The worst-performing fund sector of 2023 is staging a recovery – will it last?

Saltydog Investor explains why this fund sector has had a miserable couple of years, but may now be turning a corner.

5th March 2024 13:02

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

The worst-performing sector last year was China/Greater China, down over 20%, and it did not have a particularly good start to this year.

In January, the Japanese stock market was the fastest out of the blocks, with the Nikkei 225 gaining 8.4%, and US and European indices also went up. In the UK, the FTSE 100 and the FTSE 250 both went down, but the biggest losses were in China and Hong Kong. The Shanghai Composite ended the month down 6.3% and the Hang Seng fell by 9.2%.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

However, their fortunes turned in February. The Shanghai Composite went up by 8.1% and the Hang Seng gained 6.6%.

| Stock market indices | 2023 | 2024 | |||||

| Index | Country | 1 Jan to 31 March | 1 April to 30 June | 1 July to 30 Sept | 1 Oct to 31 Dec | Jan 2024 | Feb 2024 |

| FTSE 100 | UK | 2.4% | -1.3% | 1.0% | 1.6% | -1.3% | 0.0% |

| FTSE 250 | UK | 0.4% | -2.7% | -0.7% | 7.7% | -1.7% | -1.6% |

| Dow Jones Ind Ave | US | 0.4% | 3.4% | -2.6% | 12.5% | 1.2% | 2.2% |

| S&P 500 | US | 7.0% | 8.3% | -3.6% | 11.2% | 1.6% | 5.2% |

| NASDAQ | US | 16.8% | 12.8% | -4.1% | 13.6% | 1.0% | 6.1% |

| DAX | Germany | 12.2% | 3.3% | -4.7% | 8.9% | 0.9% | 4.6% |

| CAC40 | France | 13.1% | 1.1% | -3.6% | 5.7% | 1.5% | 3.5% |

| Nikkei 225 | Japan | 7.5% | 18.4% | -4.0% | 5.0% | 8.4% | 7.9% |

| Hang Seng | Hong Kong | 3.1% | -7.3% | -5.9% | -4.3% | -9.2% | 6.6% |

| Shanghai Composite | China | 5.9% | -2.2% | -2.9% | -4.4% | -6.3% | 8.1% |

| Sensex | India | -3.0% | 9.7% | 1.7% | 9.7% | -0.7% | 1.0% |

| Ibovespa | Brazil | -7.2% | 15.9% | -1.3% | 15.1% | -4.8% | 1.0% |

Data source: Morningstar. Past performance is not a guide to future performance.

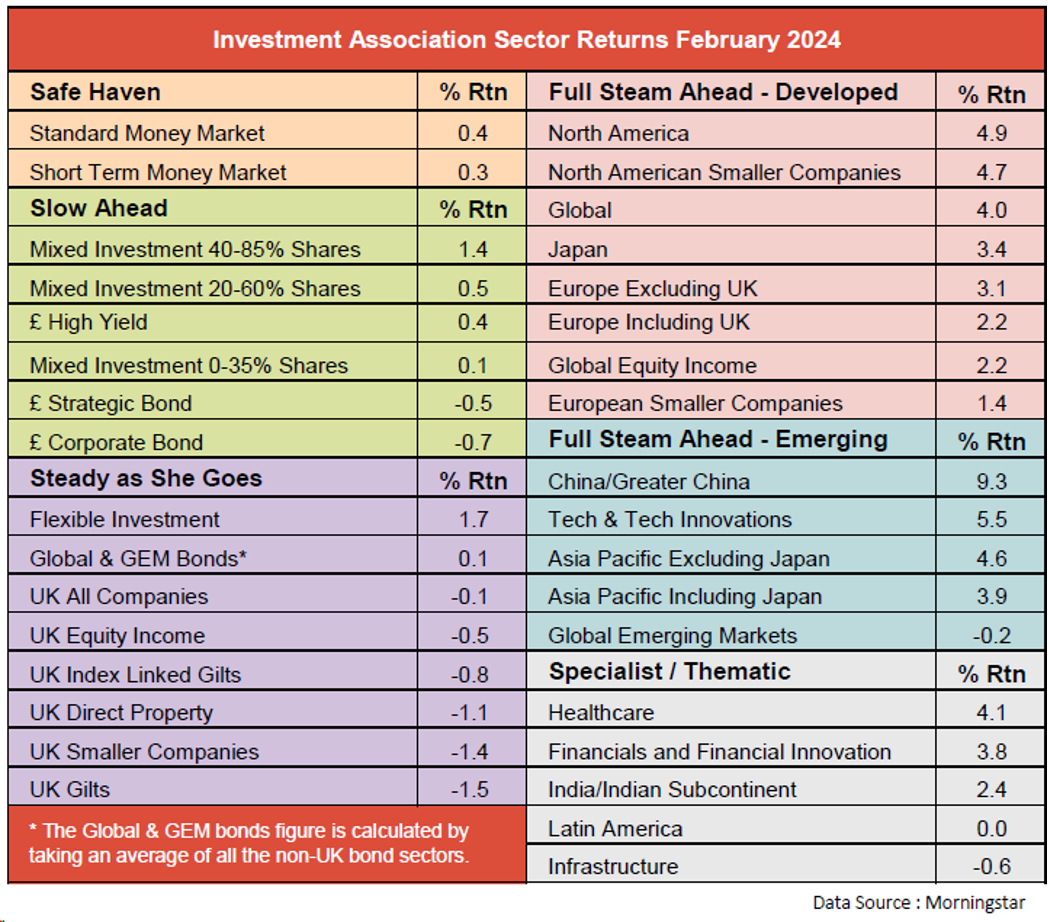

This is also reflected in our latest sector analysis. The China/Greater China sector, which went down by 9.7% in January, has rebounded since the Chinese New Year and is now showing a one-month gain of 9.3%. Hopefully the Year of the Dragon will be much better than the Year of the Rabbit.

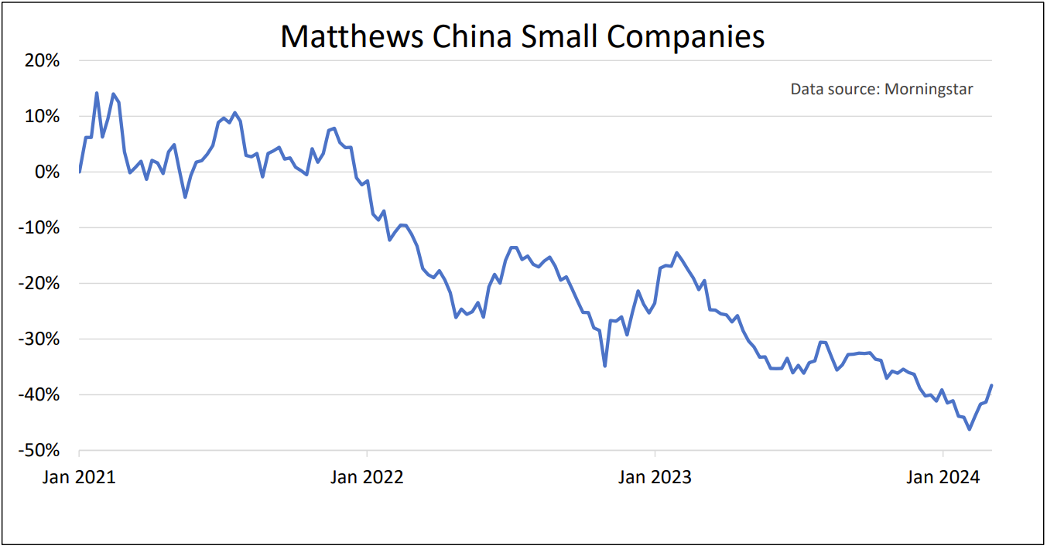

It is no surprise that funds from the China/Greater China sector also dominated our top 10 table last month. The leading fund, Matthews China Small Companies, went up by 14%.

Saltydog’ s top 10 funds in February 2024

| Fund name | Investment Association sector | Monthly return |

| Matthews China Small Companies | China/Greater China | 14.0 |

| BGF Systematic China A Share Opportunities | China/Greater China | 11.7 |

| GAM Star China Equity | China/Greater China | 11.0 |

| Pictet-China Equities | China/Greater China | 10.7 |

| Man GLG Continental European Growth | Europe Excluding UK | 10.6 |

| Ninety One GSF All China Equity | China/Greater China | 10.4 |

| JPMorgan China Growth & Income Ord (LSE:JCGI) | China/Greater China | 10.3 |

| Allianz China A-Shares Equity | China/Greater China | 10.2 |

| abrdn China A Share Equity | China/Greater China | 10.2 |

| Polar Capital Global Tech | Technology & Technology Innovation | 10.2 |

Data source: Morningstar. Past performance is not a guide to future performance.

There are a number of reasons why Chinese stocks have struggled over the past few years.

China’s zero-Covid policy, which was in place long after most countries had started to relax restrictions, led to repeated lockdowns in major cities and significant disruptions in economic activity. This affected everything from factory output to consumer spending.

At the same time, there was a collapse in the Chinese property market.

The global economic environment did not make it any easier. The recovery from the Covid-19 pandemic varied from country to country all around the world, contributing to supply chain bottlenecks, rising commodity prices and inflationary pressures worldwide. Central banks in major economies had to impose tighter monetary policies to combat inflation, leading to a reassessment of risk and a potential shift away from equities, particularly growth-oriented sectors that had benefited from low interest rates. This affected emerging markets broadly, with Chinese stocks being no exception.

- What I've learnt in 30 years as a fund manager

- DIY Investor Diary: this rule takes the emotion out of investment decisions

Looking at the performance of the Matthews China Small Companies fund, you can see that it has almost halved in value since the beginning of 2021. Just because it has had one good month does not mean that it has stopped going down for ever, but perhaps this could be the start of a recovery. Some of the headwinds that were affecting global economies seem to have abated, and that could have a knock-on effect in China and the emerging markets.

Past performance is not a guide to future performance.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.