10 dividend growth stocks to boost investment returns

5th April 2023 13:41

by Ben Hobson from interactive investor

In a bearish period like this, companies with a long track record of dividend growth could offer comfort. Stock screen expert Ben Hobson identifies dividend achievers that might outperform higher yield stocks with lower growth.

Company dividends have soared up the agenda for investors hunting dependable returns in risk-off markets. One strategy for finding them is to track down firms with a solid history of growing their payouts.

After a strong start to 2023, stock market prices came under pressure in March. It was a reminder that economic headwinds remain, and that investors are still wary of what the future holds.

- Invest with ii: Share Dealing with ii | Top UK Shares| Cashback Offers

On a one-year basis, the return from the FTSE 100, the index of Britain’s largest shares, is virtually unchanged. The FTSE 250 and FTSE SmallCap are both down 12%, and the growth-oriented Alternative Investment Market (AIM) is down more than 23%.

While these index performances tell a fairly pessimistic story about equity returns, it’s not all bad news. Many companies have been able to fend off the worst effects of high inflation and rising interest rates to protect their profits. It’s these firms that are better placed to maintain and grow their dividends over time.

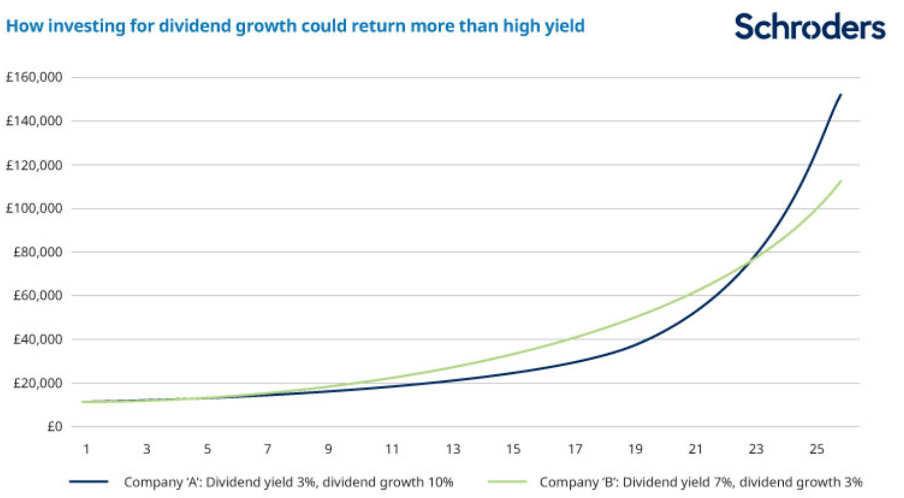

But dividend growth investing isn’t just a rainy-day strategy. If you examine the maths, choosing between high yield and high growth can deliver very different returns over time. Given that you rarely get both high yield and high growth together, it comes down to a choice.

- Stockwatch: could this AIM share be a massive winner?

- 10 quality UK stocks that are reasonably priced right now

- Insider: directors spend over £300,000 on three well-known shares

As a rule of thumb, the dividends paid out on high yielding shares tend not to grow at high rates. By contrast, shares in companies that grow their dividends tend not to have high yields. That’s partly because dividend growth is associated with earnings growth, which is something the market likes to see. It pushes up share prices and keeps the yields much more modest.

Figuring out which approach is superior is tricky because share prices move around all the time. But all else being equal (pretending that share prices don’t move), high growth/lower yield outperforms low growth/higher yield over the long term.

This chart from Schroders shows how it can happen:

You can see that a lower yield and higher growth (blue line) takes time to outperform, but eventually the difference is significant. Throw in the expected share price appreciation from dividend growth shares and you can see why so many find it an appealing strategy.

Companies with a long track record of dividend growth, in excess of 10 years, are so revered that they come with their own name: ‘dividend achievers’. To find them, all that’s needed is some all-weather dividend investing rules, together with a search for dividend growth over time. Here is how you might do it:

- A notional starting point is to look for an element of safety in companies with a market cap of more than £500 million

- A minimum forecast yield, and an average yield over five years, of 1.5%

- Forecast dividend cover of at least 1.5x

- More than 10 years of dividend per share (DPS) growth

Importantly, I haven’t specified how quickly the dividend should be growing, but it’s certainly interesting to look at this. In the first table below, our results show there are companies in the market with long histories of dividend growth. On an annualised 10-year basis, the growth ranges from 5.5% at Croda International (LSE:CRDA) to 34.3% at Ashtead Group (LSE:AHT).

Name | Market cap (£m) | Forecast yield (%) | DPS years of growth | DPS annualised growth - 10 years (%) | Industry |

8,917 | 1.8 | 24 | 5.5 | Basic Materials | |

3,654 | 2.1 | 22 | 14.1 | Industrials | |

7,988 | 2.5 | 22 | 5.6 | Technology | |

30,279 | 2.9 | 19 | 3.3 | Industrials | |

1,614 | 2.6 | 19 | 10.2 | Consumer Staples | |

3,008 | 1.8 | 19 | 13.9 | Healthcare | |

1,110 | 4.4 | 18 | 13.1 | Industrials | |

10,283 | 2.2 | 17 | 7.9 | Industrials | |

81,455 | 2.2 | 17 | 5.8 | Consumer Staples | |

20,307 | 1.6 | 16 | 34.3 | Industrials |

Source: SharePad

As expected, the forecast yields are modest, ranging from 1.6% at Ashtead to 4.4% at the only AIM stock on the list RWS Holdings (LSE:RWS). Industrials are a common theme in the top 10, and there’s a defensive feel to these results. That echoes the sense of dependability you get with dividend growth companies.

I have gone further with the data to try and understand slightly more about the profile of these shares. As per the rules, the forecast dividend cover (the degree to which earnings cover the dividends paid) is above 1.5x for all, but the average five-year cover is well above 2x in several cases, which is encouraging.

In terms of profitability, the average five-year return on capital employed for these shares is generally well into double-digits. While it’s not easy to compare the shares on that basis, it does suggest some solid financial quality.

Name | Dividend cover 5y av | ROCE 5y av | Relative price strength 1y | Index |

2.2 | 16.8 | -19.5 | FTSE 100 | |

2.1 | 18.2 | 3.0 | FTSE 250 | |

1.6 | 16.0 | 7.8 | FTSE 100 | |

2.0 | 11.3 | 37.2 | FTSE 100 | |

2.7 | 16.2 | -15.1 | FTSE 250 | |

2.8 | 14.1 | -37.5 | FTSE 250 | |

2.3 | 9.7 | -19.8 | AIM 50 | |

2.8 | 13.8 | 0.9 | FTSE 100 | |

1.8 | 15.4 | -6.6 | FTSE 100 | |

4.0 | 16.0 | -2.2 | FTSE 100 |

Source: SharePad

Of the FTSE 100 companies passing these rules, Croda has seen its shares underperform the most on a relative basis - down -19.5% over the year. BAE Systems has been the best performer, up 37.2%. The FTSE 250 stocks show much more variation, which reflects the volatility in that index over the past 12 months.

Dividend growth to boost returns

One of the observations from this screening strategy is that long term, there are certainly ways of detecting excellent dividend growth records in large, high-quality companies. In terms of successive years, dividend growth in the UK market can be found stretching towards two decades in some stocks. On an annualised basis, the growth varies but it can be impressive.

In the short term, these dividend achievers aren’t guaranteed to be rewarded by the market. Many have seen their prices fall over the past year - and it’s certainly worth investigating company health and financial trends to get more certainty. But in a bearish period, dividend growth shares could offer some longer-term comfort. We’ll keep an eye on these shares to see how that plays out.

Ben Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.