject to income tax at the recipient’s marginal rate – something you shouldn’t overlook.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information – SIPPs are aimed at people happy to make their own investment decisions. Investment value can go up or down and you could get back less than you invest. You can normally only access the money from age 55 (57 from 2028). We recommend seeking advice from a suitably qualified financial adviser before making any decisions. Pension and tax rules depend on your circumstances and may change in future.

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.