Two attractive stocks that could leave you sitting pretty

7th June 2023 09:26

by Rodney Hobson from interactive investor

Both companies profited from the Covid pandemic, but one of them is back where it started. Overseas investing expert Rodney Hobson thinks there’s a trading opportunity here.

Despite rising interest rates, high inflation and a squeeze on living standards in many countries, there is one commodity that people can usually find cash for: cosmetics. It sometimes seems as if beauty comes before full tummies.

However, even cosmetics producers have started to feel the squeeze after bouncing back strongly from the pandemic.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

The Estee Lauder Companies Inc Class A (NYSE:EL) has seen growth in nearly every market, including the key markets of the United States and Britain. Hong Kong has performed well along with emerging markets globally. Alas, that has not stopped total sales from falling 12% to $3.75 billion in the three months to 31 March, mainly because of weakness in China and South Korea.

Sales did actually beat analysts’ expectations for what is the company’s third quarter, but the full-year figures are unlikely to offer much cheer, with even the company itself expecting a 10-12% decline from 2021-22. Estee Lauder had earlier hoped the decline could be limited to 5-7%.

- Watch our video: the US shares we own that will outperform Big Tech

- Watch our video: how to beat the US stock market

The profits outlook is worse. Net earnings for the most recent quarter slumped from $558 million to $156 million, which did fall short of forecasts, and the outlook for the full 12 months is for adjusted profits per share to be halved.

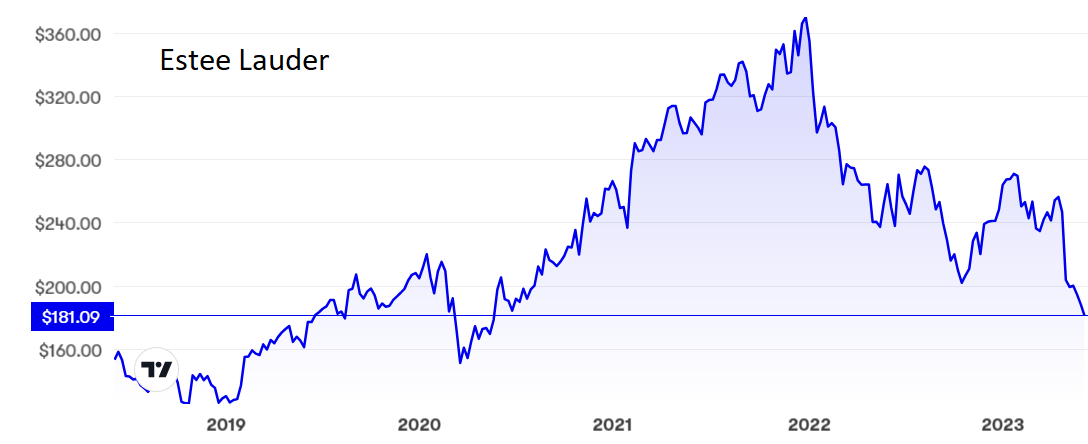

Estee Lauder shares more than doubled from $150 to $360 from March 2020 to the end of the following year, but the relentless rise has been mostly reversed since and they are back well below $200. Even so, the price/earnings (PE) ratio is still an unrealistic 60, while the yield is hardly tempting at 1.4%.

Source: interactive investor. Past performance is not a guide to future performance.

Across the Atlantic in Paris, life is looking much brighter for L'Oreal SA (EURONEXT:OR), which reported a 13% rise in first quarter sales to €10.4 billion, way better than analysts had expected and with every division beating forecasts. Thanks to strong relationships with pharmacists and dermatologists, the dermatological beauty division saw sales soar 30%.

As with Estee Lauder, business has been thriving in the US and Europe, where it was possible to pass on rising prices and sales revenue was more than 16% higher, but there was still no sign of a bounce back from the ending of Covid-19 curbs in China. This would have helped the luxury division, something of a laggard with 6.5% growth, because L’Oreal has nearly a third of the market in an increasingly consumer-conscious nation.

- Demographics: how population changes will reshape global growth

- Holding back the years: three timeless longevity stocks

- Do European smaller companies have staying power?

The second-quarter figures, due in mid-July, may see that picture improving. L’Oreal reported some early signs of improvement in China from February onwards. If that happens, sales could go with a whoosh as depleted stock levels are replenished.

L’Oreal’s share price has doubled to just over €400 over the past five years so a lot of good news is already reflected in the share price. Even so, the chunky PE of 38 is less onerous than for Estee Lauder and the yield is fractionally better at 1.5%.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I have twice suggested buying Estee Lauder shares below $195, most recently last November, and both times there has been a chance to buy in and take decent profits subsequently. That opportunity has arisen again, but given the decline in the shares and the challenging fundamentals, any buy recommendation must come with the caveat that investors should look to take profits if the price approaches $240, which has proved to be a ceiling and a floor over the past 18 months.

Last November, I rated L’Oreal as better value at €327 and, so far, that has proved to be the right call. While the case for buying is less compelling now, I still think the shares are worth at least a hold. If you do choose to buy, you are unlikely to regret it.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.