Where to find income in 2022 as the mining boom ends

1st March 2022 09:28

by Sam Benstead from interactive investor

Oil, bank and tech stocks will fuel a record year for dividends in 2022.

After doubling their previous dividend record in 2021, payouts from mining companies are forecast to fall this year as commodity prices lose steam, according to investment manager Janus Henderson.

More than one quarter of the $212 billion (£157 billion) annual dividend increase last year came from miners as total payouts hit almost $100 billion in the sector and BHP (LSE:BHP) became the world’s biggest dividend payer.

However, a slump in iron ore prices means that mining dividends are likely to fall this year and the best income opportunities could come from other business areas.

Janus Henderson’s latest Global Dividend Index says: “The big unknown for 2022 is what will happen in the mining sector. Iron ore prices are a significant driver of dividends and, despite recovering some lost ground recently, are currently lower than during most of 2021. Other metal prices, as well as coal, have held up better.

“Given the reliance of profits and therefore dividends on commodity prices, there is a significant degree of uncertainty about the level of mining payouts.”

- My favourite FTSE 100 mining stock for 2022

- Three small-cap mining share tips for 2022

- Best case for buying mining shares for 20 years

- Rio Tinto's record profit bankrolls massive dividend

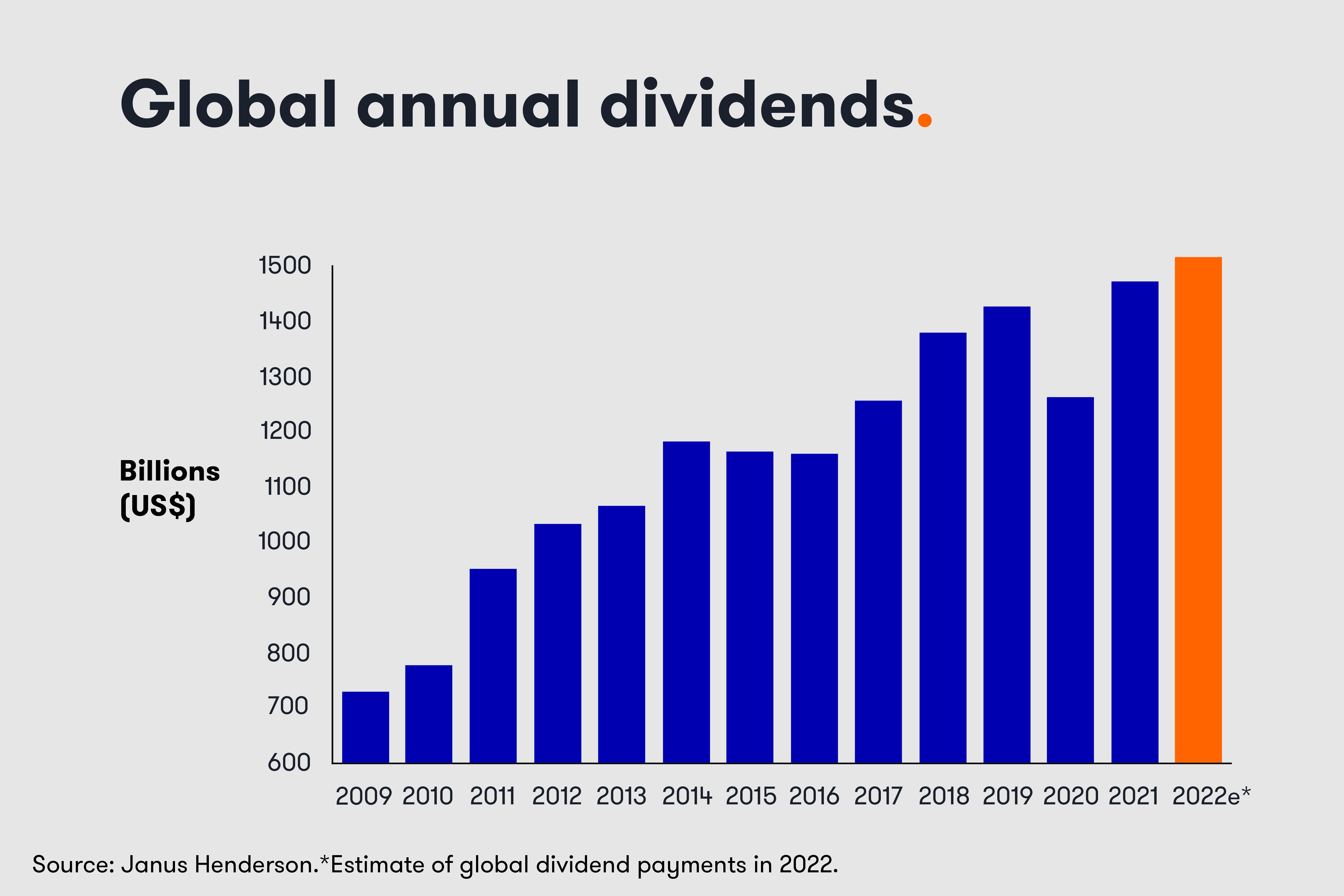

Nevertheless, Janus Henderson expects total dividends to rise 3.1% in 2022 to a new record of $1.52 trillion as oil companies boost dividends on the back of a high energy prices, banks continue to return more cash to investors, and technology stocks keep gradually increasing payouts.

Headline dividend growth, which excludes one-off special dividends, will hit 5.7% this year, according to the fund manager.

Its report notes: “In the context of the dramatic rebound seen in the banking sector and the exceptional cyclical surge from mining companies, it would be easy to overlook the encouraging growth seen from those sectors that have delivered consistent increases in recent years, such as the technology sector.”

Tech giants Microsoft (NASDAQ:MSFT) and Apple (NASDAQ:AAPL) are among the biggest dividend payers globally. The duo, however, have tiny dividend yields. They are expected to pay 0.83% and 0.53% respectively over the next 12 months, according to financial data firm Morningstar.

Oil and banks stocks have higher yields. Shell (LSE:SHEL) and BP (LSE:BP.) are forecast to yield 3.25% and 4.22% for the next year, while Barclays (LSE:BARC) and HSBC (LSE:HSBA) are expected to yield 3.18% and 3.45%.

Bank dividends jumped in 2021 as they restarted payouts following a forced pause in 2020. Dividends in the sector rose 40% year-over-year to $50.5 billion, putting them just 10% lower than their 2019 record.

Unlike miners, banks are set to continue returning more cash to investors, and according to Janus Henderson will be the main engine for dividend growth in the UK, alongside oil stocks.

The banking sector, which directly benefits from higher interest rates, has been catching the attention of some fund managers, including Laura Foll, who is co-manager of Janus Henderson-managed Lowland (LSE:LWI). In a video interview with interactive investor in November, Foll said that banks had the potential to surprise the market in 2022 with special dividend payments due to being flush with cash.

- The UK bank shares i've been buying

- Here’s why UK shares will pay lower dividends in 2022

- Mark Slater: my outlook for dividends in 2022

Jane Shoemake, client portfolio manager on the global equity income team at Janus Henderson, makes the wider point that “UK shares looks very attractively valued on both an earnings and dividend yield basis and we have exposure to a number of UK companies that are trading at a significant valuation discount to their international peers.”

Because of the influence of banks and miners on the London Stock Exchange, the UK market delivered one of the biggest increases in dividends last year. Payouts rose from $65 billion to $94 billion, a 45% jump, according to Janus Henderson.

Despite the increase, the UK only accounted for 7% of dividends last year. North America accounted for the most at 44% of total dividends, but payouts only grew 5.9% from 2020 to 2021.

The biggest dividend payers last year

Source: Janus Henderson

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.