Two funds given marching orders

14th June 2021 14:12

by Douglas Chadwick from ii contributor

Saltydog Investor explains his rationale for selling two holdings.

When we ran our usual sector reports at the beginning of the month, we were slightly surprised to find that there were no funds in the Investment Association’s (IA) UK Equity & Bond Income sector. It was a bit inconvenient because we were holding three of these funds in our demonstration portfolios – Tugboat and Ocean Liner.

I checked on the IA website and the sector still appears to exist, and they still show its definition: “Funds which invest at least 80% of their assets in the UK, between 20% and 80% in UK fixed-interest securities and between 20% and 80% in UK equities. These funds aim to have a yield in excess of 120% of the FTSE All-Share Index.”

The funds we invest in are: HSBC Monthly Income, M&G UK Income Distribution and Royal London UK Income with Growth. These funds have now been reclassified, either as ‘Flexible Investment’ or ‘Unclassified’.

- How Saltydog invests: a guide to its momentum approach

- Five standout funds that have consistently delivered

- Nine funds and investment trusts that went from zero to hero

It could be that there aren’t enough funds in the sector to make it worthwhile, or maybe the funds have failed to achieve the yield in excess of 120% of the FTSE All-Share Index. Either way, it currently appears to be a sector with no funds.

It has never been a particularly large sector, but over the last year we have been monitoring half a dozen funds.

- Cavendish UK Balanced Income (which became TM Stonehage Fleming UK Balanced Income)

- HSBC Monthly Income

- LF Canlife UK Equity and Bond Income

- M&G UK Income Distribution

- Royal London UK Income with Growth

- Threadneedle Monthly Extra Income

In our analysis, we combine the IA sectors to form our own Saltydog groups. We want to be able to compare funds from sectors that have had similar levels of volatility in the past.

The UK Equity and Bond Income sector is in our ‘Slow Ahead’ Group, along with Sterling Corporate Bonds, Sterling High Yield Bonds, Sterling Strategic Bonds, Mixed Investment 0-35% Shares, Mixed Investment 20-60% Shares, Mixed Investment 40-85% Shares, and Targeted Absolute Returns.

The M&G UK Income Distribution fund has moved into the Flexible Investment sector, which takes it out of our 'Slow Ahead' Group and into the 'Steady as She Goes' Group.

The HSBC Monthly Income and Royal London UK Income with Growth funds are now ‘Unclassified’. We do not usually include funds from the ‘Unclassified’ sector in our analysis - there are plenty of other funds to choose from and we know that the IA is monitoring them to ensure that they are sticking to the sector rules. We have now sold our holdings in these funds.

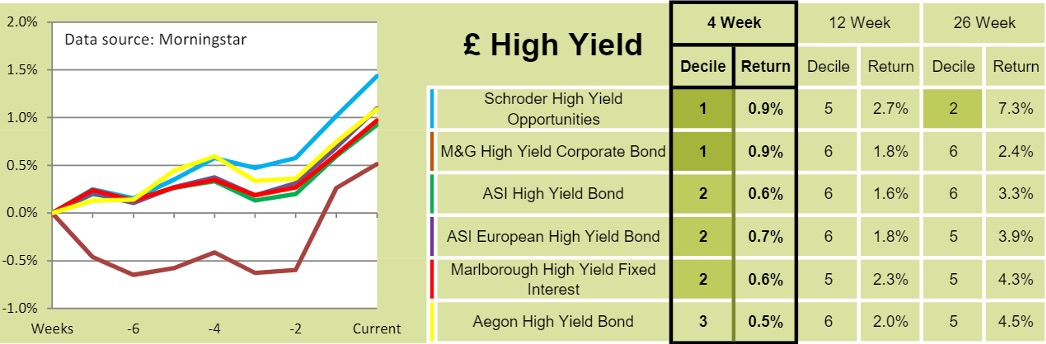

To replace them, we added to the EdenTree Higher Income fund, which I wrote about last week, and invested in the Schroder High Yield Opportunities fund. When we looked last week, the Sterling High Yield sector was the best-performing sector in the 'Slow Ahead' Group, based on its four-week return, and the Schroder fund was at the top of our latest four-week table.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.