Three profitable AIM stocks on attractive valuations

Rather than get sucked into risky new tech stocks, our small-caps expert suggests some better picks.

31st May 2019 14:24

by Andrew Hore from interactive investor

Rather than get sucked into risky new tech stocks, our small-caps expert suggests some better picks.

Technology companies can generate hype and over-excitement from investors, particularly if they are involved in a fashionable and new area. That can mean share prices get chased up to heady levels as investors scramble to get on.

Some companies are able to maintain a high share price because of the progress they are making, but many tech firms do not have a smooth ride in commercialising and growing their businesses. That can lead to the equivalent negative reaction and the share price plummets.

Alternatively, the tech companies that do achieve what is expected still do not do enough to justify the share price and it will slump.

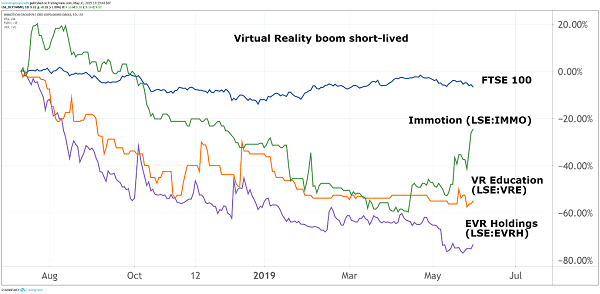

Take virtual reality, or VR for example. This is an area that created a lot of investor excitement and brought new companies to the AIM market last year.

VR Education (LSE:VRE) and Immotion Group (LSE:IMMO) floated in 2018 and the share prices immediately went to large premiums. This followed on the back success at EVR Holdings (LSE:EVRH) whose share price went from under 1p a share to 18p a share and then back to less than 3p a share, all in less than three years.

EVR had signed deals with major record labels to produce VR versions of live concerts of their recording artists.

Revenues were modest last year but they will increase significantly. However, the loss remains substantial for the next two years. The good thing for the company is that it raised cash at the inflated share price and has plenty for its needs.

VR Education has developed the ENGAGE VR education-focused platform and individual VR showcases for Apollo 11 and Titanic. Considerable effort has gone into the business, but it will take time to build revenues.

The company even reported better than expected 2018 figures, but revenues were still well below €1 million. There is enough cash to last into 2020, but more finance will need to be raised as losses continue. The share price is currently below the 10p flotation price, having been just above 24p at one stage.

Immersive VR company Immotion floated just after VR Education, also at 10p a share. It did not gain as big a premium in the early days of trading, but it was still almost 50%. The share price then dropped back to 5p.

Contracts have been won for Immotion VR Cinematic platforms from customers including LEGOLAND and Sea Life.

This required additional cash and Immotion raised £3.3 million at 6p a share. Immotion is set to breakeven this year and then forecast to make a pre-tax profit of £2.2 million in 2020. The share price is heading back to the original flotation level.

Source: TradingView Past performance is not a guide to future performance

Share prices hacked

Another example of how hype and over excitement is cyber security, where publicity about hacking and ransomware attacks led to investors seeking ways of profiting from these problems. Share price rises were not held onto for long, though.

For example, cyber security consultant ECSC joined AIM at the end of 2016, when it raised £5 million at 167p a share, and reached 575p within six months at the peak of cyber security publicity.

ECSC did not meet forecasts and, even if it had, the share's rating was unsustainable. ECSC was profitable in 2015 prior to flotation, but costs were increased ahead of expected revenue growth which was not achieved. The cost base has been realigned to a more realistic level but ECSC is not expected to make a profit until 2020. If achieved, this would put the shares, at 82.5p, on 11 times prospective 2020 earnings.

The problem is that investors feel they need to jump aboard companies in hyped up sectors because the share prices are shooting up. They fear they will miss out if they do not become involved and completely ignore the fancy valuations that they are paying.

There are technology companies where the share price has either drifted back from the high point, or where they are profitable and are trading on an attractive profit multiple. Here are three examples.

An attractive trio of tech

Boku Inc (BOKU)

Boku Inc (LSE:BOKU) is a rare example of a company that has beaten market expectations at the time of its flotation and is steaming ahead. The 2018 forecast was upgraded more than once last year yet the revenues were still at the upper end of forecasts.

Digital carrier billing technology developer Boku joined AIM less than two years ago. Boku gets paid a percentage-based fee by merchants for processing payment transactions over mobile. This includes Apple (NASDAQ:AAPL) and Spotify Technology (NYSE:SPOT). Direct carrier billing is more convenient than using PayPal or credit cards.

Boku has connections to 183 mobile carriers in 58 countries. The Boku platform is operating at one-third of capacity, so the cost base does not need to increase significantly as revenues grow, although there are additional costs from adding identity verification services provider Danal Inc to the group at the beginning of 2019. Other services could be added in the future.

The share price soared in the first 10 months of dealings and reached three times the placing price of 59p. Later in 2018, the share price nearly fell to the placing price, but positive trading has pushed the price back up to 138.5p.

Source: TradingView Past performance is not a guide to future performance

The shares are trading on nearly 100 times prospective 2019 earnings, but the multiple is set to fall rapidly. A multiple of 23 is forecast for 2021. Given the track record, these forecasts might be beaten.

Net cash was $28.9 million at the end of 2018. This year, net cash is likely to be similar, but from 2020 cash will rise at a rapid rate. If forecasts are achieved, net cash could be $79.2 million by the end of 2021.

This is a rapidly growing business in a growing market. Boku will prosper as an independent company but may also attract the attentions of much larger financial and fintech companies as a takeover target.

Elecosoft (ELCO)

Architecture and construction software provider Elecosoft (LSE:ELCO) has a record of profitability and significant revenues and an international spread of business. Elecosoft originally sold precast concrete and other building products, but it decided to focus on its construction software division.

The more recent decision to expand into property management and maintenance software further broadened the potential market. Cash generation is strong, and the dividend is growing.

Although it does not have the attention and excitement of fintech, demand for construction and facilities management software is growing rapidly. Buildtech is forecast to grow at an annual rate of 11.3%, while the much larger asset and property maintenance software market is estimated to be growing at 8.7% a year.

In 2018, Elecosoft increased its underlying pre-tax profit from £2.7 million to £3.8 million, helped by acquisitions in the past couple of years. There was organic revenue growth of 3%.

The balance of the business is moving away from construction towards facilities management and interior design applications. The acquisition of Shire Systems, which supplies maintenance management software, has helped to further widen the product portfolio.

Net debt of £2.1 million should be wiped out this year through cash generation from operations. Equity Development estimates that net cash could be more than £24 million by the end of 2024.

A full year pre-tax profit of £4.6 million is forecast. At 75.4p, that puts the shares on less than 18 times prospective 2019 earnings, falling to 15 next year. The dividend should rise from 0.68p a share to 0.85p a share.

There is much more to come from the existing ranges of software with potential for further add-on acquisitions. First quarter revenues are one-fifth higher, or 22% at constant currency.

PCI-Pal (PCIP)

PCI-PAL (LSE:PCIP) is still some way off moving into profit but, importantly, it had net cash of £3.5 million at the end of 2018 - enough to push ahead with its strategy. Capital investment requirements are small and cash flow is ahead of profit, particularly due to accounting changes to the recognition of revenues.

PCI-Pal provides payments services technology to contact centre operators. The technology helps to make payments more secure because the contact centre operator does not know the payment card details. PCI-Pal delivers its technology via the Amazon Web Server cloud platform, which enables it to provide the service outside of its core North American and European markets.

In the first six months of the financial year to December 2018, recurring contract revenues were £1.3 million and deferred revenues were £2.3 million. Revenues are expected to reach £11.1 million in 2020-21. There should still be cash left at the end of June 2021 if forecasts are met.

Source: TradingView Past performance is not a guide to future performance

The main uncertainty concerning hitting the forecasts is how quickly PCI-Pal can build up revenues in the US. It is still early days.

That is why the cash buffer is important. Other companies have good products, but they run out of funds before they can exploit them fully.

The recurring revenues generated by PCI-Pal mean that short-term cash requirements could be covered by a debt facility.

PCI-Pal has put in the investment to develop its technology and it needs to show it can generate the revenues from it. At 27.5p a share, the company is valued at £11.7 million, which is modest considering the potential.

Andrew Hore is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.