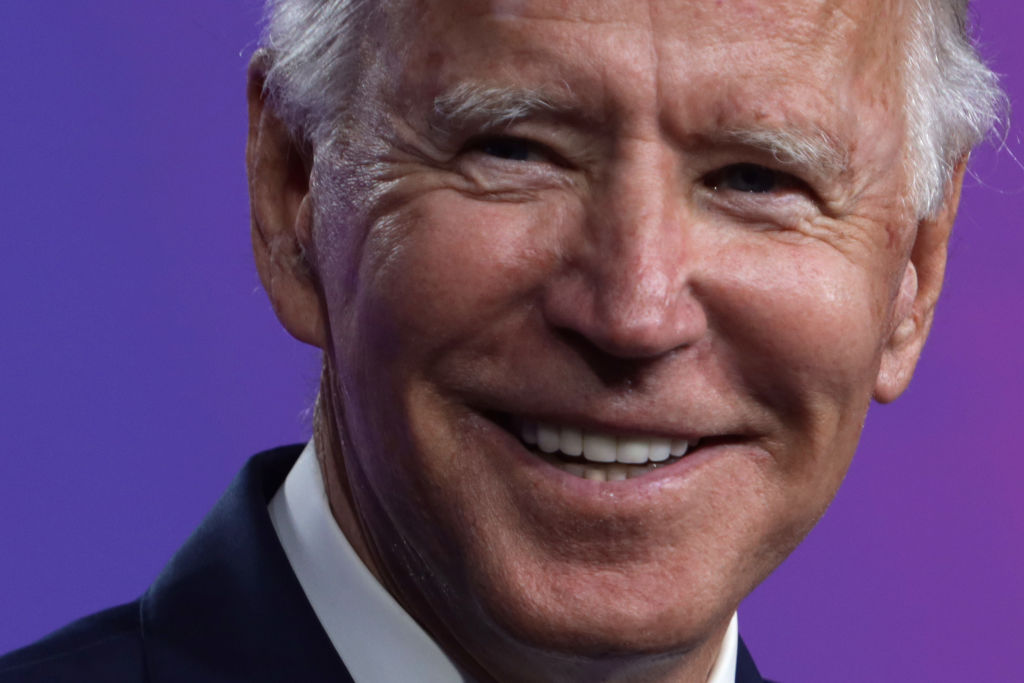

What will Joe Biden mean for US stocks?

The dollar could be affected, while the environment and tech companies are also on the agenda.

20th January 2021 15:45

by Graeme Evans from interactive investor

The dollar could be affected, while the environment and tech companies are also on the agenda.

The waiting is finally over for US investors after Joe Biden's White House inauguration today ushered in a new era for corporate America on tax, clean energy and China relations.

Biden takes the hot seat with Wall Street markets still near to record highs on the back of continued cheap money and now the prospect of a $1.9 trillion (£1.39 trillion) stimulus package to help the US economy recover from the coronavirus pandemic.

New Treasury secretary Janet Yellen wants policymakers to “act big” and worry later, but her comments last night served only to increase the focus on how the support will be paid for.

- Investing in the US stock market: a beginner’s guide

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Tesla: is Elon Musk’s vast fortune safe?

Raising taxation is the usual way of balancing the books, but, given the huge sums involved, talk has turned to modern monetary theory. This involves new money being printed to pay for government projects and taxes being manipulated to control the amount of money in the system.

- Invest with ii: Top US Stocks | US Earnings Season | Open a Trading Account

It's controversial, but a survey of fund managers by Bank of America shows it ranks third as the most likely US economic policy response to reduce the burden of debt in the next four years.

The survey found that 34% of investors expect higher taxation is the solution, followed by inflation at 26% and modern monetary theory at 23%, ahead of US dollar devaluation.

Many investors have built up above-average exposure to the US dollar over the past decade as US gross domestic products, bonds and equities have outperformed their G10 counterparts.

But UBS's wealth management team expects a rotation away from the dollar, even though they think the eventual US stimulus package is likely to end up being closer to one trillion.

They said: “Among G10 currencies, we remain bearish on the US dollar. We expect pro-cyclical currencies like the euro, commodity-producer currencies, and the British pound to benefit from a broadening economic recovery supported by vaccine roll-outs.”

Unsurprisingly, the Bank of America fund manager survey finds that investors think healthcare and infrastructure will dominate Biden's to-do list in his first 100 days. Environment is fourth highest, something not on the list of priorities in the Oval Office under Donald Trump's tenure.

With Biden expected to re-join the Paris Agreement on climate change, ‘green’ investments and stocks with a focus on low carbon are likely to prosper. As we reported this week, the accelerating clean energy transition is already exciting many interactive investor customers in their picks of US stocks.

This includes high-flying Nasdaq companies such as electric vehicle businesses Blink Charging (NASDAQ:BLNK) and Switchback Energy (NYSE:SBE) or clean energy firms Plug Power (NASDAQ:PLUG) and FuelCell Energy (NASDAQ:FCEL).

One of Biden's first climate change policies is expected to see him cancel the $9 billion Keystone XL oil pipeline connecting the Canadian province of Alberta with Nebraska.

- Are you saving enough for retirement? Our calculator can help you find out.

- Market snapshot: Biden’s stimulus and UK GDP

And despite Biden's denials, the US shale oil and gas industry will also feel under threat. One potential casualty may be London-listed Hunting (LSE:HTG), whose perforating guns, energetics and instrumentation tools are used in the shale oil Permian Basin region of West Texas.

Tighter regulation of financial markets and tech companies is also expected, in contrast to the deregulatory tone set during the first weeks of the Trump administration.

Technology companies were the stars of Wall Street trading in 2020, but a look at share price performances since the US election shows them now largely absent. Apple (NASDAQ:AAPL) is up 16% but that is mid-ranking compared to some of the big moves inspired by November's vaccine roll-outs.

Goldman Sachs is up by 49% as the biggest riser in the Dow Jones Industrial Average, while Tesla (NASDAQ:TSLA) leads the Nasdaq 100 after doubling in value since the US election. And despite the Biden uncertainty and recent violence in Washington, the S&P 500 is now more than 70% higher than in March at a near record high of 3,823.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.