Wild’s Winter Portfolios 2020: a tricky first month

This year’s portfolios made a cracking start, but their quality counted against them. Lee Wild explains.

4th December 2020 14:13

by Lee Wild from interactive investor

This year’s portfolios made a cracking start, but their quality counted against them. Lee Wild explains.

There is always some trepidation as the winter portfolios launch each year, not because of the companies in them, but events outside of your control. Despite some serious potential headwinds this year – a US presidential election, coronavirus and Brexit among them - the first week of the 2021 winter portfolios couldn’t have gone much better.

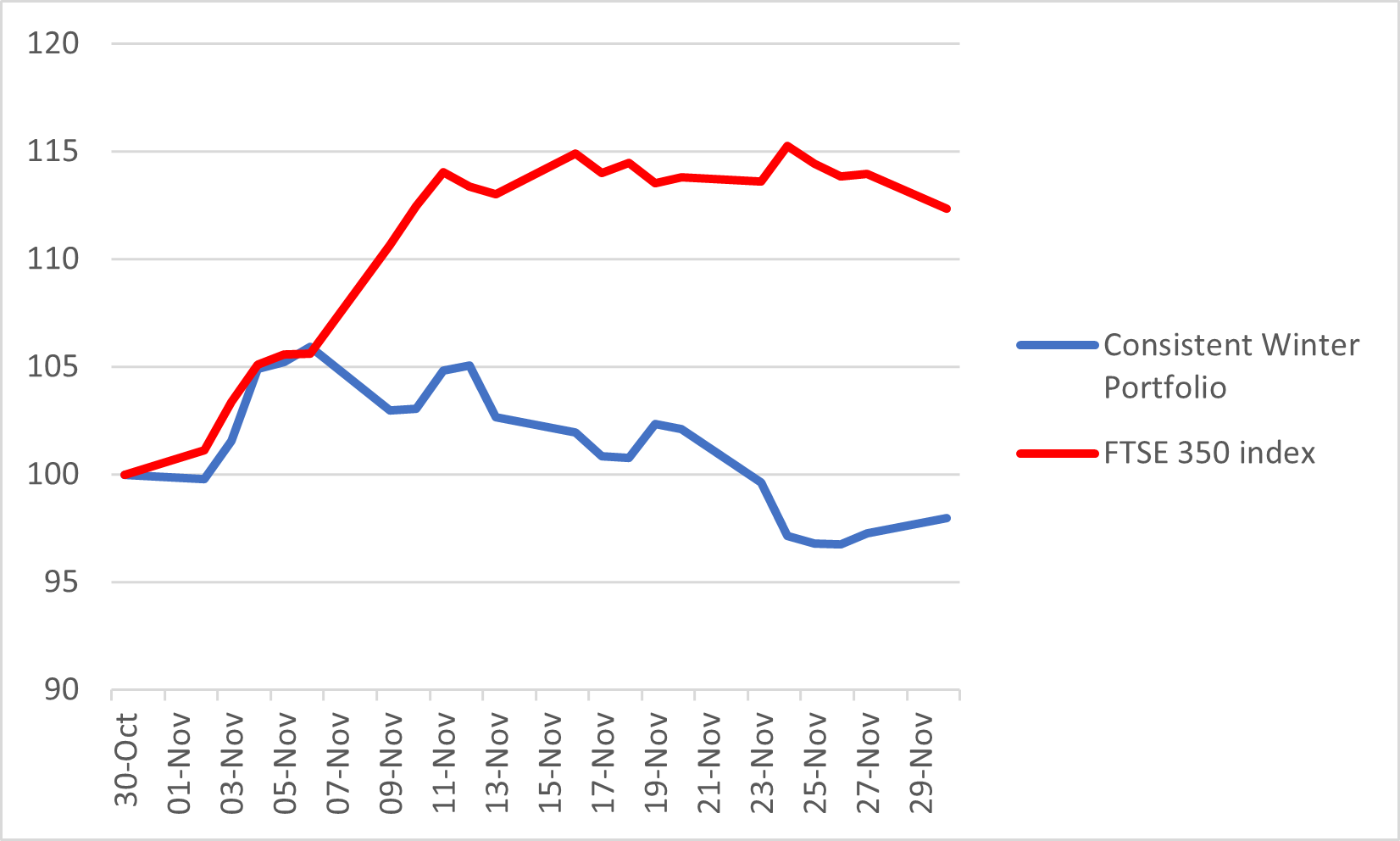

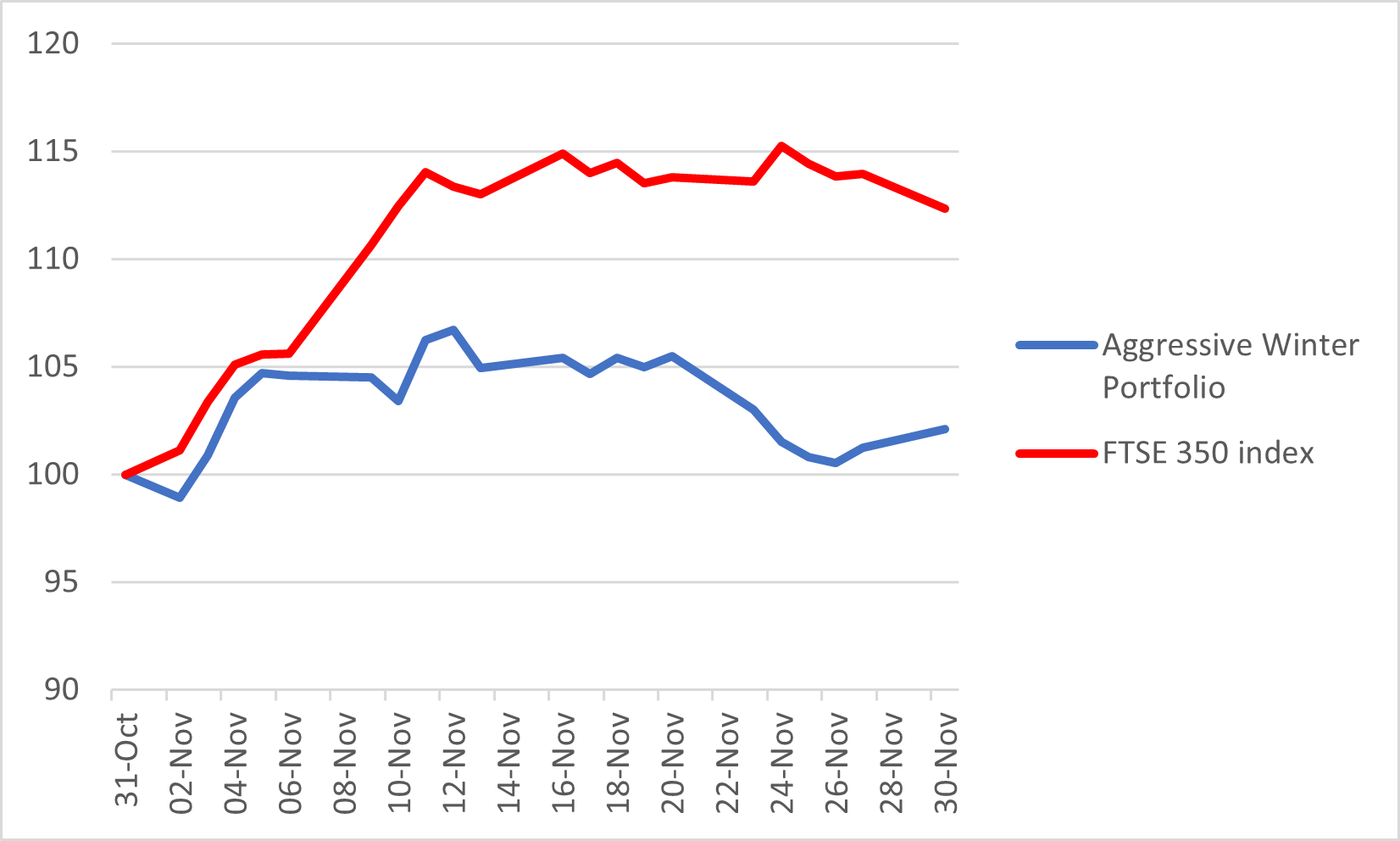

By the end of Week One, the consistent winter portfolio was sitting pretty, up 5.9%, and the aggressive portfolio had returned 4.6% in just a few days. The FTSE 350 benchmark index was up, too, kicking November off with a one-week gain of 5.6%.

Trump vs Biden turned into one of the most prolonged presidential elections in living memory, with the President refusing to concede to his Democrat rival. But as Biden pulled clear, traders put money on massive fiscal stimulus in 2021, lifting stock markets. That did our portfolios no harm.

Investors also took a “no news is good news” approach to the lack of any announcement on a Brexit trade deal. This one will go to the wire.

But after trading more or less in line with the FTSE 350 benchmark index since launch, Monday 9 November marked a major divergence. It was triggered by the announcement by Pfizer of a first possible vaccine for Covid-19, which, of course, is good news. The sooner we get back to normal, the quicker the economy begins to grow again.

Beat-up stocks like airlines, housebuilders, hoteliers and other hard-hit businesses in the FTSE 350 index surged in value. That’s great for shareholders, but not such good news for the winter portfolios. It’s because the five constituents of each basket of shares are high-quality businesses that had enjoyed a purple patch before the November rally. Good news had already been priced in.

This was something I warned about in October. Lots of solid companies either immune from the Covid crisis, or able to weather the storm, had recovered fully from the stock market collapse in March, and many were already at or near record highs.

For both portfolios, it was downhill from there. The consistent basket of shares ended November down 2%, although slightly better than its worst levels. Apart from a single dip on Day One, the higher-risk aggressive portfolio stayed in positive territory throughout the period, finishing with a gain of 2.1%. Up 15% at its peak, the FTSE 350 index ended the month 12.3% higher than it started it, registering one of the best monthly performances in its history.

That recovery by the benchmark, in what is a unique set of circumstances, makes the winter portfolio performances look worse than they are. And, as the table below shows, this is by no means the worst start to what is historically the most profitable time of year for stock market investors.

Remember 2018-19 when the aggressive portfolio ended November down 4.4%, but ended the six-month strategy up 27.7%. And in the winter of 2017-18 – a poor year for markets generally – both portfolios generated a positive total return, despite a losing start.

| Historic Winter Portfolio Performance each November | |||

|---|---|---|---|

| Year | Consistent Portfolio (%) | Aggressive Portfolio (%) | FTSE 350 benchmark index (%) |

| 2020-21 | -2.03 | 2.1 | 12.34 |

| 2019-20 | 7.25 | 7.34 | 1.79 |

| 2018-19 | 6.48 | -4.44 | -2.11 |

| 2017-18 | -3.97 | -2.9 | -2.06 |

| 2016-17 | 4.97 | 4.49 | -2.06 |

| 2015-16 | 6.42 | 1.31 | 0.23 |

| 2014-15 | -1.69 | 5.04 | 3.98 |

Source: interactive investor using Morningstar prices data

Consistent Winter Portfolio 2020-21

Source: interactive investor. Past performance is not a guide to future performance.

Insurer and winter portfolio debutant Admiral (LSE:ADM) played a starring role in November, ending the month up 3.9%. Now at a record high, there is real momentum here, although there isn’t another update scheduled until February time.

It’s a shame the other constituents didn’t follow Admiral’s lead. Self-storage provider Safestore (LSE:SAFE) started November strongly, demonstrating why it should be in the portfolio, and a fourth-quarter trading update was impressive. However, investors took the opportunity to bag some profits after a strong run since the March low, the shares down 4.2%.

London Stock Exchange (LSE:LSE) was quick out of the blocks, up 6.8% in Week One, but that performance proved unsustainable. A week before the end of November, the shares were down 8% until a recovery in the final days of the month narrowed the deficit to just 2.1%. There is talk that LSE will win EU antitrust approval for its $27 billion acquisition of data analytics company Refinitiv soon.

Ultimate consistent winter portfolio share Croda International (LSE:CRDA) flexed its muscles in the first half of November. Shares spiked over 10% as it emerged it is providing some ingredients for Pfizer’s coronavirus vaccine. Despite falling back, there is clearly demand for Croda at this time of year, and shares are only down 1.3% for this season’s portfolio.

Finally, Halma (LSE:HLMA) let the side down with a 6.4% decline for the month. Half-year results included an upgrade to annual profit expectations and there was lots to like. However, revenue and profit is down year-on-year, which likely spooked some shareholders.

You can read what CEO Andrew Williams told me when I spoke to him on the morning of the results by clicking the headline below.

Aggressive Winter Portfolio 2020-21

Source: interactive investor. Past performance is not a guide to future performance.

With both Safestore and London Stock Exchange featuring in both portfolios this year, the drag was also felt by the aggressive basket of shares. Diploma (LSE:DPLM), the technical products and services firm, also lost ground in November, down 4.8%, despite optimism alongside annual results.

On a more positive note, there were impressive performances from both chemicals company Synthomer (LSE:SYNT) and precision instrumentation business Spectris (LSE:SXS).

Shares in the former, whose ingredients make latex gloves, rose by as much as 17%, and still stand 14% higher than they were at the start of the month. They were the beneficiary of a bullish upgrade by JP Morgan Cazenove the month before, the broker backing the shares up to 450p.

Spectris generated a 7.5% monthly return as investors decided this high-quality business was too cheap, especially given its track record of delivering share price gains over the winter months. Both stocks have also made a strong start to December. More on that in a month’s time.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.