The best and worst performing funds in Q3 2022

10th October 2022 14:08

by Douglas Chadwick from ii contributor

Saltydog Investor runs through the performance charts for the third quarter of the year, but doesn't find many winners.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

This year did not get off to a great start. After three months nearly all the Investment Association sectors were showing losses and the worst, European Smaller Companies, was down 13.3%. UK Smaller Companies had only done marginally better, losing 13.1%. The only sectors that went up were Short Term Money Market, UK Direct Property, Infrastructure, and Latin America.

The second quarter was much the same. The worst sector was UK Gilts, which went down by 20%, and the Latin America sector, which had gone up by 26% in the first quarter, fell by 17%. Only four sectors went up, Short Term Money Market, Standard Money Market, UK Direct Property and China/Greater China.

In July there was a dramatic improvement. China/Greater China went down by 8.4% and UK Direct Property had its first loss-making month of the year, but almost all the other sectors went up. The best-performing sector was North American Smaller Companies, which made 10%.

August was not so good and in September nearly all the sectors fell again. Some of the losses were significant: UK Index-Linked Gilts went down by 16%, while UK Gilts and UK Smaller Companies fell by 9%.

Overall, it was a mixed third quarter. The Money Markets, American, Japanese, Technology, Thematic, and Global & Global Emerging Market Bonds sectors made gains, but the UK Bond, UK Equity, Mixed Investment, European, and Chinese sectors struggled.

- Saltydog: Less than 3% of funds make gains in September

- Saltydog: our new fund purchase even as markets fall

- Saltydog: the niche investment sectors attracting our attention

At Saltydog, we provide our members with up-to-date performance data on a wide range of funds every week. We do not guarantee that we include all funds, but we certainly cover the majority of UK-domiciled funds available through the most-popular fund supermarkets.

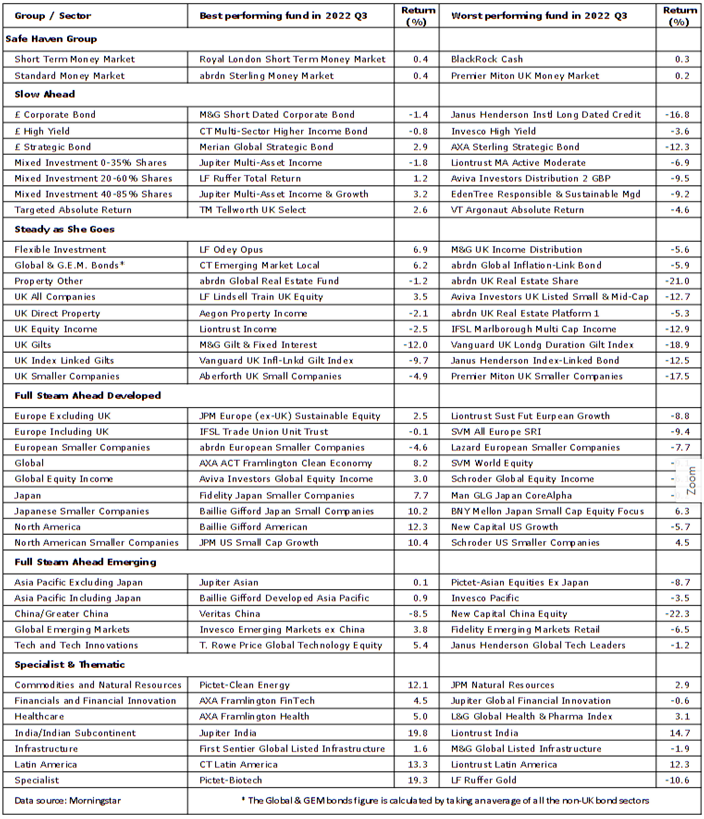

Our main focus is on trying to identify which sectors have positive momentum, and then highlighting the best performing funds in those sectors. Because we only ever look at the leading funds, it is easy to lose sight of the variance in performance of the funds within each sector. We have gone through our analysis for the last three months and picked out the best and worst fund for each sector, the results are shown in the table below.

The best-performing fund was Jupiter India, with a three-month gain of 19.8%, and it is one of the few funds that went up in July, August, and September; we currently hold it in our Ocean Liner demonstration portfolio. The Pictet-Biotech fund, from the Specialist sector, also made gains in each of the last three months and overall is up 19.3%.

There are only eight sectors where the worst-performing funds did not make a three-month loss. The two money market funds, Japanese Smaller Companies, US Smaller Companies, Commodities & Natural Resources, Healthcare, India, and Latin America. As I have highlighted on several occasions, the best-performing funds this year have come from the Specialist and Thematic sectors.

Even some of the best performing funds over the last three months made sizeable losses in September. The T Rowe Price Global Technology fund has a three-month return of 5.4% but went down by 10.4% in September.

- Saltydog: the funds benefiting from the energy crisis

- Saltydog: the two Baillie Gifford funds we’ve just bought

The worst-performing fund over the third quarter was New Capital China which fell by 22.3%. There are also a dozen sectors where even the best performing funds fell.

Unfortunately, after a dismal September, we have not seen an overall improvement in October and so both of our demonstration portfolios remain predominantly in cash.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.