Three top stock picks in the retail sector

Profits are set to take a massive hit this year, but City experts think this trio are worth owning.

21st May 2020 14:59

by Graeme Evans from interactive investor

Profits are set to take a massive hit this year, but City experts think this trio are worth owning.

A huge clearance sale to shift summer stock unsold during the lockdown has left investors fearful about a potential battering for the margins of the big clothing retailers.

With this in mind, analysts at UBS have taken a closer look at how the profitability of six of Europe's biggest firms will be impacted once these 'mega sales' get under way – most likely from next month in the UK after three months of store closures.

The forecasts point to full-year earnings per share (EPS) estimates down by 40% on average in the current year, with a 1% rise in sales estimates due to pent-up customer demand, more than offset by a 250 basis points hit to gross margins.

The bank only expects a muted recovery in profitability next year, with gross margins probably reaching pre-Covid-19 levels by the following year at the earliest.

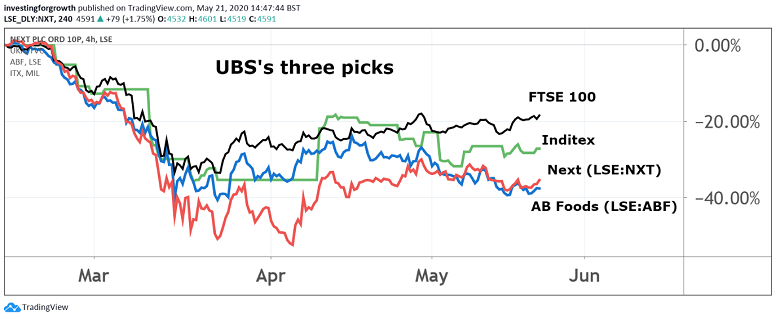

The heaviest EPS downgrade is 81% for Next, although the high street stalwart remains one of UBS's three picks in the sector alongside Primark owner Associated British Foods (LSE:ABF) and Zara business Inditex. It is ‘neutral’ on H&M and online retailer ASOS (LSE:ASC), with a ‘sell’ recommendation on German e-commerce operation Zalando (XETRA:ZAL).

Source: TradingView. Past performance is not a guide to future performance.

The biggest margin hit is seen at H&M, with an estimated 420-basis points decline compared with 70 basis points for Primark. These forecasts differ according to the mix of product and sale categories, as well as the flexibility of supply chains and length of product lead times.

The prospect of ongoing disruption was highlighted yesterday by Marks & Spencer boss Steve Rowe in the company's annual results. He warned that the Covid-19 lockdown will have altered some customer habits forever, with digital trends accelerated and changes to the shape of the high street also brought forward.

The retailer wrote off £157 million of inventory in the full-year results, based on expectations that a large proportion of current season stock will remain unsold. It has already made arrangements to hibernate around £200 million of product until next spring.

UBS does not expect a rapid recovery in the industry's margin performance, given that ongoing Covid-19 uncertainty will mean that retailers are likely to be focused over the short-term on 'just-in-time' and proximity manufacturing.

There will also be ongoing markdown pressure to clear unsold stock from this year, as well as continued appetite among consumers for discounted products. It also predicts a negative impact on prices from the increased number of retailers in financial distress.

- M&S: why pandemic may finally kickstart a true turnaround

- Buffettology fund: top 10 stocks and a buying spree

- Shares wobble as Next sends chill through retail sector

The bank thinks that Next is best placed to benefit from this trend as capacity in the mid-market sector continues to reduce.

UBS added:

“In the short term, Next’s online presence - recently reopened - should provide more buffer to profits and its history of strong cash flow generation and investment grade debt should mean relatively easy access to additional liquidity if required.”

The bank increased its price target on Next (LSE:NXT) from 5,100p to 5,400p, which compares with 4,557p currently. Its recommendation on AB Foods is unchanged at 2,400p, against a share price of 1,666p this afternoon. Today's note increased the target price on ASOS from 2,300p to 2,500p, although still lower than the current share price of 2,770p.

- Dividend good news gives boost to income seekers

- The Ian Cowie portfolio: bargain trusts and big yields

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

UBS said on ASOS: “While we expect a relatively strong sales performance during lockdown vs multi-channel peers, we remain cautious over the longer term impact of greater discounting.

“In the short term, ASOS is likely to continue stimulating demand through discounting and promotions, meaning 200 basis points gross margin decline in FY20.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.