Wild’s Winter Portfolios 2020: LSE blamed for bad month

One stock torpedoed both portfolios in March but hopes of a strong end to winter are high.

12th April 2021 17:22

by Lee Wild from interactive investor

One stock torpedoed both portfolios in March but hopes of a strong end to the winter are high.

After November’s vaccine joy put a rocket under share prices, progress in the UK has been rather pedestrian. However, there were still gains to be had for stock market investors in March, and April has started strongly.

Inflation and the impact of higher interest rates on economic growth were key considerations for investors. But, in a month where a container ship blocked $9 billion of trade – per day – in the Suez Canal, the FTSE 350 index rose 3.4%. That capped a bad month for Wild’s Winter Portfolios, which were both hit by the crash in the price of London Stock Exchange (LSE:LSEG) shares. Read more on that below.

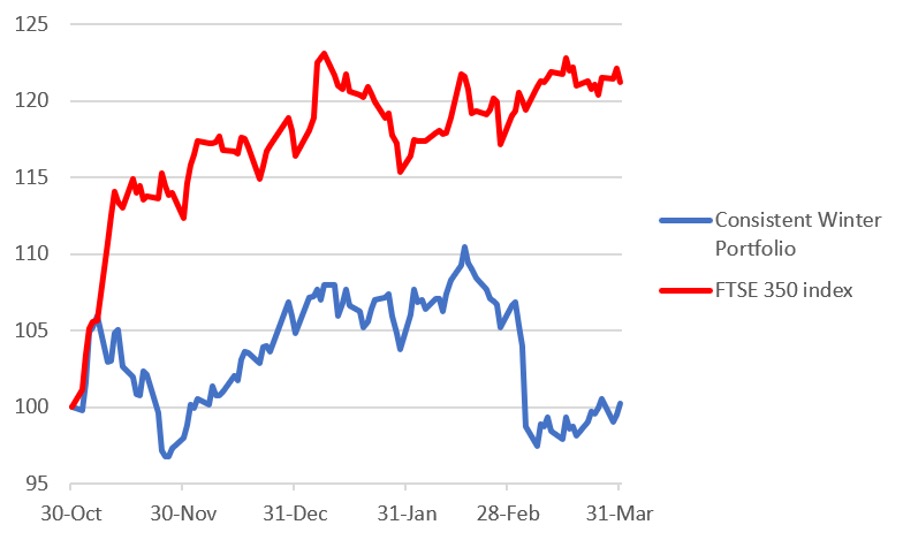

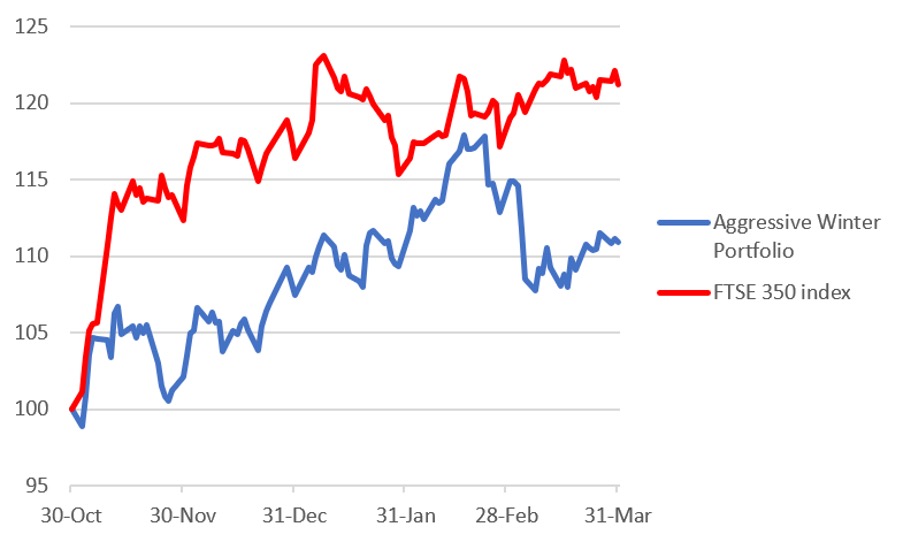

Wild’s Aggressive Winter Portfolio fell 1.7% in March as the LSE’s dive was partially offset by gains elsewhere. However, Wild’s Consistent Winter Portfolio fell 4.7% in one month, as other constituents delivered only modest gains.

- Find out more about Wild's Winter Portfolios here

- Wild’s Winter Portfolios return for 2020-21

- Will bulls have more to cheer in April after strong March?

| Consistent Winter Portfolio |

|---|

| Compiling the two winter portfolios is straightforward. The Consistent portfolio is a basket of five FTSE 350 stocks with the most stable track record of returns over the past decade. Each has risen every year for the past 10 years. |

| Aggressive Winter Portfolio |

|---|

| For the Aggressive Winter Portfolio, the FTSE 350 constituents must have delivered the highest average annual returns over the winter. While average returns are our primary criterion, stocks must also have risen over the winter months in at least nine of the past 10 years. |

With just one month left to go, both Wild’s consistent and aggressive portfolios are in positive territory for this season’s strategy – up 0.2% and 10.9% respectively. But the FTSE 350 benchmark index is up 21.2%.

April has started strongly and, as I write, the aggressive portfolio is generating a 13.4% return for the strategy so far and the consistent portfolio 5%, compared with 24.6% for the FTSE 350. What will it be at 4.30pm on 30 April?

Wild’s Consistent Winter Portfolio 2020-21

Source: interactive investor. Past performance is not a guide to future performance

Euphoria around London Stock Exchange’s $27 billion purchase of data giant Refinitiv was short-lived. Only a month after writing of its shares hitting a record share, the stock suffered one of the mightiest hangovers of any blue-chip since the pandemic sell-off a year ago. A near-28% slide took almost the whole month to complete, but it means a 16% profit for this winter’s portfolio became a 16% loss. And it was a double blow because LSE is a constituent in both the consistent and aggressive portfolios.

The decline began as a reaction to LSE’s annual results early March. Higher costs meant adjusted profits missed forecasts. Refinitiv also dilutes the growth profile, and the shares are certainly not cheap. Guidance for revenue growth of under 5% in 2021 is also disappointing, and analysts believe it could be worse given forecasts are made on a constant currency basis. A strong pound and high level of Refinitiv’s revenue in dollars is a worry.

However, non-executive directors bought over £200,000 of LSE stock in the aftermath and, while City price targets now sit in the mid-£70’s, the shares rose by 8% in the first week of April. Fingers crossed the recovery continues through April!

Safestore (LSE:SAFE), another of the winter’s laggards, was down a fraction over the month. Again, it is a constituent of both portfolios, so it’s 1% decline for this year’s strategy has proved a drag on both the consistent and higher risk portfolios.

Halma (LSE:HLMA), the technology conglomerate, had one of its best months this winter with a 4.7% advance, which leaves it in positive territory for the winter. A share recovery, already underway, was justified by news of strong progress in the second half of its financial year. Full-year adjusted profit before tax is expected to match the year before versus prior guidance of around 5% below the 2020 number.

Croda (LSE:CRDA) has been another disappointment this strategy, but it had a good March, and spiked early in the month on news it is supplying novel excipients used in the manufacture of the Covid-19 vaccine. Gains faded quickly, but April has started strongly and the shares are near a record high.

Insurer Admiral (LSE:ADM)’s annual results triggered a sell-off, despite its attractive dividend. But the shares were still in positive territory for the month and are up nearly 13% since the end of October.

Wild’s Aggressive Winter Portfolio 2020-21

Source: interactive investor. Past performance is not a guide to future performance

The negative influence of LSE and Safestore played out on the aggressive portfolio in March, but there were strong performances elsewhere. Best of all was Diploma (LSE:DPLM), building on big gains in February. The technical products and services company rose by almost 10% last month and has risen a further 7% since the month-end to sit near a record high. That followed news of a better-than-expected performance in its first half.

Spectris (LSE:SXS) remains the star of the show, up 9.7% in March, taking gains for this year’s winter portfolio to over 34%. There was no new news last month, but momentum is on its side. Synthomer (LSE:SYNT), the latex gloves firm and another top performer this season, had a quiet month by its standards, but the shares are still up 23% since the end of October.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.