11 stocks for investors wanting growth and income

This trading tactic has staged a recovery in 2019, and more companies are passing the strategy rules.

27th November 2019 13:50

by Ben Hobson from Stockopedia

This trading tactic has staged a recovery in 2019, and more companies are passing the strategy rules.

When it comes to investment strategies, there are various reasons why “fast growth” and “dividend income” might be seen as polar opposites. After all, rapidly growing firms tend to channel their available cash into expansion rather than paying it back to shareholders. But for investors looking for the best of both worlds, is there a happy medium? It turns out there is.

Back in the early 1990s, the late City businessman Jim Slater, wrote an investment guide called The Zulu Principle. In it, he spelled out an investment framework that looked for fast-growing companies trading at reasonable prices. But in assessing the investment case of a share, he saw dividends as an important marker. He wrote:

“I prefer companies to pay a dividend, as most institutions need an income stream from their investments. Also, the dividend payment and forecast (if any) to some extent corroborate the management’s confidence in the future. The ideal company will have a steadily increasing dividend growing broadly in line with earnings.”

For Slater, dividend payouts were a sign of management confidence and the expectation that earnings would grow. He wanted to see earnings and dividend growth to go hand in hand.

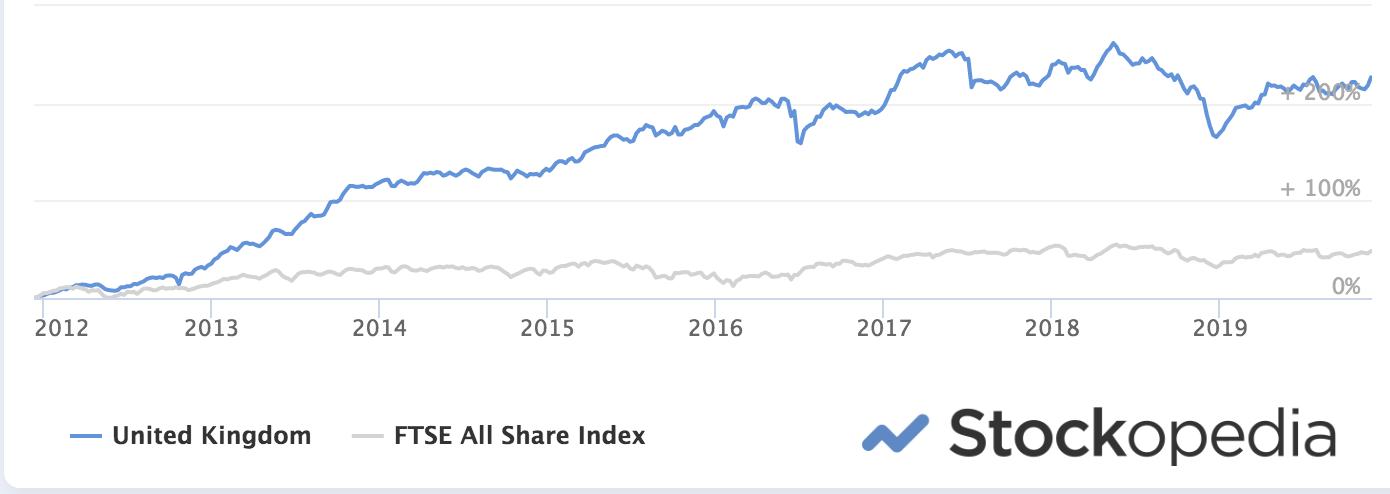

This growth and income blend might sound like some unlikely ideal, but stocks that fit this profile have actually enjoyed periods of very strong performance over the past eight years. Of all the investment models tracked by Stockopedia, one of the standout performers this decade is called Winning Growth & Income.

This strategy had a strong run between 2012 and 2017. It pulled back sharply in the market lull of 2018, but it is staging something of a recovery in 2019. Just as importantly, the numbers of companies passing the strategy rules is starting to grow.

Source: Stockopedia Past performance is not a guide to future performance

What makes growth and income a winning strategy?

The consistency of Winning Growth & Income is down to a simple set of rules that touch on three influential drivers of returns - Quality, Value and Momentum, with the added bonus of above average yield. It’s a strategy inspired by work by US investment analyst Kevin Matras in his book, Finding #1 Stocks.

In terms of quality, the screen looks for companies that are generating profits by looking for an above average Return on Equity and below average levels of debt. In the valuation stakes, the shares should be trading on a below average rolling price-to-earnings ratio. And for momentum, companies need to have seen recent analyst upgrades to their earnings forecasts for the next financial year.

In addition, the minimum market cap rule is set at £20 million, which opens the screen up to smaller - but not micro-sized - companies. But their Beta (the sensitivity of the share to the movement of the broader market) also has to be below average.

In many respects, these rules echo some of what you see in GARP (growth at a reasonable price) strategies. With this in mind, here are some of the top qualifying shares for the Winning Growth & Income approach...

| Name | Mkt Cap £m | Dividend Yield % | Forward PE Ratio | Return on Equity | Forecast EPS upgrades (over the past 3 months) |

|---|---|---|---|---|---|

| Amino Technologies (LSE:AMO) | 81 | 6.8 | 8.8 | 15 | 9.75 |

| Central Asia Metals (LSE:CAML) | 374.9 | 6.7 | 7.7 | 16 | 7.4 |

| Appreciate (LSE:APP) | 89.3 | 6.7 | 8.5 | 57.8 | 1.74 |

| Bovis Homes (LSE:BVS) | 1,799.30 | 4.8 | 10 | 13.7 | 2.2 |

| Gateley Holdings (LSE:GTLY) | 192.2 | 4.7 | 11.6 | 48.7 | 0.01 |

| Property Franchise (LSE:TPFG) | 47.6 | 4.7 | 12.1 | 23.5 | 8.51 |

| TP ICap (LSE:TCAP) | 2,084.30 | 4.6 | 10.5 | 4.8 | 3.69 |

| Barratt Developments (LSE:BDEV) | 6,809.70 | 4.4 | 9.3 | 15.7 | 0.46 |

| MJ Gleeson (LSE:GLE) | 447.2 | 4.2 | 11.9 | 17.1 | 0.24 |

| Finsbury Food (LSE:FIF) | 109.5 | 4.2 | 8.5 | 9 | 0.6 |

| Wilmington (LSE:WIL) | 198.8 | 4 | 12.2 | 27.1 | 1.49 |

Interestingly, this predominantly small-cap list is punctuated by a few very large stocks that manage to tick the growth and income boxes - the interdealer broker TP ICap (LSE:TCAP) and the housebuilders Bovis Homes (LSE:BVS) and Barratt Developments (LSE:BDEV). But elsewhere, these higher yielding growth shares range from names like Amino Technologies (LSE:AMO) and the mining company Central Asia Metals (LSE:CAML) to Finsbury Food (LSE:FIF) and the education and networking specialist, Wilmington (LSE:WIL).

For investors tempted by the excitement of growth but conscious of the importance of dividends when it comes to total return, a combined growth and income strategy could be a useful place to start.

As always, care is needed, particularly because this strategy picks up small-cap stocks, which can be potentially vulnerable, together with high yields, which in extreme cases can be a sign of trouble. But looking for signs of strengthening profitability, an improving outlook and below average valuations could help in the search for growth companies with an added dividend kick.

Stockopedia helps individual investors beat the stock market by providing stock rankings, screening tools, portfolio analytics and premium editorial. The service takes an evidence-based approach to investing, and uses the principles of factor investing and behavioural finance to help investors make better decisions.

- Interactive Investor readers can enjoy a two-week free trial and £50 discount to Stockopedia using the coupon code iii014 - click here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.