Important information: The ii SIPP is for people who want to make their own decisions when investing for retirement. As investment values can go down as well as up, you may end up with a retirement fund that’s worth less than what you invested. Usually, you won’t be able to withdraw your money until age 55 (57 from 2028). Before transferring your pension, check if you’ll be charged any exit fees and make sure you don't lose any valuable benefits such as guaranteed annuity rates, lower protected pension age or matching employer contributions. If you’re unsure about opening a SIPP or transferring your pension(s), please speak to an authorised financial adviser. Please note, partners of ii are paid a referral fee that does not affect the cost of your service plan. Tax treatment depends on your individual circumstances and may be subject to change in the future.

It’s important to understand that the use of Salary Sacrifice or the ii SIPP is not a recommendation and that the ii SIPP is not an Employer, Workplace or Auto Enrolment Pension. You can arrange with your employer to have contributions paid into your ii SIPP via Bank Transfer. The ii SIPP is a Personal arrangement between you and interactive investor, and you are solely responsible for agreeing & monitoring contributions made by your employer.

Put your best financial foot forward in 2026.

Join ii today and kick off the year with our special offers:

Offers end 28 February 2026. Terms apply.

Important information: It’s important to take your time before transferring your pension. Make sure to consider what the best option is for you. Don’t transfer just to qualify for the offer, and don't rush any decision to meet the offer deadline. We periodically run offers, and there will likely be other opportunities in the future.

Before transferring your pension, check if you’ll be charged any exit fees and make sure you don't lose any valuable benefits such as, guaranteed annuity rates, lower protected pension age or matching employer contributions.

Whether you run your own limited company, are self-employed or a contractor, finding a pension that suits the way you work is essential.

The ii SIPP gives you the flexibility and control to make your own investment decisions through its range of shares, funds, ETFs, bonds and trust. And, it gives you a tax-efficient way to save for your retirement.

What’s more, you can also change, start or stop your pension contributions at any time, allowing you take full advantage of generous allowances and carry-forward rules.

The tax benefits on contributions will depend on how your business is set up:

Self-employed (Sole trader)

If you're a sole trader, you can contribute to the ii SIPP from your taxable income. You’ll get 20% tax relief from HMRC on top of your contribution. So if you pay £80 into your SIPP, it’ll be topped up with 20% tax relief - turning your pension contribution into £100.

As well as this, you can claim back further tax relief through your self-assessment tax return if you’re a higher or additional rate taxpayer.

Limited company

If you own a limited company, you can make contributions to an ii SIPP directly from your company's pre-taxed income. Depending on your circumstances, you may be able to save on corporation tax & income tax when compared to withdrawing profits via dividends or alternatively you may be able to save income tax, employee & employer National Insurance (NI) when compared to taking a salary.

Each time you contribute to a SIPP from your taxable income, you receive 20% tax relief from the government. If you’re a higher-rate taxpayer, you can claim up to 40% tax relief, and additional rate taxpayers can claim up to 45%.

Any investment growth you make within a SIPP is protected from Capital Gains Tax (CGT), dividend tax and income tax.

You can choose to take up to 25% of your pension tax-free, subject to a maximum of £268,275, once you reach 55 (57 from 2028).

It’s important to understand that the use of Salary Sacrifice or the ii SIPP is not a recommendation and that the ii SIPP is not an Employer, Workplace or Auto Enrolment Pension. You can arrange with your employer to have contributions paid into your ii SIPP via Bank Transfer. The ii SIPP is a Personal arrangement between you and interactive investor, and you are solely responsible for agreeing & monitoring contributions made by your employer.

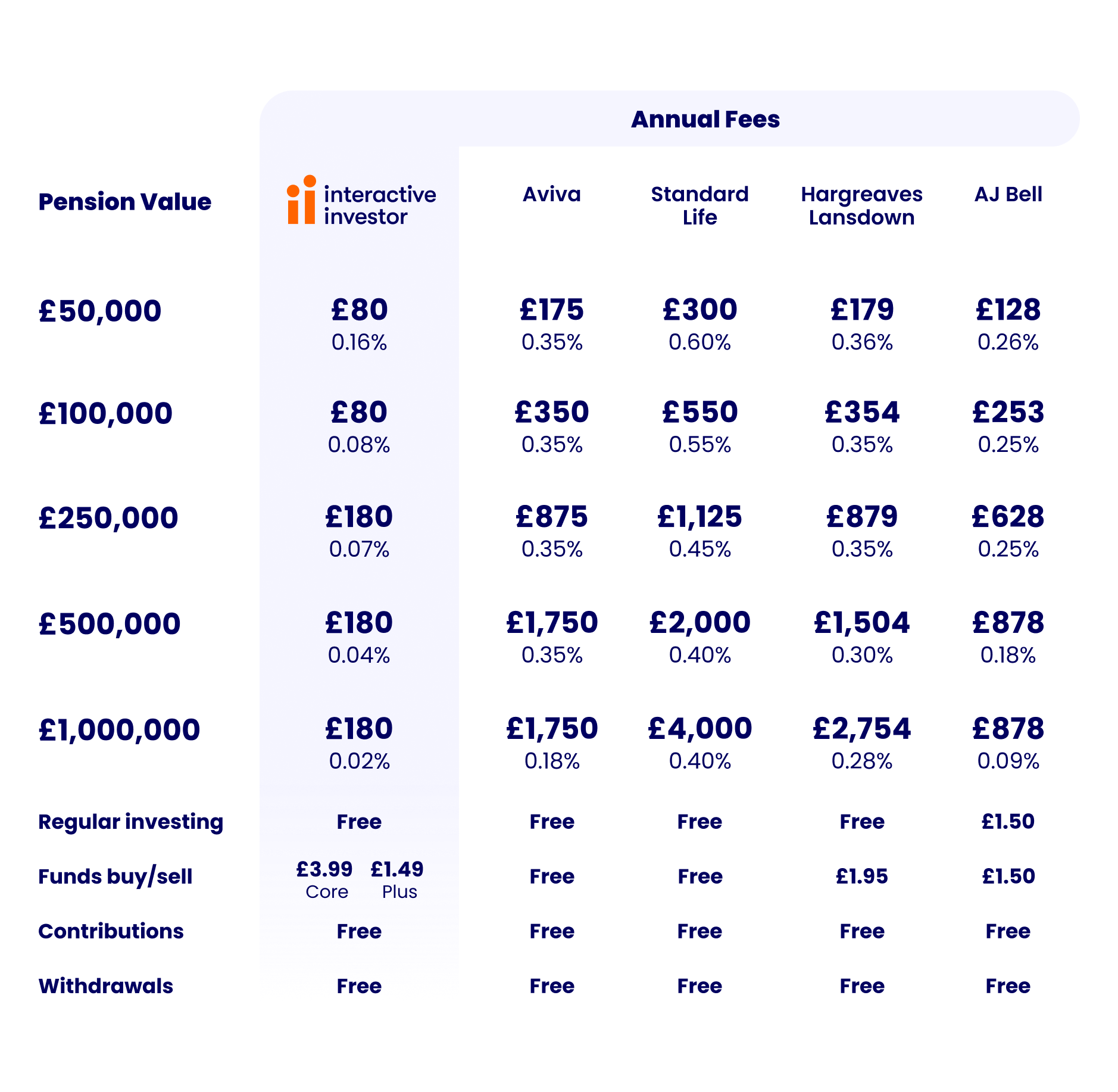

Other SIPP providers usually charge a percentage of your pot. That means you’ll be charged more as your pension grows in value. The ii SIPP is different. With our low, flat fee, from just £5.99 a month, you can keep more of what’s rightfully yours.

Combine your pensions into the ii SIPP so you can manage them better. Our SIPP offers a wide range of investments and flexible retirement options to suit most people’s needs. You can also take advantage of our expert picks to get started.

It’s easy to keep track of your pension via our website and secure mobile app. But if you’re ever in need of SIPP support, you can count on us. We’re happy to say that ii has more 5-star Trustpilot reviews than any other UK SIPP provider.

For the fourth year in a row, independent analysts at Which? have recognised the ii Personal Pension (SIPP) for its industry-leading choice, support and value.

We’ve also been named Best Contractor Pension Provider at the Contracting Awards 2025.

Join over 500,000 ii investors and start prioritising your pension, with our award-winning, low-cost SIPP.

See how much you could save with our low, flat monthly fee Personal Pension compared to other SIPP providers that charge percentage-based fees.

Here's a look at our flat monthly fees:

With ii, you will always pay a low flat fee - helping you keep more of your money invested for the future.

Important information - Annual charge comparisons based on published SIPP charges on 01/02/2026 for Aviva SIPP, Standard Life SIPP (Level 2 Investment Options) & AJ Bell SIPP. Hargreaves Lansdown SIPP charges based on new pricing plan effective 01/03/2026. Assumptions: 100% holding in funds - choosing other assets such as shares and ETFs, may result in lower charges. Two fund purchases/sales. Pension charges only, excludes fund manager charges. Read more about our analysis. Verified as accurate by The Lang Cat.

“With a lot of providers’ charges, it’s this plus that plus that. Whereas with ii, it’s straightforward. What I pay is what I pay – ii’s fees are just so much cheaper. That’s why I’m with ii.”

Mark, 47, was frustrated with the fees he was paying with his old provider. With ii’s low flat fee, he believes he may be able to retire earlier.

You can invest with no annual allowance with either a Personal or Company Trading Account. Build a diverse portfolio with access to wide range of investment options in a flexible account that’s safe and secure.

Important information: The ii SIPP is for people who want to make their own decisions when investing for retirement. As investment values can go down as well as up, you may end up with a retirement fund that’s worth less than what you invested. Usually, you won’t be able to withdraw your money until age 55 (57 from 2028). If you’re unsure if a SIPP is right for you, please speak to an authorised financial adviser.

To start investing with ii, you’ll first need to open an account. Choose from our Stocks & Shares ISA, Self-Invested Personal Pension (SIPP) or Trading Account.

You can open your account in less than 10 minutes, either here on the website or through our mobile app.

You’ll need to add cash or start a transfer to your account to start investing. You can do this by making a one-off payment or setting up a monthly direct debit.

Choose from our extensive range of shares, funds, bonds and more. Need help deciding? Get some inspiration from the experts, including our SIPP investment ideas.

When you’ve got cash in your account and chosen your investments, you’re ready to invest. You can also use our free regular investing service. Simply set up a monthly payment to buy your chosen investment, and you won’t pay any trading fees.

Yes, your limited company can make employer pension contributions, which are treated as an allowable business expense. This can reduce your company’s taxable profits and lower your corporation tax bill by 19-25%, depending on your profit level. Contributions must be reasonable and justifiable as part of your overall remuneration.

Yes, you can easily set up ii SIPP pension contribution through your limited company. You can set regular or ad hoc contributions. Check out our guides for both below:

You can contribute 100% of your annual income to your SIPP each tax year, up to the maximum annual allowance of £60,000. This annual allowance includes personal contributions, employer contributions and tax relief.

Employer contributions count towards your £60,000 annual allowance but are not limited by your income.

Yes, as a limited company director, you can make both personal and business (employer) contributions to an SIPP (Self-Invested Personal Pension).

How It Works:

Personal Contributions – Made from your post-tax income. You’ll automatically receive 20% tax relief, and higher-rate taxpayers can claim additional relief through self-assessment.

Business (Employer) Contributions – Made directly from your company, reducing taxable profits and potentially lowering your corporation tax bill (19-25%, depending on profit levels). These contributions are not limited by your salary but must be wholly and exclusively for business purposes to qualify.

You can use both methods, but the total contributions must not exceed the £60,000 annual allowance (unless using carry forward).

For every personal payment you make into your SIPP from your net income, we’ll automatically claim basic rate (20%) tax relief for you. So, if you contribute £80, this will be topped up to £100.

Once your tax relief has been sent to us by HMRC, we’ll pay it as cash into your SIPP account, so you can choose how to invest it.

If you’re a higher rate (40%) or additional rate (45%) taxpayer, you can claim back the rest of your tax relief through your annual Self Assessment.

Yes, you can have a SIPP and a workplace pension and can pay into both at the same time. Just make sure your total contributions don’t exceed your annual allowance.

Once you’ve maximised your employer pension contributions, paying into a SIPP can be a great way to complement your workplace savings.

Find out more about Workplace pension vs SIPP.

Call our award-winning UK-based support team on 0345 646 2390 between 8am-4.30pm, Monday to Friday.

If you’re thinking about retiring soon and want to understand your options, make sure you speak to someone at Pension Wise.

Pension Wise is part of the government’s Money Helper service, offering free and impartial pension guidance to the over-50s. They can also help you decide if transferring your pension is the right choice for you.