Where to invest in Q3 2022? Four experts have their say

20th July 2022 09:04

by Jim Levi from interactive investor

Our four panellists argue investors should stay defensive, rather than going bargain-hunting. Here’s their latest views on shares, bonds, property and commodities.

The second quarter of 2022 was pretty dire for financial markets.

“The widely predicted correction in the long bull market has finally happened,” points out abrdn’s head of multi-asset research Richard Dunbar.

He continues: “Some 80% of the world’s investable assets have gone down in the past three months. Diversification has not worked. Bond markets are down and have provided no protection against the weakness of equities. Industrial metals, notably copper and some soft commodity prices, including wheat, are down. Even the oil price is below its peak.”

- Read about our: ii Super 60 Investments | Top Investment Funds | Transferring an Investment Account

Fund managers may feel cornered. But they are paid to be brave and think outside the box. So it should be no surprise to find David Coombs at Rathbones donning his bargain-hunting boots after a really difficult first half of 2022.

- Funds and trusts four professionals are buying and selling: Q3 2022

- Top investors spot opportunity in ‘cheap’ tech

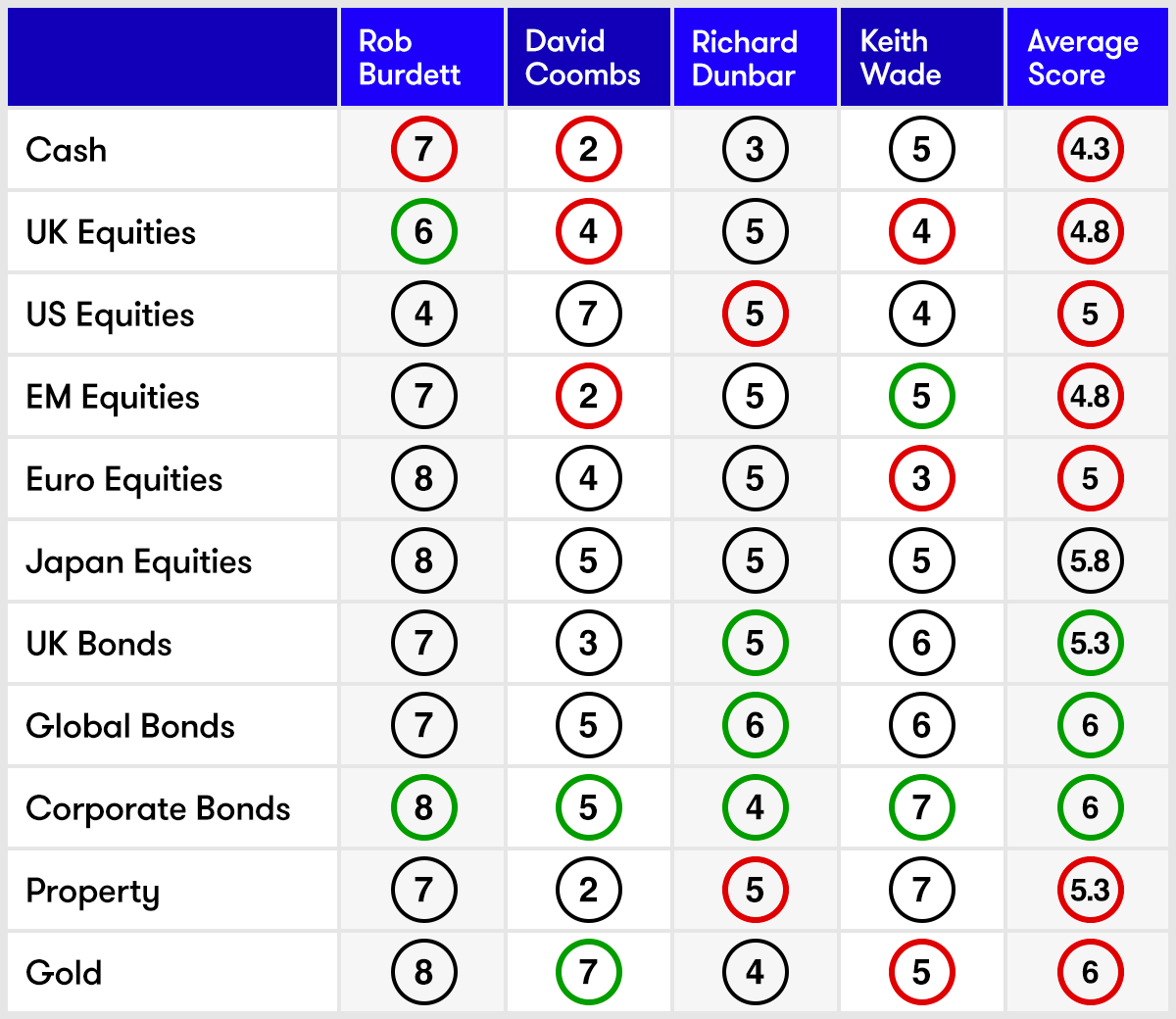

Coombs has dramatically cut his cash score from 7 to just 2. “I have spent a lot of that cash already and my cash levels are the lowest for five years,” he says. “When inflation was close to zero, I could afford to hold cash - but with inflation rising holding cash makes no sense.”

Bonds back in favour

Where has the money gone? Broadly in two directions: some is in the corporate bond market, where in the US average yields of 5% are beginning to look attractive. But Coombs is focusing on the riskier higher-yield end of the market where short-term returns can be as high as 10%.

It is notable that Rob Burdett at BMO Global Asset Management and Dunbar have also increased their corporate bond exposure. Keith Wade at Schroders led the pack going overweight three months ago. Now he raises his score again to 7. The average score is now 6.

Meanwhile, Coombs is stressing: “I am not calling the bottom of the market for equities, but I have to focus on the horizon rather than the minefield in front of us. Of course, when you are buying in the present climate it can be extremely uncomfortable. I am buying quality companies where I can see value on a three-year view.”

Equities given the thumbs down

Coombs’ equity scores show he is extremely cautious - neutral on Japan, underweight the UK and Europe, and avoiding emerging markets entirely. Most of his buying is concentrated in the US where he scores 7.

Recession fears more than inflation fears are increasingly uppermost in the minds of the panel members. Dunbar notes: “Our central case is that we are heading for a global recession, and we feel the UK and Europe are already in recession and the US is heading that way too. Consumers are reacting swiftly by cutting back spending and we think this will help the central banks get inflation under control.”

According to Burdett and Wade, interest rates may not have to rise as much as feared. “Central bank language has to be tough but sometimes they have to talk the talk in order not to have to walk the walk,” says Burdett.

Wade predicts interest rates in the US will, by the second half of next year, be “around 3% against the market’s expectation of 3.8%”.

- The investments that will keep growing – even during a recession

- US stocks enter bear market, but there’s a silver lining for funds

- Reasons why the bear market is far from over

Unfortunately, Wade thinks that unemployment will have to start rising before financial markets are convinced that central bankers are on top of inflation. “The labour market is very tight, there is increasing industrial unrest and people face the prospect of even higher energy bills this autumn,” he says.

So Wade cannot see much solace in equities at present. “One particular worry is the analysts of companies do not seem to have adjusted their earnings forecasts to allow for the economic slowdown. There may be some shocks when the earnings season gets under way.”

Wade remains underweight US and lowered his scores on both UK and European equities. He is more positive on Japan and has raised his score from 4 to 5 in emerging markets on hopes of a revival in China’s growth as it softens its zero-Covid policies.

Burdett has trimmed his cash score from 9 to 7 to add more to UK equities and corporate bonds. He, however, has left other scores unaltered. He remains overweight (with scores over five) in all sectors except US equities. “To our clients, we describe ourselves as cautious but not bearish and in the short term we think markets may be in for a bit of a bounce,” he says.

Note: the scorecard is a snapshot of views for the third quarter of 2022. How the panellists’ views have changed since the second quarter of 2022: red circle = less positive, green circle = more positive. Key to scorecard: EM equities = emerging market equities. 1 = poor, 5 = neutral and 9 = excellent.

The case for defence

Even so, there remains increasing emphasis with the panel to stay on the defensive - again gradually trimming exposure to equities, while increasing exposure to government bonds in the hope they will provide a better hedge in the coming months, given that bond yields are now looking more attractive following bond price declines.

Gold is another “alternative” investment that has failed to perform and here the panel are divided on the immediate outlook. Wade drops his score from 7 to 5, pointing out that rising bond yields makes gold less attractive, given that the yellow metal doesn’t pay an income.

Coombs, however, sees value. “Gold is interesting because it has hardly moved,” he says. “Normally you would expect the gold price to fall with rising dollar interest rates. But that has not happened.” He is raising his score from 6 to 7.

It seems highly significant that global government bonds and corporate bonds are now on average the two most highly rated sectors. It is also notable that despite Britain’s messy political situation two of the panel members have overweight positions in UK gilts.

- Top-performing fund, investment trust and ETF data: July 2022

- Why these defensive investments will continue to deliver

Burdett is often the odd one out in equities. He stays overweight in UK equities, Japan, Europe and emerging markets. Through his more optimistic eyes he sees a lot of foreign merger and acquisition potential in the UK, encouraged by the recent weakness of the pound. In emerging markets, he has support from Wade as he focuses on a revival of growth in China.

The four panellists’ enthusiasm for Japanese equities remains undimmed. Japanese equities have held up better than other major equity markets so far this year. Finally, in European equities Burdett admits he was wrong to be overweight in our April review but he is sticking to his score of 8 on hopes of a recovery in these markets. Burdett can see plenty of value there after the recent shakeout. But even he admits: “The geopolitical background is extremely troubling”

Wade takes the opposite view - lowering his scores for European equities from 4 to 3. He fears a Russian cut off of gas supplies to Europe might trigger a much deeper recession. Coombs, who cut his score from 6 to 4 in April, is sticking with that score “because there is war on the doorstep”.

Dunbar has a habit of avoiding any dramatic moves and, after lowering his US equities score to 5, is now on a neutral score in all equity sectors. He even lowers his score for property to 5 to switch more money into global government bonds and corporate bonds. “Our view remains that there will be a recession and that in the UK and Europe we may already be in recession,” he says. “But we also believe that will help the central banks to bring inflation under control. And we believe they will be successful in doing so.”

Panellist profiles

Rob Burdett is co-head of multi-manager at BMO Global Asset Management and a research team leader.

David Coombs is head of multi-asset investments at Rathbones.

Richard Dunbar is head of multi-asset research at abrdn.

Keith Wade is chief economist and strategist at Schroders.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.