The tech funds to buy as Nasdaq hits new record

The technology sector was the leading Investment Association sector in May and looks set to be the best performer in June, writes Saltydog Investor.

30th June 2025 13:04

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

The largest businesses in the world are technology companies. Only 10 companies have ever reached a market capitalisation of more than $1 trillion. Eight of these are technology companies – the other two are Saudi Aramco and Berkshire Hathaway.

Invest with ii: Open an ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Only three companies have ever exceeded $3 trillion:

- Apple (peaked above $3.9 trillion in late 2024)

- Microsoft (recently reached $3.7 trillion)

- Nvidia (now approximately $3.8 trillion)

To put this in perspective, the UK’s GDP is currently estimated at $3.4 trillion.

As a rule, when companies grow their volatility decreases. They generally have more stable earnings, diversified operations, and greater investor confidence, making their share prices less prone to dramatic swings. However, that has not stopped some of these enormous technology companies from experiencing some significant downturns.

At the end of January, DeepSeek, a Chinese start-up founded in 2023, revealed its R1 Chatbot. It was reportedly developed at a fraction of the cost of Western rivals like OpenAI’s ChatGPT. The model used fewer Nvidia semiconductors, consumed less energy, required less processing power, and was said to be just as effective. This breakthrough raised concerns about future demand for Nvidia’s high-end AI chips, contributing to Nvidia’s market value falling by $589 billion (17%), the largest single-day loss in stock market history.

- Five ways to invest in US outside of traditional tracker funds

- Shares for the future: a half-billion-pound powerhouse

A more widespread downturn in the technology stocks followed in early April, triggered by President Trump’s announcement of sweeping new tariffs. On April 3, the Magnificent Seven stocks collectively lost over $1 trillion in market capitalisation in a single trading session. Apple fell by more than 9%, marking its worst trading day in more than five years. The drop was driven by fears that tariffs would disrupt its global manufacturing and supply chain. Amazon also dropped by around 9%, its largest single-day fall since 2022, after an executive order eliminated tariff exemptions for low-value imports.

All in all, it was not a great start to the year for technology stocks, and this was reflected in the performance of the Investment Association’s Technology & Technology Innovation sector. It went down by 11.3% in the first quarter of this year, and a further 3.7% in April.

However, investor confidence has started to return in recent months, and the Technology & Technology Innovation sector has been leading the recovery. It topped the tables in May with a gain of 8.8%, and, with a day to go, looks set to do the same in June, having added another 6%.

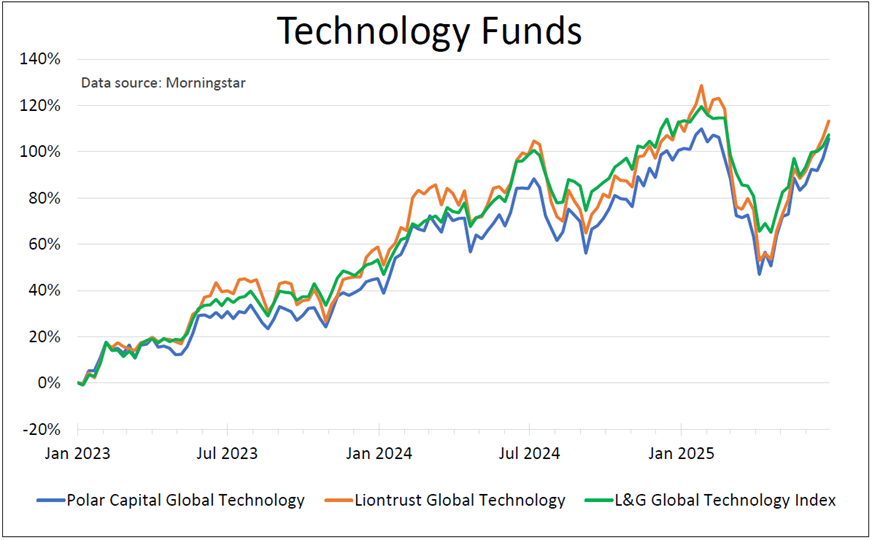

The top-performing funds in May were Polar Capital Technology, Liontrust Global Technology, and L&G Global Technology Index. That momentum has continued through June, and these funds are now approaching the highs that we saw in January.

The recent uplift reflects growing optimism around trade deals between the US and its major trading partners.

Soon after the “Liberation Day” tariffs were announced, a 90-day suspension was put in place for most countries to allow for further negotiations. That pause is due to expire on July 9. Although most countries will not have finalised deals by then, the Trump administration has signalled that this deadline may be extended, with Treasury Secretary Scott Bessent suggesting most deals could be wrapped up by the beginning of September. Some interim agreements have already been put in place.

For the technology funds to maintain their upward trajectory, optimism around these negotiations must translate into actual deals that reduce overall tariff levels. Any signs of a trade war, especially with China, could lead to another sell-off.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.