Will these ten stocks make the Decision Engine?

Our stock analyst offers a sneak preview of candidates for future inclusion in his Decision Engine.

21st February 2020 15:30

by Richard Beddard from interactive investor

Our stock analyst offers a sneak preview of candidates for future inclusion in his Decision Engine.

It’s eight shares for the future this month, one more than last time we published the Decision Engine’s rankings. The number is arbitrary, the number of shares that score seven or more out of ten, but it does tell us something. The dearth of high scoring shares means I am finding fewer obvious bargains.

| Score | Name | Description | Profile |

|---|---|---|---|

| 8 | XP Power (LSE:XPP) | Manufactures power adapters for industrial and healthcare equipment | http://bit.ly/swXPP2019 |

| 7.9 | Victrex (LSE:VCT) | Manufactures PEEK, a tough, light and easy to manipulate polymer | http://bit.ly/swVCT2019 |

| 7.8 | PZ Cussons (LSE:PZC) | Manufactures personal care and beauty brands, in the main | http://bit.ly/swPZC2019 |

| 7.2 | Goodwin (LSE:GDWN) | Casts and machines steel. Processes minerals for casting jewellery, tyres | http://bit.ly/swGDWN2019 |

| 7.2 | FW Thorpe (LSE:TFW) | Makes light fittings for commercial and public buildings, roads, and tunnels | http://bit.ly/swTFW2019 |

| 7.1 | Dewhurst (LSE:DWHT) | Manufactures pushbuttons and other components for lifts and ATMs | http://bit.ly/swDWHT2020 |

| 7 | Anpario (LSE:ANP) | Manufactures natural animal feed additives | http://bit.ly/swANP2019 |

| 7 | Castings (LSE:CGS) | Casts and machines parts for vans and trucks primarily | http://bit.ly/swCGS2019 |

| 6.9 | Portmeirion (LSE:PMP) | Designs and manufactures tableware, candles and reed diffusers | http://bit.ly/swPMP2019 |

| 6.9 | RM (LSE:RM.) | Supplies schools with equipment and IT, and exam boards with e-marking | http://bit.ly/swRM2019 |

| 6.7 | Howden Joinery (LSE:HWDN) | Supplies kitchens to small builders | http://bit.ly/swHWDN2019 |

| 6.7 | Hollywood Bowl (LSE:BOWL) | Operates tenpin bowling centres | http://bit.ly/swBOWL2020 |

| 6.7 | Solid State (LSE:SOLI) | Manufactures rugged computers, batteries, radios. Distributes components | http://bit.ly/swSOLI2019 |

| 6.5 | Next (LSE:NXT) | Retails clothes and homewares | http://bit.ly/swNXT2019 |

| 6.5 | Judges Scientific (LSE:JDG) | Buys and operates small scientific instrument manufacturers | http://bit.ly/swJDG2019 |

| 6.5 | Bloomsbury Publishing (LSE:BMY) | Publishes books, provides online collections to professionals and academics | http://bit.ly/swBMY2019 |

| 6.4 | Games Workshop (LSE:GAW) | Manufactures, retails Warhammer miniatures for collectors, gamers | http://bit.ly/swGAW2019 |

| 6.3 | Softcat (LSE:SCT) | Sells hardware and software to businesses and the public sector | http://bit.ly/swSCT2019 |

| 6.3 | Avon Rubber (LSE:AVON) | Manufactures respiratory protection and milking equipment | http://bit.ly/swAVON2020 |

| 6.3 | Trifast (LSE:TRI) | Manufactures and distributes nuts and bolts, screws, and rivets | http://bit.ly/swTRI2019 |

| 6 | Cohort (LSE:CHRT) | Manufactures military tech. Does research and consultancy | http://bit.ly/swCHRT2019 |

| 5.9 | Renishaw (LSE:RSW) | Whiz bang manufacturer of automated machine tools and robots | http://bit.ly/swRSW2019 |

| 5.8 | Churchill China (LSE:CHH) | Manufactures tableware for restaurants and eateries | http://bit.ly/swCHH2019 |

| 5.6 | Dart Group (LSE:DTG) | Flies holidaymakers to Europe. Trucks fruit and veg around the UK | http://bit.ly/swDTG2019 |

| 5.6 | Quartix Holdings (LSE:QTX) | Supplies vehicle tracking systems to fleets and insurers | http://bit.ly/swQTX2019 |

| 5.5 | Porvair (LSE:PRV) | Manufactures filters and filtration systems for fluids and molten metals | http://bit.ly/swPRV2019 |

| 5.4 | dotDigital (LSE:DOTD) | Developer of marketing automation software | http://bit.ly/swDOTD2019 |

| 5.3 | Tristel (LSE:TSTL) | Manufactures disinfectants for simple medical instruments and surfaces | http://bit.ly/swTSTL2019 |

| 4.9 | Treatt (LSE:TET) | Sources, processes and develops flavours esp. for soft drinks | http://bit.ly/swTET2018 |

| 4.7 | James Halstead (LSE:JHD) | Manufactures vinyl flooring for commercial and public spaces | http://bit.ly/swJHD2019 |

Source: The author

The average score of the 30 shares in the list has dropped to 6.4, principally as a result of surging share prices, which has increased valuations and rendered the shares less attractive long-term investments (in aggregate). They have realised some of their long-term potential ahead of schedule.

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

The increase in valuations means returns from portfolios of shares selected from the Decision Engine today will likely be lower than returns from portfolios selected a year or two ago, which have been highly lucrative already!

I hasten to add, scores are a relative measure. Lower scores do not make these 30 shares bad long-term investments. They are all, in my estimation, shares in good businesses capable of prospering through thick and thin.

Their average earnings yield is 5%. The earnings yield is a theoretical yardstick measuring the return we would earn if a company paid all profit back to investors rather than investing some of it to generate new business.

Since all of the companies in the Decision Engine are investing some of their profit to grow, and they all earn a high return on capital (the average is 38%), I consider the earnings yield to be a baseline measure of investor return and expect better from my portfolios over the long-term. The short-term is another matter, unfathomable to me, so we must be patient.

Patience does not imply inactivity, though. As well as being less attractive investments than they once were, the balance may also have shifted between the 30 shares in the Decision Engine and the more than 2,000-odd shares listed in London that I do not rank.

That is why I am trawling the stockmarket for equally good companies at more attractive valuations. Companies that might one day join the Decision Engine. They are shares for further in the future, perhaps.

Shares for further in the future...

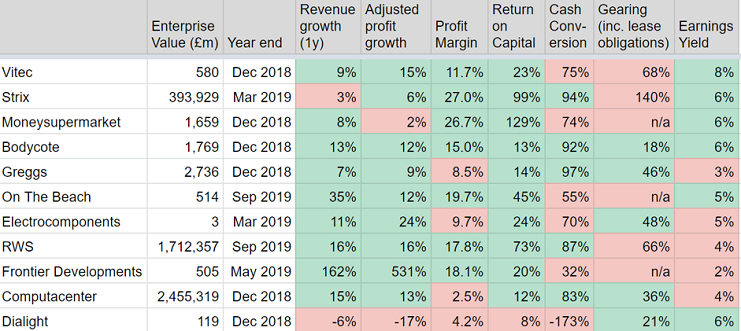

The table below shows ten new candidates for the Decision Engine. They have not been subjected to the same scrutiny as the 30 companies listed in the Decision Engine, and until they have received it, they will not be admitted.

They are ranked using the same scoring system as the shares in the Decision Engine so I know which shares to prioritise, but since I have not evaluated them fully the scores are more than usually informed by instinct and guesswork and I have chosen not to share them with you. Put a number on something, and it lends it credibility, and these prototypical scores do not deserve it.

The columns show the performance, financial strength, and valuation of each company. Causes for celebration are highlighted in green, and causes for concern are highlighted in pink.

Source: The author

Because most companies report their full-year results in the first half of the year, many in this list will be publishing annual reports relatively soon, which is when I will score them properly. The nearer a company is to the top of the list, the more likely I am to score it, although I hope to augment the list significantly over time, pushing shares near the bottom further down, or letting them fall off the bottom.

These shares have warts, of course, most companies do and if it’s apparent to everyone that a firm is flawless, then the share price is likely to be the wart.

Vitec (LSE:VTC), Strix (LSE:KETL) and Greggs (LSE:GRG) are top of the list.

Warts ’n all

Vitec makes camera equipment for photographers and videographers, from film crews and broadcasters to “smartphonographers”. Its warts are perhaps minor and transitory. It will report slightly lower profits for the year to December 2019 than it did in 2018 due to prior overstocking by some of its customers and a fire in one of its factories, and it is quite heavily dependent on outside capital, the result of an acquisitive strategy that has seen it add numerous brands over the years.

At 13%, the company’s Return on Total Invested Capital at cost in 2018 was decent, so it’s likely Vitec has invested wisely, and while a dip in its performance may have encouraged traders to sell, an earnings yield of 8% implies good returns for those of us with a longer time horizon.

Strix dominates the global market for electric kettle controls, and it is transferring some of the technologies it has invented into other markets, like water purification. Strix’s warts have little to do with the business. As long as Strix can protect its intellectual property, the kettle controls business will probably grow slowly over the long-term as electric kettle use increases outside Europe, where pretty much everybody has one.

Newer initiatives may hasten growth, but Strix is very heavily dependent on outside finance. On the one hand the debt does not make Strix a bad business. The company’s cash flows indicate it would be self-financing, had its previous owners not floated it on the stockmarket loaded with debt. On the other hand, debt is not likely to fall as quickly as I would like because Strix is funnelling money into a new factory in China.

If you read last week’s article about Greggs, the sandwich shop, you know I would love to include this share in the Decision Engine. The only wart I have detected so far is the share price, which means the share has an earnings yield of just 3%.

Richard owns shares in most of the companies listed in the Decision Engine. He doesn’t own any of the shares in the list of candidates (yet).

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.