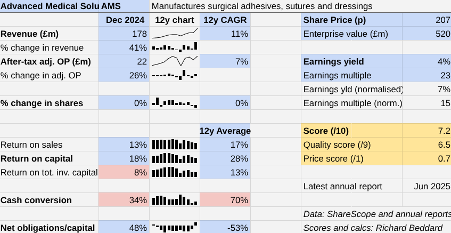

Shares for the future: a half-billion-pound powerhouse

This company claims to be a ‘powerhouse’ in its sector, but it’s just scraped into analyst Richard Beddard’s slimmed down Decision Engine. Here’s how he scores it.

27th June 2025 15:02

by Richard Beddard from interactive investor

When I last scored Advanced Medical Solutions Group (LSE:AMS) in June 2024, I was concerned about the size of an impending acquisition.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

AMS: Peters acquisition leaves its mark

The results for the year to December 2024 give us our first comprehensive look at AMS’ finances since it acquired Peters Surgical midway through the financial year. The acquisition has definitely left a mark:

It has added considerably to revenue, which grew 41% (10% at constant currency, excluding acquisitions) but less to profit, which grew 26%. The cost of acquiring Peters has eradicated the company’s cash surplus. Now it carries considerable debt.

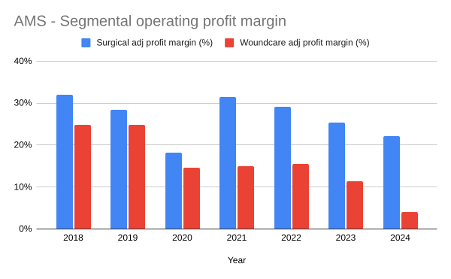

Peters Surgical has all but doubled the size of AMS’ surgical division, by far the biggest and most profitable division of two. Surgical earned £136 million in revenue in 2024 and £30 million of adjusted operating profit compared to £42 million of revenue and less than £2 million of profit in Woundcare.

Surgical makes surgical glue systems, collagen implants, synthetic bone substitutes, and sutures. Peters adds more suture and adhesive products, and clips and clamps to AMS’ portfolio.

Peters also gives AMS a direct sales force in Europe, and a much stronger sales presence in the Far East and Africa. AMS intends to sell its products where Peters is strong, and Peters products where AMS is strong.

It also expects to be able to improve some of its products with complementary technology. For example, AMS can improve Peters’ surgical glue system by combining it with its more precise delivery device technology. It anticipates accelerated suture development due to Peters’ research and development capability in this category.

Peters’ contribution in 2024 has diluted profitability though, so we will have to wait and see whether these developments restore it in coming years. Dates for realising synergies reach out to 2027 in the annual report.

Source: AMS annual reports.

Even at depressed levels, Surgical derives high profit margins from branded products. The same cannot be said for Woundcare, which makes dressings. The loss of royalty income from an expiring patent licensed to another company in 2023 and 2024 has driven adjusted operating profit margin down to just 4%.

Without providing any detail, AMS says it is refocusing Woundcare on high margin business. It has its own brand, ActivHeal, but it also earns an unspecified proportion of the division’s revenue manufacturing under contract for third-party brands.

Striking a balance may put AMS in a tricky position. My guess is that ActivHeal is more profitable, but AMS’ customers will not look kindly on more aggressive competition from their supplier. To raise profit margins, it would have to strike better contracts or push its own product harder, at the expense of contract manufacturing.

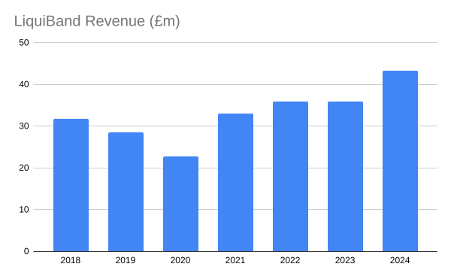

Better news comes from the Surgical Division. AMS’ most significant surgical product is LiquiBand, a range of tissue adhesives. Following disruption in 2023, when the company switched distributors in the US, its biggest LiquiBand market, sales have taken off again.

The company has introduced versions of LiquiBand for closing large wounds and hernia mesh into the US market, and provided exclusivity to distribution partners to motivate them.

Almost £11 million in fees and costs relating to the acquisition have been added back to profit so we can see how the underlying business has performed, but they have contributed to the second consecutive year of poor operating cash flow.

Weak cash conversion was also a result of a spike in receivables, although the company says large payments were received shortly after the year end.

Transformation can be unnerving when it depresses returns and AMS’ 8% Return on Total Invested Capital (ROTIC) in 2024 indicates it must deliver promised synergies to justify the purchase cost of Peters.

- What a weird six months it’s been in the markets

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

The company believes the combined business will become a “surgical powerhouse”. I’m not taking that for granted, because Peters is a large and potentially disruptive acquisition, but my score suggests it is just about worth the risk.

In making that judgement, I’m putting my faith in Chris Meredith, who has run AMS since 2011 but was commercial director before that. Eddie Johnson was promoted to chief financial officer in 2019. He joined the company in 2011.

Internal appointments at the top are a signal to employees that a company might meet their career aspirations, and they appear to be happy at AMS. Employee attrition was a modest 11% in 2024.

The company’s vision is one I can sign up to: “A world where the outcome of every patient can benefit from our products and a company where every employee feels invested and valued.”

It’s also worth remembering that AMS is developing a number of products that have yet to be commercialised, and may deliver a return on its ongoing investment eventually.

Advanced Medical Solutions | AMS | Manufactures surgical adhesives, sutures and dressings | 25/06/2025 | 7.2/10 |

How capably has Advanced Medical Solutions made money? | 2.0 | |||

Under Chris Meredith's leadership, AMS has experienced strong revenue growth but weakening profit growth. It has reinvested weakening cash flow to build the leading LiquiBand tissue adhesive brand and others and acquired complimentary businesses culminating in its biggest acquisition, Peters Surgical, in 2024. | ||||

How big are the risks? | 2.0 | |||

Peters joined the Surgical division, the largest and most profitable of two. It has indebted the company, and diluted profitability. Promised synergies may heal these wounds. Having lost valuable royalty income the Woundcare division has been exposed as a low margin business. | ||||

How fair and coherent is its strategy? | 2.5 | |||

AMS is restructuring the Woundcare division and investing in its more profitable surgical division. This is coherent but the scale and pace of change worries me. Engaged employees and worthwhile products give me some confidence though. | ||||

How low (high) is the share price compared to normalised profit? | 0.7 | |||

Low. A share price of 207p values the enterprise at £520 million, about 15 times normalised profit. | ||||

A score of 7.2/10 indicates Advanced Medical Solutions is a good long term investment. | ||||

NB: Bold text indicates factors that reduce the score. Bold and italicised text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explainedhere) | ||||

AMS’ score of (6.5) for the three quality factors, capabilities, risks and strategy, put it on the brink. Anything less than 6.5 out of 9 would trigger its exit from the Decision Engine.

The company may well become a surgical powerhouse, but quite rightly it identifies “increased business complexity” as a large and impactful risk. As of the end of May it hadn’t detected any change in ordering patterns due to tariffs.

A further deterioration in its financial position, another big acquisition, or a change in management might persuade me that AMS is too risky.

23 Shares for the future

Here’s the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score more than 7 out of 10 to be good value. Shares that score 7 or less are good businesses that are not obviously cheap at the moment.

Bloomsbury Publishing (LSE:BMY) and Keystone Law Group Ordinary Shares (LSE:KEYS) have published annual reports. I need to review their scores.

company | description | score | qual | price | ih% | |

1 | James Latham | Imports and distributes timber and timber products | 8.0 | 1.0 | 8.0% | |

2 | FW Thorpe | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.5 | 0.2 | 7.3% | |

3 | Howden Joinery | Supplies kitchens to small builders | 8.0 | 0.5 | 7.1% | |

4 | Dewhurst | Manufactures pushbuttons and other components for lifts and ATMs | 7.5 | 1.0 | 7.0% | |

5 | Churchill China | Manufactures tableware for restaurants etc. | 7.5 | 1.0 | 7.0% | |

6 | Oxford Instruments | Manufacturer of scientific equipment for industry and academia | 7.5 | 0.8 | 6.6% | |

7 | Renishaw | Whiz bang manufacturer of automated machine tools and robots | 7.5 | 0.6 | 6.3% | |

8 | Solid State | Assembles electronic systems (e.g. computers and radios) and distributes components | 7.5 | 0.5 | 6.0% | |

9 | Focusrite | Designs recording equipment, loudspeakers, and instruments for musicians | 7.0 | 1.0 | 6.0% | |

10 | Bunzl | Distributes essential everyday items consumed by organisations | 7.5 | 0.4 | 5.8% | |

11 | Renew | Repair and maintenance of rail, road, water, nuclear infrastructure | 7.5 | 0.3 | 5.6% | |

12 | Hollywood Bowl | Operates tenpin bowling and indoor crazy golf centres | 7.5 | 0.3 | 5.6% | |

13 | Macfarlane | Distributes and manufactures protective packaging | 7.0 | 0.7 | 5.4% | |

14 | James Halstead | Manufactures vinyl flooring for commercial and public spaces | 7.0 | 0.6 | 5.2% | |

15 | Anpario | Manufactures natural animal feed additives | 7.0 | 0.7 | 5.4% | |

16 | Games Workshop | Manufactures/retails Warhammer models, licences stories/characters | 9.0 | -1.7 | 4.6% | |

17 | Jet2 | Flies holidaymakers to Europe, sells package holidays | 7.5 | -0.2 | 4.7% | |

18 | Advanced Medical Solutions | Manufactures surgical adhesives, sutures and dressings | 7.2 | 6.5 | 0.7 | 4.3% |

19 | YouGov | Surveys and distributes public opinion online | 7.5 | -0.2 | 4.5% | |

20 | Porvair | Manufactures filters and laboratory equipment | 8.0 | -0.9 | 4.3% | |

21 | Bloomsbury Publishing | Publishes books, and digital collections for academics and professionals | 7.5 | -0.4 | 4.1% | |

22 | Auto Trader | Online marketplace for motor vehicles | 8.0 | -1.0 | 4.1% | |

23 | Softcat | Sells hardware and software to businesses and the public sector | 8.0 | -1.0 | 4.0% | |

24 | Volution | Manufacturer of ventilation products | 8.0 | -1.1 | 3.8% | |

25 | DotDigital | Provides automated marketing software as a service | 6.5 | 0.2 | 3.4% | |

26 | 4Imprint | Customises and distributes promotional goods | 8.0 | -1.3 | 3.4% | |

27 | Dunelm | Retailer of furniture and homewares | 8.0 | -1.4 | 3.3% | |

28 | Quartix | Supplies vehicle tracking systems to small fleets and insurers | 7.5 | -1.2 | 2.6% | |

29 | Judges Scientific | Manufactures scientific instruments | 7.5 | -1.8 | 1.3% | |

30 | Goodwin | Casts and machines steel. Processes minerals for casting jewellery, tyres | 8.0 | -2.3 | 1.4% | |

31 | Tristel | Manufactures disinfectants for simple medical instruments and surfaces | 7.5 | -2.1 | 0.8% | |

32 | Cohort | Manufactures military technology, does research and consultancy | 7.5 | -2.2 | 0.6% | |

33 | Keystone Law | Runs a network of self-employed lawyers | 7.0 | -2.4 | 0.0% |

Scores and stats: Richard Beddard. Data: ShareScope and annual reports

Click on a share's score to see a breakdown (scores may have changed due to movements in share price). Key: qual is the share’s score out of 9 for the three quality factors (capabilities, risks, and strategy), price is the price score from -3 to +1, and ih% is the suggested ideal holding size as a percentage of the total value of a diversified portfolio.

Strategy notes

Former Decision Engine member PZ Cussons (LSE:PZC) has sold its 50% stake in Nigerian cooking oil joint venture PZ Wilmar to its joint venture partner last week. It has also formed a strategic partnership with Emmerson to distribute fake tan brand St Tropez in the US.

I liked the focused strategy announced by the company’s chief executive in 2020, but his time in charge has been marked by crises not of his making: first the pandemic and then the catastrophic devaluation of the Nigerian currency and PZ Cussons’ cash trapped in subsidiaries there.

Last year, the company announced it would simplify the business and repair its balance sheet by selling Nigerian assets and St Tropez. St Tropez’s biggest market is the US, but it is not a major market for PZ Cussons’ other products.

The disposal in Nigeria will improve the company’s finances, so I’ve made a note to check its financial position when it publishes its annual report.

St Tropez suffered a double-digit decline in revenue for the year to May 2025, which may have weakened PZC’s hand in sale negotiations. It expects Emmerson’s reach to return the brand to growth.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns AMS and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.