UK banks: What to make of Lloyds, RBS and Barclays?

Having underperformed since April's stock market peak, here's what to expect from the domestic lenders.

14th May 2019 14:23

by Graeme Evans from interactive investor

Having underperformed since April's stock market peak, here's what to expect from the domestic lenders.

With UK banks making heavy weather of Q1 results and the Brexit shackles still in place, there's a clear lack of momentum behind shares of Lloyds Banking Group (LSE:LLOY), Barclays (LSE:BARC) and The Royal Bank of Scotland (LSE:RBS) as we head towards the second half of 2019.

But as the dust settles on a lacklustre set of quarterly earnings, it's worth remembering that there are still analysts in the City who see reasons for optimism around domestic banks.

They include UBS's banking expert Jason Napier, who after taking a closer look this week at the sector's Q1 performance has stuck to his 'buy' recommendations for Lloyds, Barclays and RBS.

Significantly, he notes the trio offer free cash flow yields of between 8% for Barclays and 13% for RBS, compared with Asia-focused HSBC (LSE:HSBA) and Standard Chartered (LSE:STAN) trading at 5% to 6%.

And whereas HSBC's reassuring and resilient Q1 performance puts it on a 33% price/earnings (PE) premium to the sector and more than double its 15-year average, the UK domestic banks are trading at fairly meaningful discounts to their longer term averages.

- It's not just UK stocks that pay big dividends. Check out these ii Super 60 recommended income funds

Napier points out that this comes despite capital bases being fully rebuilt, and with clean balance sheets and the prospect of share buy-backs over the next 18 months. There's also the hope of a more favourable interest rate environment once Brexit uncertainty eases.

In the meantime, however, UK domestic banks are finding the going tough after their Q1 earnings missed consensus forecasts by 4%. This was driven by revenues 3% to 6% below estimates, partially offset by a better performance on costs and impairments.

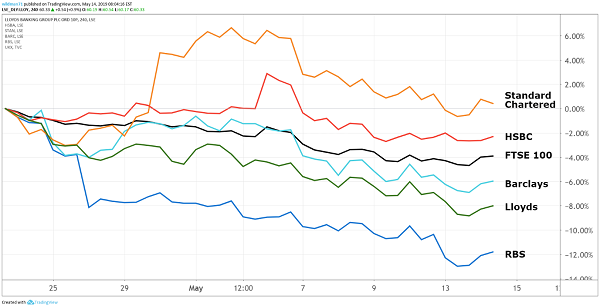

Bank sector performance since FTSE 100 hit its 2019 peak on 23 April

Source: TradingView Past performance is not a guide to future performance

UBS's review of the results and various industry benchmarks point to some stability in conditions for the banks, although any recent suggestion that the squeeze on mortgage market profitability is easing appears wide of the mark.

Despite the softer Q1 results, all UK banks have reiterated their return on tangible equity (ROTE) targets for 2019/20. UBS, however, thinks the market is expecting a material failure to deliver on these targets, meaning that Barclays, Lloyds and RBS are trading on between 6.6x and 7.9x current year earnings per share.

Napier said:

"On our numbers, which assume that the banks fall short of their ROTE objectives, principally due to lower-than-planned revenues, Lloyds and Barclays are the sixth and seventh cheapest stocks in our coverage."

Lloyds anticipates a return on equity figure of between 14% and 15% in 2019, compared with 12.5% in the most recent quarter. Its tight control of the business has already enabled a share buyback of £1.75 billion, alongside a dividend yield of above 5%.

The recent announcement from regulators on the systemic risk buffer requirement for UK's ring-fenced banks should give Lloyds more room to move in terms of future shareholder returns. Some analysts think this could increase the capacity for share buy-backs by £1 billion in 2019.

Napier, meanwhile, thinks RBS is capable of returning £6 billion in capital to shareholders in 2019, equivalent to around 20% of its market cap. He expects part of this capital to be devoted to an off-market repurchase of 5% of the company from the Treasury, taking the government's stake down to 57%.

His price target for RBS is 290p, with Lloyds Banking Group priced at 75p and Barclays at 220p.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.