Wild’s Winter Portfolios return for 2022-23

27th October 2022 09:11

by Lee Wild from interactive investor

Last year was one to forget for winter portfolio followers, as high inflation and the spectre of rapidly rising interest rates changed the investment landscape. Will the seasonal strategy get back on track this time?

Seasonal investing was once a very profitable strategy, generating returns way above anything the broader stock market could manage. In just five years, an adventurous portfolio of shares we’d built had almost doubled in value. But things have changed. Covid has had a massive impact on investing behaviour and markets are in unfamiliar territory.

Central banks had been able to keep interest rates at historic lows since the financial crisis in 2008, creating an era of cheap money and low inflation. But inflation isn’t low anymore, and now rates are rising fast. At the same time, governments are struggling with a cost-of-living crisis that looks set to peak over the winter months and could tip the domestic economy into recession if not this year, then next. Other countries face similar difficulties.

- Read about: Free regular investing | Opening a Stocks & Shares ISA | Cashback Offers

You can add Ukraine into the mix, a war still raging more than eight months after it began and with no sign of a resolution. Investors also have a close eye on corporate profits and the impact of rising costs on margins, looking for clues in the third-quarter reporting season which kicked off recently.

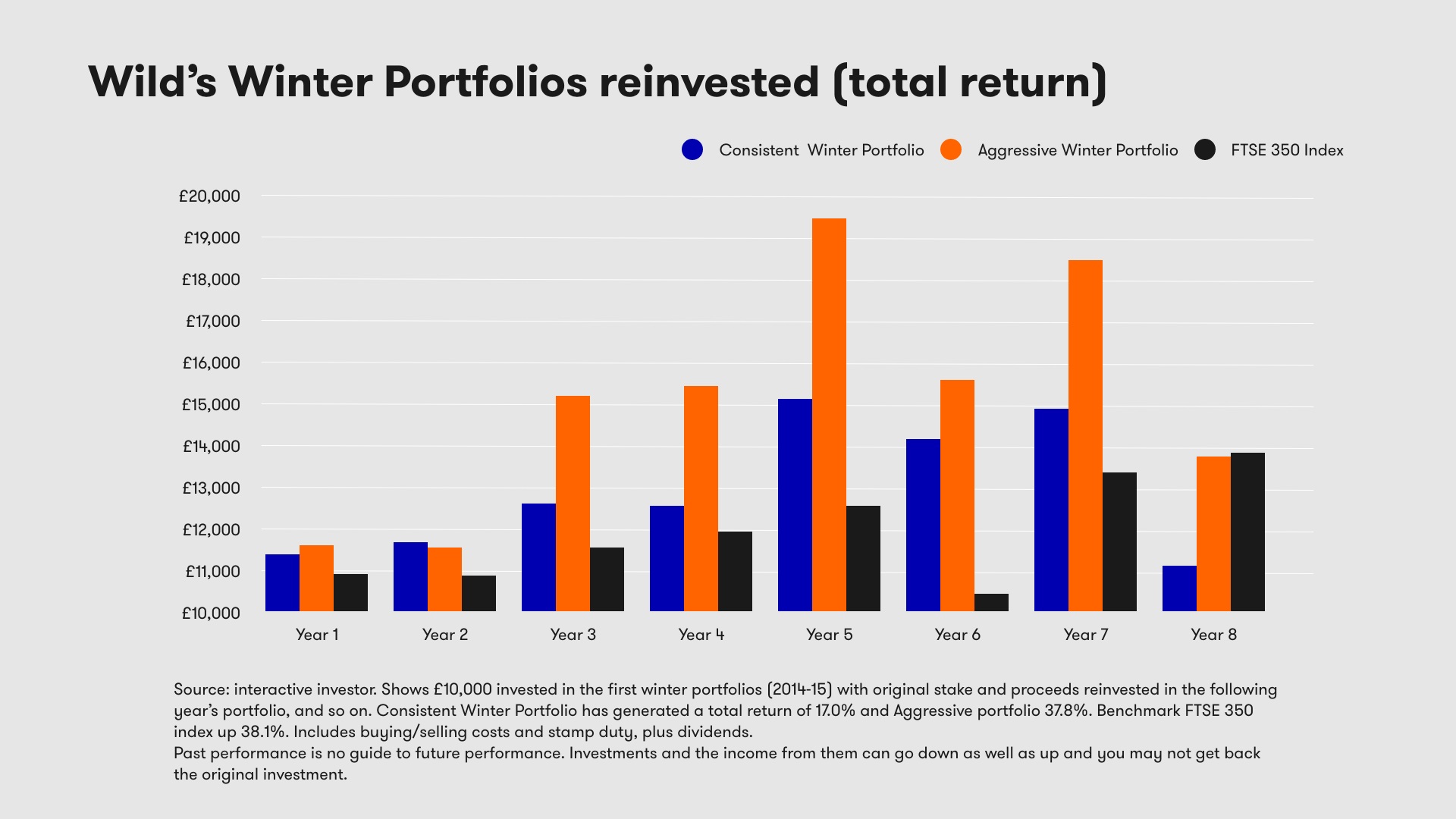

A five-year run of outperformance and profitability for Wild’s Winter Portfolios ended in the 2019-20 season. If you had reinvested profits in each portfolio year after year since launch in 2014, by 2018-19 the Consistent portfolio would have generated a total return of 51.7% and the Aggressive portfolio 95.9%. The FTSE 350 benchmark index was up a more modest 26.8%.

Losses in 2019-20 were recouped the following winter, but then lost again last year when both baskets of shares fell by 20% or more. The peculiar thing here is that the FTSE 350 actually rose 1.7% last winter, making it one of the world’s best-performing indices. For comparison, America’s S&P 500 was down 10%, the Nasdaq tech index slumped by 20% and our own AIM market fell 16%.

To understand why last year’s winter portfolios underperformed the FTSE 350 index, you need to dig a little deeper. The index is made up of the FTSE 100 plus the next 250 biggest UK-listed companies, and it was the dramatic difference in performance between them that makes things clearer.

The FTSE 250 index actually fell 10.4% in the six months between the end of October and 30 April 2022, while the FTSE 100 index rose 4.2%. The constituents of last year’s winter portfolios were mostly FTSE 250 companies exposed to industries such as asset management, electricals and engineering, which had turned tail after some blistering success, while other constituents suffered company-specific issues. Investors clearly favoured larger, more defensive, dividend-paying companies such as miners, utilities and military equipment, while rising energy prices gave Shell (LSE:SHEL), BP (LSE:BP.) and other oil companies a huge boost.

The rationale

Our interest was originally piqued by an anomaly in the stock market which demonstrates that buying and selling at two specific dates of the year has historically generated better returns than if you had stayed invested all year round.

Buying a portfolio of shares on 1 November, or late on 31 October, and selling them on 30 April the following year, has significantly outperformed the wider stock market over the last 27 years. It provides investors with a clear strategy that’s simple to execute and enjoys a successful performance history.

Data provided by Stephen Eckett, mathematician and co-founder of Harriman House, publisher of The UK Stock Market Almanac, shows that £100 invested in the UK stock market (as measured by the FTSE All-Share Index) in 1994 and held continuously for the past 27 years, would have grown to £265 (excluding dividends). However, if they had only invested in the market between 1 November and 30 April every year, then that £100 would be worth £357. Conversely, if they had chosen to only invest over the summer months, they would have lost money; their original £100 would be worth just £68.

“This anomaly, sometimes called the Sell in May Effect, has been known about for a long time,” explains Mr Eckett, “there is even some evidence that dates knowledge of this effect back to 1694. However, it is certainly the case that the economic and political turmoil seen in recent years has disrupted many long-term established trends and anomalies such as this Sell in May Effect. Whether the anomaly will re-establish itself at some point as strong as it was before remains to be seen.”

Of course, this strategy is not without risk, none are. But the theory is compelling.

How do we do it?

The objective is to create two portfolios that best exploit stock market seasonality. Screening only stocks listed in the FTSE 350 index for a greater level of liquidity, the five most reliable winter performers of the past 10 years make up Wild’s Consistent Winter Portfolio. A basket of five higher risk/higher return stocks, which still exhibit impressive consistency over the winter months, become Wild’s Aggressive Winter Portfolio.

Four of the five constituents of Wild’s Consistent Winter Portfolio 2022-23 have each risen in nine of the past 10 winters. One has risen every winter for the past decade. The average return between November and April, excluding dividends, is 16.1% versus an average gain of just 3.7% for the FTSE 350 benchmark index.

To access even greater potential returns, we relax the entry criteria for the aggressive portfolio for 2022-23. That makes it a little riskier, but even now it also has one stock with a 100% winter record and two with nine positive years. The final two have an 80% success rate over the past 10 winters. The average winter return for the 2022-23 aggressive portfolio since 2012 is 17.3%.

Normally, investors are rewarded for taking extra risk with the prospect of higher returns. However, as you can see, this year the gap in average historic returns between the consistent and aggressive portfolios is only marginal. Even if you relax the entry requirements for the aggressive portfolio to seven positive years out of 10, it doesn’t improve the average performance very much. Investors must decide whether the extra few percentage points are worth the extra risk.

The five stocks in each of the 2022-23 winter portfolios will be announced on Monday 31 October.

Why does the winter portfolio strategy work?

While there are no conclusive studies that neatly explain the historic outperformance of stock markets during the winter months, there are plenty of theories, some more plausible than others.

Perhaps most likely is that far more money flows into the market over the winter months. This occurs at the end of long summer holidays for big players at financial institutions on Wall Street and the Square Mile. While the City no longer shuts down for the cricket, horse racing and rowing at Henley, it is probable that some of the big trading decisions are left until everyone is back in the office. Investment strategies deployed in the following months increase liquidity and boost sentiment.

Most investors will have heard of the Santa rally, when equity markets historically have done well in the weeks leading up to Christmas. You could attribute this to seasonal optimism, or, more likely, end of calendar-year window dressing of portfolios by funds and investment houses. Selling losers and buying successful stocks flatters the numbers that determine City bonuses.

Then, in the spring, at the end of the financial winter, investors take advantage of tax-efficient products in the run up to tax year-end. In what is often referred to as ISA season, many investors rush to use their tax-free allowance in the final days, weeks and months of the tax year. So-called early birds then use their ISA allowance as soon as the new tax year begins.

Among obvious drivers of individual stocks or sectors is the retail industry, where investors will guess whether consumers are spending heavily on Christmas presents. There are often seasonal swings for the pubs sector too, often dependent on results demonstrating the financial impact of weather, good or bad, on our drinking habits over the summer.

The ongoing coronavirus crisis means this year might be very different. And, as usual, there will be some significant and potentially market-moving events occurring during this winter season.

Events to monitor over the next six months

Every year I spell out the risks for investors during the winter portfolio period. The list of potential banana skins is always long but, on most occasions, the portfolios have done their job and beaten the market.

I’ve already mentioned inflation, interest rates, energy and cost-of-living crises, and the war in Ukraine, but my annual list has never included the threat of recession. It does this year.

A worsening economic crisis and inflation will very likely have an even greater impact on consumer spending over the next six months.

To get runaway inflation back under control, global central banks have been forced to raise interest rates at breakneck speed. If inflation proves difficult to tame, policymakers will be forced to go harder on rates for longer.

Rising interest rates have already made mortgages and borrowing costs in general much more expensive, which will inevitably feed through to economic activity. Any drop in demand would clearly have a direct impact on many industry sectors at a time when rising costs are putting company margins under increasing pressure.

- Do British prime ministers influence economic growth?

- Recessions are becoming more likely – here’s how to invest

A widely predicted recession is likely to begin in the period covered by these winter portfolios. While most major economies are struggling with the same problem, it’s the US Federal Reserve and the outcome in America that will dictate the length and depth of any global economic downturn.

All eyes are on the economy but, as the British government just proved, political risk cannot be ruled out as a driver of investor sentiment and stock market behaviour. The UK has a new prime minister who is charged with bringing much needed stability to the domestic economy. And in the US, Donald Trump is throwing cash at Republican candidates in the run-up to midterm elections on 8 November.

This is, historically, the time of year when companies generate the best stock market returns, and our portfolios feature the cream of the crop. However, the list of possible problems is a worry and investors should tread carefully.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.