Wild’s Winter Portfolios 2020: when it paid to be aggressive

It lags the benchmark index, but this higher-risk portfolio narrowed the gap at the half-way stage.

5th February 2021 15:02

by Lee Wild from interactive investor

It lags the benchmark index, but this higher-risk portfolio narrowed the gap at the half-way stage.

During a 2020 that most of us will want to forget, there were at least some positives for investors, many of whom recovered from some horrendous paper losses suffered in March.

That recovery continued through Christmas and into 2021, as markets priced in a successful and accelerating vaccination programme. Unfortunately, the euphoria was short-lived, and many markets saw their peak just after the first week of 2021. After that, it was all downhill.

However, it paid to be aggressive, as Wild’s higher risk basket of shares outperformed the wider market and its consistent sister portfolio.

The FTSE 350 benchmark index lost 0.9% last month and was down 6.7% from its high on 8 January. Wild’s Consistent Winter Portfolio also tailed off at the end of the month as part of a broader market decline, but Wild’s Aggressive Winter Portfolio added 1.7% for the month, largely thanks to a couple of star stocks and recovering laggards.

| Consistent Winter Portfolio |

|---|

| Compiling the two winter portfolios is straightforward. The Consistent portfolio is a basket of five FTSE 350 stocks with the most stable track record of returns over the past decade. Each has risen every year for the past 10 years. |

| Aggressive Winter Portfolio |

|---|

| For the Aggressive Winter Portfolio, the FTSE 350 constituents must have delivered the highest average annual returns over the winter. While average returns are our primary criterion, stocks must also have risen over the winter months in at least nine of the past 10 years. |

Now half-way through this seasonal strategy, the FTSE 350 is still ahead of the two portfolios. The consistent portfolio is up 3.8% and the aggressive portfolio 9.3%. The FTSE 350 had risen 15.3% by the end of January, the beneficiary of the stampede into recovery stocks triggered by the November vaccine news. Remember, our ‘quality’ stocks had already done much of their recovering in the previous few months before this strategy began.

That said, the portfolio stocks are looking much stronger now, and there are still three months left of this six-month strategy. Could they overtake the benchmark index?

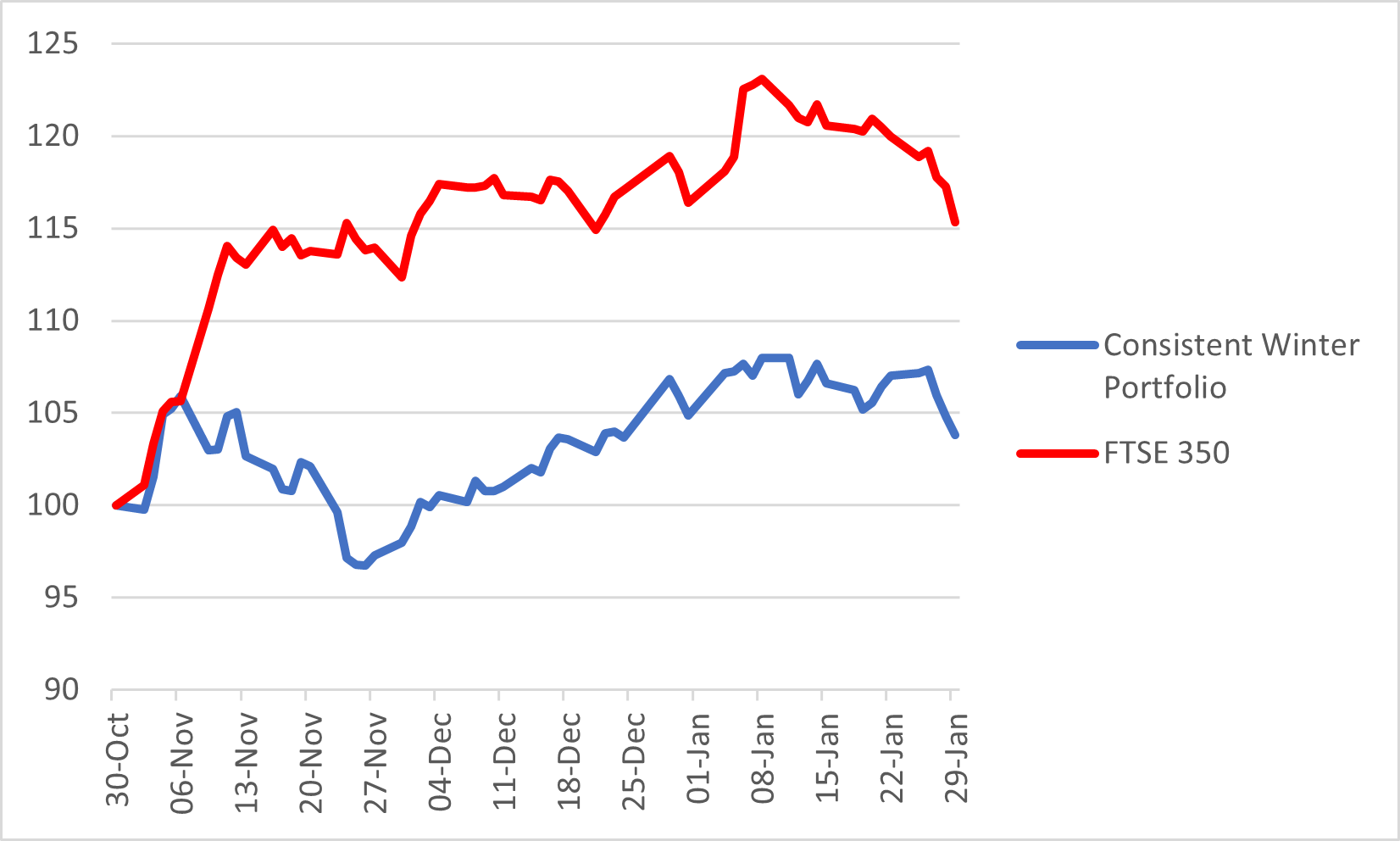

Wild’s Consistent Winter Portfolio 2020-21

Source: interactive investor. Past performance is not a guide to future performance

A decline in the consistent portfolio during January, largely in line with the benchmark index, was down to two of the historically most reliable winter performers out of the five constituents.

Croda International (LSE:CRDA) has risen every winter for at least the past 16 years, but it is allowed a bad month, and January 2021 was it. The FTSE 100 speciality chemicals firm fell 4.7%, leaving it up 4.2% for the strategy so far. London Stock Exchange (LSE:LSEG) did a similar thing, this time dropping 3.6% for the month, reducing its gain for this winter portfolio to 4.9%.

Insurer Admiral Group (LSE:ADM) slightly outperformed the market to keep a decent 4.8% lead over the past three months. FTSE 100 technology conglomerate Halma (LSE:HLMA) is up 4.3% since the end of October after a 0.8% gain in January.

But it was Safestore (LSE:SAFE) that saved the portfolio’s blushes this time. A relative laggard up until now, the self-storage firm hit 2021 running and didn’t stop until profit taking after full-year results mid-month. The shares moved sideways for the rest of the month, ending January in positive territory.

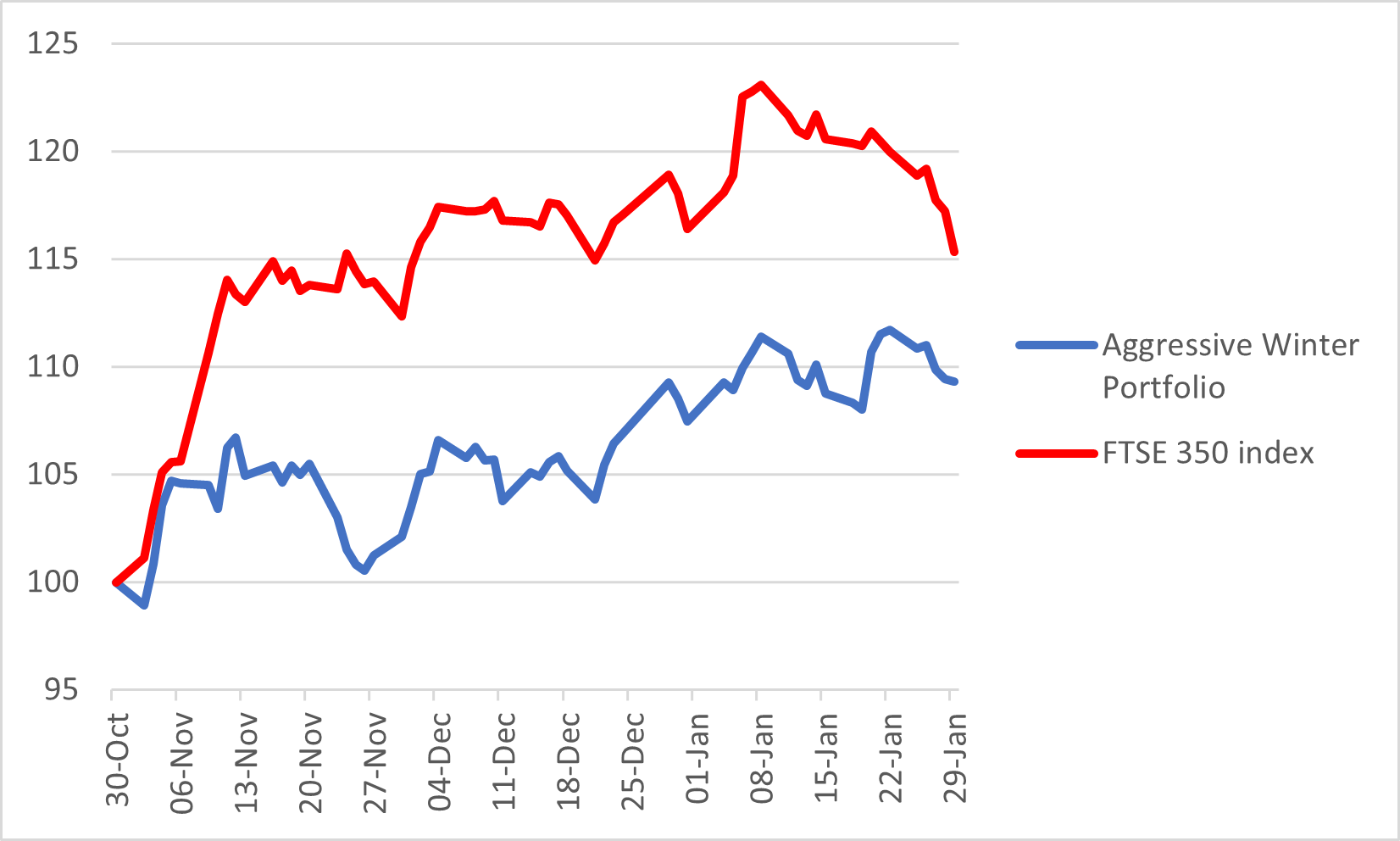

Wild’s Aggressive Winter Portfolio 2020-21

Source: interactive investor. Past performance is not a guide to future performance

At 6%, the aggressive portfolio’s deficit to its benchmark index is now as narrow as it has been since early November.

There were a couple of main reasons for this. Precision instrumentation company Spectris (LSE:SXS) was top of the class in January after a positive trading update shot the share price up 7.7% for the month. They’re now up 22.6% since the end of October.

It was a much better month for technical products and services company Diploma (LSE:DPLM). Shares rose 5.7% over the month and close to a record high following a positive trading update. Remember, Diploma made a significant acquisition which triggered a share price rally not long before this six-month strategy began.

Latex gloves firm Synthomer (LSE:SYNT) said it expects to have made more money than expected in 2020, but news that CEO Calum MacLean will leave the company by January 2022, after six years at the firm, took the shine off numbers. The shares fell over 4% during the month, but one City analyst did upgrade its price target to 515p, implying significant potential upside. The shares are up 14% since October.

Safestore and London Stock Exchange, also constituents of the consistent portfolio, cancelled each other out (see above).

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.