The two clean energy funds we have just bought

22nd November 2021 14:24

by Douglas Chadwick from ii contributor

Saltydog analyst hopes COP26 is the beginning of a long-term trend and not just a knee-jerk reaction to hype around the event.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Over the last few weeks, COP26 and climate change have been all over our media, from the news and farming to Strictly Come Dancing. I am not sure what this attention will achieve in the long run, but one must be hopeful.

With two of the major generators of carbon, China and Russia, staying away, success is facing a strong headwind. Nevertheless, with China and the US talking to each other to make a common plan, and the commitment of many trillions of dollars to address the problem, this is definitely a big step in the right direction. I hope that it materialises and does not disappear into a fog of politics.

The arrival of 25,000 people in Glasgow with their accompanying carbon-generating transport, caused Greta Thunberg to chant “you can shove your climate crisis up your arse”! Perhaps a little direct, but from her point of view, understandable.

- COP26: key takeaways for your personal finances

- ii COP26 hub: see tips, news, comment and analysis from our experts

- Get £100 cashback when you switch to an ii ISA in November. Terms apply

There can be little doubt that tackling the adverse results of changing weather patterns can only be a positive, but I do wonder whether the UK is moving too fast in endeavouring to become carbon neutral at the expense of the economy. After all, the UK generates less than 2% of the world’s carbon pollution.

However, that said, it does raise some important questions, including: do we want to breathe polluted air, and do we want to eat factory-produced foods and sugar that leave many people obese and with diabetes? In addition, do we need an over-populated planet? Personally, I don’t think so. In which case, all this attention must be a good thing.

- Two UK climate change shares I am backing

- Fund managers call for more action and fewer words on climate change

- Proof from a pro that green investing does not sacrifice returns

At the same time as the talks in Glasgow, the US Senate passed a $1 trillion Infrastructure Bill. At the end of last week, the House of Representatives also passed US president Joe Biden’s $1.75 trillion Build Back Better Act, which now has to be approved in the Senate. Although not all this money is earmarked for clean energy projects, a significant amount of it is, and there is also private sector money to consider. Bill Gates has said that he will put $1.5 billion into clean energy causes if the bill goes through.

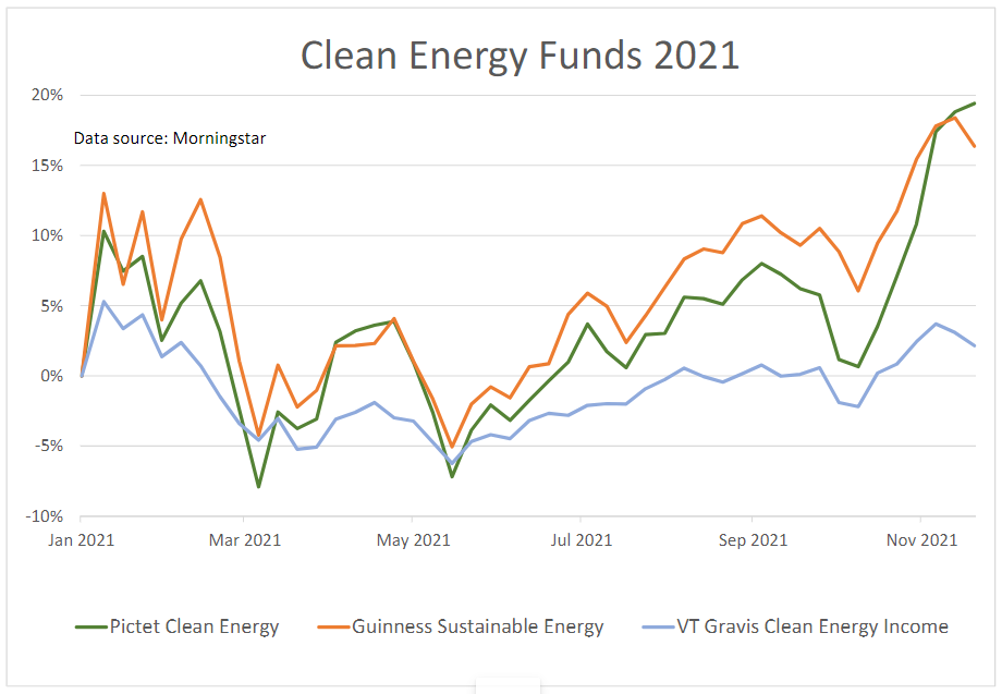

There are several funds investing in clean energy, and it is not surprising to see that they have gone up in recent weeks.

Past performance is not a guide to future performance

Our demonstration portfolios have recently invested in the Pictet-Clean Energy and Guinness Sustainable Energy funds. They both performed well last year, but peaked in January this year and then dropped by around 15%. They have only recently recovered and are now back in positive territory. Both have outperformed rival fund – VT Gravis Clean Energy Income – as the above chart shows.

We hope that this is the beginning of a long-term trend and not just a knee-jerk reaction to all the recent hype.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.