Wild’s Winter Portfolios 2020: gap to benchmark narrows significantly

There was further progress during February, but our portfolios have just two months to beat the market.

5th March 2021 15:23

by Lee Wild from interactive investor

There was further progress during February, but our portfolios have just two months to beat the market.

Stock markets ended February in a similar manner to how they had ended the previous month – tumbling lower. Thankfully, a mid-month rally meant there was room to play with, and indices finished in positive territory.

A successful vaccination programme and the UK’s roadmap out of lockdown is clearly good news. But we’re seeing more switching out of growth stocks and increasing talk about inflation and interest rate rises coming sooner than expected. Watch bond yields for further clues.

The FTSE 350 index rose 1.6% in February, but it was trounced for a second month in a row by Wild’s Aggressive Winter Portfolio, which jumped 3.2%. The Consistent Winter Portfolio delivered a more modest 1.3% gain for the month.

As explained before, this winter has been all about playing catch-up. The winter portfolio companies had already enjoyed a purple patch prior to the start of this six-month strategy at the end of October. They had recovered fully from the Covid collapse in March and many were at or near record highs.

However, many FTSE 350 stocks took longer to recoup their pandemic losses. Plenty of them only did so following confirmation of Pfizer’s (NYSE:PFE) vaccine in November. As such, they were at pre-recovery prices when our winter portfolios launched.

| Consistent Winter Portfolio |

|---|

| Compiling the two winter portfolios is straightforward. The Consistent portfolio is a basket of five FTSE 350 stocks with the most stable track record of returns over the past decade. Each has risen every year for the past 10 years. |

| Aggressive Winter Portfolio |

|---|

| For the Aggressive Winter Portfolio, the FTSE 350 constituents must have delivered the highest average annual returns over the winter. While average returns are our primary criterion, stocks must also have risen over the winter months in at least nine of the past 10 years. |

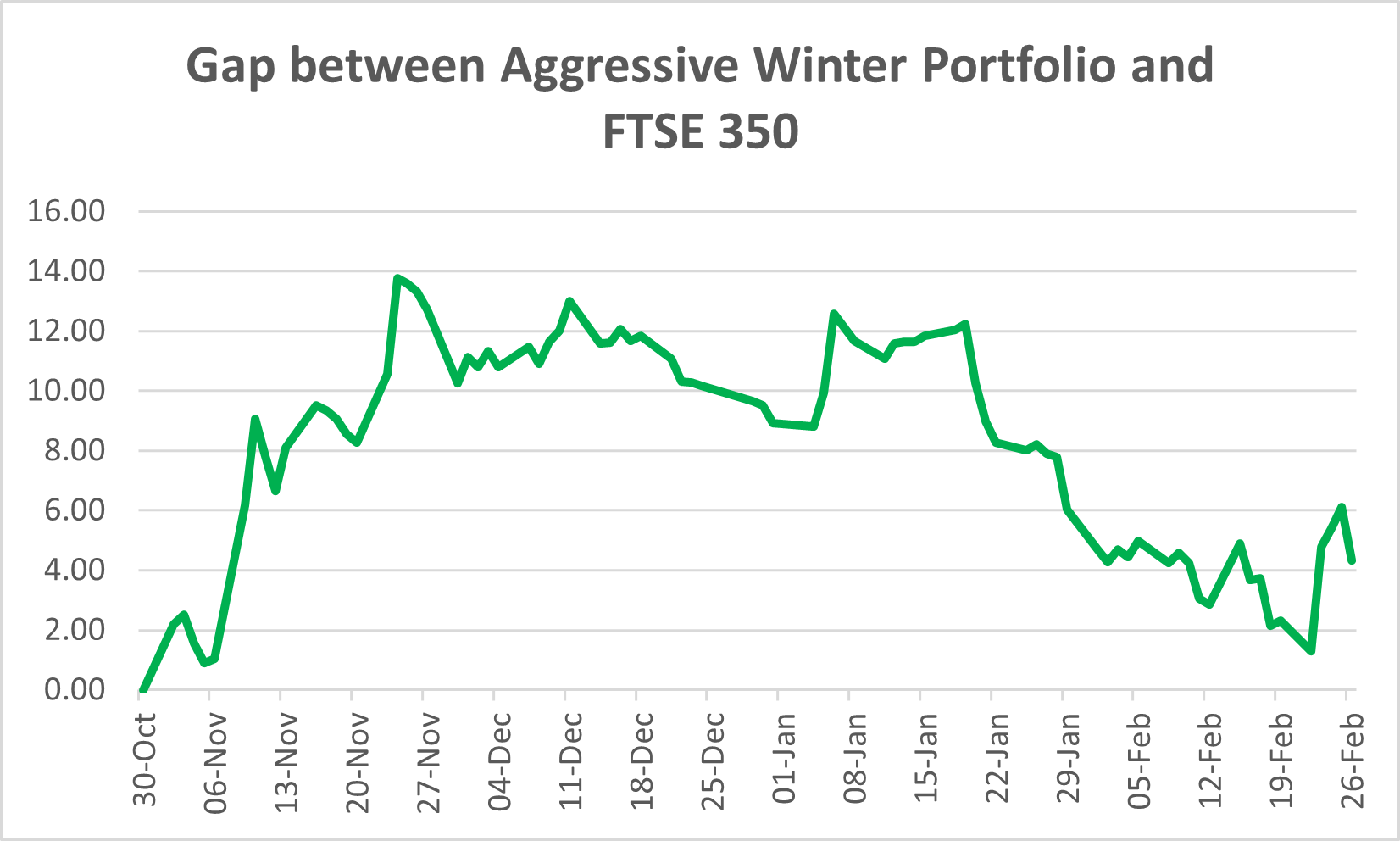

With two months left to go, both Wild’s consistent and aggressive portfolios are in positive territory for this season’s strategy – up 5.2% and 12.8% respectively. But the FTSE 350 benchmark index is up 17.2%

I asked last month whether the portfolios could overtake the FTSE 350. Well, they came as close as they have done on 22 February when the aggressive portfolio stood 17.9% higher compared with the benchmark index up 19.1%. It’s going to be a close call.

Source: interactive investor. Past performance is not a guide to future performance

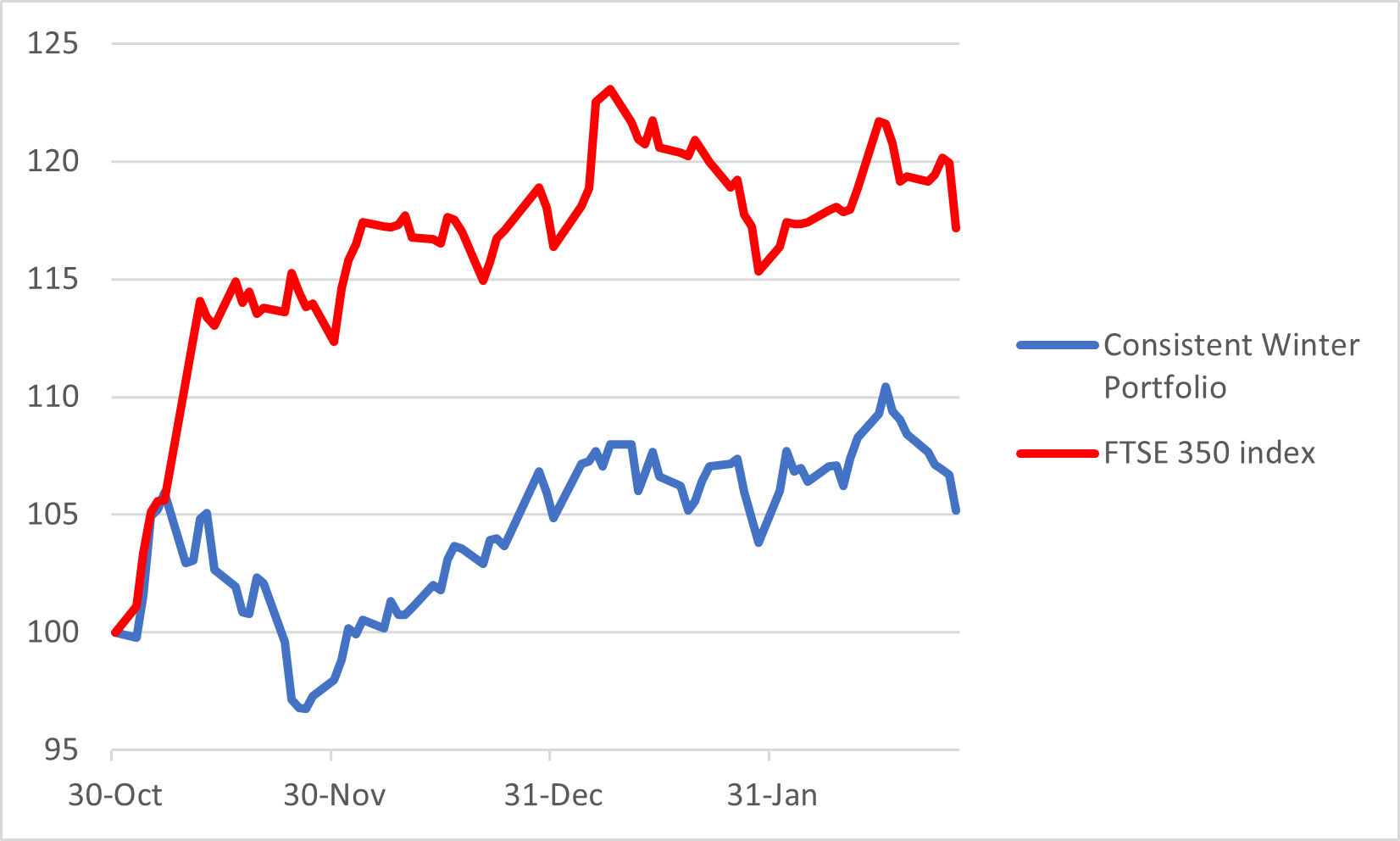

Wild’s Consistent Winter Portfolio 2020-21

Source: interactive investor. Past performance is not a guide to future performance

Although it lags both its sister portfolio and the benchmark index this winter, there are some star performers in this consistent portfolio.

London Stock Exchange (LSE:LSEG) celebrated completion of its $27 billion purchase of data giant Refinitiv with a two-week rally to a record high. The shares changed hands for above £100 each for the first time and, despite some profit taking, ended the month with a 10.7% profit and a 16.2% gain for this winter’s portfolio.

Insurer Admiral (LSE:ADM) has done well, too, adding 7.1% in February, taking its four-month return to 12.3%. The shares, however, are 'priced for perfection', so any slip-ups could be punished.

The portfolio's other three constituents have been rather a let-down so far, especially Halma (LSE:HLMA) whose reliability guaranteed entry to this year’s basket of consistent shares. The highly-rated shares fell 8.2% in February and are now down 4.3% in the past four months.

Self-storage firm Safestore (LSE:SAFE) is flat for this winter strategy after a 1.4% decline last month. First-quarter results were warmly received but gains disappeared over the next week.

Finally, speciality chemicals giant Croda International (LSE:CRDA) lost 1.9% over the month. This stock never falls in the winter months, and it is still up 2.2% since late October, so hopes are high that it will extend its impressive seasonal track record.

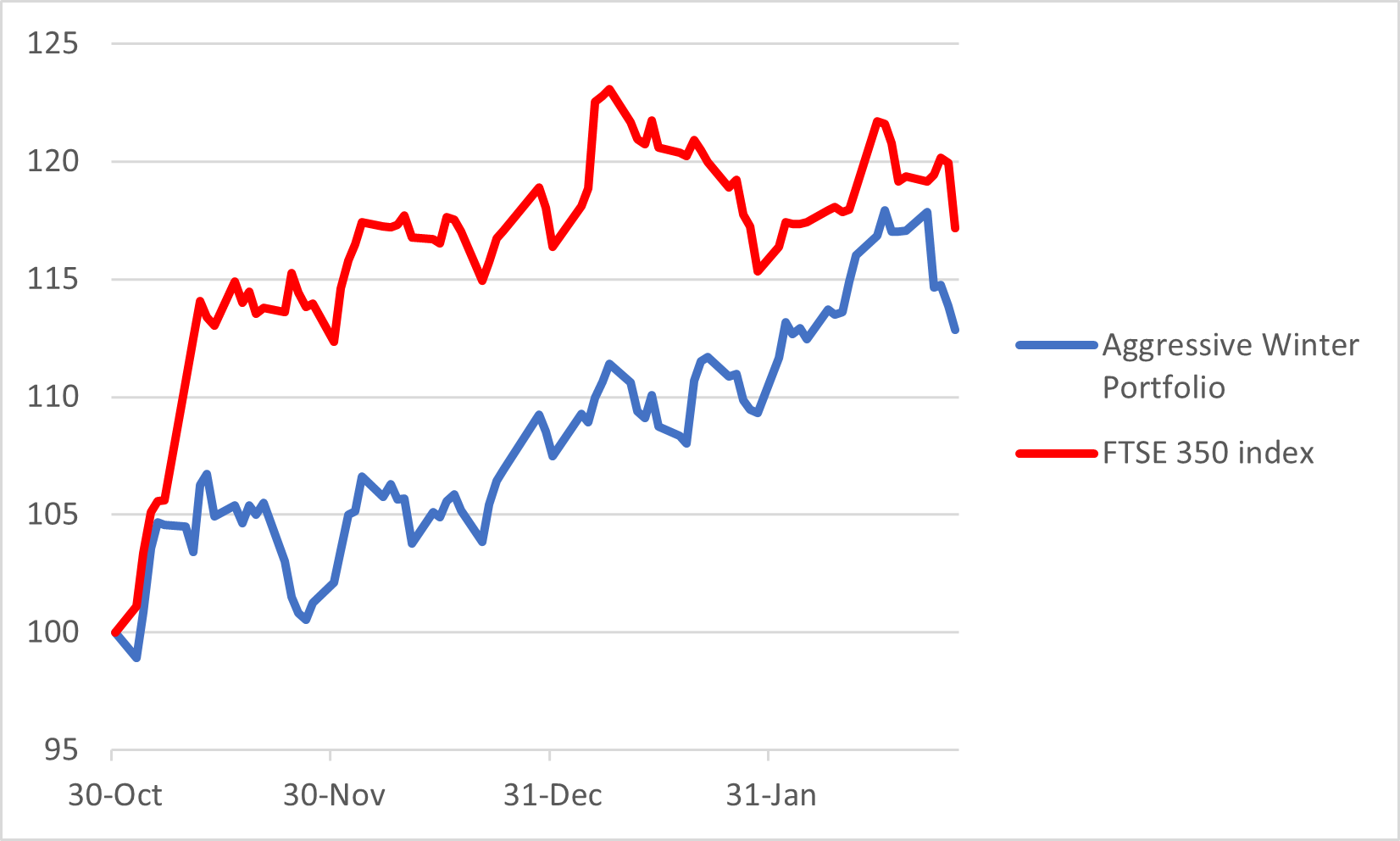

Wild’s Aggressive Winter Portfolio 2020-21

Source: interactive investor. Past performance is not a guide to future performance

As well as London Stock Exchange, which, like Safestore, lives in both portfolios this year, two of this winter’s best performers are driving gains for the aggressive basket of shares.

Synthomer (LSE:SYNT), the latex gloves firm, rose a further 6.9% in February, taking its winter gains to 21.9%. There was excitement towards the end of the month when management was forced to confirm “it is not in discussions regarding a possible offer for the company”.

Precision instruments star Spectris (LSE:SXS) lost a fraction of a percent last month, but is still up 22.5% this winter. Annual results triggered appositive share price reaction, but it was not enough to make up ground lost since mid-month.

Technical products and services company Diploma (LSE:DPLM) ended the month where it began, but not before it made a record high. At its peak the shares were up almost 15% for this year’s winter portfolio, but a limp finish unwound those hard-won gains.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.