This company already owns tomorrow’s money spinners

9th June 2021 13:46

by Rodney Hobson from interactive investor

Its shares are significantly cheaper than they were a few years ago, and this telecoms giant has a lot to prove, but the company seems to be pulling itself together at last.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Spanish telecoms giant Telefonica (XMAD:TEF) has been reducing debt and seeking to move into more profitable businesses, forging alliances as part of its strategy. Investors have been unimpressed so far and the shares remain in the doldrums. However, the tide could be turning at last.

Telefonica, based in Madrid, is one of the largest telephone operators and mobile network providers in the world despite having only 300 clients in more than 20 countries. It provides fixed and mobile telephony, broadband and subscription television. It is the main telephone operator in Spain, which accounts for nearly 30% of its revenue. Other important markets include the UK, where it owns the O2 mobile network, Germany and Latin America.

It has launched two new business units, Telefonica Tech which is a business-to-business operation offering cybernet security and cloud services, and Telefonica Infrastructure managing asset such as communications towers and data centres.

- The telecoms winners and losers from the 5G auction

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Check out our award-winning stocks and shares ISA

That all augurs well for the future, as Telefonica has a good geographic spread and a range of products and services that will be tomorrow’s money spinners. However, the past, in the shape of an unsustainable debt pile, casts a dark shadow. The company needs to raise cash to fund its expensive but potentially exciting development.

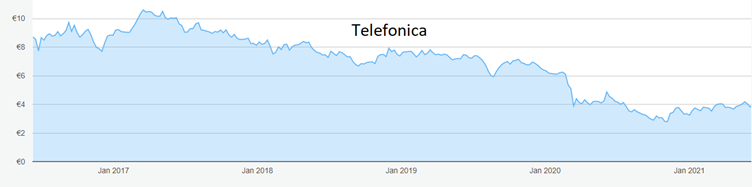

Source: interactive investor. Past performance is not a guide to future performance

The biggest deal to reduce debt has just gone through: the €6.2 billion sale for cash of 30,000 mobile phone masts in Europe to American Tower Corporation (NYSE:AMT), announced in January but delayed until regulators in Spain and Germany gave their approvals.

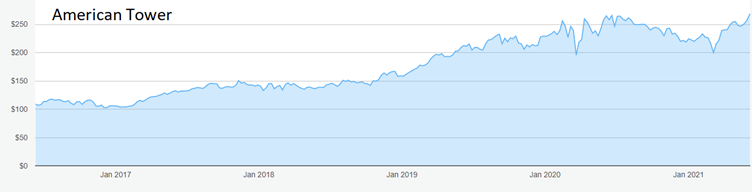

The deal is a clear gain for American Tower, which will pocket over €300 million revenue in the rest of 2021 alone. It will benefit from scaling up its presence in Europe and add to the organic growth it is already achieving in strategic markets.

American Tower operates as a property investment trust. It rents out space on nearly 200,000 towers in the US, Asia, Latin America, Europe and the Middle East to a select group of top mobile telecoms companies in each market.

Source: interactive investor. Past performance is not a guide to future performance

Telefonica receives much needed cash but will be paying rent on the masts from now on. It will reduce its debts by €3.4 billion and hope to build its own revenue by improving the efficiency of its business units and cashing in on 5G rollouts, where competition is extremely aggressive and the weak risk going to the wall.

Telefonica hopes to raise a total of €7.7 billion from the sale of masts in Europe and in Latin America, where the sale of masts, also to American Tower, is likely to be completed in August.

The Spanish telecoms company has also just completed a merger of its UK network with that of Virgin Media, a subsidiary of Liberty Global (NASDAQ:LBTYA), to create a challenger to BT Group (LSE:BT.A). The 50:50 joint venture creates a strong player in the UK mobile telecoms market, makes upgrading to 5G easier and will take the total reduction in Telefonica’s debt to a potentially game-changing €9 billion.

More sales are expected, particularly for non-core businesses such as logistics and express-delivery unit Zeleris.

Telefonica’s most recent results, for the first quarter of 2021, were mixed. Revenue was down, as it has been for the past five years, but net income more than doubled to €886 million or 15 cents a share.

- Bill Ackman: I think this could be the Black Swan event of 2021

- Stockwatch: a great company you might never have heard of

Again, there is a downside. Although Telefonica offers a juicy yield of 10%, shareholders have received the dividend in the form of shares rather than cash for the past two years, which tends to depress the share price. Given the need to keep debt under control, this situation is likely to continue for this year at least.

Telefonica shares slipped from over €10 in March 2017 to under €3 last November before stabilising at around €4. There is a lot to prove but the company seems to be pulling itself together at last.

Hobson’s Choice: Buy up to €4.40, where any recovery could run into selling resistance.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.