10 small-cap shares to lead a recovery in 2023

4th January 2023 13:58

by Ben Hobson from interactive investor

After a painful year for fledgling companies, stock screen expert Ben Hobson pinpoints which shares could be at the vanguard of a recovery.

Last year was a difficult one for investors in UK small-cap shares. Rising inflation and a series of interest rate hikes corresponded closely with a fall in the valuations of the main small-cap indices.

The implied economic consequences of those rate rises, such as lower consumer spending, constrained growth, possible recession and certainly risk-off sentiment, hurt small-caps the most.

- Invest with ii: Share Dealing with ii | Open a Stocks & Shares ISA | Our Investment Accounts

But could that change soon? And if it does, where can you find small-caps that are already showing signs of bucking the trend?

Predicting a pivot by central banks

Cast your eye over some of the predictions published by investment banks and commentators over the new year, and you’ll find some clear themes.

One is a sense that inflation will ease in 2023. Energy prices were a major inflation driver last year, and we already know that they are now falling. Quite how bumpy things will be from here is still unclear, but so far the signs are promising.

This is important when you think about how interest rate hikes (that aim to tame inflation) hammered small-cap valuations last year.

- An AIM share to own in 2023

- Five AIM share tips for 2023

- Visit our YouTube channel to view our experts’ tips for 2023

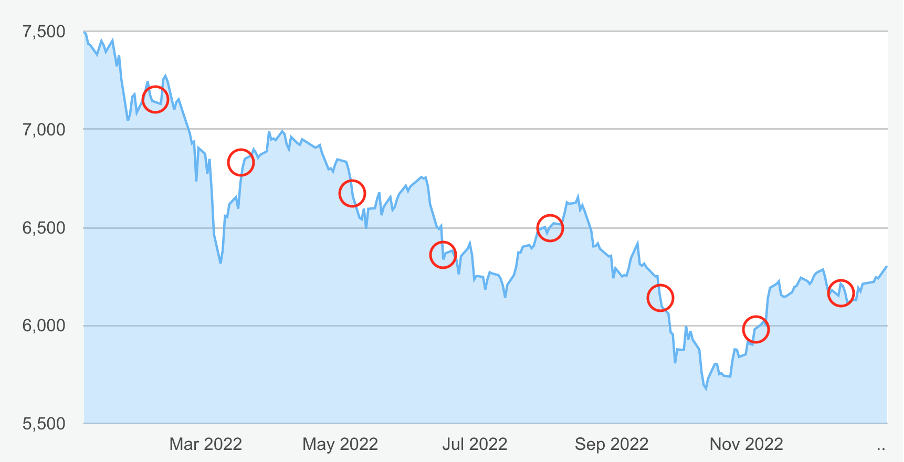

The FTSE Small Cap index (excluding investment trusts) comprises fully listed shares that fall outside the largest 350 companies in the market - and it fell by a painful 19.8% in 2022.

The AIM 100 index, which is home to shares with a similar median market cap as the small cap index (of just under £300 million) fell even further, by 33.6%.

The chart below shows how the Bank of England’s sequence of rate hikes last year correlated with a fall in the FTSE Small Cap index:

Bank rate increases in 2022 versus the FTSE Small Cap Index

It is worth remembering that the market knew that rate rises were coming, so it was constantly trying to anticipate the size and frequency of those moves. Relentless hikes dragged down the index over time.

If inflation does start to ease soon, it seems likely that the market will look for signs of a pivot in the Bank of England’s strategy as it tries to engineer a soft economic landing. That could breathe life into small-cap share prices.

This brings us to the second main theme in recent market commentary, and that’s that the UK market - and small-caps in particular - now look noticeably cheap relative to many other countries. That doesn’t mean that small-caps won’t fall further, but it is a massive plus for those who have been wary of frothy valuations in recent years.

As always, timing the market is next to impossible. An added challenge in these conditions is judging how a potential recession might impact company earnings. That uncertainty makes accurate valuations and earnings forecasts even more difficult than normal.

Hunting for cheaper small-caps on the move

One factor that could be useful in the search for early recoveries among small-caps this year is momentum. Price trends have been negative for many small-caps over the past year, but some have resisted. So finding those with solid medium and near-term price strength could be a useful clue.

- This is what the ideal share for 2023 looks like

- Why these could be 10 of the most reliable shares for investors in 2023

That said, momentum can be a risky tool in volatile conditions when the economic outlook is uncertain. So combining it with a focus on ‘cheapness’ (where the shares might be recovering) or financial strength (where the market is warming to higher-quality firms) makes sense.

With that in mind, this week’s screen focuses on companies quoted on the FTSE Small Cap and AIM 100 indexes. Here, firms are small but generally more financially stable than speculative micro-caps.

This is a sweet spot for individual investors because shares here can potentially re-rate much quicker than those of larger firms. Institutional investors can struggle to deal in size in the shares of these firms, so they tend to attract less research coverage. Again, this gives private investors an edge.

Screening techniques to spot momentum

A popular technical approach to finding shares on the move is to look for those with 50-day moving average prices that are ahead of their 200-day moving average prices. This is known as the ‘golden cross’.

Moving averages (such as the 50 day MA) work by cutting out the noisy day-to-day price movements that might hide the underlying price trend. With this ‘golden cross’ measure, anything over 100% suggests that near-term price momentum is accelerating - and that can be a positive sign.

This screen looks for firms where

- The 50-day moving average price has risen above the 200-day moving average price

- Price strength has been positive against the market over one year, three months and one month

- Positive forecast earnings-per-share growth in the year ahead

Name | Mkt Cap (£m) | 1 Year Relative Price Strength (%) | 50dMA / 200dMA (%) | Forecast EPS Growth (%) | Forecast P/E Ratio | Sector |

Hunting (LSE:HTG) (HTG) | 549.3 | +104 | 103.43 | 361.0 | 21.1 | Energy |

431.0 | +98.2 | 121.42 | 8.0 | 9.4 | Technology | |

352.8 | +39.6 | 122.36 | 5.8 | 30.7 | Technology | |

268.3 | +35.8 | 121.17 | 14.7 | 9.2 | Consumer Cyclicals | |

184.0 | +18.5 | 100.42 | 6.9 | 5.3 | Basic Materials | |

453.2 | +16.2 | 106.43 | 5.4 | 9.8 | Technology | |

298.6 | +10.7 | 109.61 | 11.7 | 13.8 | Industrials | |

168.5 | +3.29 | 102.90 | 7.9 | 8.5 | Consumer Cyclicals | |

529.5 | +2.52 | 103.77 | 5.8 | 23.8 | Industrials | |

Zotefoams (LSE:ZTF) (ZTF)* | 160.9 | -14.8 | 105.69 | 19.9 | 17.1 | Basic Materials |

Data: Stockopedia

Unsurprisingly, this momentum-focused strategy picks up some of the best performing small-caps over the past year, including self-serve vending machine business ME Group International (LSE:MEGP) and customer management systems specialist Cerillion (LSE:CER). Both companies have been beating earnings forecasts over the past year, and that is showing up in the price momentum in their shares.

Others include the energy services group Hunting (LSE:HTG), which is set to swing from a loss to a solid profit in the year ahead and engineering consultancy Ricardo (LSE:RCDO). Note also that several of these shares are on single-figure price-to-earnings (p/e) ratios, including Card Factory (LSE:CARD), Capital Ltd (LSE:CAPD), CentralNic Group (LSE:CNIC) and Ten Entertainment Group (LSE:TEG).

The only exception to the rules in the table is Zotefoams (LSE:ZTF), the specialist foam manufacturer. Technically it fails because its one-year relative price strength is below the market. But it passes on a three-month and one-month basis and its price does show technical signs of accelerating. It also has a solid earnings per shares (EPS) growth forecast of nearly 20%. It’s an example of how negative one-year performance can give way to much more positive nearer-term signals that might prompt further investigation.

Overall, small-caps have been on the ropes over the past year, with interest rate rises casting a big shadow over the economic outlook for the market’s smaller companies. Despite the headwinds, some firms in this territory have still delivered solid performances and look capable of withstanding further pressure.

Careful research is essential in this part of the market - and mixing momentum with a focus on good value and high quality is worth thinking about. There may be more turmoil to come but if you believe the experts, UK small-caps look cheap and any improvement in the economic conditions could trigger renewed interest in them.

Ben Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.