Are private investors bargain hunting?

With discounts at their widest levels since the global financial crisis, interactive investor looks at investment trust private investor trends.

14th September 2023 10:17

by Jemma Jackson from interactive investor

The spotlight has been on the investment trust sector in recent months, withdiscounts hitting their widest level since the 2008 Global Financial Crisis this year – and with few signs of narrowing, just yet.

interactive investor, the UK’s second-largest platform for private investors, explores whether this has prompted potential bargain hunting from private investors looking to get more bang for their buck.

- Research: Top Investment Trusts |Sustainable Funds List | Top UK Shares

Looking at ii customer buying ratios, it seems that on the whole, and at least on average, the answer is ‘not quite yet.’

Looking at funds and investment trust ‘buys’, demand for investment trusts has actually dipped in relative terms this year to date versus last year, according to ii data. That said, trusts continue to be far more popular than funds, despite there being far fewer of them.

Looking at ‘real time’ buys, which strip out regular investing, 54% of trades in collective funds this year to date have been in investment trusts, versus 46% for open-ended funds. But over the same period a year ago, investment trusts accounted for 59% of ‘buys’ versus 41% for funds.

More than sentiment?

It seems that unusually wide discounts seem to go beyond market sentiment. For context, global shares have risen about 10% this year, in sterling terms, and there is much less “fear” in markets than during the global financial crisis, according to fund manager surveys. So you might have expected discounts to narrow this year and boost returns for shareholders after a genuinely tough 2022 for stock and bond markets. But there’s no sign of discounts narrowing.

Sam Benstead, Deputy Collectives Editor, interactive investor, explains: “There are three reasons that discounts are stubbornly wide despite a stock market rebound. One is the impact of higher interest rates on trusts investing in ‘alternative’ sectors for income. Alternative investment trusts that pay an income have grown in importance over the past decade, as investors looked for income outside of traditional stocks and bonds due to falling yields. However, rising bond yields have taken the shine off these alternatives as investors now have a genuine option for income from the bond market.

“Another is new rules around cost disclosure that are making some investment trusts less attractive to investors. That includes wealth managers and fund managers, who had already been weaning themselves off trusts on scale grounds. The third reason has been scepticism about the valuations of private assets, and some high-profile issues in the industry haven’t helped.”

Discounts widening – time to buy?

ii’s data today shows that regular investors have an even higher tendency to buy investment trusts versus funds, and seem less phased by discount volatility, with 60% of buys in collective investments being via investment trusts. But looking at real time buys – we can see that ii investors are buying fewer investment trusts this year compared with 2022.

Investment trust buys versus fund buys on ii between 1 Jan and 31 Aug - each year from 2019-2023

Real Time | Inv Trusts | Funds | Regular Investing | Inv Trusts | Funds | All Trades | Inv Trusts | Funds | ||

2019 | 49% | 51% | 2019 | 62% | 37% | 2019 | 57% | 42% | ||

2020 | 54% | 46% | 2020 | 64% | 35% | 2020 | 60% | 40% | ||

2021 | 52% | 48% | 2021 | 60% | 40% | 2021 | 57% | 43% | ||

2022 | 59% | 41% | 2022 | 60% | 39% | 2022 | 60% | 40% | ||

2023 | 54% | 46% | 2023 | 60% | 39% | 2023 | 58% | 41% |

Kyle Caldwell, Collectives Editor, interactive investor says: “There’s no question that investment trusts are grappling with some headwinds right now, and it is interesting to see that private investors aren’t rushing out to the sales just yet. There’s never any guarantee that a discount won’t widen out further, and it’s always worth scratching under the surface to make sure something isn’t cheap for a very good reason.

“But history also tells us that over the long term, brave contrarian investors can be reworded, as recent AIC data looking at past discount troughs recently bears out. And if you don’t want to invest purely in passive funds, investment trusts are the ultimate active vehicle. That’s because they have some unique structural features such as the ability to gear to enhance returns and smooth dividends for tougher times.

“There may be no quick fix for investment trust discounts, but the investment trust industry has tended to be good at managing them over the long term. And in a world where growth can be hard to come by, there’s nothing wrong with a good bargain if you can find one.”

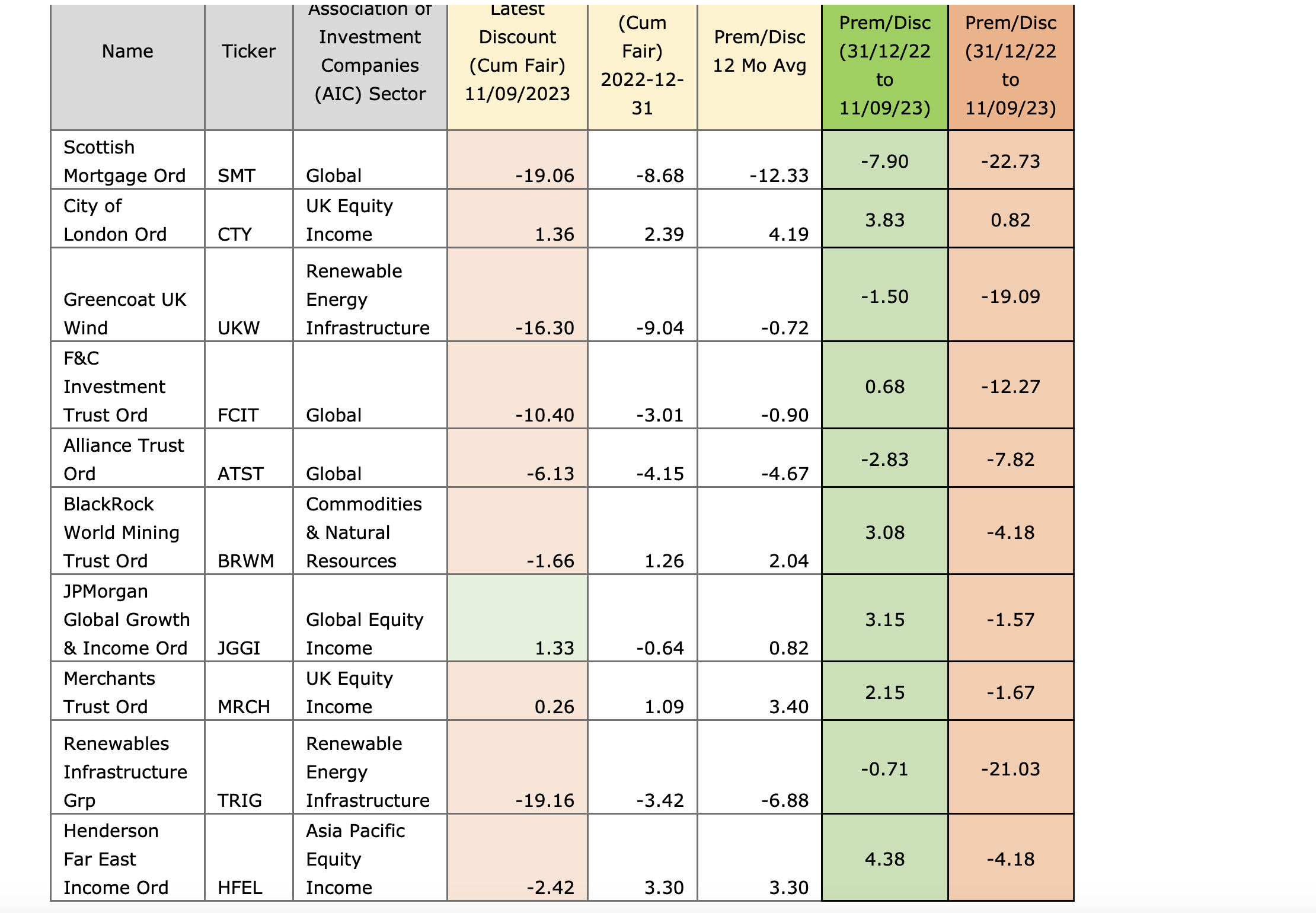

The most-popular trusts on ii: where are the discounts?

Most-bought investment trusts on ii (real time) YTD 31 December 2022 – 11 September 2023 |

Discount highs and lows – ii’s most-bought investment trusts YTD

Source: Morningstar Direct Discount Cum Fair to 11/09/2023

Commenting on the data above, Alex Watts, Investment Data Analyst, interactive investor, explains: “Of the 10 most-bought trusts on ii year to date, we can see that all but one (JPM Global Growth & Inc) are trading at a deeper discount than they were at the end (market close) of last year.

“In addition, all but one (JPM Global Growth, again) are trading at a deeper discount or smaller premium to than their 12-month average.

“Of these most bought, the greatest ranges in discount over the year-to-date period come from those few investments (Greencoat UK Wind, Renewables Infrastructure, Scottish Mortgage) holders of unlisted assets within the portfolios, while other trusts dealing in more easily valued listed, large-cap equities, such as City of London and Merchants Trust saw relatively minimal movements in discount/premium rates through the time period. It is important to note, however – that both of these trusts enact a form of discount management.”

*Association of Investment Company and Morningstar data, as of 8 September 2023.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.