Car stocks that stand to gain as lockdown eases

The pandemic has caused a wave of pent-up demand, and some firms are sitting pretty.

14th April 2021 16:53

by Rodney Hobson from interactive investor

The pandemic has caused a wave of pent-up demand, and some firms are sitting pretty.

As the world starts to move away from the coronavirus lockdowns, opportunities continue to crop up among motor manufacturers. This is admittedly an industry in flux, as drivers switch from diesels and petrol-driven vehicles to electrics or hybrids, but there is pent-up demand from drivers who were unable or unwilling to visit showrooms until vaccinations started to get on top of the pandemic.

- Invest with ii: Top US Stocks | US Earnings Season | Open a Trading Account

Many consumers in the US will be particularly flush with cash after receiving Covid-19 stimulus cheques from the government. These cheques have been issued irrespective of need: those who have come through the pandemic relatively unscathed will be looking for high-ticket items to spend their windfall on.

- Want to buy and sell international shares? It’s easy – here’s how

- Check out our award-winning stocks and shares ISA

So vehicle makers with a strong US presence are potentially attractive, and American Depository Receipts (ADRs), which are the equivalent of shares, offer a dollar-based way into two well-known Japanese marques.

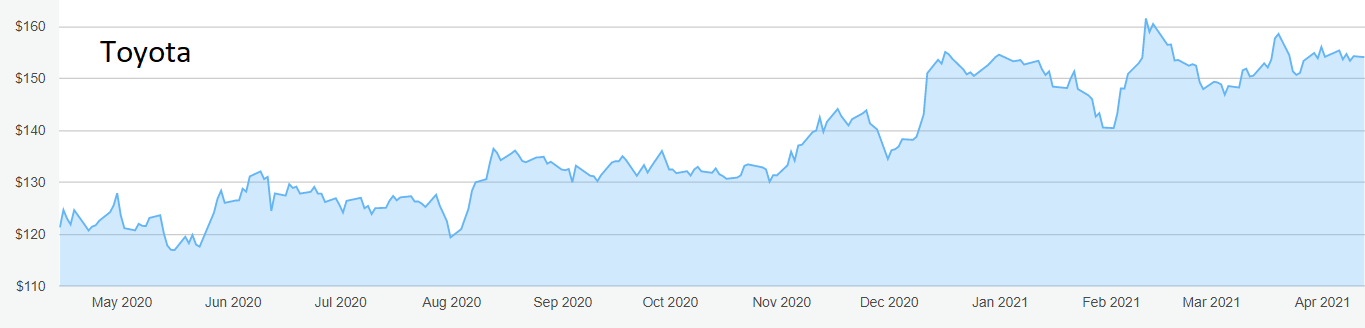

Toyota (NYSE:TM) has brands including Toyota, Lexus and Daihatsu. It also has a finance arm that supports vehicle leasing. It has proved to be a decent investment over the past five years, rising from $100 (£72.46) to peak at $160 in January, before coming off the boil. At $156 it offers a yield of 2.75%, which is pretty good for the sector.

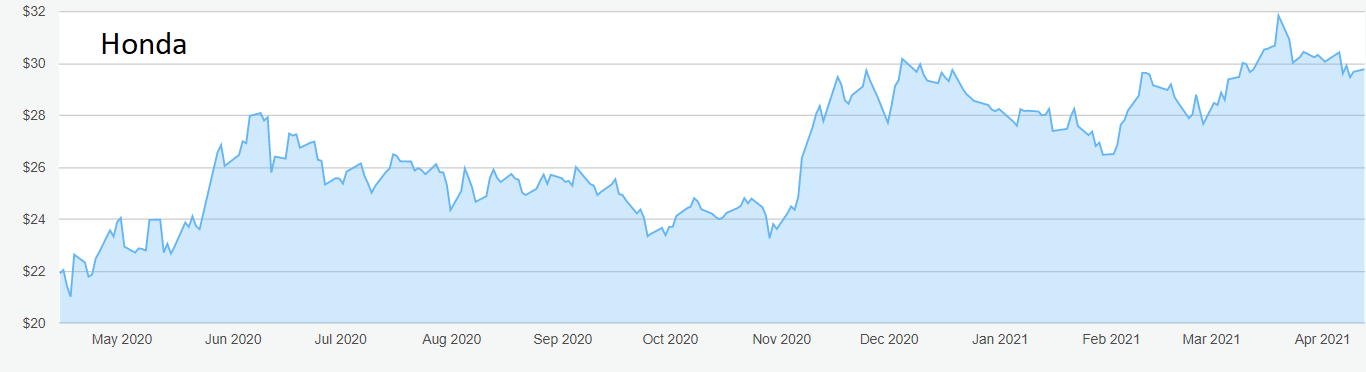

Honda (NYSE:HMC) has grown from a motorcycle manufacturer to include cars, private jets, boat engines, robots, generators and even lawnmowers in its portfolio. Cars are now its main product.

The shares have had a pretty erratic ride over the past five years, ranging between $20 and $36. At the current $30 they are little changed from April 2016. The yield is 2.63%.

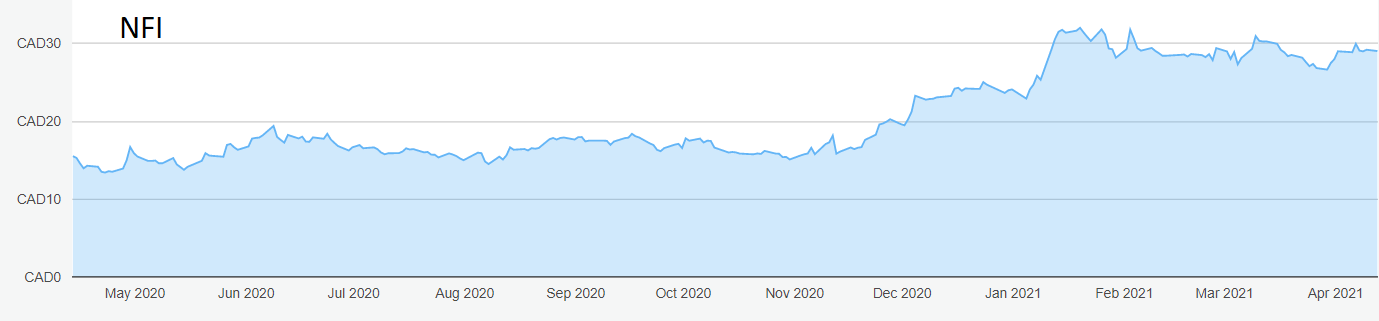

While car sales should recover strongly this summer, many travellers will be reliant on bus and coach journeys. NFI Group (TSE:NFI) is a Canadian bus and coach maker that also has aftermarket operations such as servicing and spare parts. It operates in the US, its largest market, as well as in Canada.

The shares have disappointed since peaking at C$60 in January 2018 but looked to be picking up when I tipped them at C$34 two years later. The pandemic provided a nasty knock but NFI is trying to get back above C$30. The yield is 2.93%.

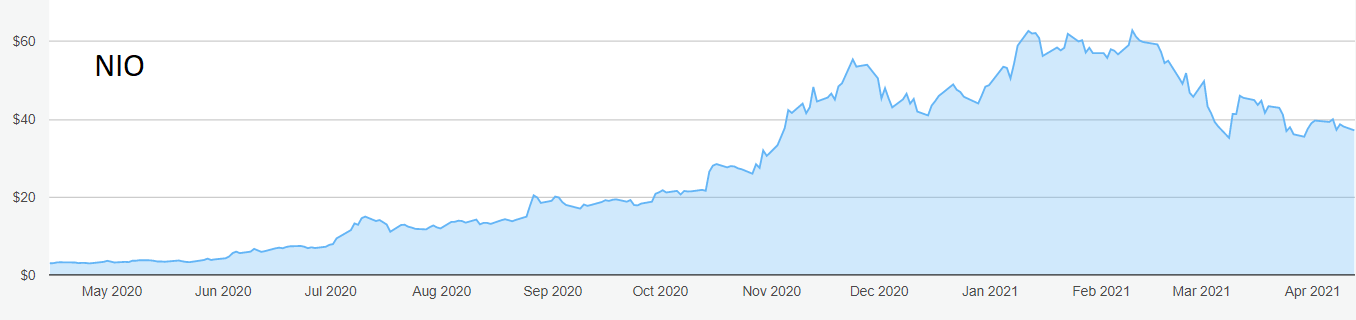

This represents a higher risk for investors than with Western and Japanese rivals, and not just because concerns over human rights abuses will prompt ethical investors to stay well clear. Trade tensions with China continue to flare up. Even so, NIO will have prime position in the world’s second-largest economy with scope to sell into the country’s growing consumer middle class.

The Chinese economy has, against all expectations, come out of the pandemic faster and in better shape than most. The day when it overtakes the US in size has probably been brought forward by one or two years.

There is no dividend at NIO, nor is there any sign of one, as the company will need to plough any cash raised back into developing the building. Investors will need to look for short-term selling opportunities or be prepared to play a very long game during which the share price could move sharply and erratically.

NIO currently trades at around $38.50, having fallen back heavily from $62 in January. The way the shares ran into a sharp correction after racing ahead of themselves from only $3 to the peak 20 times higher in only nine months is a cautionary warning.

Hobson’s choice: I tipped Toyota at $134 in September so anyone buying then is already ahead. It is not too late to buy in, although the best chance has gone. NFI looks a bargain below C$30.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.