Wild’s Winter Portfolios 2022: dark December follows record start

5th January 2023 12:49

by Lee Wild from interactive investor

Investors had little to celebrate in December, but both portfolios are still showing a big profit this winter. Our head of equity strategy explains what happened last month.

A strong November for global stock markets, but especially the UK, got this year’s winter portfolios off to a cracking start. Both the more reliable and riskier baskets of shares had a record first month. Unfortunately, any repetition of that success was scuppered by an unusually weak December for equities.

- Invest with ii: Share Dealing with ii | Open a Stocks & Shares ISA | Our Investment Accounts

I’d recently written at length about how statistically strong the final month of the year is – the FTSE 100 and FTSE All-Share indices had only fallen six times since 1986 – but losses in 2022 made it seven negative Decembers in 37 years. On reflection, avoiding losses given everything that’s going on in the world right now would have been more surprising.

I had also spelled out the risks for investors over the next six months in my first winter portfolio article for 2022 - inflation, interest rates, energy and cost-of-living crises, war in Ukraine and recession. You can add Covid in China to that list. And it was all of these that took the cheer out of December this time round.

- Find out more about Wild’s Winter Portfolios here

- Best shares in November and outlook for UK stock market in December

- Wild’s Winter Portfolios return for 2022-23

There were two big losers among the constituents of the winter portfolios in December, but as one of them is included in the consistent basket of five shares and the aggressive portfolio of five riskier stocks, the pain was felt by investors in both.

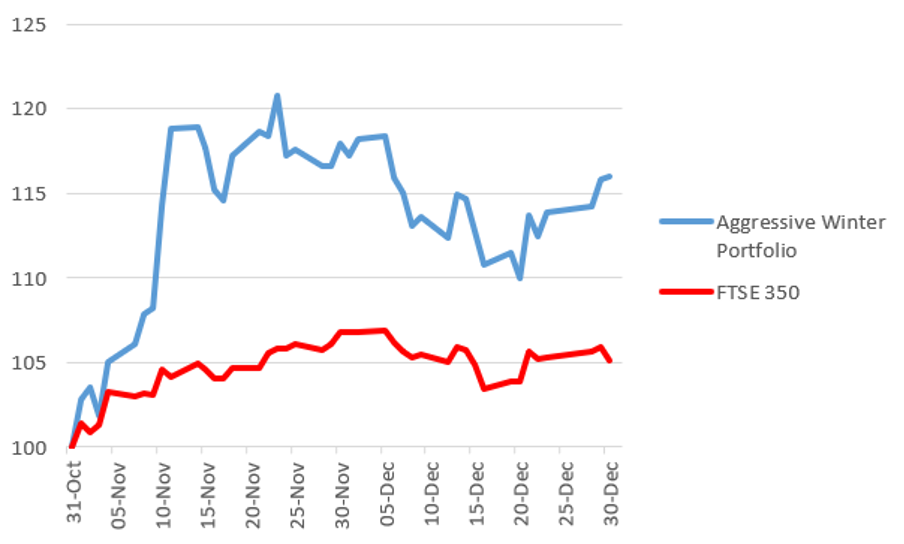

Wild’s Aggressive Winter Portfolio fell a tad over 1.6% for the month, a fraction more than the FTSE 350 benchmark index. Wild’s Consistent Winter Portfolio, which holds both the big losers, ended the month down 3.7%.

However, it was such a good first month that the aggressive portfolio is still up 16% for the six-month strategy and the consistent portfolio 3.9%. The FTSE 350 is up 5.1%.

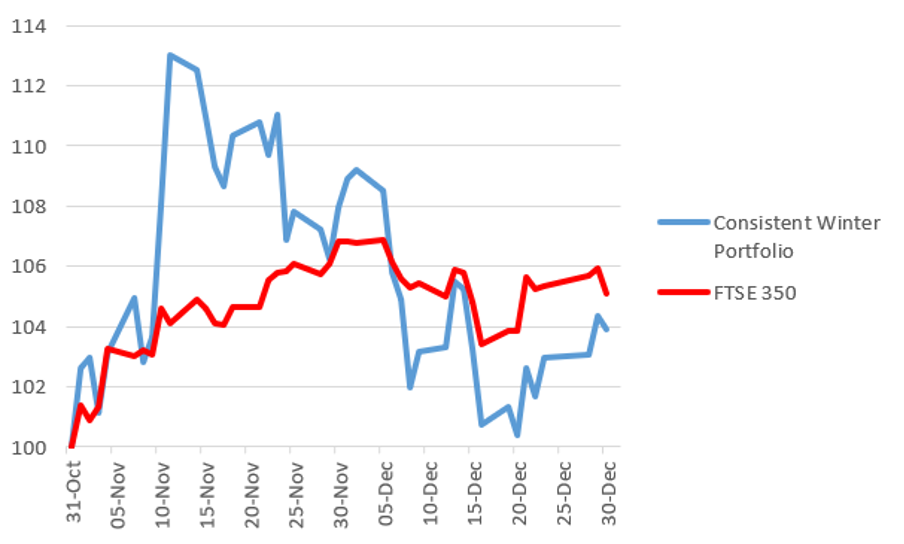

Wild’s Consistent Winter Portfolio 2022-2023

Past performance is not a guide to future performance.

Biggest faller in December was London Stock Exchange Group (LSE:LSEG), with a 13.5% deficit. After posting a 9% gain in November, the stock peaked on the first day of the new month, then spent most of the next three weeks in freefall as global stock prices weakened.

There was some relief mid-month, albeit brief, when the LSE announced that Microsoft would buy a 4% stake in the business for £1.5 billion. As part of a 10-year strategic partnership, the pair will develop new products together. However, it was not enough to prevent further share price declines that left LSE stock down 5.7% for this winter portfolio season so far.

In late November, just before it announced “very strong” half-year results, discoverIE Group (LSE:DSCV) shares hit an 11-month high. A fall followed, but the electronic components company still ended that month up over 11%. December was harder for all companies, and Discoverie ended the month with an 11.9% decline, giving a 1.9% loss for the first two months of these winter portfolios.

There were no company specific issues, but the shares had risen almost 50% in the six weeks since mid-October, so profit taking is probably at least partly to blame. On a more positive note, the company announced an acquisition just before Christmas that’s been well received by City analysts.

- Visit our YouTube channel to view our experts’ tips for 2023

- This is what the ideal share for 2023 looks like

FinnCap backs the $22 million (£19.1 million) acquisition of high-margin Magnasphere, a US-based designer and manufacturer of magnetic sensors and switches for industrial application. It also believes Discoverie has the financial clout to make more earnings enhancing purchases. The broker’s price target of 1,220p implies potential upside of around 68%.

Investment bank Berenberg also likes the stock, rating them a ‘buy’ with 1,030p price target and predicting more margin-enhancing acquisitions like this.

The remaining three portfolio constituents all posted gains. After a flat start to the winter, self-storage facilities provider Safestore Holdings Ordinary Shares (LSE:SAFE) rose 4.2% in December. Food packaging firm Hilton Food Group (LSE:HFG) had a nightmare debut in November, issuing a fairly predictable profits warning. Its share price sank as much as 18% from the end of October to 8 December, but bargain hunters thought the selling had gone far enough and picked up cheap stock. Hilton ended the month with a 3% gain, although the shares are still down 8.7% this winter.

Finally, Liontrust Asset Management (LSE:LIO), star of the show in November with an incredible 30.2% rally, managed to add a little extra to its tally, ending December with total winter gains of 31.1%. It was a rollercoaster month, but a flourish in the final week guaranteed a successful end to 2022.

Wild’s Aggressive Winter Portfolio 2022-2023

Past performance is not a guide to future performance.

This year, three companies appear in both portfolios. Unfortunately for the aggressive basket of shares, one of them was laggard Discoverie. Fortunately, the other two – Safestore and Liontrust – were winners for a second month.

The remaining two companies - JD Sports Fashion (LSE:JD.) and Investec (LSE:INVP) – had a mixed month.

Hot on the heels of a 29.4% jump in November, sports clothing chain JD extended gains early in the new month before jogging backwards for the next fortnight. But a sprint for the finish in the final 10 days of December recouped all the losses, leaving the shares up a fraction for the month. Main news from JD during that time was the sale of 15 UK-based non-core fashion labels to Frasers Group.

Following a 48% two-month rally from year low to near an eight-month high, financial services firm Investec started December badly. However, a late rally turned around an 8% decline and left the shares down just 1.3% for the month. At the start of January, Investec shares hit their highest since 2007.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.