Four top-performing funds we’ve been buying

Saltydog Investor has been increasing exposure to ‘old favourites’ in its portfolios.

23rd August 2021 14:03

by Douglas Chadwick from ii contributor

Saltydog Investor has been increasing exposure to ‘old favourites’ in its portfolios.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Last week, we increased our holdings in some of the best-performing funds that are in our demonstration portfolios, Tugboat and Ocean Liner.

To control the overall volatility of the portfolios, we ensure that most of our investments are in the slower and more steady sectors, and only have a smaller amount in the racier funds.

Our ‘Slow Ahead’ Group is made up of funds from the following sectors:

- Sterling High Yield Bonds

- Sterling Strategic Bonds

- Sterling Corporate Bonds

- Mixed Investment 0-35% Shares

- Mixed Investment 20-60% Shares

- Mixed Investment 40-85% Shares

- Targeted Absolute Returns

Since the 2020 market crash, the leading sector from this group, based on its four-week return, has most often been the Mixed Investment 40-85% Shares sector. The Sterling High Yield sector has also featured a few times, mainly when equity markets have temporarily faltered. The last time was back in June when we bought the Schroder High Yield Opportunities fund.

In last week’s report, the Mixed Investment 40-85% Shares sector was at the top of the table with a four-week return of 2.1%. Over 12 weeks it was up 5.6% and in the last 26 weeks it has made 7.4%. In comparison, the Sterling High Yield sector has gone up by only 0.1% in the last four weeks.

We have now sold the Schroder High Yield Opportunities fund and added to the Liontrust Sustainable Future Managed fund and the Royal London Sustainable World fund. These are two funds that we are holding from the Mixed Investment 40-85% Shares sector along with the Janus Henderson Global Responsible Managed and the Baillie Gifford Managed funds.

- How Saltydog invests: a guide to its momentum approach

- Five consistent funds that have doubled in three years

- Funds Fan: Terry Smith, trust dividends and top fund performer

At the beginning of last year, we were holding three of these funds; they were the last ones to be sold during February and March when they fell along with markets in general. When we started to reinvest at the beginning of April, the first fund we bought was Royal London Sustainable World, followed by the Janus Henderson Institutional Global Responsible Managed fund. In May, we added the Liontrust Sustainable Future Managed fund and a couple of months later we went into the Baillie Gifford Managed fund. They have been the mainstay of our portfolios ever since.

Each week, we calculate a decile ranking for each fund in the group based on their returns over various time periods. The top 10% go into decile one, the next 10% go into decile two, and so on, all the way down to the last 10%, which end up in decile 10. When we looked last week, these four funds were in decile one based on their returns over four and 12 weeks. The Royal London and Liontrust funds were also in decile one over 26 weeks.

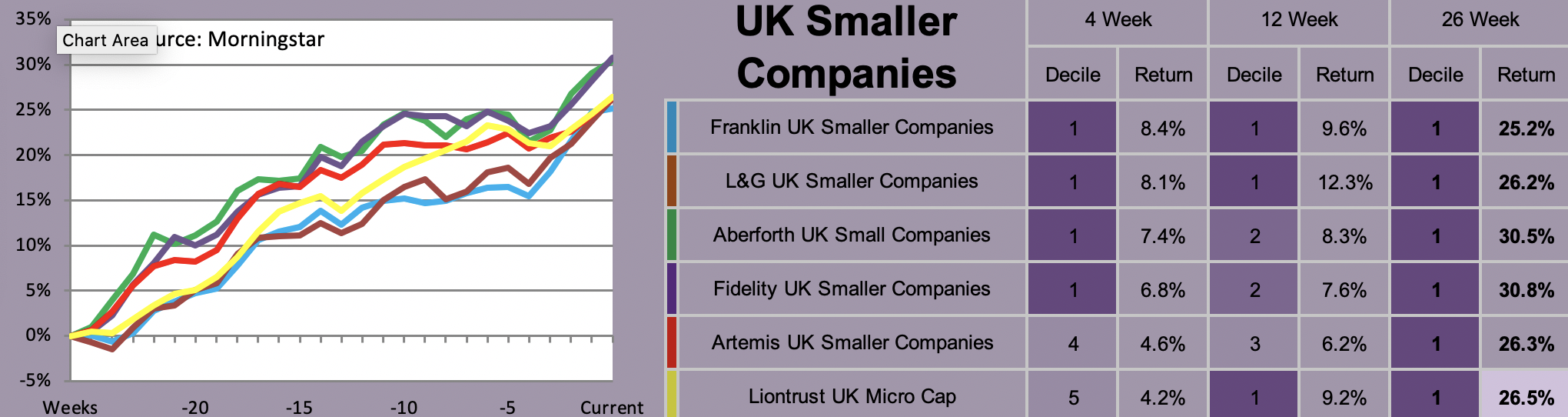

Another fund that we have held for a little while is FTF Franklin UK Smaller Companies, from the slightly more volatile ‘Steady as She Goes’ group.

After the coronavirus crash, the UK equity sectors did not recover as quickly as many of the overseas sectors. However, once news came through that our vaccine development looked as though it was going to be successful, and the government had committed to a full-scale roll-out, things started to pick up. The UK Smaller Companies sector finished last year strongly and has done well this year.

Last November, we invested in the Franklin UK Smaller Companies and are very pleased with its performance over the last nine months. In last week’s analysis, it was in our shortlist of best-performing funds in its sector based on its performance over four and 26 weeks. We also hold the L&G UK Smaller Companies fund, but only went into it in June this year. Last week, we increased the amount invested in both funds.

Data source: Morningstar. Past performance is not a guide to future performance.

- Check out our award-winning stocks and shares ISA

- Subscribe to the ii YouTube channel and catch all our latest interviews and video content

Although we review the portfolios each week, and are happy to make changes when necessary, we can also hold funds for a year or more if they continue to perform well.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.