Bank stocks: one to buy, one to hold and one to sell

It’s a good time to be a bank, and shares have been strong through earnings season so far. Analyst Rodney Hobson is still bullish on one lender, but not so hot on two others.

23rd October 2024 08:01

by Rodney Hobson from interactive investor

Banks have got the quarterly results season off to a great start in the United States, sending the key S&P500 index to a record high with 6,000 points suddenly looking highly achievable. This is a big improvement from earlier this year when financial institutions were complaining that lack of dealmaking and higher interest rates were depressing their profits.

Earnings from other large American companies will play a role in banks’ potential profits but, with the US economy holding up well, the rest of the year is looking good for the finance sector. Falling interest rates across developed economies would normally be a negative for banks, as the spread between borrowing and lending rates are squeezed, but the boost to Western economies should offset that effect for the foreseeable future.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

interactive investor’s Keith Bowman has already analysed results from JPMorgan Chase & Co (NYSE:JPM) and Citigroup Inc (NYSE:C) but three other major American banks have added varying degrees of success to the mix.

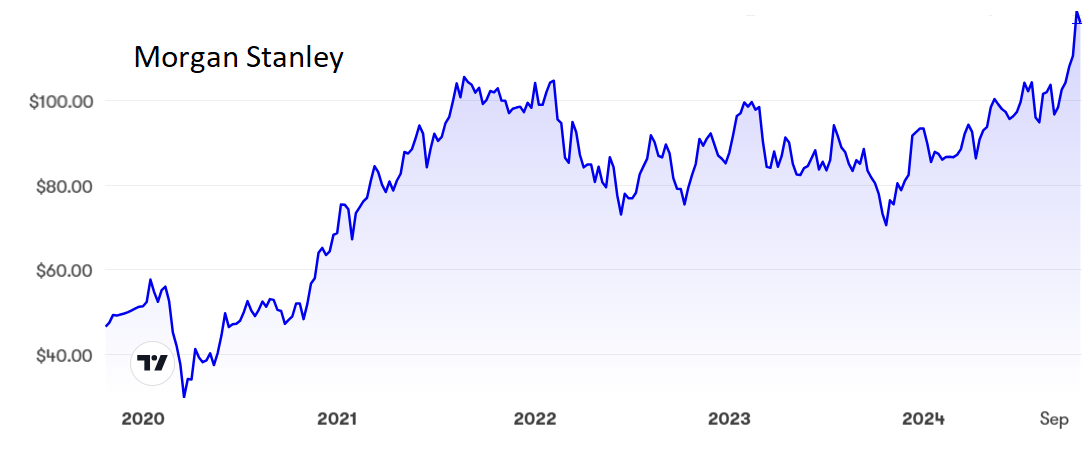

Morgan Stanley (NYSE:MS) boasted that all parts of its business grew in the third quarter, pushing revenue and profits well above analysts’ expectations. Revenue rose 16% to nearly $15.4 billion while net income shot up 36% to $3.23 billion.

The star performer was investment banking, where revenue soared by 56%, but wealth management was also well ahead with more substantial assets under management.

The shares reacted immediately with a 4% gain and went on to break above $120 for the first time, although they have since come a little off the boil. It is hard to remember that they nearly crashed below $30 in the depths of the pandemic. The price/earnings (PE) ratio is still not unreasonable at 18 while the yield is around 2.9%, reassuringly solid given the prospects for dividend increases.

Source: interactive investor. Past performance is not a guide to future performance.

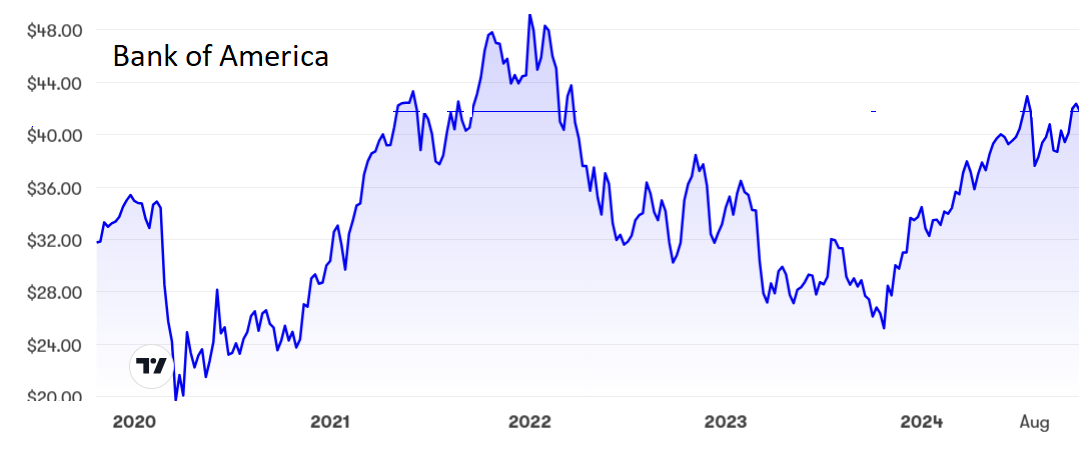

Bank of America Corp (NYSE:BAC) was left to claim a little unconvincingly that it had achieved solid results in what was in fact a somewhat less spectacular quarter. Although it, too, saw growth in its investment banking arm, total revenue was only a fraction higher while net income fell 12% to $6.9 billion.

One downside is that the change in economic circumstances led to a 2.9% fall in net interest income to just under $14 billion. More encouraging was news that total provisions for credit losses, although understandably a little higher than last year, have remained flat quarter on quarter at $1.54 billion.

- ii view: Citigroup beats forecasts but mixed metrics

- ii view: lots to like at JP Morgan after forecast beat

- An election-year playbook for investors

The bank is trying to look after shareholders by returning cash through dividends and share buybacks, parting with $5.6 billion in the latest quarter.

BoA shares have been on the rise since bottoming at $25 a year ago but seem to be peaking around $42, still well shy of the $49 reached in January 2022. The PE is less challenging at 15.2 and the yield is 2.3%.

Source: interactive investor. Past performance is not a guide to future performance.

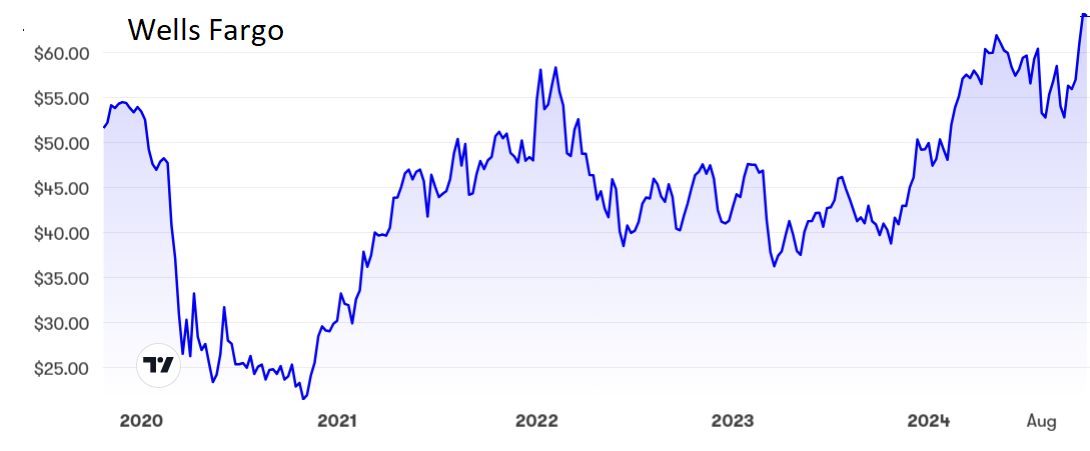

Wells Fargo & Co (NYSE:WFC) is another bank describing the latest quarter as solid, yet net income and revenue were both down, revenue by 2.4% to $20.3 billion and net income by a worrying 11% to $5.1 billion, thanks in part to customers switching their savings to products paying a higher rate of interest.

Nonetheless, the bank increased its dividend by 14% to 40 cents a quarter, although that still leaves the yield at only 2.25%. The PE is also low for the banking sector at 13.4 with the shares at a new peak of $65.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: My recommendation in April to buy Morgan Stanley still holds. It looks to be in better shape.

My previous advice to hold on at Bank of America when the shares were $35 is repeated at the current higher level but only just. It would not be wrong to take profits while the going is good.

Wells Fargo has been difficult to judge for some time, mainly because of legacy issues, but now the worries are over for the immediate future. However, there are just too many negative factors, so I would be inclined to sell while the shares are at a high and look elsewhere for a banking stock.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.