Why I’m happy to own these two industry leading stocks

31st May 2023 08:40

by Rodney Hobson from interactive investor

They own some of the most recognisable brands in the business, and overseas investing expert Rodney Hobson finds plenty more to like about this pair of top stocks.

Revenue and profits are gaining momentum at the world’s biggest brewer Anheuser-Busch InBev SA/NV (EURONEXT:ABI), but investors need to be cautious as, like so many companies producing consumer products, it is facing serious cost pressures.

AB InBev, based on Belgium but with substantial interests in South Africa, reports its figures in US dollars. Gross profit grew 12% to $7.7 billion (£6.2 billion) in the first quarter of 2023 with revenue 13% higher at $14.2 billion. Its best-known brands, Budweiser, Stella Artois and Corona, all performed well, taking total volumes up by nearly 1%.

This follows a rather mixed 2022 when sales volumes hit a record high and revenue grew 11%, but profits slumped by 19% as rising input costs and disruptions to the supply chain took their toll.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

First-quarter revenue and profits both beat analysts’ expectations, not least because AB InBev has managed to pass on rising costs, with a double-digit increase in its selling prices in what is normally the most challenging quarter for brewers: after the Christmas period and before summer weather brings out drinkers in the Northern hemisphere.

The big growth areas were Asia-Pacific and South America. In contrast, the US was somewhat disastrous, with sales of Bud Light, the best-selling beer in America, plunging by 26%.

The reason was somewhat bizarre. A transgender influencer posted a video on social media showing her face on a can of Bud Light, prompting an outcry over “corporate wokeism” and forcing AB InBev to deny that this was part of a formal advertising campaign. The company did not mention the controversy in its trading update and is probably right to expect the issue to die a natural death.

The sales slump did, however, persuade AB InBev not to raise its guidance of 4-8% profits growth for the full year. Sales are expected to rise at a faster rate than profits through a combination of volume growth and price rises, and it would not be a surprise if the profits forecast is raised at half year.

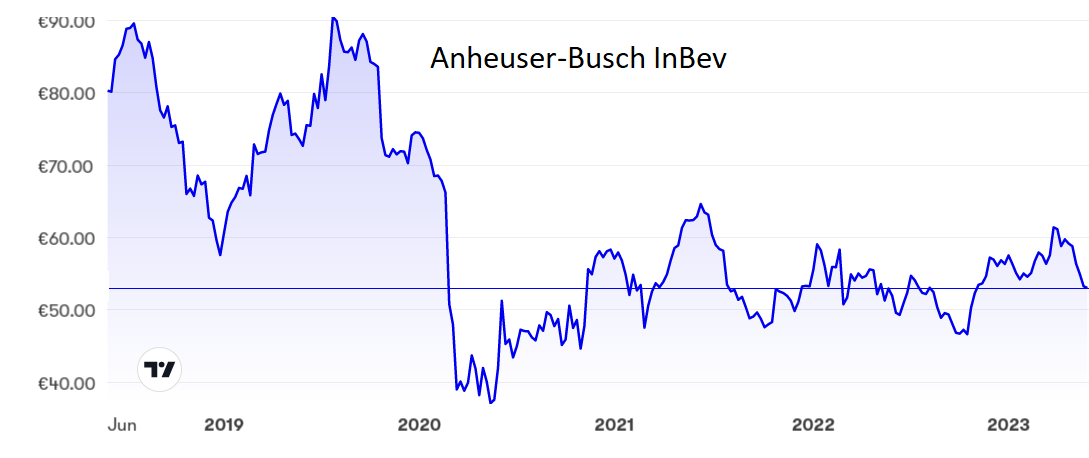

AB InBev shares settled between €40 and €60 just over three years ago and the range has slowly narrowed to around €50, where the price/earnings (PE) ratio is just over 15, pretty much in line with the stock market overall. The yield is 1.4%, not great but solid.

Source: interactive investor. Past performance is not a guide to future performance.

The closest rival is Heineken NV (EURONEXT:HEIA), where first-quarter revenue rose 9.2% to €7.6 billion despite a fall in beer volumes, but net profits slipped 3.4% to €417 million. The global picture was the opposite of AB InBev, with a strong American performance but disappointment in Europe and Asia Pacific.

Even so, this was overall a decent performance given that Heineken is still suffering from the impact of halting sales in Russia.

- Stocks are climbing a ‘wall of worry’ and it sounds more doomy than it is

- Watch our video: the US shares we own that will outperform Big Tech

- Watch our video: how to beat the US stock market

Confident Heineken is on the expansion trail, having recently completed the acquisition of Distell's wine, spirits and cider business and Namibia Breweries to create a formidable force across a swathe of Africa. It is also creating 600 more jobs by upgrading its UK pubs business.

The shares have crossed €100 several times over the past five years but have turned back down each time. They currently stand at around €97, where the PE is higher than AB InBev at 21.4, but so is the yield at 1.7%.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I first drew attention toAB InBev shares three years ago when there was ample opportunity to get in well below €50. Those who followed that advice are sitting on a small profit plus dividends and should hold on. Otherwise, look to buy on any weakness. It should be possible to pick them up below €50 before the next upward surge. Look to take profits if the shares reach €58, which has been both a ceiling and a floor over the past six months.

Heineken looks fully valued for now but is still worth holding if you followed my earlier suggestion to buy around current levels on several occasions.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.