UK Smaller Companies tops our sector performance tables in February

Saltydog Investor has profited from increasing exposure to this in form fund sector.

1st March 2021 14:43

by Douglas Chadwick from ii contributor

Saltydog Investor has profited from increasing exposure to this in form fund sector.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

After a promising start to the year, stock markets around the world stalled at the end of January and many ended up posting a loss for the first month of the year.

At the beginning of February, they rebounded and most of the leading stock market indices went up, although again there were some jitters towards the end of the month.

Stock Market Indices 2020-21

| Index | Country | 1st Jan to 31st March | 1st April to 30th June | 1st July to 30th Sept | 1st Oct to 31st Dec | Full Year | Jan 2021 | Feb 2021 |

| FTSE 100 | UK | -24.8% | 8.8% | -4.9% | 10.1% | -14.3% | -0.8% | 1.2% |

| FTSE 250 | UK | -31.0% | 13.4% | 1.1% | 18.3% | -6.4% | -1.3% | 3.4% |

| Dow Jones Ind Ave | US | -23.2% | 17.8% | 7.6% | 10.2% | 7.2% | -2.0% | 3.2% |

| S&P 500 | US | -20.0% | 20.0% | 8.5% | 11.7% | 16.3% | -1.1% | 2.6% |

| NASDAQ | US | -14.2% | 30.6% | 11.0% | 15.4% | 43.6% | 1.4% | 0.9% |

| DAX | Germany | -25.0% | 23.9% | 3.7% | 7.5% | 3.5% | -2.1% | 2.6% |

| CAC40 | France | -26.5% | 12.3% | -2.7% | 15.6% | -7.1% | -2.7% | 5.6% |

| Nikkei 225 | Japan | -20.0% | 17.8% | 4.0% | 18.4% | 16.0% | 0.8% | 4.7% |

| Hang Seng | Hong Kong | -16.3% | 3.5% | -4.0% | 16.1% | -3.4% | 3.9% | 2.5% |

| Shanghai Composite | China | -9.8% | 8.5% | 7.8% | 7.9% | 13.9% | 0.3% | 0.7% |

| Sensex | India | -28.6% | 18.5% | 9.0% | 25.4% | 15.8% | -3.1% | 6.1% |

| Ibovespa | Brazil | -36.9% | 30.2% | -0.5% | 25.8% | 2.9% | -3.3% | -4.4% |

| RTSI | Russia | -34.5% | 19.5% | -2.8% | 17.7% | -10.4% | -1.4% | 3.2% |

Data source: Morningstar. Past performance is not a guide to future performance.

They are now nearly all showing gains since the beginning of the year. The only exception is the Brazilian Ibovespa, which is down 7.5%.

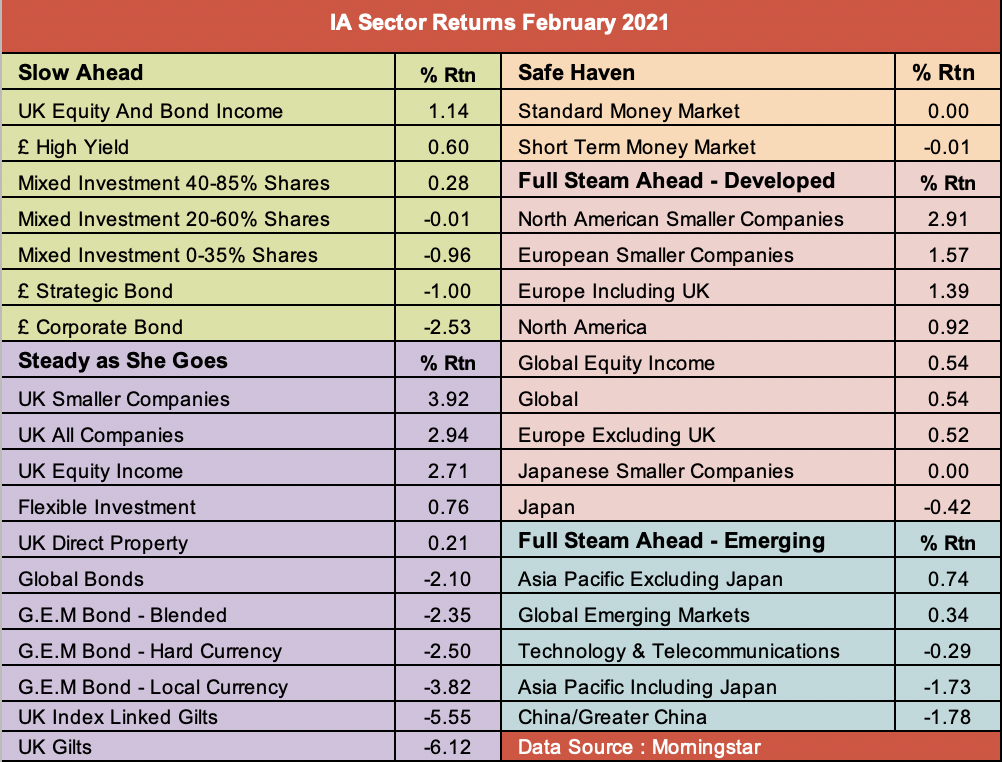

The best-performing sector last month was UK Smaller Companies, gaining 3.9%, with UK All Companies in second place, up 2.9%. The UK Equity Income sector was not far behind having risen by 2.7%.

The three UK equity based sectors began to perform well towards the end of last year and in November our demonstration portfolios started to invest in them.

UK Smaller Companies was the best-performing sector in December, making 7.5%, but only just avoided a loss in January when the momentum had swung towards China and the emerging markets.

In the last month, we have seen it recover. We are still holding the Franklin UK Smaller Companies fund, which we went into on the 19 November, and it is currently showing a profit of 9.9%.

- How Saltydog invests: a guide to its momentum approach

- UK small caps help Saltydog portfolios to a record high

- UK Smaller Companies continues to outperform other UK sectors

In mid-January, we added the Premier Miton UK Smaller Companies fund, which has already gone up by over 11%, and a couple of weeks ago we invested in two more funds from this sector; the FP Octopus UK Micro Cap Growth fund and the Marlborough Nano Cap Growth fund.

If the pound continues to strengthen, then the UK equity sectors could carry on doing well. They certainly will be less exposed to the currency losses that funds investing overseas will suffer. Although the pound has appreciated against the US dollar over the last year, it is still lower than it was before the Brexit referendum. In July 2014, it went above $1.70, that is more than 20% higher than it is now. I do not think it will be getting back there anytime soon, but anything is possible.

During February, the value of the pound went from $1.37 to $1.39, an increase of 1.9%, and it briefly went above $1.42. Sterling saw a bigger move against the euro. It started the month at just below €1.13, and by the end of the month was €1.16, up almost 2.6%.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.