ii Super 60 FAQs

Learn more about the ii Super 60 and how to start investing.

Your questions answered

- What is your selection process for Super 60 constituents?

- How is your list any different from everybody else’s rated lists?

- How many changes do you expect to the list?

- Are there any hidden commercial considerations to be aware of?

- Why don’t we ask for discounts?

- How do flat fees benefit our customers?

- What are the investment categories?

- Are these recommendations?

- How much does it cost to buy the Super 60?

- What is a fund?

- What is a trust?

- What is the difference between a fund and a trust?

- What is an ETF?

- What is the difference between active funds and passive funds?

- How can I invest in the Super 60?

- What information do I need to open an account?

- Can I invest in the Super 60 in an ISA or SIPP?

- Can I set up a regular investment and buy these investments monthly?

- Can I hold other investments in my account?

- Which investment is right for me?

- How can I look at alternative investment options to invest in?

What is your selection process for Super 60 constituents?

We have chosen to partner with Morningstar’s Manager Selection Services group to enhance our fund selection process and they will follow the principles summarised below and then explained in further detail.

It’s made up of seven steps:

- Initial screening

- Performance analysis

- Cost assessment

- Risk profiling

- Qualitative assessment

- Selection and approval

- Review and refresh

Here’s more detail about the seven steps:

- We look at all available tradeable options in the selection process for the Super 60. We then, using a variety of filters including track record and liquidity, pick out an initial list of viable funds for full review and discussion.

- With performance, we look at both long and short-term performance of active investments and try to identify those that deliver superior performance consistently. The list may occasionally include a few deliberately 'contrarian' choices where the investment style pursued by the manager has not been in favour, but where we believe past performance and/or the current investing environment suggest a change in fortunes may be due. In the case of passive funds we are looking at costs and tracking errors and trying to make sure they deliver as close to benchmark returns as possible.

- We then look at cost and remove investments with an initial charge or those that are too expensive relative to their peer group unless their performance makes them compelling.

- The risk rating process is focussed on identifying those managers who are able to deliver the strongest risk-adjusted returns. Investments with poor risk characteristics relative to peers are eliminated.

- In addition to analysing historical performance data, investments are also subjected to qualitative due diligence. Factors taken into consideration include manager track record and yields, where relevant, plus dealing spreads and share price discount or premium to underlying asset value for investment trusts.

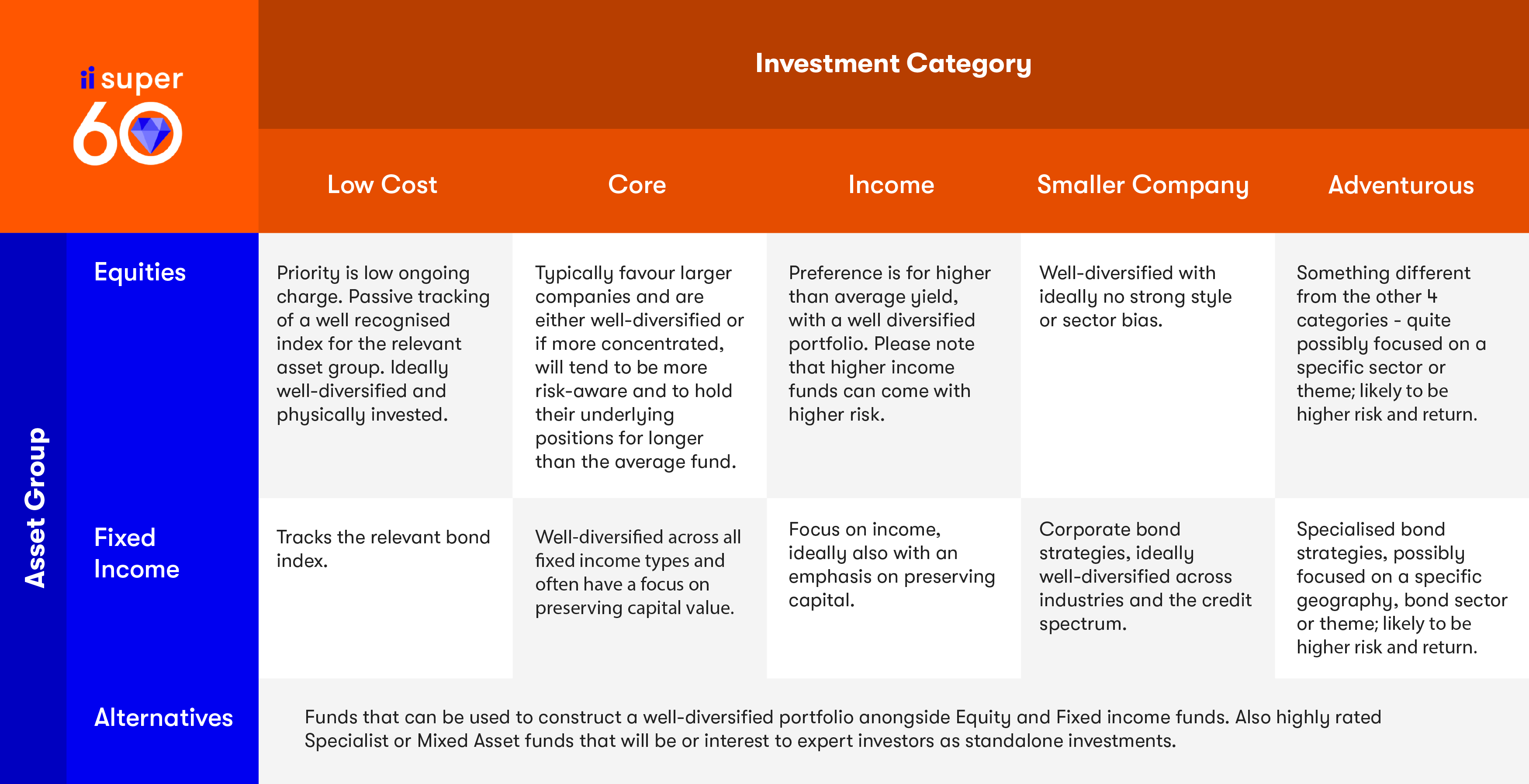

- By this point in the process we will have distilled the original investment list to around 260 high quality funds, investment trusts and ETFs. From this shortlist, we now identify the 60 investments we believe to be the most suitable candidates for the 15 x 5 matrix of asset groups and investment categories described above. The selection and approval process is overseen and challenged by the Investment Committee. The committee comprises of both internal experts and can draw on independent external experts as required.

- We maintain regular contact with the management companies of all investments on the Super 60 recommended list, to ensure that each selection continues to be managed in line with our expectations. In particular a detailed fund questionnaire is being completed each year for each Super 60 investment, covering all the key areas of our due diligence process and based on information sourced directly from the management company concerned.

- The Super 60 list is monitored continuously for ‘yellow card’ events. Examples include, but are not limited to, fund manager moves, soft closures (where a fund closes to new money) or a major rating downgrade from external or internal sources. Investments that experience a yellow card event are automatically placed under formal review. In addition, we monitor the performance of the Super 60 on a monthly basis, based on peer group rankings over multiple periods. Inevitably, investments have periods of out- and under-performance. Our approach aims to identify, in a timely manner, those that are struggling, so we can assess whether this is caused by fundamental reasons rather than temporary tactical reasons.

How is your list any different from everybody else's rated lists?

Our screening process begins with the entire collective investment universe rather than just the funds universe. Including investment trusts and exchange-traded funds (ETFs) is essential to making sure we include the best possible options. Choosing to only concentrate on funds would overlook two thirds of the collective market, which can’t be optimum for investors.

Cost to the investor is one of our principal considerations, but it is a factor in relation to the underlying success of the investment rather than the only thing that matters or even a mandatory requirement for getting on a list at all.

Our selection process is rigorous and independent and cannot be influenced by potential conflicts of interest.

How many changes do you expect to the list?

Once a year we repeat the entire selection process described above, beginning with a refresh of the entire universe of tradeable investment options. This ‘clean sheet’ approach ensures that we consider any new fund offerings and significant market events so that our list remains fresh. The danger with simply maintaining rated lists and not ever adopting a full review of the universe is that you might keep less attractive investments on the list for longer and miss good new opportunities.

In spite of these measures to replace and refresh we do not anticipate a high rate of turnover, with the majority of funds expected to retain their Super 60 rating over several years. This is consistent with our aim of selecting investments that should be suitable for long term investment purposes.

Why don't we ask for discounts?

We are happy to obtain discounts from fund management groups, and our aim is to provide the keenest prices in the market. However, we do not allow such commercial considerations to affect the selection process, which should choose the best investments available before any marginal discounts are offered. If we are subsequently able to achieve better prices for our customers for some of the Super 60 constituents, then this will be an additional bonus. [Note – discounts are generally easier to obtain for higher-cost actively managed funds.] Even without discounts, the cost of buying a fund is usually cheaper for ii customers than obtaining a discount and paying a percentage-based platform fee elsewhere.

How do flat fees benefit our customers?

Flat fees are typically more advantageous for those customers who already have assets more than £20,000. For those with more substantial assets, the benefit is even more pronounced, enabling investors to save thousands of pounds each year in costs.

For an investor who chooses to invest in low-cost passive funds, it makes no sense to pay a large percentage-based platform fee on top of the small management fee.

Are these recommendations?

No, as an execution-only provider we do not provide advice involving personal recommendations. Our objective is to develop a trustworthy shortlist of rated investments from which our customers can choose their own investments.

In our experience, individual investors tend to have product type(s) they prefer, be they ETFs, funds or investment trusts, or to be primarily active or passive investors. Where possible, we try to include attractive options in each of these categories.

The Super 60 section of the ii website includes explanatory information on each asset group and investment category. Factsheets for each of the funds and trusts are updated regularly. They contain current performance and valuation metrics, as well as key statistics to help investors make their own judgements.

The Super 60 rated fund list is for information and discussion purposes only and does not form a personal recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in the rated investment list may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

How much does it cost to buy the Super 60?

Our customers pay a monthly fee, depending on the Service Plan they choose. There are additional fees for buying and selling investments. Regular investing is free. View our full rates and charges.

What is a fund?

A fund is a pool of investors' money run by a fund manager who invests on behalf of the customer, invested into different assets and professionally managed by the fund manager and their research team. Each investor receives units, which represent a portion of the holdings of the fund.

What is a trust?

Investment trusts are listed companies that invest in the shares of other companies or fixed income securities, unquoted securities or property.

As a listed company its shares are quoted on the London Stock Exchange and the share price is determined by demand and supply.

What is the difference between a fund and a trust?

Investment trusts are closed-ended companies. This means they have a fixed number of shares in issue, unlike Funds that are open-ended investment companies ('OEICs') or Unit Trusts. Investment Trusts are also listed companies and must have an independent board of directors that are obliged to answer to their shareholders.

What is an ETF?

Exchange-traded funds (ETFs) are collective funds that trade on a stock exchange. They are designed to track the movements of an index, commodity or basket of assets. They will do this by taking positions in the underlying securities that make up an index in the same weights that they appear in that index.

ETFs are offered on a vast range of indices and commodities and usually have a lower annual management fee than other types of collective investment fund. They are also bought and sold in the same way as normal shares, but because they are a basket of stocks like a fund, you do not pay stamp duty on the purchase of ETFs, as stamp duty has already been paid on the underlying investments held by the ETF. However, you will be subject to tax on any gains made from your investment in an ETF.

What is the difference between active funds and passive funds?

An actively-managed investment fund has an individual fund manager or a team of managers who make investment decisions for the fund. They seek to deliver a higher return than the relevant market index.

Passive management of a fund intends to track the returns of an index, it doesn't have a fund management team making decisions.

Passive funds typically cost less than actively managed funds.

What information do I need to open an account?

To open a Trading Account you must be 18 or over and either a UK, Channel Islands or Isle of Man resident. You will need the following information.

• Your address details (last three years)

• Your National Insurance number

• Your debit card details.

Can I invest in the Super 60 in an ISA or SIPP?

Yes. All these funds can be held in a Stocks and Shares ISA or a SIPP (Self-Invested Personal Pension) and being tax-efficient is hugely important over the long term.

Can I set up a regular investment and buy these investments monthly?

Yes. Our account allows you to invest regularly for free. This allows you to build up your investment portfolio in a simple, low-cost way to achieve your investment goals. It also ensures that you can balance your returns over the longer term, removing the worry of investing a lump sum.

Click here for more details.

Can I hold other investments in my account?

Yes. Once you have an account with us you can choose to invest across a wide range of investment options including funds, investment trusts, ETFs, equities (shares), including both the UK and a wide range of international markets, and bonds.

We also offer a range of tools and filters to try and make it easy for you to decide what investment options suit you.

How can I look at alternative investment options to invest in?

We offer search options that allow you to explore the whole range of available funds, shares, investment trusts and ETFs.

The Super 60 / ACE 40 investments list has been selected by our investment experts to help narrow down the wide choice of available investment products. We believe it represents a set of high-quality choices, across different asset classes, regions, and investment types.

However, you should note that the selection of Super 60 / ACE 40 investments list is not investment advice or a ‘personal recommendation’. This means neither we, nor Morningstar, have assessed your investment knowledge, your financial situation (including your ability to bear losses), your investment objectives, your risk tolerance, or your sustainability preferences.

You should ensure that any investment decisions you make are suitable for your personal circumstances, and if you are unsure about the suitability of a particular investment or think you need a personal recommendation, you should speak to a suitably qualified financial adviser. Neither ii nor Morningstar are responsible for any trading decisions, damages or other losses related to the Super 60 / ACE 40 investments list.

The past performance of an investment is not a reliable indicator of future results, and ii or Morningstar do not guarantee or predict the future performance of the Super 60 / ACE 40 investments list as a whole or the constituent investments.