Is this the time to buy Moneysupermarket shares?

Find out how our companies analyst scores the price-comparison site as an investment in troubled times.

13th March 2020 15:45

by Richard Beddard from interactive investor

Find out how our companies analyst scores the price-comparison site as an investment in troubled times.

I abhor price-comparison sites. You need to know this, as my jaundiced attitude may taint the verdict on Moneysupermarket (LSE:MONY), a highly profitable business that may be staking out a unique and customer focused position in its markets.

I think price comparison has helped fracture the relationship between product providers and their customers. Insurance, savings accounts, and utilities are treated as commodities and their suppliers must win business by offering low introductory prices. Customers endure the purgatory of price comparison whenever they renew a policy or contract because suppliers increase their rates on renewal to claw back profit.

Where possible, I avoid this penny-pinching culture, preferring to buy direct from companies that promise to charge existing customers the same as new customers or have treated me well in the past, even if they are a bit more expensive.

A good actor in a bad system?

Masses of people seem to relish the money saving game though, so perhaps I need to accept the World does not always work the way I think it should. Perhaps there are companies that help people play the game better than others.

Moneysupermarket owns the campaigning MoneySavingExpert site, which is still overseen by founder and honest broker Martin Lewis. MoneySuperMarket (with capital letters), the biggest of the group’s brands, is two years into reinventing itself as a more sober partner in managing our household finances.

Only a few years ago price comparison sites appeared to have the same strategy, to produce the loudest, most ridiculous campaign to funnel people into their sales mills and convert them into customers. This is how we got meerkats, jingles bellowed by opera singers, and big-bummed male pole dancers in denim shorts.

Now MoneySuperMarket urges us to “get money calm”, a shift that signals it is trying different. The adverts have changed, but so too has the strategy. Having revamped its technological infrastructure, Moneysupermarket is inventing new features, dubbed “clever ways to save” by helping us monitor spending. “Bill Manager” offers customers better deals when it thinks they are paying too much for energy, and “Credit Monitor” helps people understand their credit rating and offers them credit cards and other products they will probably qualify for.

- 10 low volatility stocks and a 4-point checklist for tough markets

- Biggest fallers during the crash and the shares to buy

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

As one half of a joint venture, Podium, Moneysupermarket is aiming to disrupt the mortgage market by offering a “comparison-to-completion” service like it does with more routine financial products. The whole industry is maturing, but as the biggest price comparison site, and leader in insurance, Moneysupermarket may be changing from a position of strength.

New economy share, old economy price

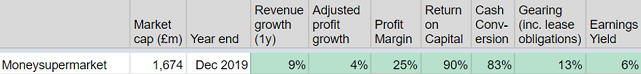

The company trades on an enterprise multiple of about 17 times adjusted profit in the year to December 2019, which is modest for a highly profitable new economy share. The stats look good across the board:

Source: The author, from annual report data

The problem as far as other investors are concerned is probably growth, which Moneysupermarket says it is “reaccelerating”. As the company has matured it has become more profitable, but the rate of growth has slowed dramatically. In 2019, revenue increased 9% and adjusted profit increased 4%, while during much of the last decade Moneysupermarket was growing far more rapidly.

The slowdown is probably why the company is changing tack. As well as trying to make its own sites more useful, in 2018 it bought Decision Tech, a provider of phone and broadband price comparison services for third parties (including Moneysupermarket).

Decision Tech is enabling Moneysupermarket’s strategy to “take price comparison to the user”, by offering ways to save in products we already use (like budgeting apps, and ultimately our bank accounts).

Since joining Moneysupermarket, Decision Tech has developed an energy comparison service from Moneysupermarket’s platforms, and sold it to a number of apps and sites.

- Trading the dip: Inside the mind of an emotional investor

- Will these ten stocks make the Decision Engine?

- The Decision Engine as you will never see it again

Old doubts return

By coincidence, my home insurance is up for renewal and so, despite heavy misgivings, and in the name of research, I went to MoneySavingExpert to get some advice

To get the cheapest price, MoneySavingExpert advocates getting quotes from a ranked list of four price comparison sites and two big affiliated insurers who sell directly. Then it recommends haggling with our existing insurer to see if it will beat the quote. Having got the cheapest quote, it suggests buying through a cashback site!

Life’s too short. The highest ranked (cheapest) price comparison site for home insurance, generally speaking, is MoneySuperMarket (according to MoneySavingExpert). So I got a quote from it and one from the company that supplies my motor insurance. I like this company because the motor insurance is renewed on the same terms as new customers’ insurance, and it offers a discount to existing customers when they buy new products.

Only MoneySuperMarket’s top quote beat the insurer, and both new quotes handily beat my renewal. But MonySuperMarket’s quote was from a company I had never heard of, and getting it was much more taxing. While MoneySuperMarket asked me to identify every lock on every external door in my house, declare whether there were any trees over 10m tall within 5m of our boundary, estimate the rebuilding and market cost of the property, disclose our professions, how many adults, and children, live in the house and much more besides, the insurer used an automated system that took seconds. I presume, to get a quote from all the insurers it partners with, MoneySupermarket must ask every question they need answering.

I’m going direct again, and my experience leaves me in a bind because I hate buying shares in companies I wouldn’t use myself. But I also recognise I may well be atypical. People are lazy, perhaps even lazier than me, and, since Moneysupermarket is a big name, lots of people end up there.

So I’m going to give Moneysupermarket a score...

Does Moneysupermarket make good money?

Indisputably.

Score: 2

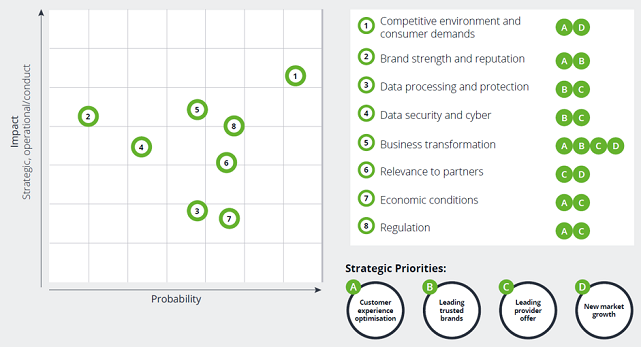

What could prevent it from growing profitably?

I don’t normally share company’s risk matrices, they tend to banality. Moneysupermarket’s is typical, but one thing stands out. The company believes the big risk, the most probable and the highest impact, is competition (1). I agree, and that makes Moneysupermarket quite a simple company to evaluate. In the Darwinian world of price comparison, the established companies with the best strategies should prosper.

If Moneysupermarket’s competitors were only price comparison sites, I’d give it two out of two. But it seems to me insurance companies like Aviva (LSE:AV.) and Direct Line (LSE:DLG) that won’t partner with price comparison sites are innovating: offering discounts for multiple products, a place to hold many policies in one place, and by being more competitive than they once were when it comes to renewal.

Score: 1

How will it overcome these challenges?

Moneysupermarket is addressing the competitive threat by daring to be different, recognising perhaps that saving money isn’t epic, as its old advertising campaigns claimed. Most of us would just like it to be easier.

While this strategy differentiates it from other price comparison sites, it’s still basically playing the same game, and doesn’t really address the threat posed by direct channels.

Score: 1

Will we all benefit?

The Director’s remuneration report is 19 pages long, and I can find little evidence of pay restraint. Although no share options vested in 2018 and the chief executive earned 61% of his bonus, he still earned £1.24 million. Neither have the two executive shareholders been with the company long, so they don’t have large shareholdings.

On the other hand, Moneysupermarket says all the right things about employees, appears to offer a large range of benefits and training (including a “personal stipend”) and scores highly on recruitment site Glassdoor.

I’m not sure how much of an advantage a good corporate culture is, though. Most of the price comparison sites treat employees well judging by online reviews, although reviews of Uswitch are mixed.

Score: 1

Are the shares cheap?

A share price of 308p values the enterprise modestly at about £1.65 billion, about 17 times adjusted profit. They’re not obviously expensive.

Score: 5.9

As I drafted this article I had a higher score in mind, but in the end I couldn’t overcome my biases.

A score of 5.9 out of 10 would rank Moneysupermarket 27 out of the 30 shares I rank in my Decision Engine, were I to include it. But for now, I’m keeping it on the watchlist.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.