Tech crash: three big stocks to buy, hold and sell

6th May 2022 08:06

by Rodney Hobson from interactive investor

America’s Nasdaq tech index crashed 5% overnight and is down more than 20% in 2022 so far, but don’t throw the baby out with the bathwater, warns our overseas investing expert.

Investing in tech stocks tends to be more of a rollercoaster ride than picking traditional companies. It has been so for more than a quarter of a century, so some recent sharp movements following first quarter updates should have come as no surprise.

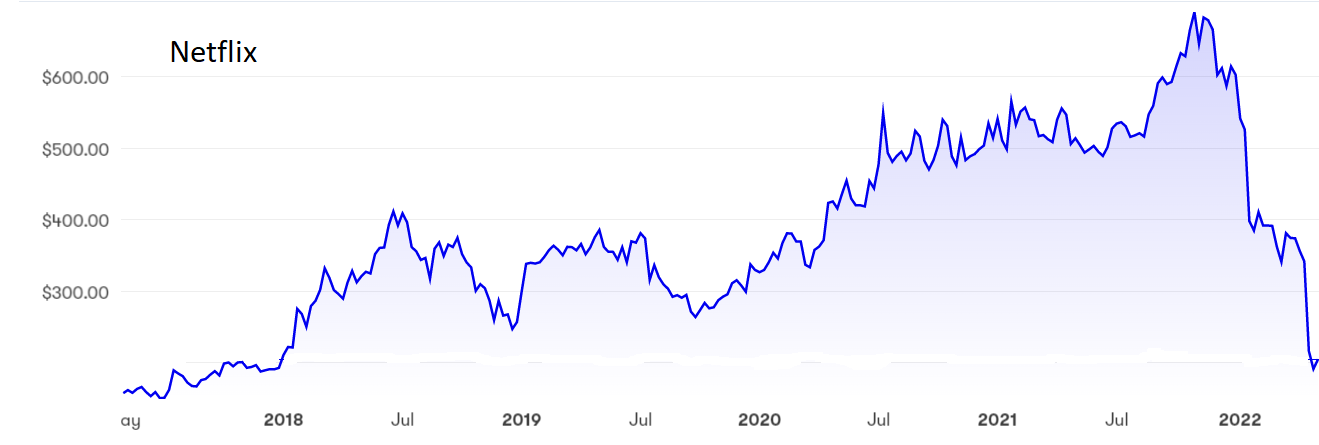

Nowhere has the switch from hero to zero been more dramatic than at streaming service Netflix Inc (NASDAQ:NFLX), a stock market darling while bored housebound consumers were binge-watching hit series such as The Crown, Bridgerton and Girls from Ipanema.

The trouble with binge watching night after night is that you can get through an awful lot of television in two years of lockdowns, so when you are allowed back out into the real world the need to continue your Netflix subscription becomes less persuasive.

- Invest with ii: Top UK Shares | Super 60 Investment Ideas | Open a Trading Account

It is no exaggeration to say that the whole basis of Netflix, where young subscribers pay for the joy their grandparents knew in the 1950s of viewing television uninterrupted by adverts, is under threat. Churn is always part of the way of life for subscription services, but it becomes a problem only when departures outnumber newcomers, as happened for the first time at Netflix in the first quarter.

The subscriber base could shrink by another 2 million viewers in the current quarter, a sizeable chunk out of the current 222 million paying users. Now the channel is considering a two-tier system with a cheaper alternative that includes adverts.

It is also grappling with the realization that possibly more than 100 million people are using the service for free by using a subscriber’s password. In a world where people legitimately use several devices to access the Internet, this is a difficult practice to stamp out.

- Warren Buffett: stocks I’m buying and AGM comments

- US earnings season calendar here

- Want to buy and sell international shares? It’s easy to do. Here’s how

Netflix shares looked like breaking above $900 as recently as last October but they have fallen off a cliff since then, including a drop of 35% on the day the latest figures came out, and are back where they were four years ago below $200. The price/earnings (PE) ratio is admittedly now less demanding at 18.5 but there is no dividend.

Kyle Caldwell reported on 21 April that star investor Bill Ackman had bitten the bullet and sold his entire Netflix stake at a loss Bill Ackman cuts losses on Netflix after ‘losing confidence’ (ii.co.uk). It is not too late to do likewise.

Source: interactive investor. Past performance is not a guide to future performance.

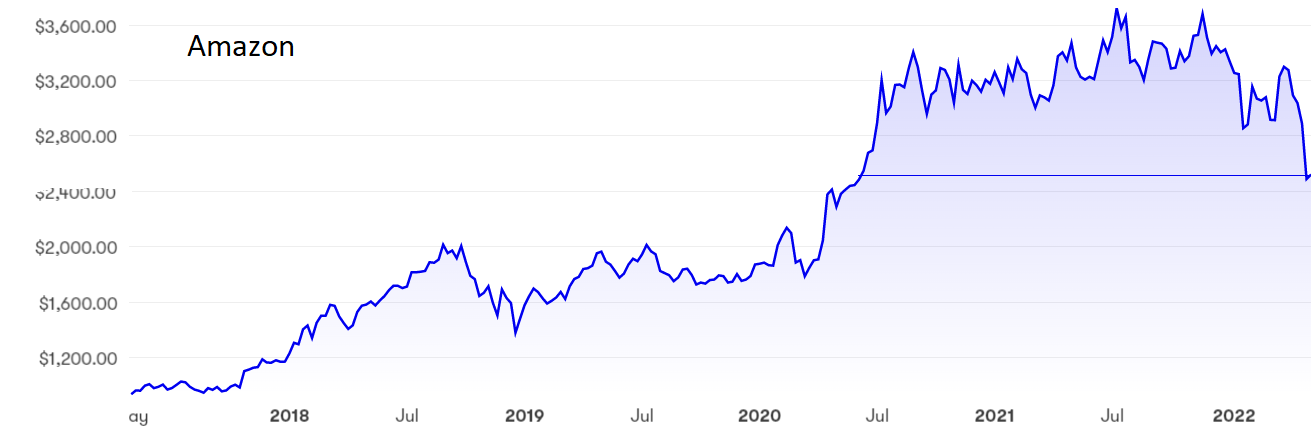

Amazon.com Inc (NASDAQ:AMZN) has not produced blockbusters on anything like the same scale as Netflix – its latest offering Ten Per Cent lacks the flair of the French original – but at least its eggs are scattered around many baskets. The retail giant has avoided the costs of maintaining bricks and mortar outlets, while Amazon Prime offers prompt delivery on a wide range of goods as well as free TV viewing and Kindle downloads.

It does have its own problems, though, such as rising wages and higher distribution costs. It, too, was a major beneficiary of lockdowns and now the fulfilment network that doubled in size during the pandemic is a disadvantage as it means there is spare warehouse and distribution capacity.

The outcome was a surprise $3.8 billion loss in the first quarter, the first deficit for seven years, as sales growth slowed to 7% compared with more than 30% in the halcyon days of 2020.

- Top 10 things you need to know about investing in the US

- Find out what is now being tipped to be the best investment of 2022

- How high could US interest rates really go?

It takes time to scale back expansion plans that may be developed over several years, but Amazon has started to reduce its hefty capital expenditure. It had indicated this would hit $76 billion this year but could now be as little as $60 billion, still quite a burden with sales growth set to slow further as armchair consumers escape back to the High Street. Margins are going to be squeezed.

Amazon shares peaked at $3,700 last year but have slipped back to a more realistic $2,300, where the PE ratio is still a hefty 60. There is no dividend and, while cash is being ploughed into the business, there is no sign of one in the near future.

Source: interactive investor. Past performance is not a guide to future performance.

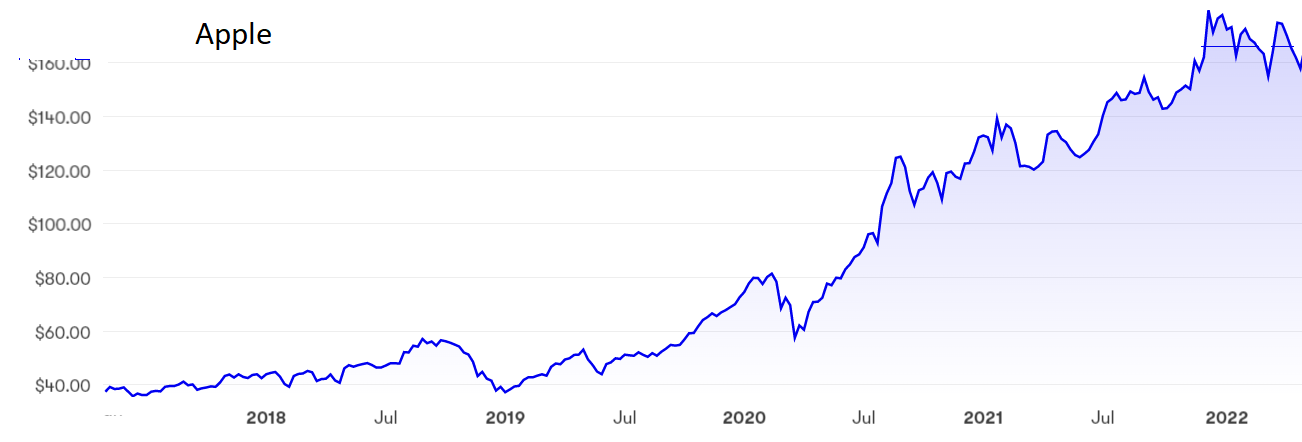

It is hard to find anything to complain about in the latest figures from Apple Inc (NASDAQ:AAPL), which showed another quarter of record sales as iPhones and Mac computers continued to fly off the shelves.

For the three months to 25 March, Apple’s second quarter, sales grew 8.6% year-on-year to $89.6 billion, producing net income 5.8% higher at $25 billion. It seems to have defied supply chain issues despite admitting to “very significant” shortages of some components. iPhone sales, up 5.5%, and Mac sales, up 15%, both hit record levels. About 98% of iPhone customers buy another model when they decide to upgrade, which is a massive vote of confidence.

It should, though, be noted that growth has slowed somewhat from the stellar performance in the previous three months, but shareholders should not be too worried. Over six months net income rose 14% on sales 10% higher.

- Tactics the pros use to combat rising levels of inflation

- Shares to protect against persistently high inflation

- Recessions are becoming more likely – here’s how to invest

An important factor for the immediate future is the mounting success of higher margin Apple’s services division, which sells software and iCloud storage space. It also brings in revenue from subscription services for music, television and fitness programmes. Growth in the latest quarter was 17%.

Apple will inevitably be hit by the looming global slowdown, by the squeeze on consumers caused by inflation and rising interest rates, and by difficulties in obtaining supplies from factories in China until the pandemic is finally over. However, the quality of its brands and the loyalty of its customers should tide it over even if sales growth slips during the summer.

Source: interactive investor. Past performance is not a guide to future performance.

The shares have quadrupled over the past five years to around $160 so they are not cheap, although they have been as high as $180 earlier this year. The PE is 27, above stock market norms but not excessive for a tech company. At least there is a progressive dividend, albeit one that gives a yield of only 0.5%, and a share buyback scheme that has been increased by $90 billion.

Hobson’s choice: Sell Netflix, there are just too many risks. Hold Amazon if you are prepared to sit out what promises to be a year of stagnation. Apple ranks as a buy. There looks to be a floor at $155 and the next movement is likely to be upwards.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.