Vanguard cuts fees on dozens of passive funds

The cut is part of an ongoing race among index fund and ETF providers to offer the lowest fees possible.

25th October 2019 09:19

by Tom Bailey from interactive investor

The cut is part of an ongoing race among index fund and ETF providers to offer the lowest fees possible.

The race to the bottom in passive fund investment fees continues, with Vanguard announcing a new round of fee cuts to its funds.

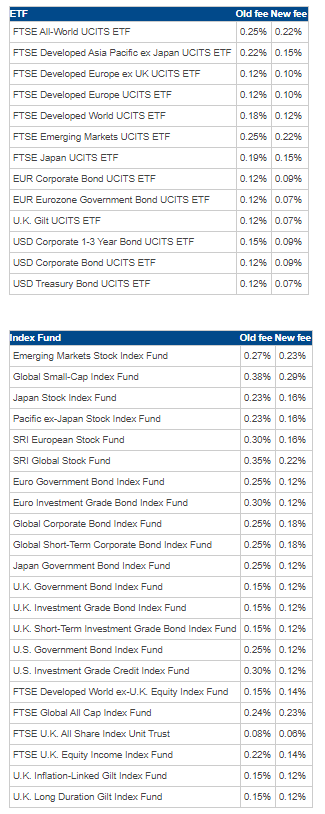

In total, 13 ETFs and 22 index tracking funds have seen their fees slashed. Vanguard's actively managed Sterling Short-Term Money Market fund will see its fees reduced from 0.15% to 0.12%.

As the table below shows, several ETFs and index funds now charge fees below 10 basis points. The cheapest on the list of those cut, the FTSE UK All Share Index fund, now charges just 0.06%. Investors can also purchase Vanguard's Vanguard UK Gilt UCITS ETF (LSE:VGOV) for just 0.07%.

Some of the biggest fee cuts were to Vanguard's "socially responsible investing" index funds. Both the Vanguard SRI European Stock fund and Vanguard SRI Global Stock fund have seen their fee slashed by over 40%.

Several bond funds have also seen heavy fee cuts. Both the US Investment Grade Credit Index fund and Euro Investment Grade Bond Index Fund have seen their fees goes from 0.30% to just 0.12%, a reduction of more than 60%.

The cut follows a decision in June to reduce the fees on its actively managed funds. The management fee for Vanguard Global Equity, Vanguard Global Equity Income and Vanguard Global Balanced Fund was dropped from 0.6% to 0.48%.

Vanguard's full list of funds (both active and passive) available to UK investors now have an average fee of just 0.20%. The company's index funds now have an average fee of 0.15% and ETFs an average of 0.10%.

The cut is part of an ongoing race among index fund and ETF providers to offer investors products with the lowest possible fees. In the US, this so-called "fee war" has led to some providers offering investors index trackers and ETFs with zero management fees and, in one case, a temporary negative fee, meaning investors are paid to invest.

Vanguard, however, has long placed emphasis on reducing fees, with the company's late founder Jack Bogle regularly arguing that the best predictor of investment returns was the amount of fees paid.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.