UK Smaller Companies continues to outperform other UK sectors

Over the past six months, the three best-performing UK smaller company funds are up more than 40%.

22nd February 2021 14:31

by Douglas Chadwick from ii contributor

Over the past six months, the three best-performing UK smaller company funds are up more than 40%.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Towards the end of last year, our two demonstration portfolios (Tugboat and Ocean Liner) started increasing exposure to funds investing in UK equities.

In November, the best-performing Investment Association sector was UK Equity Income with a one-month return of 15.7%. The UK All Companies sector was not far behind, up 14.0%, while the UK Smaller Companies sector was showing a gain of 12.7%. During the month, we invested in theMerian UK Equity Income, Artemis UK Select and Franklin UK Smaller Companies funds.

The following month, the UK Smaller Companies sector led the way, rising by 7.5%, with UK All Companies making 4.5%, and UK Equity Income up 3.7%.

Since then, the UK Smaller Companies sector has continued to pull away from the other UK sectors. In January, our Ocean Liner portfolio invested in another fund from this sector, Premier Miton UK Smaller Companies, and it is already showing a gain of 12.5%.

At the beginning of February, we sold the Merian UK Equity Income fund. It had gone up by 5.8% in less than three months. A good result, but its performance had started to wane.

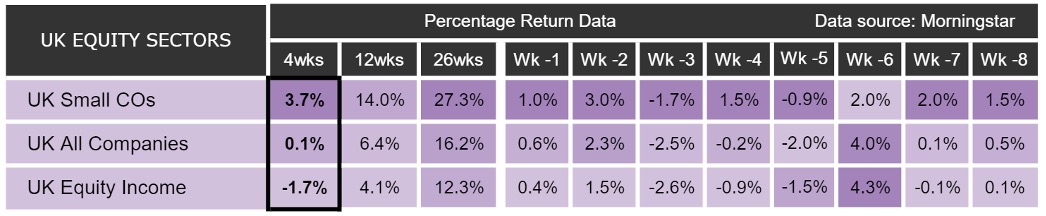

When we looked at our sector analysis last week, UK Smaller Companies was still looking promising, compared with the other UK equity sectors, and so we decided to invest in some more funds.

Past performance is not a guide to future performance

We are still holding the Franklin UK Smaller Companies fund, which has gone up by 10.7% since we bought it on the 19 November. That is not a bad three-month return, but it no longer features in our shortlists as there are other funds that have done better.

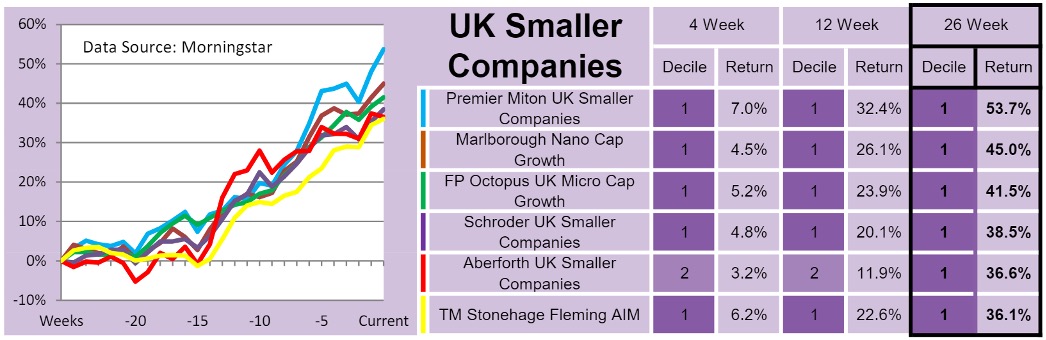

Funds listed in the table: Premier Miton UK Smaller Companies, Marlborough Nano Cap Growth, FP Octopus UK Micro Cap Growth, Schroder UK Smaller Companies, Aberforth UK Small Companies, TM Stonehage Fleming AIM. Past performance is not a guide to future performance

We also hold the Premier Miton UK Smaller Companies fund, which is at the top of our table, based on its cumulative 26-week return. It is also ahead over four and 12 weeks. We considered adding to this fund, but in the end decided against it.

One of the features of some of the funds in this sector is that they have a relatively small amount of assets. This can be an advantage, because it means that they can invest in smaller companies without their positions being too significant, but it can cause problems if they experience large inflows or outflows of investors’ money. With the amount of money that we are investing, I would not expect it to be a problem, but we have decided that it is safer to spread our net a little wider anyway.

Our Tugboat portfolio is investing in the FP Octopus UK Micro Cap Growth fund and the Ocean Liner is investing in the Marlborough Nano Cap Growth fund. They have not done quite as well as the Miton fund, but the returns over the last six months have still been pretty spectacular. They have both gone up by more than 20% in the last 12 weeks, and more than 40% in 26 weeks.

We certainly would not complain if they keep going up at that rate.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.