What do investors think of a potential windfall tax on energy firms?

26th May 2022 09:12

by Jemma Jackson from interactive investor

A new poll of interactive investor website visitors reflects a variety of views on this nuanced issue.

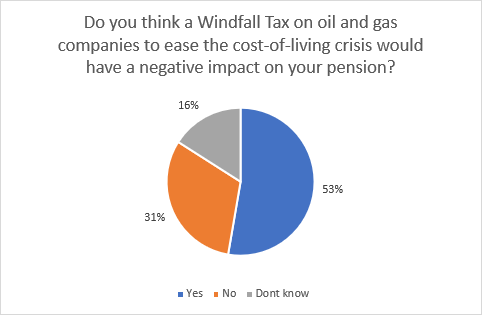

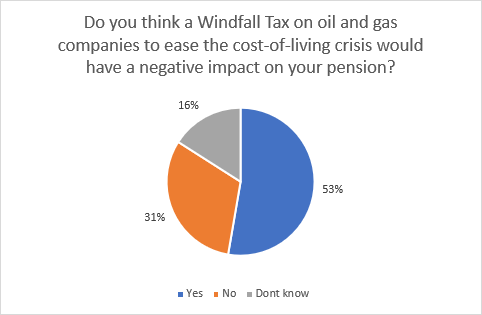

- Some 53% of consumers think a windfall tax on oil and gas companies to help ease the cost-of-living crisis squeeze would have an adverse impact on their pension

- When asked if they would support a windfall tax even if it hurt their investments, 62% of investors said they wouldn’t – but over a quarter (28%) said they would.

A windfall tax on energy companies appears imminent, with chancellor Rishi Sunak expected to announce a multi-billion-pound package to help consumers with the cost-of-living squeeze later today.

Reports of the tax had sent shockwaves across the energy sector earlier this week. The value of shares in Drax (LSE:DRX), SSE (LSE:SSE), Harbour Energy (LSE:HBR), Centrica (LSE:CNA) and Greencoat UK Wind (LSE:UKW) investment trust have fallen recent days as investors weigh up the potential impact of the tax if extended to electricity generators.

A new poll of just under 1,500 interactive investor website visitors between 24 and the morning of 25 May 2022, reflects a variety of views on this nuanced issue.

Just over half of consumers (53%) thought a windfall tax on oil and gas companies to help ease the cost-of-living crisis squeeze would have an adverse impact on their pension.

But 16% of respondents weren’t sure, while just under a third (31%) believe it wouldn’t hurt their retirement savings.

When asked if they would support a windfall tax to ease the cost-of-living crisis even if it hurt their investments, 62% of investors said they wouldn’t.

However, over a quarter (28%) of respondents said they would support it if used to ease the cost of living, while 11% were unsure.

Commenting, Myron Jobson, Senior Personal Finance Analyst, interactive investor, says: “The argument for a windfall tax has been given more credence following the recent revelation by the boss of energy watchdog Ofgem that the October energy price cap is likely to go up by more than £800. But the prospect of imposing the tax on energy companies has taken a toll on the sector, with green energy companies feeling the brunt of a downturn in sentiment.

“While most respondents to our survey appeared spooked by the adverse impact a windfall tax on gas and oil companies might have on their investments, over a quarter support it if used to ease the cost of living [crisis].

“It is important to remember that investors are consumers too and are not only thinking about their profits. Not all investors are high net worth individuals, and many have been caught between a rock and a hard place amid the escalating cost of living crisis.

“For many, investing for tomorrow has taken a back seat to staying financially buoyant today as rising prices continue to weigh on budgets. So, measures to help support consumers through the raging cost of living storm is in the interests of many investors – particularly those nursing paper investment losses following recent market underperformance.

“Misinformation about the exposure to energy companies in pension funds is perhaps one of the reasons why the majority of respondents to our survey believe the windfall tax would have an adverse effect on their pension. While applying a windfall tax could impact the share price performance and dividends paid out by impacted energy companies, it is a myth that such firms make up a significant portion of most pension funds today.

“There is a lot to consider with a windfall tax. Questions remain over how much money the tax can raise and how it can be used to alleviate the cost-of-living burden on those who need it most. It is difficult to imagine that the cash raised will be enough to nullify the £800 increase in energy bills come autumn – let alone other areas of inflation such as shopping and petrol.

“Also, what impact will the tax have on Britain’s transition to clean energy? The worry is the tax will damage investor confidence ahead of key auctions for licences to develop new wind and solar projects in the UK. The threat of the tax has already wiped millions off the value of renewable energy companies in recent days, including Greencoat UK Wind and Renewables Infrastructure Group (LSE:TRIG) investment trusts.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.