Discount Delver: the 10 cheapest trusts on 22 July 2022

22nd July 2022 11:49

by Kyle Caldwell from interactive investor

As part of a new series, we reveal the biggest investment trust discount changes over the past week.

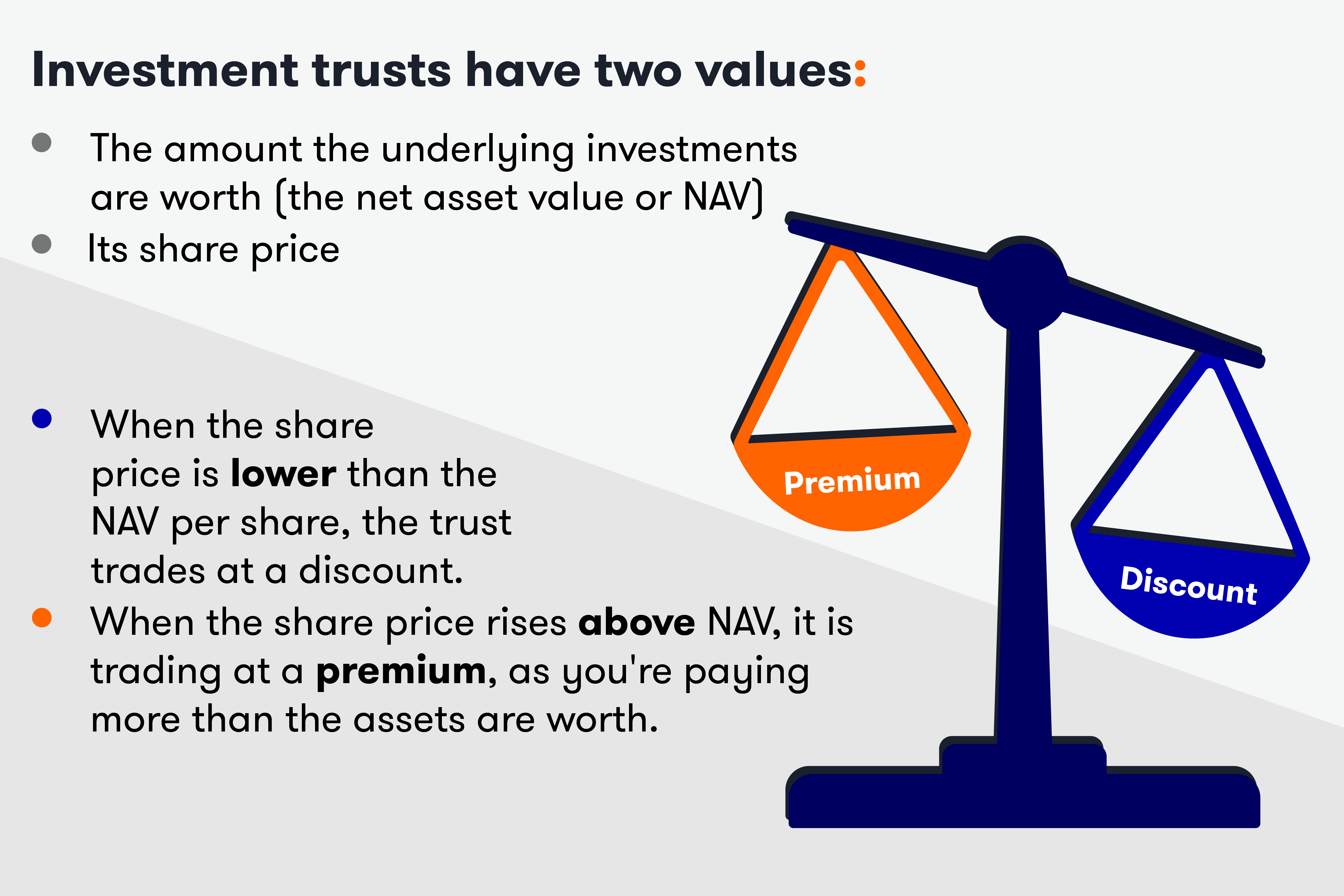

Investment trusts, due to their structure, offer investors the chance of picking up a potential bargain. This arises when a trust’s share price is lower than the underlying investments held by the trust (the net asset value, or NAV).

However, a trust trading on a discount is not necessarily a buying opportunity. There’s likely a good reason why the trust is cheap, such as subdued short- or long-term performance, or poor investor sentiment towards how it invests.

As part of a new weekly series, interactive investor will highlight the 10 biggest investment trust moves over the past week. We will publish this article every Friday, with data to the close of trading the previous day.

- Discover: Top Investment Trusts | Sustainable Funds List | Top UK shares

In total, nearly 400 investment trusts have been screened, with the data sourced from Morningstar. Venture Capital Trusts (VCTs) have been excluded and we also strip out trusts with less than £20 million in assets.

Over the past week, CT UK High Income has been the biggest discount mover. A week ago, it was trading on a discount of 3.9%, but it is now available on a discount of 13.6%. Two other trusts managed by Columbia Threadneedle, CT Private Equity Trust and CT Global Managed Growth, are also in the table below.

A variety of trust sectors are in the table including UK equities, renewable energy infrastructure, private equity, unlisted companies, bonds and environmental.

Two of the trusts in the table, Ecofin US Renewables Infrastructure and CT Global Managed Portfolio Growth, have moved from premiums to discounts over the past week.

Discount Delver: the 10 biggest discount moves over the past week

| Investment trust | Sector | Discount/premium change over past week* (%) | Current discount (%) |

|---|---|---|---|

| CT UK High Income (LSE:CHI) | UK Equity Income | -9.76 | -13.62 |

| Ecofin US Renewables Infrastructure (LSE:RNEW) | Renewable Energy Infrastructure | -6.76 | -0.96 |

| CT Private Equity Trust (LSE:CTPE) | Private Equity | -6.21 | -38.54 |

| Schiehallion C (LSE:MNTC) | Growth Capital | -5.30 | -24.18 |

| M&G Credit Income Investment (LSE:MGCI) | Debt - Loans & Bonds | -5.10 | -5.36 |

| Axiom European Financial Debt (LSE:AXI) | Debt - Loans & Bonds | -5.07 | -15.57 |

| Schroder British Opportunities (LSE:SBO) | Growth Capital | -4.63 | -26.22 |

| CT Global Managed Portfolio Growth (LSE:CMPG) | Flexible Investment | -4.42 | -1.55 |

| Jupiter Green (LSE:JGC) | Environmental | -4.29 | -21.12 |

| abrdn Smaller Companies Income (LSE:ASCI) | UK Smaller Companies | -4.00 | -22.93 |

Source: Morningstar. *Data from close of trading 14 July 2022 to close of trading 21 July 2022.

Of course, in the case of any investment trust discount, further homework is required. Among the things to consider are the prospects for the trust going forwards. Ultimately, investors will need to have a positive view of how the trust invests.

In some cases, large discounts can be a more permanent feature for trusts due to a lack of investor appetite for shares and a lack of share buybacks by the board.

Trusts with a low profile, or those that invest in a specialist area of the market, can also persistently trade at discounts to NAV. Such trusts tend to fly under the radar of many investors. With demand low, these trusts tend to persistently trade on a discount.

- Five reasons why investment trusts are different from funds

- Why do some trusts always trade on a discount?

- When is an investment trust premium too high?

In general, investment trusts have a greater tendency to converge to their mean discount rather than the value of their underlying investments. Therefore, it is useful to consider the current discount versus history, and take a view over one, three and five years, for example.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.